In recent years, financial advisors have increasingly embraced tax planning as a core element of delivering value to clients. This shift reflects the reality that taxes permeate virtually every financial decision clients make – whether related to investing, retirement, business structure, or charitable giving – and often represent one of the largest expenses faced by clients over their lifetime. Historically, tax-related services within advisory firms were primarily focused on investment strategies, like using ETFs for their tax efficiency or implementing asset location and tax-loss harvesting strategies to boost after-tax returns. But as the profession has evolved toward more holistic planning, tax considerations have likewise expanded into more areas of advice, including Roth conversions, charitable strategies, and small business structuring.

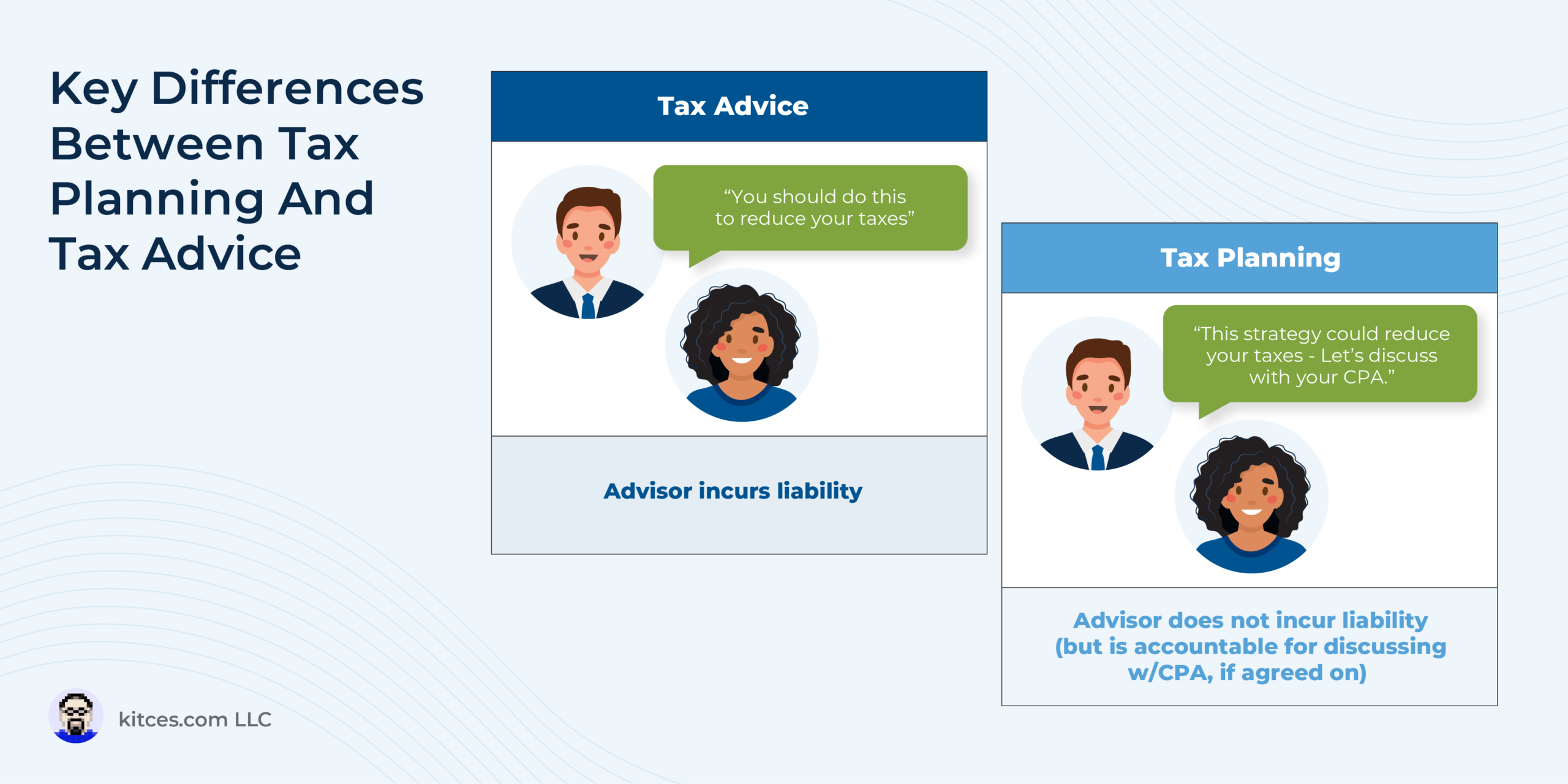

Despite this growing interest in tax conversations, most advisors are still quick to distinguish their services as “tax planning”, not “tax advice” – a distinction largely driven by liability concerns. While common wisdom suggests that only CPAs, EAs, or attorneys are authorized to give tax advice, this is only strictly true in limited contexts, such as in promoting abusive tax shelters. The broader concern is that giving actionable tax advice can expose advisors to legal and financial liability, especially since RIA compliance policies and E&O insurance typically only cover investment advice. As such, advisors who provide specific tax recommendations (like exact Roth conversion amounts), without the backing of a tax professional, risk legal and financial penalties if those recommendations result in unintended tax consequences.

Understanding the difference between tax planning and tax advice is crucial for advisors seeking to stay on the right side of this liability line. Tax planning may involve discussing general tax rules, modeling hypothetical scenarios, or analyzing the tax impact of strategies for the client – without actually making concrete recommendations. Tax advice, by contrast, involves discussing specific actions with tax consequences, which can expose advisors to significant legal risk, particularly when clients interpret such statements as recommendations. Given how easily clients may conflate a discussion of potential tax savings with an endorsement to act, advisors must be extremely careful in how they communicate tax-related strategies.

Additionally, recent developments in advisory firm practices and technology have further blurred the lines between planning and advice. For instance, the rise of live, collaborative planning sessions in lieu of static, written reports means there are fewer opportunities for advisors to append disclaimers clarifying that they don’t intend to give tax advice. At the same time, the emergence of sophisticated tax planning software like Holistiplan and FP Alpha introduces a higher level of precision and actionability to advisors’ planning conversations, increasing the change that suggestions may be construed as advice.

To navigate this environment, advisors may consider a two-part strategy: First, by proactively setting expectations during meetings with a clear verbal preface explaining that tax advice falls outside the scope of their role; and second, by documenting the conversation to clarify what was discussed, explicitly note the absence of a formal recommendation, and reiterate the importance of consulting a qualified tax professional. This step is especially important in spontaneous or emotionally charged situations where advisors may feel pressure to respond quickly. AI meeting notetakers can assist in documenting these interactions, but advisors should review the tools’ output carefully to ensure no inadvertent ‘recommendations’ are implied.

Ultimately, the rising integration of tax strategies into financial planning is a positive development that enhances the value advisors can deliver. But it also demands new considerations in how those strategies are presented. By clearly delineating the boundary between planning and advice, and by proactively communicating and documenting that boundary, advisors can continue to offer high-impact tax insights while protecting themselves and maintaining the trust of their clients.

Read More…