Financial advisors at RIAs have a fiduciary obligation to their clients, which includes both a Duty of Loyalty (to avoid – or at least disclose and take steps to mitigate – any conflicts of interest) and a Duty of Care (to act with prudence when making investment recommendations, considering both their investment opportunity and benefits along with the associated costs). However, while certain costs (e.g., fund expense ratios or ticket charges on trades) are relatively transparent, RIA custodians also earn revenue in various ways from client portfolios in exchange for the custodian’s services. Which means RIAs that place clients at a particular RIA custodial platform also have a fiduciary obligation to ensure that their clients are paying reasonable expenses to the platform in exchange for the services they receive. That said, when it comes to RIA custodians, there is no explicit fee for services – nor really any way to determine the total costs clients actually pay (i.e., that their RIA custodian earns) for custodial-related services – making it difficult for firms to determine whether their current custodial relationships are truly aligned with their fiduciary obligation to their clients.

Notably, RIAs aren’t necessarily required to choose the lowest-cost custodial option for their clients. Nonetheless, if an RIA did choose a more expensive one, the firm would, at a minimum, have a fiduciary obligation to justify why that option was chosen and how it would benefit the client (e.g., a particular custodian might offer superior technology to execute trades and better service to resolve client issues). Though, given the lack of price transparency amongst custodians, such a calculation is again nearly impossible to make!

With the current RIA custody model creating challenges for advisory firms to fulfill their fiduciary responsibilities to their clients – and putting their interests at odds with those of the custodians they work with (with a firm trying to minimize custodian-related client costs and the custodian having an interest in generating more revenue from each RIA client) – both RIA firms and custodians have an interest in finding an alternative.

