Saturday’s Powerball jackpot — headed toward $1 billion as of press time — is now the sixth largest in the lottery’s history. No winner has been declared in the past three months, and with the odds at 1 in 292,201,338, it’s no wonder.

But if a client came into your office next week holding the winning ticket, what would you tell them?

The odds may be astronomical, but smaller prizes do get claimed regularly. Even more common? Clients coming into unexpected windfalls.

Melissa M. Estrada, founder of Fidela Wealth in Calabasas, California, hasn’t had a lottery winner walk through her door, but she has worked with clients who’ve received unexpected windfalls, usually from inheritances.

“I’ve seen both sides of the story: people who listened to advice and still have assets working for them today, and people who ignored it and watched the money disappear faster than they ever imagined,” she said.

Advise clients to slow down, assemble a team

If a Powerball winner were to ask her advice, what is the No. 1 thing Estrada would recommend they do?

“Absolutely nothing, for at least three to six months.”

“Don’t buy, don’t sell, don’t quit your job, don’t make announcements,” she said. “Just keep living your normal life until you’ve had time to truly process what just happened. After that, the next move is for us to assemble the right professionals. Starting with a trust attorney, in order to begin laying the foundation for a long-term plan.”

READ MORE: Advisors clamor for estate planning tools as attorneys wave red flags

The reality is that most lottery winners don’t already have a financial advisor, said Estrada. Winning often forces them to find one, and unfortunately that exposes them to predatory practices, she said.

“That’s why I’d stress, don’t rush to claim the prize,” she said. “You usually have up to six months. Use that time to interview and vet at least three advisor and attorney teams. And I do mean teams. You want people who have worked together for years, who communicate well, and who will close ranks around your best interests. You want professionals who can also act as a buffer between you and everyone who’s about to come knocking, because money changes relationships in profound ways.”

While Filip Telibasa, owner of Benzina Wealth in Sarasota, Florida, hasn’t had any lottery-winning clients he did have one who inherited close to $10 million from a wealthy uncle.

“No, that’s not a Netflix plotline,” he said. “It was real life, and he had a pretty average life beforehand. Worked for the [Metropolitan Transportation Authority] in New York, making an average salary. Once he discovered the inheritance, his emotions went from excitement to panic quickly. He didn’t want to make any mistakes.”

READ MORE: How much time AI saves advisors — and how they spend it

That’s why Telibasa said his advice to a Powerball winner would be to stay anonymous, breathe and hire a team, including an attorney, a financial planner and an accountant, before claiming a single dollar.

“They do not need to have prior experience with major windfalls, though this may be a plus,” he said. “The attorney sets up trusts or LLCs to protect privacy and reduce liability. A financial planner creates the road map so you can enjoy some of the money today without sabotaging your future. And an accountant keeps the IRS from becoming your biggest beneficiary.”

Help clients assess major investments, life changes

One of the biggest mistakes windfall recipients make is mentally spending the money before it even arrives, said Estrada.

“A good advisor won’t even let clients rush into investments until there are clearly defined life goals, charitable priorities and commitments to family,” she said.

Samantha Mockford, associate wealth advisor with Citrine Capital in San Francisco, has worked with clients who suddenly received large inheritances, including one who was “a burned-out public school teacher.”

“A huge desire was to step back from her working hours,” she said. “In terms of household cash flow, the inheritance allowed her to do that, but it conflicted with another goal, which was to retire fully by a certain age. When earning less gross income, she’d be contributing too little to her retirement accounts to still retire on the same timeline. So we essentially moved inherited assets from her taxable account to her tax-deferred retirement accounts by increasing her retirement account deferrals to hit her annual maximum.”

As a teacher, the client was even able to open a second retirement account and contribute the maximum to both a 403(b) tax-sheltered annuity plan and a 457(b) deferred compensation plan, said Mockford.

“This increased deferral rate, and working part-time meant her net pay was virtually nothing,” she said. “She then lived off regular distributions from her taxable account, like it was a replacement paycheck.”

Michael Ashley Schulman, founding partner and chief investment officer at Running Point Capital Advisors in El Segundo, California, has seen an actual lottery winner (at a previous firm) as well as clients who suddenly receive cash windfalls.

If a client were to land a Powerball jackpot of $1 billion or more, it would be important to emphasize that the figures splashed across the news is a mirage, said Schulman.

