Financial advisors’ basic asset location services are “one of the most powerful, yet often underutilized” strategies in portfolio management, a new Morningstar study found.

Processing Content

And the placement of assets for the best tax efficiency and higher after-tax returns drives a substantial share of the value advisors can deliver for clients through portfolio management.

For a saver with $1 million at retirement, asset location strategy over the next 30 years of decumulation pushes the value up seven to 30 basis points a year and $112,000 in the final bequest “without sacrificing annual spending,” according to the study, which was released last month by independent research firm Morningstar. The “extensive simulations reflecting real-world tax policies and withdrawal sequences” show the “compelling upside” of asset location, Senior Quantitative Analyst Abhijay Gupta and Director of Data Science Neelotpal Shukla wrote.

“The mechanism is straightforward but profound,” they wrote. “By concentrating higher-growth assets in tax-exempt accounts and lower-growth assets in tax-deferred accounts, investors allow more wealth to compound free of tax drag. Over decades, this structural efficiency compounds into a meaningful difference in both portfolio longevity and legacy value. Importantly, these benefits are achieved without additional risk, without new products and without altering the investor’s overall asset allocation.”

READ MORE: Here’s a financial advisor’s estimated value to clients

A basic, potent value proposition

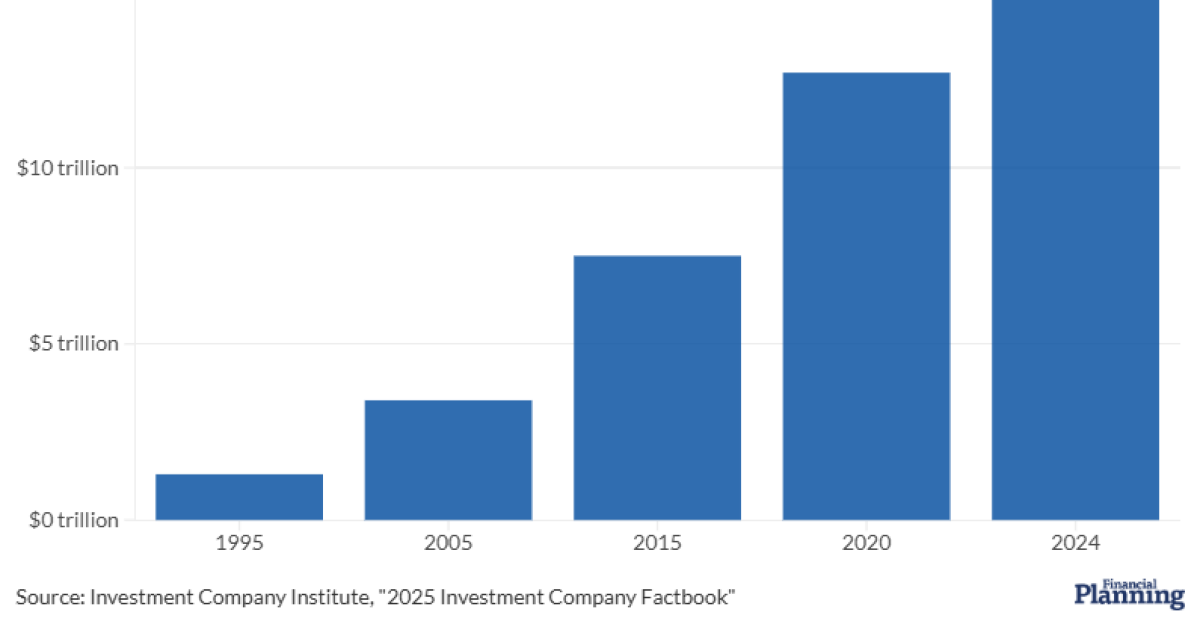

The research puts more data behind what advisors already know is an important aspect of their work on behalf of clients. At the end of 2024, tax-deferred traditional individual retirement accounts, which carry duties with their decumulation withdrawals, held more than $12 trillion in assets, far exceeding assets in post-tax Roth IRAs, which have duty-free distributions in retirement.

“For any real advisors out there, this is table stakes,” said Dinon Hughes, a partner at Portsmouth, New Hampshire-based registered investment advisory firm Nvest Financial and a member of this year’s class of Financial Planning Rising Stars. “It is part of the investment process. It goes hand in hand with asset allocation.”

