Private equity — once a niche corner of the market reserved for big institutions and wealthy investors — is suddenly showing up in conversations about everyday 401(k) plans.

Interest jumped in August after President Donald Trump signed an executive order telling regulators to make room for private-market investments and even cryptocurrencies inside 401(k)s. News coverage surged, as did Google searches from curious investors.

Still, even with all the newfound attention, researchers, financial advisors and plan sponsors are wrestling with a core question: Does the potential for better returns outweigh the complexity that comes with adding these investments?

That debate has taken on new weight as more data emerges about how private market strategies might actually behave inside a 401(k).

Until recently, most studies leaned on traditional private equity funds — the kind built for institutional investors with long lockups — which don’t map neatly onto how defined contribution plans operate. But a new analysis from Morningstar attempts to close that gap by modeling the types of semiliquid, evergreen funds that are more likely to show up in workplace plans.

The study looks not just at performance but also how these vehicles interact with real participant behavior, glide paths and Social Security benefits, offering one of the clearest pictures yet of what private markets might mean for retirement savers.

Working with a sample of more than 265,000 real 401(k) participants drawn from Morningstar’s managed accounts database, researchers modeled each participant’s savings trajectory using basic inputs — account balance, age, salary, contribution rate and gender — and layered in assumptions about salary growth, employer match rates, IRS contribution limits and Social Security benefits.

From there, they ran everyone through a retirement simulation to establish a “base case,” before introducing various allocations to semiliquid private equity and private credit funds.

The results offer consistent, if tepid, support for the role of private markets in investment glide paths.

“Preliminary results suggest that semiliquid private market allocations may improve retirement outcomes across participant cohorts — albeit modestly,” wrote Hal Ratner, head of research, investment management at Morningstar. “Importantly, no scenario produced worse outcomes than the base case (without private markets).”

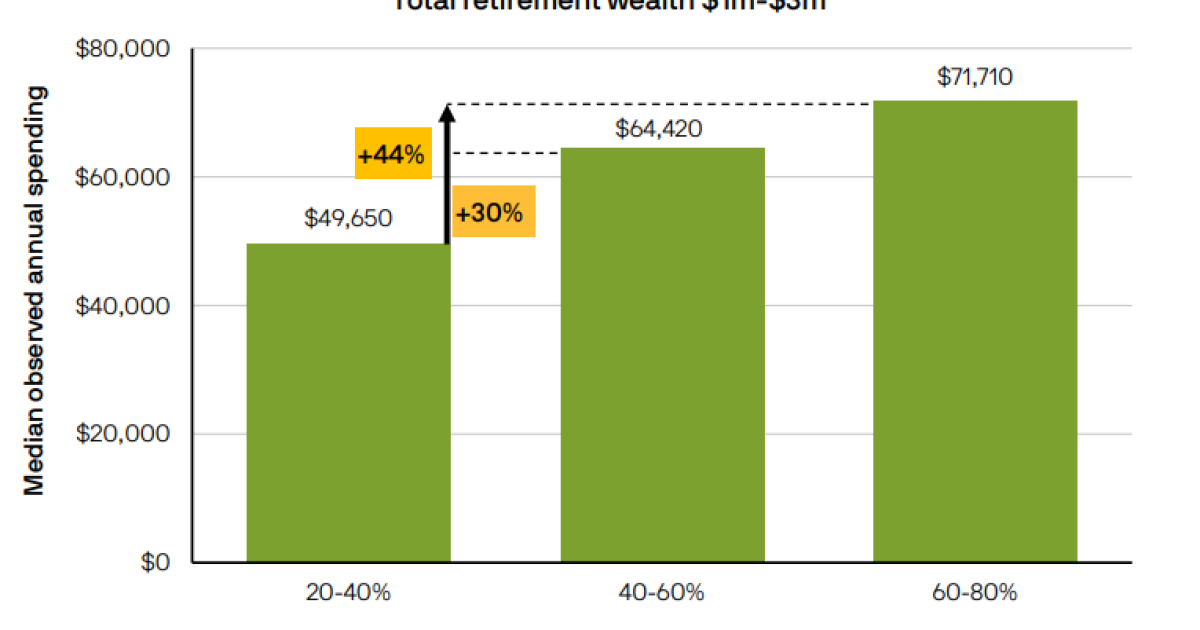

To gauge the impact of adding private market investments, Ratner used a metric he calls the “success ratio.” It compares how much income someone can expect to have in a tougher-than-average scenario (the 25th percentile) with how much they’d ideally need in retirement. A ratio of 100% means their income matches their expenses. Anything below 100% signals a shortfall, while anything above 100% suggests they’re on track to more than cover their needs.

