The appreciated assets locked in tax limbo from the capital gains in separately managed accounts amount to a massive opportunity for ETF conversions, a new study said.

About $2.7 trillion in SMA holdings, including $1.6 trillion among wirehouse clients and $484 billion with customers of registered investment advisory firms, could use “a rotation into a more tax-efficient solution, given how much advisors’ clients dislike paying taxes on investments,” according to a report last month by research and consulting firm Cerulli Associates. The increasingly popular Section 351 conversions of assets into ETFs defer capital gains and bring much more efficiency and lower costs for financial advisors, fund companies and wealth management service providers. Consolidation at RIAs is fueling the ETF transfers, too.

However, experts caution that the process poses technical challenges and involves strict compliance rules requiring diversification of the holdings. While Section 351 conversions are “not something that every advisor could or should do,” the move (named after a provision of the tax code) has generated “so much demand for the service that we don’t need salespeople,” said Wes Gray, CEO of ETF technology firm ETF Architect and asset management company Alpha Architect. The 351 conversions have become essentially “all we do on a go-forward basis” at the tech firm, noted Gray, whom Bloomberg has described as a “tax-slashing ETF trailblazer.”

“It’s extremely complex, and it’s very useful for people who manage money for high net worth, taxable types and deal with hodgepodge portfolios all the time,” Gray said. “It’s a lot of work, a lot of effort, and it’s not easy. It’s not like you just press buttons.”

READ MORE: Using tax-aware long-short vehicles to track down alpha

What’s driving the conversion opportunity

So-called white-labeling services, such as ETF Architect, Tidal Financial Group and other wealth and investment technology firms like SEI and Ultimus Fund Solutions, assist portfolio managers with ETF launches and help advisors and their firms carry out the migration of assets, according to Cerulli. Last March, asset manager Eagle Capital Management “ignited industry interest” with the conversion of $1.8 billion in SMA assets into the EAGL ETF, the report noted. Rockefeller Capital Management and Nicholas Wealth Management have also created ETFs through the conversions of SMAs and other kinds of holdings.

The method can act as “an exit valve for some separate accounts that have exhausted tax-loss harvesting or simply become too operationally burdensome for the advisor or asset manager” and “serve as an efficiency tool for the advisor, including as a way to deliver their strategy to clients and charge fees for it,” the report said. Direct indexing available through the SMAs “had been considered a competitor to ETFs,” but the conversions are getting more attention because of those capabilities, it noted. Besides the assets in SMAs, another pool of client holdings in the form of $9.5 trillion of individual securities could flow into ETFs.

“While not all of this can or will be converted, the top-level asset pool is huge,” the report said. “Cerulli finds a particularly applicable archetype of advisor who may be running their own SMA strategies for clients. These advisors, classified by Cerulli as insourcers, may believe they have strong investment selection abilities and in functioning as de facto asset managers, at times create separate account portfolios for their clients — a task difficult to scale and one from which wealth management firm owners will seek to shift away.”

