When Mindy Neira, a wealth manager and principal at Modera Wealth, joined her firm, she was asked what she was passionate about.

So, as many advisors who develop niches do, she looked inward at the things that had shaped her life to that point. What she found was that key aspects of her identity — as a queer woman and a former therapist for children with autism — were underserved from a financial planning perspective.

That not only sparked a desire to help often-marginalized clients, but it also offered her an opportunity to bring her formal education to the fore.

“I was a psychology major, and I still use a lot of my psychology education in this field. I love numbers, problem solving, connecting all of that,” Neira said. “So it was sort of a best of both worlds … but I’d probably say I use my psychology more than my financial economics education.”

READ MORE: Know Your Niche: Tailoring services to tech executives

Neira is a chartered special needs consultant and said that much of the joy she felt as a therapist has transferred to her role as a financial advisor for families who need her guidance.

“I used to help clients at home with their children and behavioral therapy, and now I get to help these families with financial planning,” she said. “There’s quite a bit of nuance within that space, and so I was really happy to join that segment as my first experience into niche planning.”

Below, Neira discusses how she built her niche with a strong marketing plan, the special financial needs of her clients and the advice she would give someone looking to develop a niche of their own.

This conversation has been lightly edited for length and clarity.

Financial Planning: How did you find your first clients in your niches?

Mindy Neira: The first thing was to build an online presence of content and put myself out there as a specialist in these two areas. I was writing material [on my website and blogs], looking, watching what’s happening in the news in both areas, and making sure that I’m addressing it in a timely fashion.

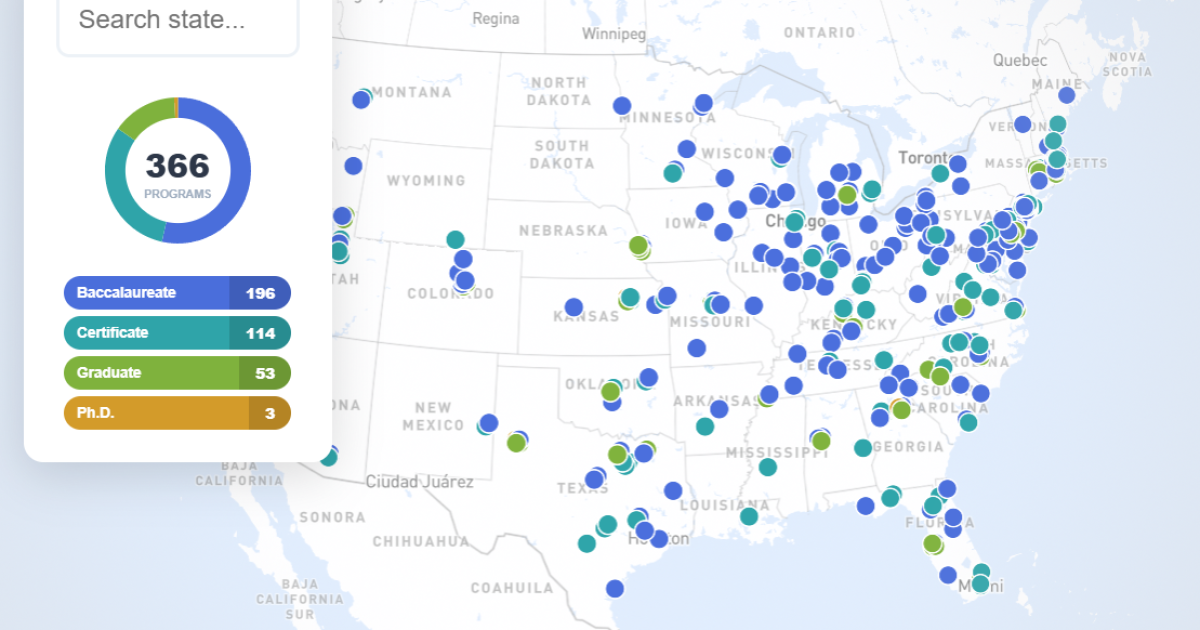

If someone were to search for an LGBTQ financial planner, is my name coming up? If someone wants a special needs advisor, what websites am I on? What directories am I on? So I really spent a good amount of time.

It’s an ongoing project, but I would say that I fully focused on that for a year. I’m on a number of directories for both specialties, and then I put these in my bio. So while there are many LGBTQ financial advisors, I get calls from across the nation that they can’t find anyone except for me.

