Merrill and other parts of Bank of America’s wealth management business rode a surge in lending and other services provided to clients to a revenue record in the third quarter of 2025.

Merrill and Bank of America Private Bank, which together make up Bank of America’s global wealth and investment management business, reported Wednesday that their revenue rose by over 9% to an all-time quarterly high of $6.3 billion in the July-to-September period. Executives said on a call with reporters the increase was driven in part by doing more with existing clients, such as providing loans and other banking offerings.

The revenue figure was offset by a 6% year-over-year increase in noninterest expenses, which rose to $4.6 billion as a result of “revenue-related incentives and investments in people.” The wealth management units’ net income was up by 19% to nearly $1.3 billion.

Lending your way to a revenue bonanza

Helping drive the quarter’s record revenue was a balance for loans to clients of $253 billion, a figure up 11% year over year. Such “cross-selling” of banking services by financial advisors is often prized by large firms not only for its ability to generate revenue but also to make clients “sticky,” or less likely to move their accounts to industry rivals.

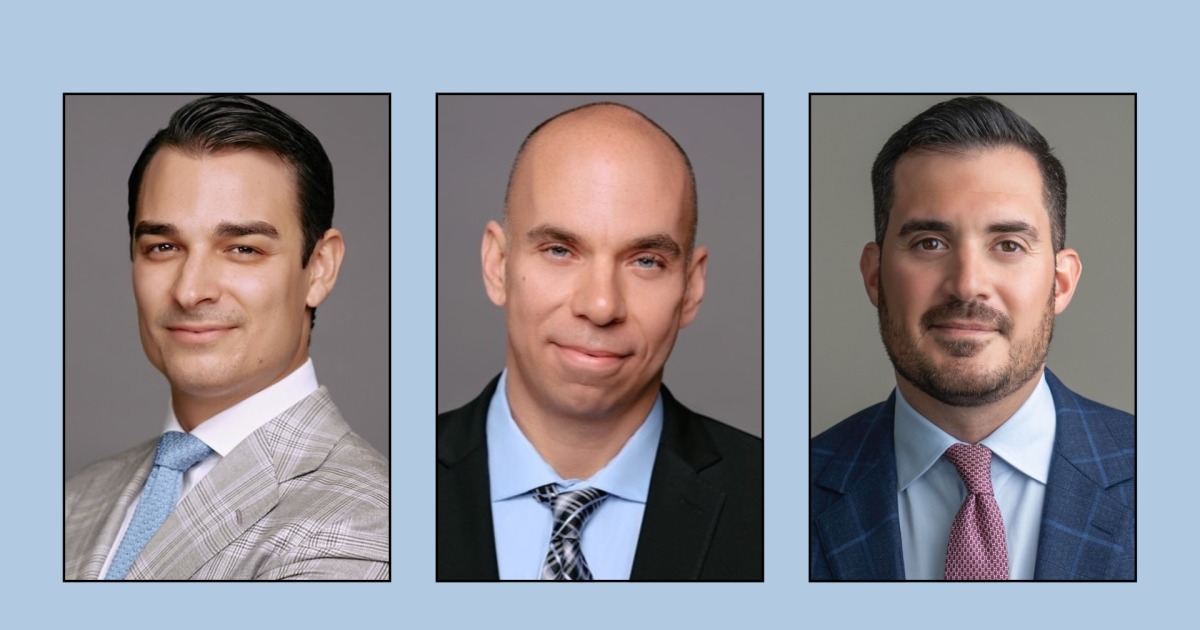

Lindsay Hans, Merrill co-head and president, said Merrill and Bank of America Private clients turned to their advisors to open 26,000 bank accounts in the third quarter.

“And then, as we sit here today, 53% of Merrill clients have a Bank of America bank account, which is up 10% from just a few years ago,” Hans said. “With that continued momentum, plus tailoring our banking offering and dedicated servicing resources, we plan to increase banking adoption amongst Merrill clients to 60% in the next three to four years.”

Strong inflows

Also bolstering Merrill and the private bank’s revenue figures were strong inflows of client assets. The firm reported its net new assets increased by 10% year over year to $24 billion in the third quarter.

Those inflows pushed the firm’s assets under management tally up by 13% year over year to $2.1 trillion. With deposits and loans added into that total, all of Bank America’s wealth businesses held $6.4 trillion in total client balances. Of that, $3.9 trillion was held at Merrill (up 10% year over year), $745 billion at the private bank (up 12%) and the rest in Bank of America’s consumer banking business.

Eric Schimpf, Hans’ fellow Merrill co-head and president, said the wealth management businesses have added 17,000 net new client relationships so far this year, 5,400 in the third quarter alone. Of the new households it has brought in, nearly 80% have $500,000 or more to invest, he said.

“Summer is typically a slower season for us for client acquisition,” Schimpf said. “But so far this year, we are on track to exceed last year’s total of net new households, reflecting, again, a continued strong momentum in growth.”

Doing more with clients, especially wealthy ones

The wealth management units meanwhile reported that their relationships with ultrahigh net worth clients — or investors with $10 million or more — is up 23% year over year, but did not provide a total number. Clients of this sort are particularly sought after by firms not only because their large asset tallies typically produce more revenue but also because of their often greater need for financial services.

Merrill’s newest offering for ultrahigh net worth clients is its Lending Solutions Group, which specializes in providing loans to wealthy investors. In another example of “doing more with clients,” Merrill and the private bank reported that their number of client households invested in alternatives like private equity, credit and markets beyond standard stocks and bonds has more than doubled in the past five years.

400 set to graduate Merrill’s training program annually

Along with working to bring in new clients and offer existing clients more services, Merrill and the private bank have been busy trying to build their advisor workforces. The wealth management divisions stopped releasing official advisor headcounts after January 2024, when the total was reported at just over 18,000.

Still, Merrill and Bank of America have shown growing interest in recent years in adding to their advisor workforce. A renewed emphasis on recruiting has resulted in some large teams pulled from other firms.

Merrill, meanwhile, maintains the largest training program for industry newcomers on Wall Street. Schimpf said Wednesday that roughly 2,500 trainees are enrolled in it at any given time and is in a position to graduate 400 of them a year.

The rate for new advisors who leave the industry is notoriously high. Schimpf did not say how many Merrill trainees go on to full financial planning careers, but he did say the firm’s success rate with newcomers is high in part because of its size and ability to surround them with expertise and resources.

“I think one of the components of that is, again, riding the rails of being part of a really large enterprise,” Schimpf said. “We’re able to deliver to our trainees, lead flow and referral flow at scale.”