At the same time, the study (and the growing research around estimating and communicating advisors’ potential value to clients) offers some explanation into why tax planning and preparation are “elements I see time and time again among the fastest growing practices,” said Shelby Nicholl, founder of advisor recruiting and consulting firm Muriel Consulting. Since early-career advisors often face difficulty generating organic growth — a problem shared by even some of the most profitable registered investment advisory firms — the numbers could be a boon to their practice management and marketing.

“I am looking at, how do we make our advisors more successful in the long term, which is, how are they positioning compared to others?” she said. “They are looking at, how do they create a moat around their business, and how do they grow their business faster?”

To do so, advisors will need to convince skeptical prospective customers that the higher cost of human advice is a better value than digital allocation tools or do-it-yourself services. And that’s where the research by Morningstar and others could come in handy. The only element of the study that Hughes pushed back against was the researchers’ description of asset location as a “free lunch” for financial security and legacy in retirement. In reality, that takes knowledge of tax laws and rules and distribution strategies that elude most retail investors.

“I would not at all consider that a free lunch, because ‘free’ insinuates anyone can do it,” Hughes said, suggesting that only about 5% of the DIYers could do so. “They would have a very hard time executing this on their own. But, with an advisor, it is possible.”

READ MORE: You’re doing it wrong: Annual portfolio rebalancing isn’t enough

Hot research topic

Morningstar’s latest asset location findings add further heft to earlier conclusions from studies by it and other companies about the role of asset location in the value of advisors’ services. For instance, asset location alone constitutes up to 60 basis points out of the roughly 300 bps in higher net returns attributable to advisors’ value to investors, according to Vanguard’s latest annual “Advisor Alpha” report.

Advice on asset management and portfolio rebalancing during a client’s top-earning accumulation years “can add annual benefits of 1.4% and 20%, respectively,” Albert Zhao, a lead quantitative analyst for Morningstar’s asset management arm, Morningstar Investment Management, wrote in a different study posted earlier this year. That study took a “life cycle evaluation framework” in seeking to quantify the value added by quality financial advice. No peer-reviewed journal has published the report, but it nevertheless displays further evidence that asset management forms a crucial part of advisors’ multifaceted value to their clients.

“The incorporation of accumulation stage information is critical for risk management and retirement planning during the decumulation stage, as sound financial health in retirement is built on the foundation of career-long earnings and savings,” Zhao wrote. “A financial advisor’s effective management of all these risks is equivalent to value creation, as they are two sides of the same coin.”

READ MORE: Should clients in the ‘retirement red zone’ reconsider withdrawal strategies?

‘Unequivocal’ results

The variety of income and wealth levels, time spans and outcomes among their clients also means that how to calculate the specific quantifiable advantage for the “known strategy” of asset location is “often unclear,” Gupta and Shukla wrote.

To reach their quantifiable estimate, they simulated hundreds of thousands of hypothetical clients who withdraw from balanced portfolios over three decades to compare the end values. In the first set of 384,000 runs, they considered a retiree with $500,000 each in a Roth IRA and a traditional IRA that both maintained a split of 40% equities and 60% bonds. For the other set, they ran the same simulation on a retiree who put all of the stocks in the post-tax Roth IRA and placed the fixed-income holdings in the tax-deferred traditional IRA. In the first year alone, the latter approach had already brought $250 in additional value to the nest egg, which will compound over time.

“The results are unequivocal,” they wrote. “The data shows that implementing asset location is a robust strategy that overwhelmingly preserves portfolio longevity. In the vast majority of scenarios, the longevity success probability is near or at 100%, indicating that the strategy rarely, if ever, shortens the withdrawal period and often extends it. This finding provides a crucial baseline of safety: Retirees can pursue the benefits of asset location without taking on additional longevity risk.”

What sounds self-evident to advisors, however, may not be so obvious to potential clients who are understandably less familiar with asset location. The strategy is “often ignored — despite its potential to materially improve results,” and the benefits just go up among clients “with higher tax rates and a higher proportion of wealth in tax-deferred accounts,” the researchers concluded. And that, in turn, leads directly to the value of advisors’ asset location work.

“For providers of managed account services, the implication is clear: ignoring asset location is a missed opportunity,” Gupta and Shukla wrote. “It is a structural advantage that should be embedded in every retirement solution. Investors deserve strategies that treat their portfolios holistically, not as a collection of disconnected accounts. If a platform does not optimize for asset location, it is leaving measurable value on the table.”