For advisors hoping their practice will be bought by a larger firm, sheer talent is no longer enough.

Processing Content

RIA acquirers now place much more value on “culture,” a catchall term often used to describe advisors’ and firms’ general approaches to clients, wealth management and how they do business. That shift in emphasis from talent to culture was one of the biggest changes noted in the latest Annual RIA M&A Outlook report from consulting and dealmaking firm DeVoe & Co.

A mere two years ago, only 4% of the firms DeVoe polled said they most valued culture in the RIAs they were considering buying. This year’s results, drawn from interviews with more than 100 RIA executives at firms managing anywhere from $100 million to more than $10 billion, showed the share of respondents looking for a good cultural fit has skyrocketed to nearly 70%.

Meanwhile, the proportion of potential acquirers valuing raw talent above all else among potential RIA acquisitions plummeted from roughly half in 2023 to 15% in the latest survey. DeVoe said in its report that the drop is likely the result of lessons learned from previous acquisitions.

“For many, talent alone is no longer the differentiator it once was,” according to the report. “Great people can only thrive in the right environment. After years of integrating high-performing teams, firms have learned that sustainable success depends less on who joins the organization, and more on how well they fit within it.”

The greater emphasis acquirers now put on culture was just one trend DeVoe & Co. teased out in its latest RIA M&A report. The results also suggested that advisors continue to be concerned about the valuation they can fetch for their firm if they choose to sell, their ability to pass their practice down to the next generation of owners, their capacity for increasing revenue and profits by means of “organic” growth and the effects of artificial intelligence and other innovations on the industry.

For more on those trends, read on.

Can RIAs still fetch high EBITDA multiples?

Consultants like DeVoe & Co. frequently issue reminders that there is no easy way to know what price acquirers might pay for an RIA. There are too many variables at play — including, above all, a given acquisition target’s prospects for business growth.

But that doesn’t stop advisors from trying to figure out the “going rate” for an RIA. Valuations are usually stated as a multiple of a firm’s EBITDA (earnings before interest, taxes, depreciation and amortization); in recent years, some firms have seen prices as high as 16 times EBITDA.

DeVoe’s M&A report doesn’t attempt to furnish a simple number showing what advisors can expect to fetch if they choose to sell. But it does show confidence that high prices are likely to stick around.

Nearly 60% of the respondents to DeVoe’s latest survey said they expect valuations to stay roughly the same next year; 32% said they would go somewhat lower, and 9% predicted a steep fall.

READ MORE: How EBITDA multiples are misleading RIA sellers in wealth

Advisors worry their young colleagues can’t buy the business

Accompanying thoughts about high valuations are worries that next-generation advisors can’t afford to buy the business when the owners decide to retire.

Only 22% of the respondents to DeVoe’s latest survey said they think they’ll be able to sell their firm to internal owners. That’s down remarkably from the 38% who said the same in 2021.

DeVoe noted in its report that the figure for this year is actually up slightly from 2023, when only 18% expressed confidence about their ability to sell their firm internally to younger advisors. But the slight rise isn’t necessarily a sign of improvement, DeVoe found.

“Firms whose next-gen cannot afford to take over are selling externally, leaving a smaller pool where an internal transition remains possible,” according to the report. “The trend remains worrisome.”

What’s more, roughly two-thirds of the respondents to DeVoe’s survey said they think succession planning is a “big future problem” in the industry. That’s up from roughly half in 2020.

READ MORE: How financial advisors can buy a wealth book of business

No slowdown for mergers and acquisitions

With many young advisors unable to buy out their older colleagues, firm owners continue turning to large outside acquirers..

The DeVoe survey asked respondents about the main reasons they’d consider selling their firms, allowing for multiple answers. Nearly 40% said “succession,” or the ability to pass it on to younger owners, and almost half said “liquidity,” or the desire to convert the business into cash. But the No. 1 reason, also cited by roughly half of the survey takers, was to boost business growth.

DeVoe has previously reported that 2025 is on pace to break yet another record for mergers and acquisitions in the RIA industry. For the third quarter alone this year, DeVoe counted 94 M&A deals, breaking the previous record of 81 deals cemented in the fourth quarter of 2024.

DeVoe’s latest survey results suggest firms expect no abatement to the frenetic pace. Nearly 55% of the respondents said they expect dealmaking to accelerate next year, and only 2% predicted a slowdown.

