The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, largely serves to extend and modestly expand several provisions of the 2017 Tax Cuts and Jobs Act (TCJA), providing advisors and their clients with a clearer tax planning landscape heading into 2026. While many of the most impactful provisions – such as the enhanced State And Local Tax (SALT) deduction and new below-the-line deductions for tips and overtime – are already in effect for 2025, OBBBA still introduces several nuanced planning opportunities with looming year-end deadlines, offering advisors an opportunity to help a variety of clients before the end of 2025.

One major opportunity stems from OBBBA’s changes to charitable contribution rules. Beginning in 2026, itemized charitable deductions will be reduced by a 0.5%-of-AGI floor, and high-income taxpayers in the 37% bracket will also see a 2/37 haircut on all itemized deductions. High-income clients may benefit from frontloading charitable giving into 2025 to avoid these new limitations, potentially using Donor Advised Funds (DAFs) to preserve flexibility in future grantmaking. Simultaneously, starting in 2026, a new above-the-line charitable deduction of up to $1,000 (single) or $2,000 (joint) will become available to non-itemizers. This introduces a planning wrinkle for clients near the itemizing threshold, who may want to lump non-charitable deductions like SALT and mortgage interest into 2025, while preserving smaller charitable gifts for future standard-deduction years.

Another time-sensitive strategy applies to employees with Incentive Stock Option (ISOs) compensation. In 2026, the phaseout threshold for the AMT exemption will drop, while the SALT deduction cap will rise to $40,000, increasing the risk of triggering AMT for ISO exercises. This narrows the window for clients with unexercised ISOs to act in 2025 to avoid or reduce AMT exposure. Especially for clients whose ISO exercises would land them in the 2026 “bump zone” – where marginal tax rates on additional AMT income can reach 42% – it may make sense to accelerate exercises into 2025, where they may result in no or lower AMT.

OBBBA also expands 529 plan distribution rules to include up to $20,000 of K–12-related expenses and credentialing costs like coursework required for CFP certification, effective for distributions made after July 4, 2025. Importantly, funds can be used to reimburse expenses incurred at any point during 2025, as long as the distribution is made before year-end. This creates a one-time opportunity for clients with eligible 529 balances to reimburse themselves for previously ineligible educational expenses from earlier in the year.

