This is the 30th installment in a Financial Planning series by Chief Correspondent Tobias Salinger on how to build a successful RIA. See the previous stories here, or find them by following Salinger on LinkedIn.

Processing Content

Even though they often help prepare clients for retirement, registered investment advisory firm owners frequently struggle with the exit from their own business.

In an industry in which more than 100,000 financial advisors say they’ll retire in the next decade and rookies usually wash out, RIA owners must confront the growing urgency to compose and enact their succession plans. However, for small business owners in any field, retiring represents a task more difficult than simply quitting and enjoying their free time. And advisors in particular may find it tough to relish newfound leisure time. They’re used to running the show at their firms and keeping in close touch with longtime clients.

In fact, a planned retirement represents only the third most common reason that advisors decide to sell their businesses, according to Todd Doherty, the vice president of acquisition and legacy with coaching and consulting firm Advisor Legacy. They’re more likely to transfer equity because they’re burned out by the many aspects of running their RIA or advisory practice, or as a result of health problems or other unforeseen life events. Handing off clients and retiring amounts to a “very emotional decision” that is similar to selling “your house with your family in it,” he said.

“If you ask advisors when they’re going to retire, they say, ‘Five years.’ And if you had asked them five years ago, they would have said the same thing,” Doherty said. “For many advisors, I’d say the majority, the decision is being made for them and not by them. That’s not ideal, of course.”

He recommended setting a retirement date five years in advance.

Some advisors should come to terms with the fact that completing a quick succession deal before that hoped-for day isn’t “necessarily a shoe-in,” said Melissa Caro, the founder of coaching and training firm My Retirement Network. Amid the ample private equity investments and record deal flows, RIA founders may have some misperceptions that they can rapidly “ride off into the sunset with millions and millions of dollars,” she said.

“I think that a lot of advisors looked at some of those numbers and that’s what they attached their retirement to,” Caro said. “I think they’re kind of surprised that, maybe, ‘This isn’t going to be as easy or quick as I thought it was going to be.'”

READ MORE: How financial advisors can buy a wealth book of business

A bumpy road to retirement

Advisor retirements pose some fraught questions for the whole wealth management industry ahead of the looming departure of more than a third of them in the next 10 years. In any succession plan, the need to preserve the best services to clients goes in tandem with emotional concerns such as keeping a founder’s legacy intact and supporting longtime employees, along with financial matters like netting a healthy valuation.

For a survey earlier this year of 180 advisory practice owners planning for retirement and succession, wealth management firm Kestra Holdings and polling firm 8 Acre Perspective asked the group to divide 100 points among their biggest goals in the eventual turnover of their firm. The priority of “ensuring my clients are served with the same level of care I provide,” received the largest allotment at 43%, followed by “maximizing my practice valuation” at 23%, “ensuring my employees are taken care of” at 19% and “preserving the legacy I have built” at 15%.

For instance, one of the advisory practice owners said he or she would like clients to say, “‘I took great care of them, made sure their needs and goals were met first and foremost, and ensured they were left in great hands, and a strong relationship was built before I left.'”

That simple yet multifaceted hope reflects why selling equity and retiring is complex. Among the group of departing advisory practice owners set to retire in the next decade, 52% told the pollsters they have a succession plan in place, with 9% admitting they do not have one and another 39% saying they’re in the process of creating it. Nevertheless, 67% of them said they’re confident or very confident in their ability to achieve their desired goals in succession planning and leadership transitions.

At the same time, the outgoing generation of advisory practice owners expressed reluctance — especially among the solo practitioner firms in the group. At least 58% said they agree or somewhat agree with the statement that, “It’s difficult for me to give up control of the business I have built.” Forty-one percent of the respondents agreed or somewhat agreed with the statement, “I am afraid my clients will not be taken care of as well if I leave,” a sentiment that netted a 51% share of the solo firms and 38% for those on a team. And the notion that, “I am not sure what I want to do after I retire,” received some measure of agreement from 38% of the group, with 55% of the solo advisors agreeing or somewhat agreeing and only 32% of those on teams.

“The business is something you started yourself and built,” one of the outgoing advisory practice owners said. “It’s really hard to say goodbye. It’s hard to give up control. It’s hard to leave something that’s part of you. It’s who you are.”