Sampled investors were then divided into three groups: prepared, vulnerable and critical. Investors with a success ratio of 100% or higher were considered prepared. Those between 100% and 75% fell into the vulnerable category, and anyone below 75% was labeled critical. From these cohorts, Ratner built three representative investor profiles using the median attributes of each group (including income, age, account balance and contribution rate).

Early results are promising, if underwhelming

Ratner ran simulations across the cohort representatives with varying degrees of exposure to private equity and private credit, up to a maximum allocation of 15% of the total glide path.

Across the cohorts, those in the prepared group saw the most significant impact from the inclusion of private investments.

The reason behind that gap points to a critical consideration that research thus far has largely missed: the role of Social Security income.

For vulnerable and critical savers — who rely heavily on Social Security to meet their retirement needs — the guaranteed income stream offsets much of the added return potential that private equity and private credit aim to provide.

In other words, because Social Security already covers a substantial share of their projected retirement spending, incremental gains from private markets have a smaller effect on vulnerable and critical savers’ overall success ratios. Prepared investors, by contrast, depend less on Social Security and more on the performance of their portfolios, which is why introducing private market allocations meaningfully boosts their outcomes in the simulations.

Ratner’s findings may undermine some of the grander claims around private investments, but he said he still thinks they have a place on a retirement glide path.

“The main benefit of these vehicles may likely be a diversification benefit, which is important, as opposed to astronomical returns,” Ratner told Financial Planning. “And that should be factored into the equation.”

Early private markets research comes with caveats

The growing effort to add private market investments to 401(k)s reflects a broader trend in investing: giving everyday savers access to strategies once reserved for the wealthy.

But when it comes to adding private investments to 401(k)s, Ratner said everyday savers probably won’t get the same kinds of private equity and credit opportunities that affluent investors have enjoyed for years.

The private market vehicles likely to appear in 401(k)s are not the same as the traditional drawdown funds that dominate long-term private equity data, Ratner said. Those older funds follow a clear cycle — capital is called, invested and eventually returned — while the newer semiliquid, or “evergreen,” structures designed for defined contribution plans must keep a steady mix of liquid and illiquid assets.

To maintain that balance, these products hold cash or public investments and reinvest paydowns immediately, which pushes managers toward lower-risk, lower-return private holdings than those found in classic buyout funds. The difference, Ratner said, is driven by the very different cash-flow demands of 401(k) plans compared with endowments or defined benefit systems.

That difference affects more than just potential returns; it also limits what researchers can reliably say about how private markets might help 401(k) savers. Historical data for traditional drawdown funds spans decades, but comparable performance records for evergreen funds are almost nonexistent.

Ratner’s analysis shows promise for private market allocations, but he also warned that his “level of uncertainty at forecasting private market returns is quite high.”

What’s behind the push for private markets?

Private assets have become one of the buzziest topics in investing, even as many of the voices in those conversations struggle to grasp how these markets work. So who’s behind the push — and what’s motivating it?

“It’s really being driven by the asset managers, if only because most other people, you know, the recordkeepers, the plan sponsors, individual investors really don’t have an understanding of private equity,” Ratner said.

Asset managers are eyeing the defined contribution market for a mix of reasons, he added. Traditional institutional funding sources have thinned in recent years, and expectations for future private equity returns have cooled.

“There’s good reason to believe that, if you’re an institutional investor, the types of returns that you’ve got on PE over the past, let’s say 20 years, you’re probably not going to get that going forward,” Ratner said.

Defined contribution investments also present a massive untapped space for private markets — one with the potential to generate immense revenue.

A recent analysis by accounting firm PwC projected that private market products will overtake actively managed public strategies and make up the majority of revenue across the asset and wealth management industry within five years. Private market assets under management are expected to climb to $26.6 trillion by 2030 as firms race to open the retail pipeline for alternatives.

And the revenue potential is outsized: Private markets are expected to command a far larger share of industry fees than their share of total assets, thanks to fee structures that remain significantly higher than those in traditional public markets.