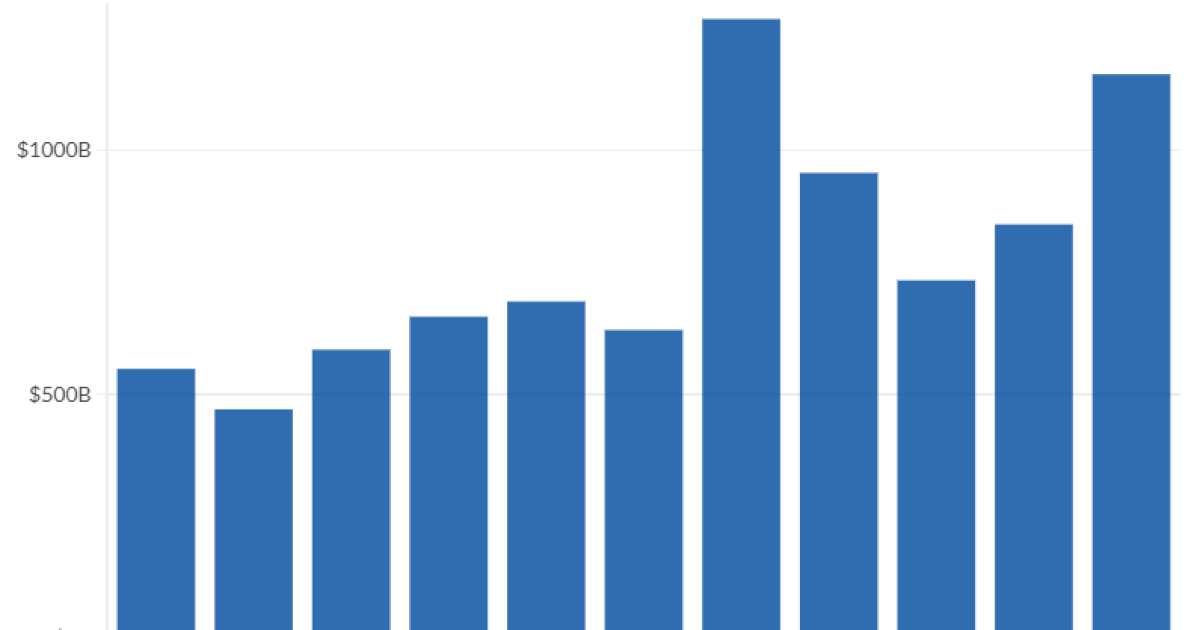

“The number is the gross total paid out over nearly three decades, before taxes even get a sniff,” he said. “The annuity delivers steady payments, but each one gets trimmed by Uncle Sam, and often your state, at ordinary income rates. At the federal level, that’s roughly 37%, plus whatever your state demands. Suddenly, that $1 billion win is more like $540 million to $630 million over decades, depending on tax laws and location.”

Most people grab the lump sum, said Schulman.

“Instant gratification with a haircut,” he said. “A $1 billion jackpot in lump-sum form would be closer to $550 million to $600 million before taxes. After 37% federal plus 5% to 10% state, you’re walking away with $318 million to $378 million in real money. Still life-changing, but not buy-your-own-moon-base money.”

The importance of ownership and trusts

Advisors can also help suddenly wealthy clients by recommending they keep the good news to themselves, said Estrada.

“Loose lips sink ships,” she said. “Once word spreads, so do the expectations. Even family can quickly feel entitled to your winnings, and you might feel pressured to oblige before you’ve thought it through.”

Over the years, Julianne Hertel, owner and financial advisor at Dream Big Wealth Strategies in Worcester, Massachusetts, and member of the trade organization Million Dollar Round Table has had several clients win large lottery prizes and several more families become clients after winning the lottery.

“It is always so exciting when we meet with people who come into a windfall under such positive circumstances,” she said. “The amount of money that clients receive varies but is almost always life-changing.”

In a prior role, Joe Buhrmann, senior financial planning consultant at Fidelity’s eMoney Advisor, led a team of advanced markets consultants who assisted advisors with financial planning and more. They were often called in to assist when clients received major windfalls — whether it resulted from winning the lottery, receiving an inheritance, selling a business or settling a legal case.

Lottery tickets are considered “bearer instruments,” said Buhrmann. Because of this, advisors should make sure any jackpot-winning clients establish ownership.

“Similar to the plot in the original ‘Die Hard’ movie, whoever possesses the lottery ticket is considered the owner,” he said. “Take a picture of yourself with the winning ticket. Consider signing it as the owner and then securing the ticket.”

Hertel also recommended that clients take a photo of the ticket or make a photocopy, then store the original ticket in a bank safe deposit box. Then the winner can work with a financial advisor and an estate planning attorney to claim the prize.

“The attorney may suggest accepting the prize in the name of a trust if your state allows,” she said. “Some states allow some level of anonymity, while others require the winner to be more public. We recommend maintaining as much privacy as possible.”

In Massachusetts, for example, an attorney can claim the prize on behalf of a client’s trust, which should be given an anonymous name.

“By doing it this way, it keeps your name and photograph out of the news and off of social media,” she said.

The antidote to all the potential windfall pitfalls is patience and planning, said Estrada.

“Take the time to map out, in detail, exactly what you want this money to do for you and others,” she said. “Only once you have that bulletproof blueprint should you start making moves.”