Before the SECURE Act was passed in 2019, non-spouse heirs who inherited IRAs could ‘stretch’ Required Minimum Distributions (RMDs) over their own single life expectancy, often allowing inherited accounts to last for decades. The SECURE Act replaced that treatment with a 10-Year Rule for most non-spouse beneficiaries, who must now fully deplete their inherited accounts within 10 years, typically much sooner than under the stretch rules would have allowed. Yet, in rewriting the law, Congress left one category of beneficiaries unchanged: Non-Designated Beneficiaries (NDBs).

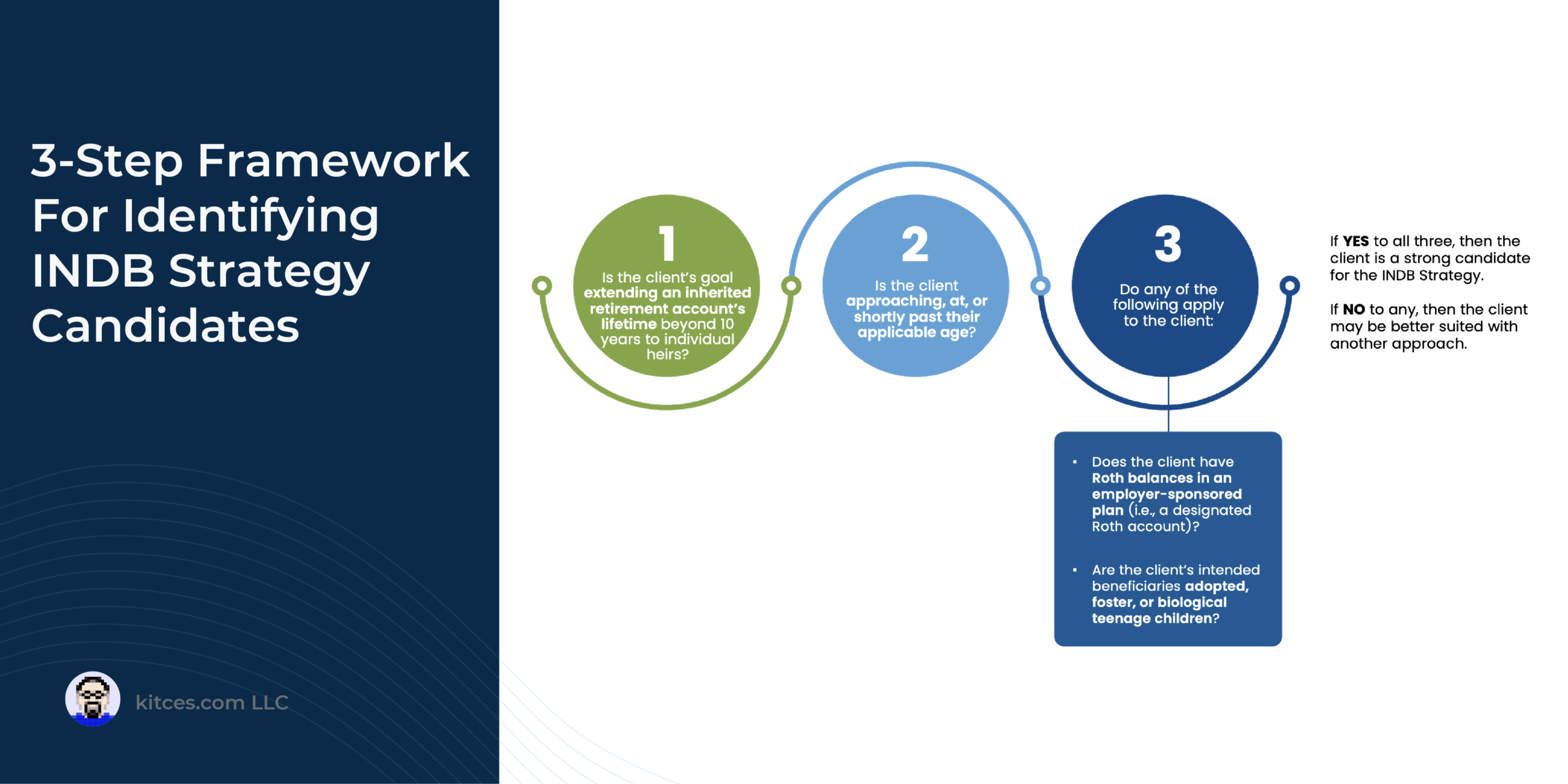

In this guest post, Brad Herdt, a financial planner at Deseret Mutual Benefit Administrators, introduces a strategy that allows financial planning clients to potentially stretch distributions for heirs beyond ten years – by intentionally using NDB treatment.

For NDBs, the maximum account lifetime is either five years if the account owner died before their Required Beginning Date (RBD) – the point when RMDs must begin – or the decedent’s remaining single life expectancy (reduced by one each year and rounded up) if the account owner died on or after their RBD. Which means that after the owner’s RBD, an NDB may potentially be allowed to deplete the account over a longer period based on when the owner dies – unlike Non-Eligible Designated Beneficiaries (NEDBs), who face a fixed 10-year window to empty the inherited account.

Importantly, once the owner survives past their RBD, the distribution schedules for NDBs is tied to the owner’s remaining life expectancy – which, in the early post-RBD years, can exceed the 10-year rule by as much as five years. At that point, deliberately naming specific beneficiary designations, certain types of trusts, or even the owner’s estate (all of which can make the heir an ‘Intentional’ NDB, or INDB) can stretch the payout period well beyond what an NEDB would receive. Still, as the owner ages and their remaining life expectancy shortens, NDB treatment eventually results in a shorter payout period than the 10-Year Rule – making it advantageous to revert back to an individual (i.e., NEDB) designation.

Even under ideal circumstances, though, an INDB’s annual RMDs for the first nine years will always be larger than under NEDB rules – front-loading taxable income. Which suggests that a cost-benefit analysis based on each client’s unique circumstances (e.g., the intended beneficiaries’ tax outlook and distribution behavior, account-specific factors like Roth earnings maturity and sequence-of-returns risk, and the client’s own preferences) is essential. Still, for the right clients – such as those with heirs who can absorb higher early traditional account withdrawals, or those with certain Roth employer plans – the benefit of stretching distributions beyond ten years can outweigh the cost.

Ultimately, the key point is that the INDB Strategy can potentially extend the distribution period by up to 50%, giving heirs more time and flexibility in managing cash flow and taxes. And because the strategy’s success depends on understanding the IRS timing and rule constraints, financial advisors can play a critical role in both determining when it’s appropriate and helping clients implement it effectively!

Read More…