DeVoe noted that much of the purchasing is being done by two dozen or so firms it deems “meta-RIAs.” These serial acquirers, often large aggregators with backing from private equity investors, have stirred up their own host of concerns.

But whatever their drawbacks, private equity-owned firms have one distinct advantage: They can usually pay more for the firms they acquire.

“Backed by deeper capital resources, stronger leverage profiles, and proven post-acquisition growth efficiencies, PE firms have the capacity to support premium pricing,” DeVoe wrote. “Private equity now drives roughly 70% of RIA M&A activity, reshaping transaction dynamics and competitive positioning.”

READ MORE: How financial advisors can avoid bad private equity deals

Keeping those growth engines humming

Along with handing their firms down to younger advisors, RIA owners often struggle to keep their revenues and profit margins going in the right direction.

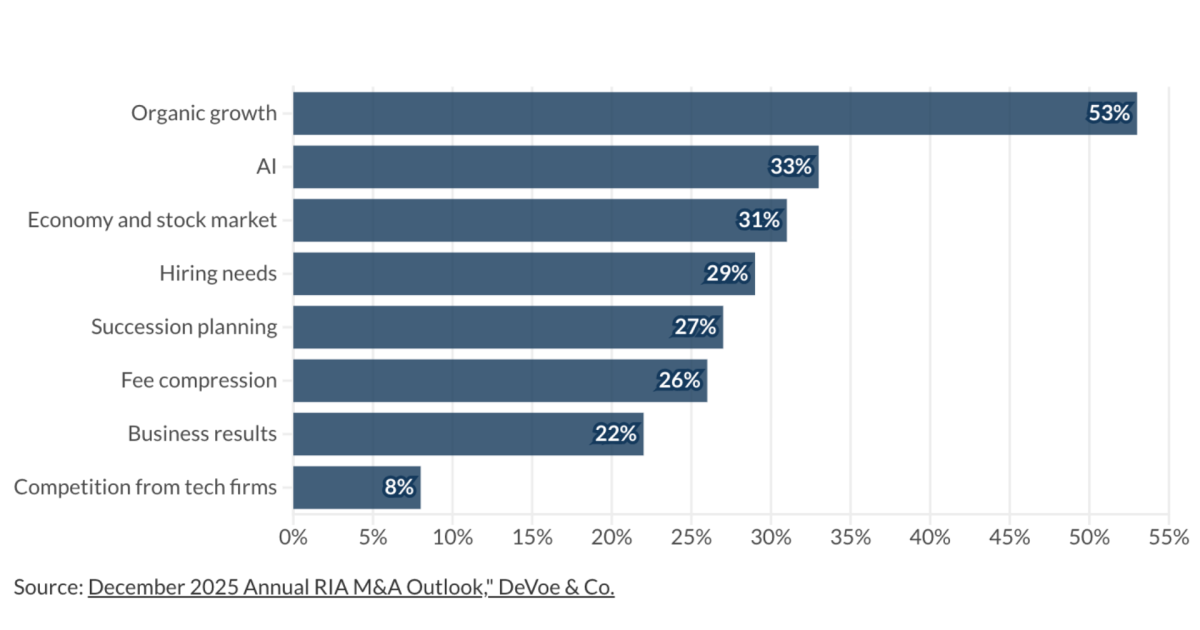

Asked about “what keeps them up at night,” just over half of the RIA executives surveyed by DeVoe said it was their firm’s “organic growth,” or business growth achieved without acquisitions. That response beat out the effects of AI on the wealth management industry (cited by 33%), the economy and the stock market (31%) and their firm’s hiring needs (28%).

It’s not only executives who have their minds fixed on organic growth. Among the potential RIA buyers surveyed by DeVoe, nearly 80% said their No. 1 driver for buying firms was a desire to achieve “growth.”

DeVoe’s report notes that many firms have struggled to expand even amid recent favorable economic conditions and bull market runs enjoyed in the U.S.

“That realization is pushing more leaders to view M&A as a necessary complement (or, in some cases, a required alternative) to the growth they have struggled to produce on their own,” according to the report.

READ MORE: Financial advisors express doubts about giant RIA rollups

The influence and effects of AI on wealth management

The DeVoe study also looked at what artificial intelligence, machine learning and similar technologies are likely to mean for wealth management.

Just over 40% of the respondents said they think AI will have a modest effect on the wealth management industry, “mainly in regard to advisor efficiency.” Thirty-seven percent said AI will largely be a boon for RIAs, whereas only 2% said it will be harmful.