This is the 14th installment in a Financial Planning series by Chief Correspondent Tobias Salinger on how to build a successful RIA. See the previous stories here, or find them by following Salinger on LinkedIn.

Recruiting a financial advisor to work alongside the founder of an upstart registered investment advisory firm could alter the company’s fate for the better — or for the worse.

On the one hand, hiring more advisors represents a business imperative for the entire wealth management industry, based on research suggesting that client demand will soon outpace the supply of quality advice and that too many founders expecting to retire in the next decade still lack successors. However, the risk that an incoming advisor may not jibe with the founder poses the prospect of a hefty wasted investment or a lengthy and costly legal fight. And the firms that have reached a large enough size to recruit a substantial number of teams each year face many fewer potential threats with each new advisor than smaller firms.

Firms of lesser tenure and size have more at stake when they wade into practice management and professional development waters that are teeming with rivals vying to catch big, profitable fishes in the industry’s perpetual contest for top talent.

The recruiting process can extend to as long as two years from the time a firm begins a search to the moment that a new advisor joins the company. Whether the interviews stem from network connections or a job listing, the time spent “getting to know each other” and exploring the “comfort and relational piece” of the equation takes much longer than the actual execution of any deal agreements or platform transitions, said Partheev Shah, a managing partner and the chief operating officer of Philadelphia-based RIA firm Zenith Wealth Partners. The firm has offices in five cities and eight advisors after opening in 2019, with a geographic focus on the East Coast but remote capabilities that have been “part of our fabric from inception,” he said.

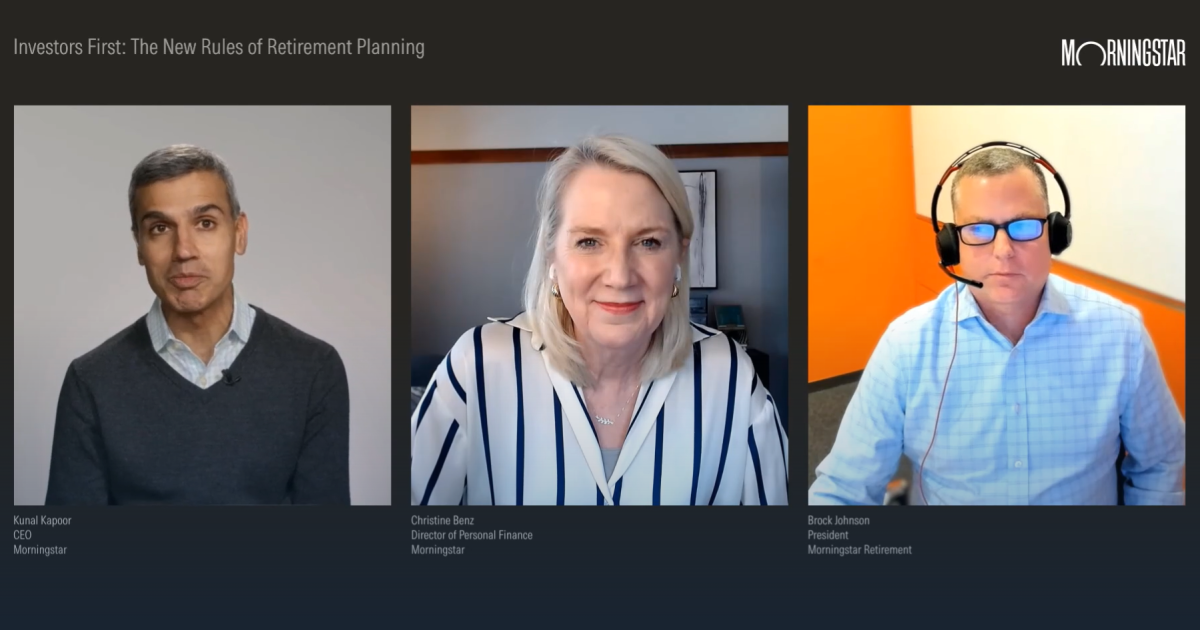

Zenith Wealth Partners

“We have, in many ways, a recruiting advantage, because we’re able to find candidates who potentially live in a much broader geography,” Shah said. “We’re likely engaging with recruits or team members who want to have a hybrid or remote working arrangement which I know a lot of firms are shifting to in some capacity.”