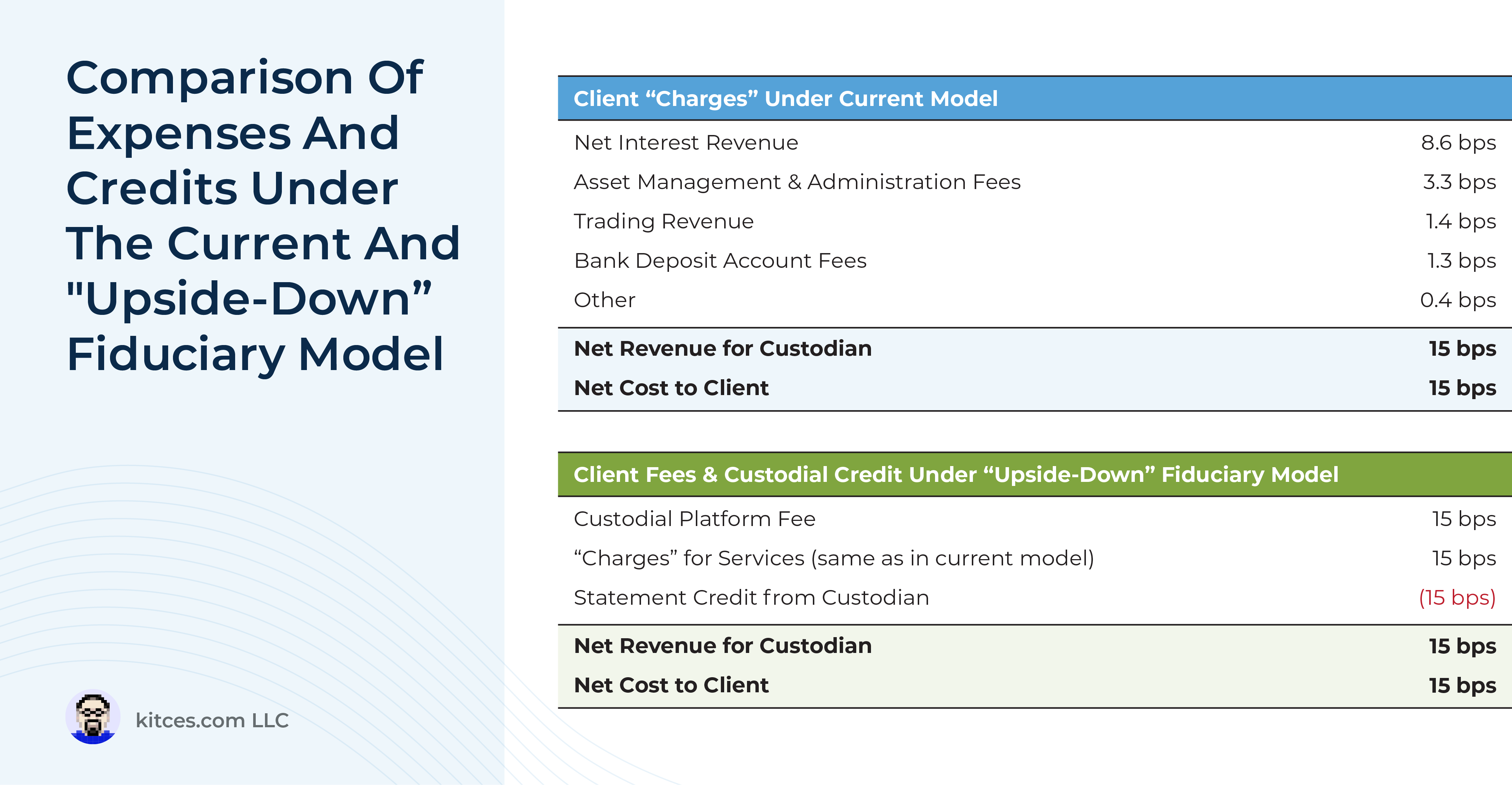

One possible option would be for the RIA custodian to charge a basis-point fee to each client of RIAs on its platform, equal to the average fees they’re earning under the current model (so the custodian continues to earn the revenue it needs to provide its services), and then apply a credit to the client’s statement for any other revenue the custodian is earning. In many cases, this might fully offset the custodial fee anyway, but it would be done at the client’s discretion as to how they wish to pay! In turn, custodians would be incentivized to better ‘stock the shelves’ of their custodial platform with unique offerings (e.g., highest-yielding cash sweeps, lower-cost investment products) to attract advisors and their clients to the platform to pay the fee (and thus grow their own assets).

While the concept of such an ‘upside-down’ fiduciary model for RIA custody is relatively straightforward to re-align the interests of the custodian, the advisor, and their client, doing so would come with non-trivial complexities and questions – not only in terms of systems but also in determining fairness to RIAs and their clients. For example, a custodian would have to determine whether the statement credit would be allocated across all clients on their platform at the client, account, or individual holding level. Also, such a move could lead to uncomfortable conversations for advisors (e.g., if they choose a more expensive custodian that provides them with practice management support or client referrals, which benefit the advisory firm but don’t actually benefit the client that incurred the cost).

Though, arguably the biggest challenge of instituting a basis-point fee and statement credit system is behavioral. Simply put, clients (and their advisors) aren’t used to paying an outright fee for custody. And when something has been provided for ‘free’ for so long, any fee – no matter how reasonable – can induce sticker shock (even if much, or even all, of the fee is being rebated through the statement credits)! Though notably, the entire evolution of the RIA movement for the past 20 years has been the transition from opaque commissions (on investment products) to transparent advisory fees, which consumers have ultimately come to prefer because of the better alignment with their advisor… suggesting that, in the long run, custodians stand to benefit from a more fiduciary pricing model for RIA custody in the same manner that RIAs themselves have benefited in the marketplace.

Ultimately, the key point is that the current RIA custody model presents fiduciary challenges for advisors, who have no feasible way to compare the costs for their clients of different custodians they might work with to ensure clients are receiving benefits commensurate with their cost (as custodial revenue yield, and thus pricing, can vary significantly from one platform to another). Which suggests that an alternative approach – pairing a clear basis-point fee for the client with statement credits for revenue generated by their use of custodial services – not only offers greater transparency in the costs for custodial services but also better aligns the interests of clients, advisors, and the custodians they work with. And, in the end, that alignment would allow advisors to more effectively fulfill their fiduciary obligations to clients!

Read More…