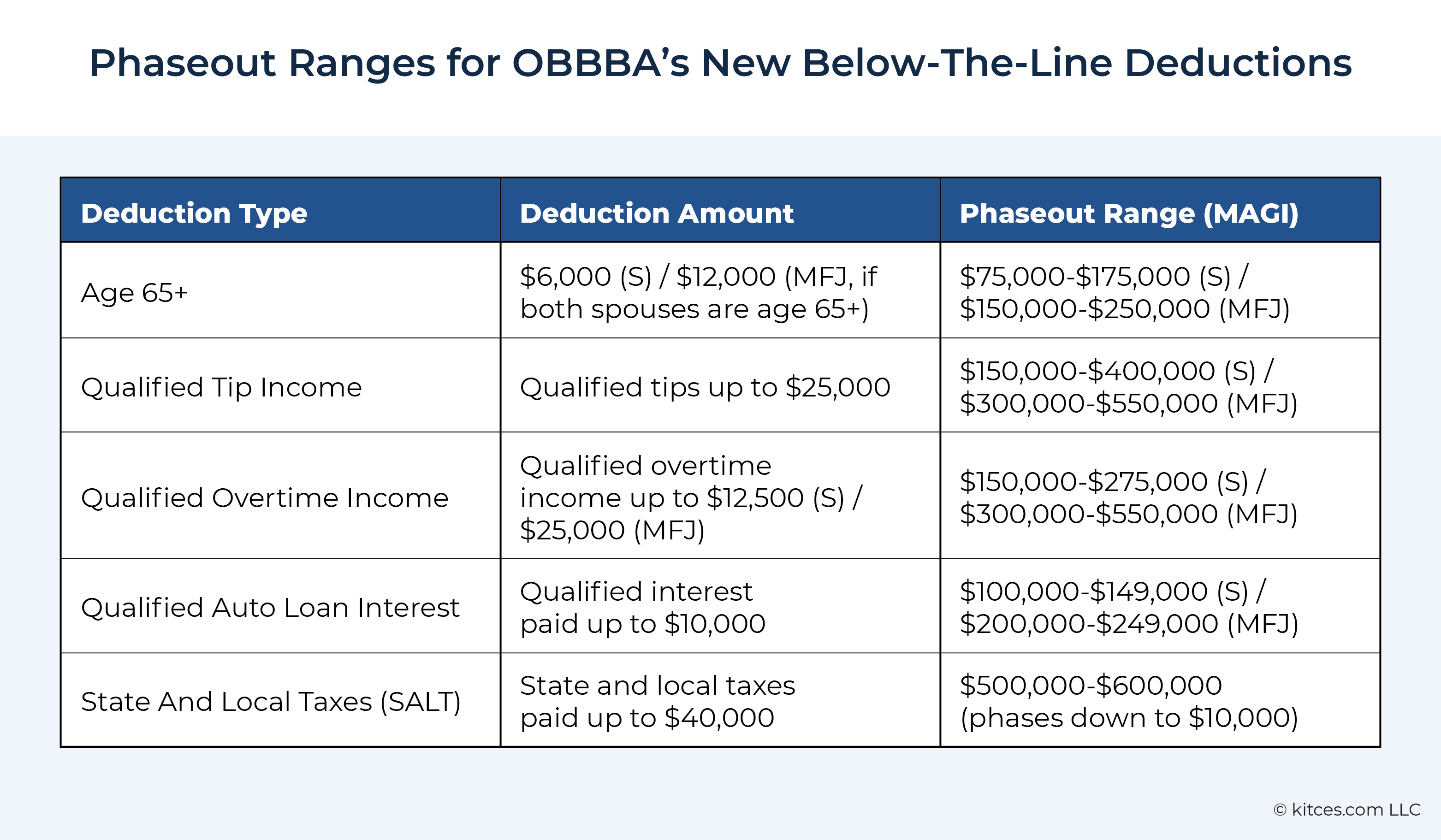

Additionally, the introduction of several temporary below-the-line deductions for seniors, tip earners, overtime workers, and auto loan interest creates a new layer of complexity for Roth conversion and withdrawal strategies between 2025 and 2028. Each deduction phases out over specific (but separate) income thresholds, meaning pre-tax income from withdrawals or conversions could unintentionally reduce or eliminate one or more deductions. Advisors can revisit existing Roth conversion plans in light of these phaseouts, recognizing that even modest conversions may produce ‘magnified’ marginal rates due to lost deductions. Effective coordination between tax software and the advisor’s planning tools will be critical to model the true cost of conversions during this window.

For self-employed professionals in Specified Service Trades or Businesses (SSTBs) – including financial advisors – the shifting phaseout ranges for the Qualified Business Income (QBI) deduction create yet another one-time planning opportunity. Though OBBBA retains most of the QBI deduction in its previous form under TCJA, it widens the SSTB phaseout range in 2026. As a result, SSTB owners whose income falls within the current 2025 phaseout range may want to defer income into 2026, where the spike in marginal tax rates on income through the phaseout range will be more gradual. Conversely, those whose income already exceeds the 2025 phaseout limits but could fall within the expanded 2026 range may benefit from accelerating income into 2025 to avoid a spike in marginal income next year.

Finally, OBBBA accelerates the expiration of certain energy credits originally introduced by the Inflation Reduction Act. While some deadlines – such as those for electric vehicle credits – have already passed, there’s still time before December 31, 2025, to complete qualifying energy-efficient home improvements and receive up to $3,200 in tax credits. Smaller projects like new doors or windows – and even scheduling a home energy audit – may still be feasible within this narrow timeframe and can help clients reduce both their taxes and utility costs.

Ultimately, while OBBBA doesn’t completely overhaul the tax code, it does introduce a series of narrow but meaningful planning opportunities for a wide range of clients. Helping clients plan and execute year-end tax strategies is an annual opportunity for advisors to show their value, but with OBBBA’s new provisions, advisors have the chance to create even more tangible tax savings before the calendar flips to 2026!

Read More…