At larger firms, the ability to aid incoming teams in identifying possible recruits and help them transfer incoming advisors onto a different platform also represents a key selling point with prospective teams, said Jimmy Lee, founder and CEO of Las Vegas-based hybrid RIA firm, The Wealth Consulting Group. His firm, a major independent branch with LPL Financial, has reached about 125 advisors across 50 offices with nearly $9 billion in client assets, after starting with 30 advisors and $800 million 10 years ago. The recruiting services have fueled the firm’s expansion, alongside resources like complex planning tools, back-office administration and practice management, Lee said. An advisor who “wants to build their team and grow” amounts to “the perfect scenario for us,” he said.

“We help them with that whole thing, from A to Z,” he added. “We have all of those things in-house that our advisors can tap into and offer to advisors that they’re recruiting or are on their team today.”

READ MORE: Should financial advisors be dually registered or RIA-only?

By the numbers

Each and every advisor move reflects a choice relating to, for instance, career path, compensation, the impact of an M&A deal by a brokerage or RIA firm, or a personality clash. A combination of any number of general to highly specific factors can cause experienced advisors to leave their current firms, according to the latest annual “Advisor Transition Report” by recruiting firm Diamond Consultants.

In 2024, at least 9,615 experienced advisors, or nearly 6% of those with four or more years of tenure, carried out a switch in their brokerage or RIA.

“The raw movement data (with net recruiting being more or less flat year over year) might suggest that advisor satisfaction has improved,” the report said. “But this obscures an important dynamic that has been bubbling beneath the surface: There is an ongoing battle for control between advisors and firms, and advisors are increasingly losing. Firms seldom (if ever) make changes to the benefit of advisors and clients, and so advisors are faced with a difficult calculus: ‘Vote with their feet’ and opt to make a change, which is potentially risky, disruptive, and onerous (particularly amid a strong bull market run), or stay put even if it means accepting something less than optimal. This dynamic is only worsening as the delta between the goals of advisors and firms widens.”

When advisors do decide to leave their firm for a new one, they usually stay within the same channel of wealth management, according to another yearly tracking survey by industry research firm ISS Market Intelligence.

Among the larger group of registered representatives with any level of experience, though, wirehouses sustained the largest turnover of any channel in the industry during the last five years, with the net loss of 8,303 brokers — or nearly 10% of all wirehouse reps. In contrast, retail-focused RIAs gained the most advisors during that span, at 8,739, and independent brokerages drew the second highest figure, 6,332. The number of RIA-only reps jumped 28% to 97,603 in the past five years, easily outpacing the 4% growth in the amount of dually registered reps, who have much bigger ranks of 323,533. In the last decade, a range of 3.7% to 5.1% of reps have left their firms for greener pastures, with the lowest total in 2020 and the highest in 2022. Last year, the number remained about the same, at 34,838 reps who went to new firms.

“These numbers have been shaped by evolving compensation structures, regulatory pressures, and the growing appeal of independent advisory channels,” the ISS report said. “A cross-channel move — such as from a wirehouse to an independent firm — can involve significant shifts in compliance requirements, compensation structures and client service models, creating a complex transition for many advisors. Consolidation has also driven intra-channel movement, especially in the independent and retail investment advisor channels. Many reps made the leap in recent years, however, drawn by a mix of factors, including higher payouts, improved access to technology, and closer alignment with client interests.”

READ MORE: Solo advisors can thrive in a consolidating industry. Here’s how

Finding the fit

Regardless of an advisor’s origin or destination, their talks with a prospective firm frequently include a visit to the home office or, at the very least, a series of conversations resembling the due-diligence exercises for considering whether to add a product to a firm’s investment menu.

At Zenith, the firm strives to find cultural alignment through virtual meetings at the beginning stages and face-to-face discussions toward the end, Shah said.

“We always think that in-person component is important,” he said. “It’s really an exchange both ways, in that the candidate is just as much evaluating us and making sure it’s the right fit for them as us making sure it’s the right fit for us.”

The Wealth Consulting Group

And part of that process revolves around matching personalities to roles, compensation, managers and career outlooks, according to Lee. For example, if an incoming advisor is seeking to find leads, convert prospects to clients and build a large book of business someday, then “you better make sure you have a path to a partnership or succession,” he noted. A more supportive advisor position may not require that plan for the future, although some firms embark on hiring when “they’re not willing to pay the salary and bonus it takes” to add to their team, he said. Hiring a new advisor may stress-test the founder in unexpected ways as well.

“A lot of financial advisors want to bring on another advisor to work less,” Lee said. “If they’ve never done that before, they end up being the trainer and also the manager to another financial advisor. They may not be prepared for that.”