It’s a decent bet: Professional gamblers will become the first taxpayers ever to pay Uncle Sam for unrealized or “phantom” income in 2026.

That’s because, barring changes to the One Big Beautiful Bill Act, one provision in the vast legislation cuts the deductibility of gambling losses to no more than 90% of winnings, beginning next year. That means that breaking even will come with a tax bill. Hobbyists who itemize will also see an impact to their federal taxes and, possibly, their state taxes.

Experts say the changes make it even more important for gamblers to keep careful records of their wins and losses. Bipartisan lawmakers have introduced bills in both houses of Congress to tweak the provision, but whether they might pass in time to alter the rules for 2026 is unclear.

The new law may spur more itemizers who previously placed bets as a hobby to gamble instead as a business venture, in order to count expenses such as hotel stays and flights against their earnings, according to Kevin Thompson, an enrolled agent and certified financial planner who is the CEO of Fort Worth, Texas-based registered investment advisory firm 9I Capital Group. Though a congressional committee projected that limiting the deductibility of gambling losses would generate around $1 billion over the next eight years, Thompson predicted federal revenue from the change would fall far short of that.

“I don’t understand what they’re trying to accomplish with this,” Thompson said. “People are going to gamble. It’s an addiction, it’s something people want to do.”

READ MORE: Caps, credits, contributions: Tax planning for parents under OBBBA

Taxing the pros

OBBBA’s adjustments to taxes on gambling income will “not only discourage people from bettering themselves in their trade” by playing in the toughest tournaments, but they could further be “pushing people offshore or underground” with their bets, said certified public accountant Miklos Ringbauer of Los Angeles-based MiklosCPA.

“We’ve had clients and prospective clients reaching out to us and saying, ‘What are we going to do?'” he said. “It’s going to be very hard decisions that professional players are going to have to make for their careers and for their business activities.”

For example, star poker player Daniel Negreanu’s take-home winnings after taxes at the 2025 World Series of Poker would plummet by 42% to roughly $66,000 under the new rules, according to a calculation by the nonpartisan, nonprofit Tax Foundation using the highest federal bracket rate and numbers that Negreanu has shared publicly. The provision creates “a unique precedent of taxing unrealized income” that could carry effective rates above 100% in some cases and situations in which gamblers whose winnings are zero will be booking “a net loss after paying taxes on money they never made,” experts at the foundation wrote in the blog post. Senate rules for the budget reconciliation process that require only a simple majority to pass legislation likely caused the writers of the legislation to insert the provision.

“The OBBBA provision limiting the deduction of gambling losses might cause individuals to owe taxes on imaginary income, incentivizing gamblers succeeding on thin margins to exit the U.S. or participate in illicit markets,” they wrote. “While the Joint Committee on Taxation estimated that the deduction limit would generate $1.1 billion in tax revenue over eight years, behavioral responses and tax avoidance could quickly reverse that effect. If only a fraction of professional gamers take their bets outside of legal U.S. markets, the effect will be a net loss to tax collections and an increase in illegal activity.”

READ MORE: The big changes to HSAs and what they mean for planning

The importance of keeping close track of winnings

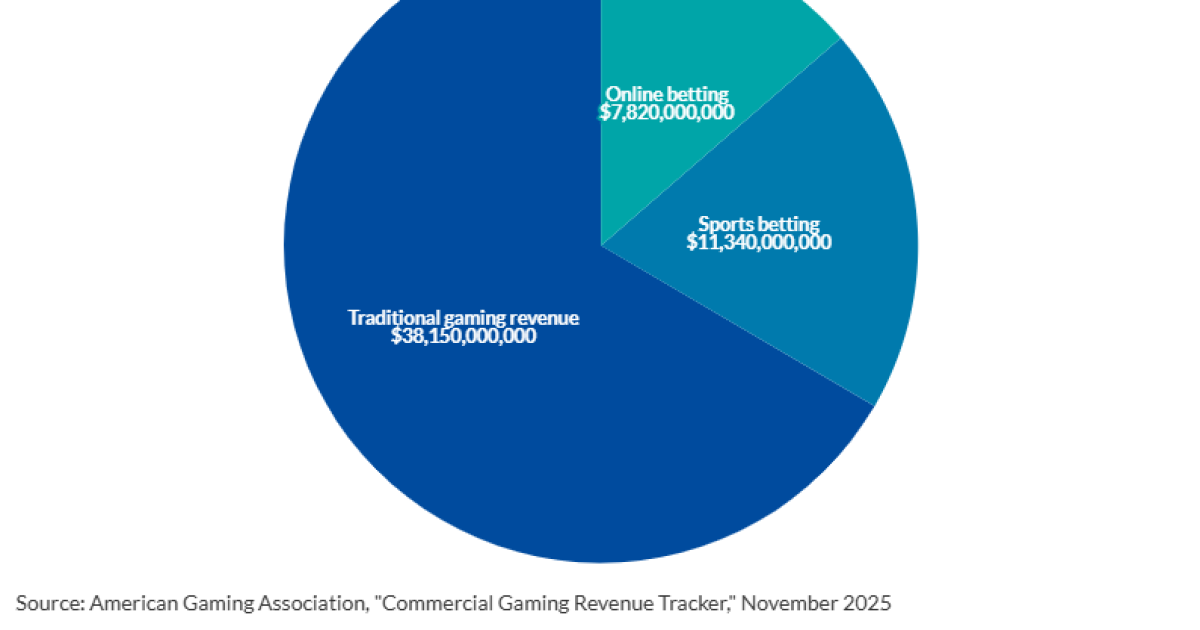

With illegal betting amounting to hundreds of billions of dollars per year and legal gambling in casinos, sports books and online platforms reaching the tens of billions annually, the shift poses implications for financial advisors, tax professionals and their clients, according to a blog by accounting firm Withum.

“For those who treat gambling as a trade or business, operating through a legal entity can offer greater flexibility in managing expenses,” the blog said. “This is particularly relevant for costs not directly tied to wagering, such as research tools, data subscriptions, travel and professional services. While the 90% limitation on deducting gambling losses still applies, properly categorizing and documenting these ancillary expenses could help reduce taxable income more effectively. Maintaining thorough records and assessing whether such expenses qualify as ordinary and necessary business deductions will be essential steps for those looking to optimize their tax position.”

Even casual gamblers — whether or not they itemize — should take steps to document their winnings such as signing up for casino loyalty programs that track them easily, Ringbauer said. And, at the state level, many jurisdictions have gambling tax regulations that conform to the federal standards, so bettors could be facing another layer of bills in some places.

“It will result in a very uncertain world for a lot of tournaments,” Ringbauer said. “It’s going to be very, very scary how the industry is going to be impacted by an unintended procedural rule in the Senate.”