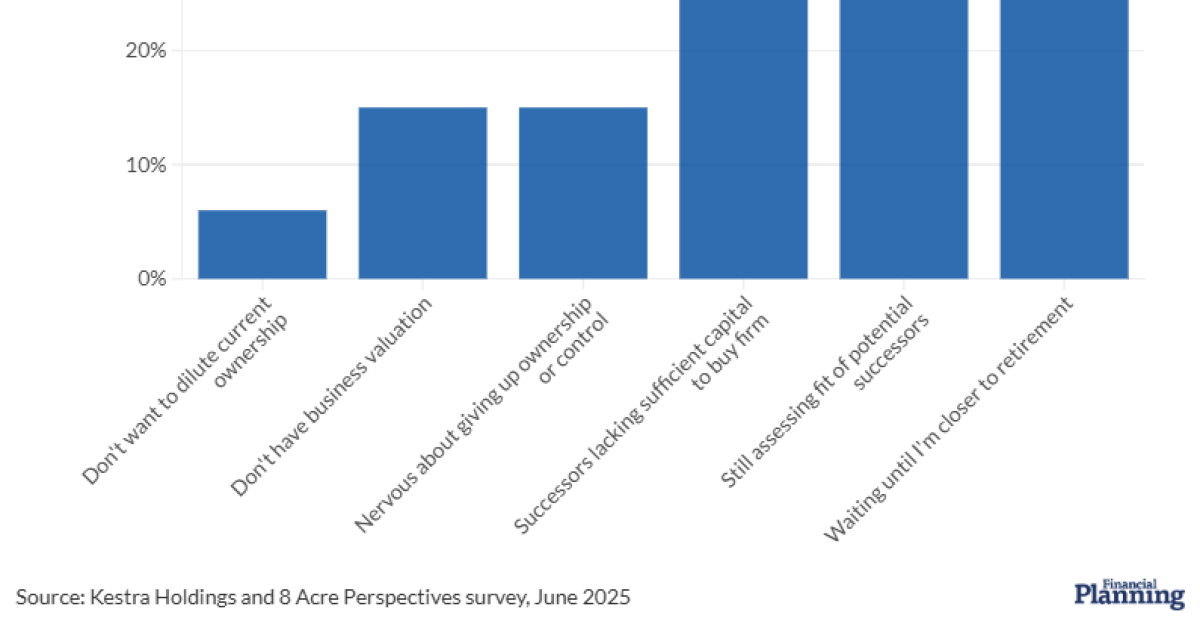

That may help explain why just 41% of advisors planning to retire in the next 10 years have transferred equity to a successor. And the most commonly cited reason that “G1” (firm founder) respondents gave for not yet doing so is that they want to wait until they’re closer to retirement.

“But waiting can backfire,” the report said. “Equity, thoughtfully structured and timed, can be one of the most powerful tools for retention, development and alignment. It sends a clear message: You belong here. G1s should carefully consider the potential advantages of giving successors equity earlier.”

Those advantages include stronger retention of clients and successor advisors, acceleration of leadership development and better transparency in the overall plan, according to the report.

READ MORE: The RIA race to $1B — and whether it’s worth running

Exit stage left

Established timelines that provide founders with a “longer runway out of the practice” through setups known as sell-and-stay succession deals can nudge more advisors “over the emotional hurdle, somewhat,” Doherty said. Investment bankers, M&A advisory firms and other consultants exist to aid advisory firm owners in selecting potential acquirers through an open bidding process or using more selective criteria. An internal succession to the next generation of advisors represents a third and increasingly popular option.

Regardless of which route they choose, the retiring owners should tell clients about the upcoming transition early and often. “Understanding how you want to go about it and then communicating it to clients well in advance is really the key to preparing, in my opinion,” he said.

Other measures, such as remaining a board member, keeping no more than five clients or maintaining other limited responsibilities, could also reduce the drastic changes to an advisor’s life in retirement, according to Caro. However, she has seen some retired advisors contend with trouble on either side of the equation, in terms of realizing that their travel plans in retirement don’t jibe with staying on top of any client relationships or “actually gripping the steering wheel tighter than they were before” because they don’t want to let go completely, she said.

“If you’re retiring, you must have put someone in place,” Caro said. “One of the most important things is making sure that you are ready to give up the reins.”