FP: So, those efforts brought in clients in those niches. Are those the only clients you serve?

MN: I have clients within both niches and more clients that are not. I get calls from people who say, “I just really love that you work in both areas. Neither area fits what I need, but I just love that you do that.” So I’ve actually gotten clients that aren’t in either specialty area; they’re just appreciative that I work in that space. Kind of shows your values and what you’re passionate about, and who you help and who you surround yourself with.

READ MORE: Know Your Niche: Wooing romance writers as clients

FP: What are the specific planning challenges that clients in these niches face? Let’s start with the special needs community.

MN: In both, there’s a lot of legislation out there that is being discussed and enacted around the lives of clients. Being up to date and aware of what’s going on and what’s affecting people’s day-to-day life, that is No. 1, and then the planning aspects that come from that.

So for special needs, the tax bill that just came down will cut Medicaid for many people. There are a lot of people who rely on Medicaid as their primary medical insurance, regardless of your wealth status. Knowing that has come down, and that there’s not a lot of information yet to be had about that or who’s going to be affected, having empathy and just knowing that exists and that’s happening is building that trust.

And then how do you plan for cash flow purposes if my child loses Medicaid and I now have to pay for all of their equipment out of pocket and their services out of pocket, or they lose state benefits because the state lost funding for various programs. So many times, there’s a cash flow component to special needs planning and then protection. How do I protect my assets if I have a disability, or my family member has a disability, and I want to make sure that they’re responsible, that they have accounts that allow them to access the money, but if taking advantage of benefits makes sense, they can still do that. And if not, then what other accounts should I set up to protect them so they’re making the right decisions?

FP: I would assume that people who have special needs or have children with special needs, probably have longer-term planning to focus on. Is there anything there where you differentiate yourself?

MN: I usually call it a third retirement. So if it’s a two-parent household, you’re planning for the third retirement. Essentially, you want to cover that kid’s lifetime, which extends beyond yours, especially if they’re not going to bring in income.

So sometimes I’m running a plan for the parent or parent’s lifetime. What happens when they pass away, and then what does the next 30, 40, 50 years look like for their child, and do they have the right account set up? Are there tax considerations that are being accounted for and how they withdraw from it? Let’s say they have multiple children, and they’re looking to leave money to all their children. What accounts they leave, how much they leave to each of them, is a key component as well.

FP: What about planning challenges for the LGBTQ community?

MN: A lot of what I’m talking to clients about is going to be, right now, heightened decisions around marriage. If you get married, it’s certainly a personal decision, but do you have your documents in place? If you have a name change, did you legally change your name and update all of your estate documents? What if you’re moving abroad? How does that impact things?

I know there’s clients who have children who’ve moved to Canada or abroad, and how are they leaving assets to them? And so there’s key components like that.

Building a family in the queer community costs more money most of the time than other clients that I’m working with. So we need to think about, how do we family plan, and how do you secure parentage, to make sure that if marriage equality were to be overturned, is there any question on who’s the parent of your child that you had through IVF or surrogacy?

So just making sure that all of your legal documents are up to date and that you’re thinking about that marriage decision. I have clients who just don’t want to get married, but there’s pros and cons from a financial perspective on that as well.

FP: What advice would you give to someone who wants to start a niche?

MN: It would be: What are you passionate about, and being authentic about it. Because you could just pick a niche.

When I joined Modera, they were wondering if I’d be interested in divorce and working with people who are divorced, which I do. That sparked my interest in that I do talk to clients who are going through divorce, but it’s not necessarily my main passion in terms of financial planning. So it didn’t feel as authentic once I heard about this special needs designation or that I could market to the LGBTQ community and fill a gap there. So I would look at what you’re passionate about and what brings you fulfillment.

The next thing is that you’re going to have to brand yourself and market yourself, and don’t be afraid of pigeonholing yourself into a niche. As I mentioned, I get a number of clients who are not within the niche areas that I serve, and I work with them, and I get a lot of clients that way.

Finally, just keep up with what’s important to that group of people. So whether it’s underserved communities like I have, or you’re doing a niche based on hobbies or interests from clients — staying up with news and information that’s going on is just going to keep you interested, and then also build that authenticity and reputation that you need in the community.