READ MORE: How to unlock tax savings in incoming client portfolios

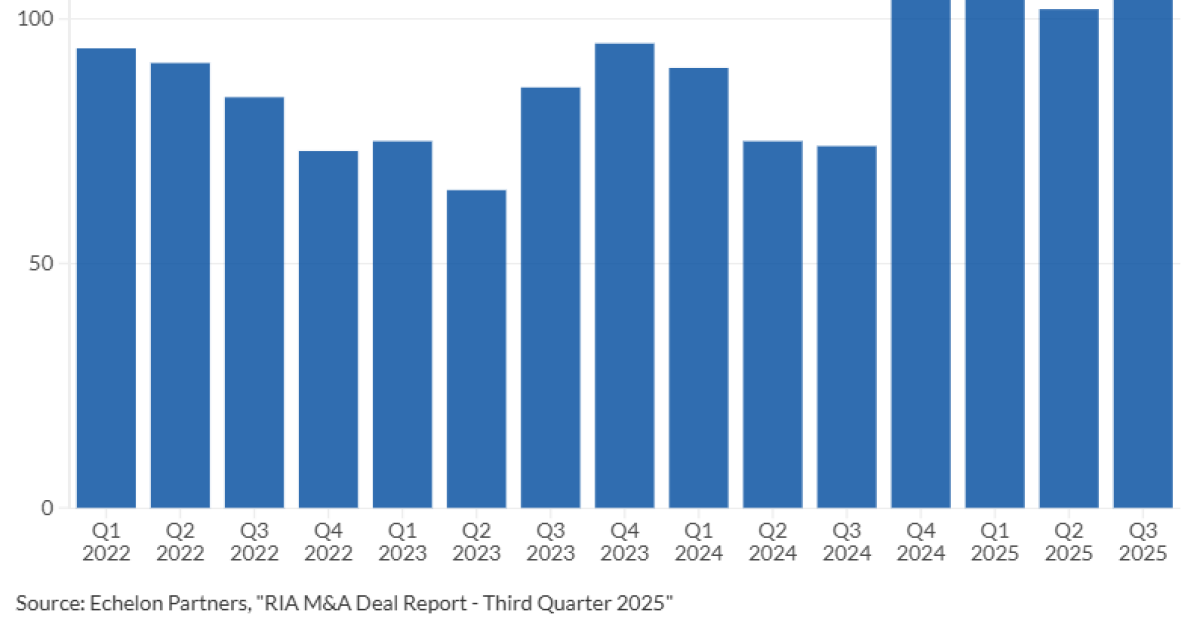

The RIA M&A impact on SMA transfers to ETFs

And those scenarios could especially play out in the case of the frequent RIA M&A deals, since the transfers enable acquirers to “combine assets across the firm” into an ETF and “gather scale for the strategy,” said Daniil Shapiro, a director with Cerulli’s product development unit. The SMA transfers to ETFs represent “an interesting theme to keep an eye on in the medium term,” Shapiro said. But the technical constraints will slow the process down at many firms.

“You probably have discussions that are happening right now between ETF issuers and scaled RIA firms,” he said. “It’s important to consider this within the scope of the broader ETF industry. This is going to take a significant amount of time before we see scaled conversions of tens of billions of dollars.”

SMA conversions to ETFs entail jumping over at least seven logistical hurdles and navigating four types of regulatory factors, according to another report on the process by ETF Architect. For example, the current SMA clients must give their formal permission, and the firms need to keep thorough records on the transaction and coordinate it with one or more custodians. In addition, they’ll have to ensure there are sufficient assets to make the process feasible and that the makeup of the new ETF aligns with the fund prospectus and complies with the regulations for investment companies, diversification mandates and formal “control” of the holdings.

“It’s actually really complicated and takes a lot of work. It’s not like we just whip it up,” Gray said. “I would say, today, a lot of people still don’t know how ETFs operate. A 351, it’s even more complicated, more esoteric.”

READ MORE: Wall Street brokers risk losing billions in fees on SEC shift

Watch this space

For SMA investors, the problem lies in the fact that, “Once you’ve got low basis in these things, you can’t do much,” and “all 351 does — and the reason it’s so disruptive — is it allows capital to flow freely” without any tax hits, Gray continued. The conversions are “going to rip out tons of operational complexity that the RIA is dealing with” as a result of “managing all of these Frankenstein portfolios,” he said. Cerulli’s $2.7 trillion estimate of the possible amount of SMA assets ripe for conversion sounded correct to Gray. Further transfers are likely, if the Securities and Exchange Commission approves the creation of ETF share classes in mutual funds sought by all of the largest asset managers after the expiration of Vanguard’s patent.

“What they don’t know, because they’re not that smart, is that all that’s going to do is open them up to massive 351 exposure,” Gray said. “It’s just not looking good for people who don’t have a real value proposition anymore. You can’t lean on the sunk tax cost, which is a real problem.”