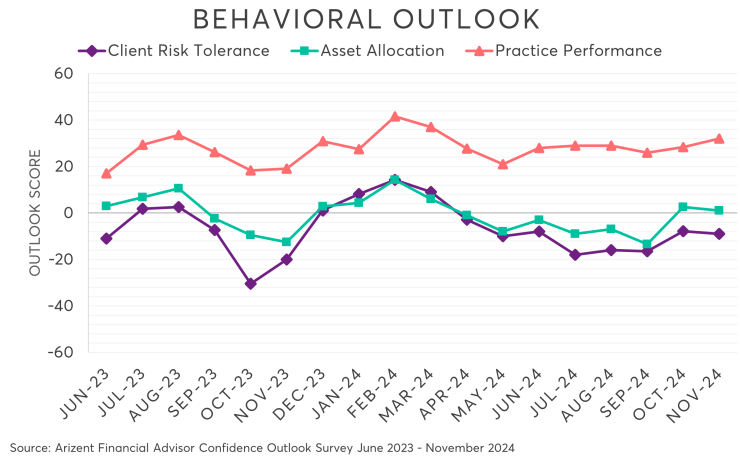

Financial confidence held steady this month as advisors and clients — like the rest of the country — awaited the presidential election and held their breath.

That’s according to the Financial Advisor Confidence Outlook (FACO), Arizent’s monthly survey of wealth managers. Every month, FACO asks hundreds of advisors about their confidence in the U.S. economy, measuring it on a scale of minus-100 to 100.

At the start of November, that confidence ticked upward, but only slightly — from a score of 2 in October to 3 this month.

In their survey responses, many planners said they could not have a clear economic outlook until they knew who would be entering the White House.

“The key thing on everyone’s mind is the presidential election,” one advisor wrote. “It is hard to predict what my clients will feel about the next three months without knowing who wins.”

Advisors on both sides of the political aisle expressed high election anxiety. Whether they supported former president Donald Trump or Vice President Kamala Harris, many said their finances — or their clients’ — depended heavily on the outcome.

“A Trump win would make my clients feel better about their money,” one wealth manager said.

Another said their business outlook depended on “whether the election continues our democracy or ushers in a totalitarian theocracy.”

“I’m very worried about a Trump administration,” a third planner wrote. “While he might be ‘pro-business,’ his off-the-cuff remarks, supporters who follow him like a cult, and talk of civil war, etc. worry me that we are heading for very dark and violent times. That will only hurt businesses, including mine.”

Like FACO’s overall score, other metrics remained nearly frozen in place. Asset allocation dipped from a score of 3 in October to 1 in November, and client risk tolerance ticked downward from minus-8 to minus-9.

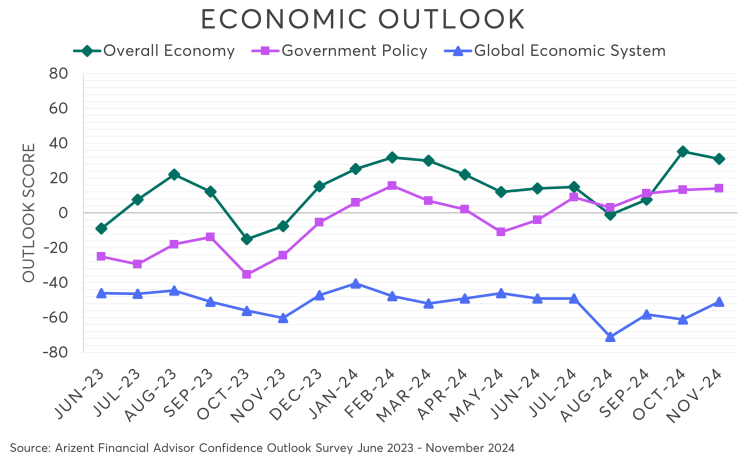

Scores for the macro environment were similarly static. Confidence in the overall economy slid from 35 in October to 31 in November, while faith in government policy rose by one point — from 13 to 14.

The outlook for such policy, many wealth managers said, depends a great deal on who will be running the government next year.

READ MORE: Ahead of Election Day, financial advisors’ confidence highest in 6 months

“New legislation is an X factor,” one planner said. “It could be positive, negative or both. Depends a lot on what happens with the election.”

Other advisor concerns included the wars in Ukraine and Israel, uncertainty over interest rates and what many saw as excessive regulation of their industry.

One worry that came up less than usual, however, was inflation. Price increases have slowed in recent months — one measure, the Consumer Price Index, has fallen for six consecutive months, settling at 2.4% in September. (In June 2022, it had been at 9.1%.)

Another area of improvement, many wealth managers mentioned, was the stock market. Both the S&P 500 and Dow Jones reached record highs in October — but for some planners, this was also a source of anxiety.

“We are overdue for a correction in the equity markets,” one advisor said. “We continually tell clients not to expect the high returns to continue.”

Whatever their concerns, overall wealth managers said their businesses were doing well. FACO’s score for practice performance increased this month, rising from 28 in October to 32 in November.

“Just waiting for the election outcome,” one planner said. “But generally staying the course.”