Following the equity market volatility of the first half of 2025, investors (and their advisors) saw a calmer third quarter that rewarded those who stayed invested. As the Q4 2025 begins, this relative calm offers an opportunity for advisors to review the current state of the market and ensure portfolios remain positioned to meet their clients’ unique long-term objectives.

In this guest post, James Liu, CEO and founder of Clearnomics, highlights 10 market themes that are likely to arise in client conversations – from the possibility of a market pullback after a series of all-time highs to the broader outlook for the economy.

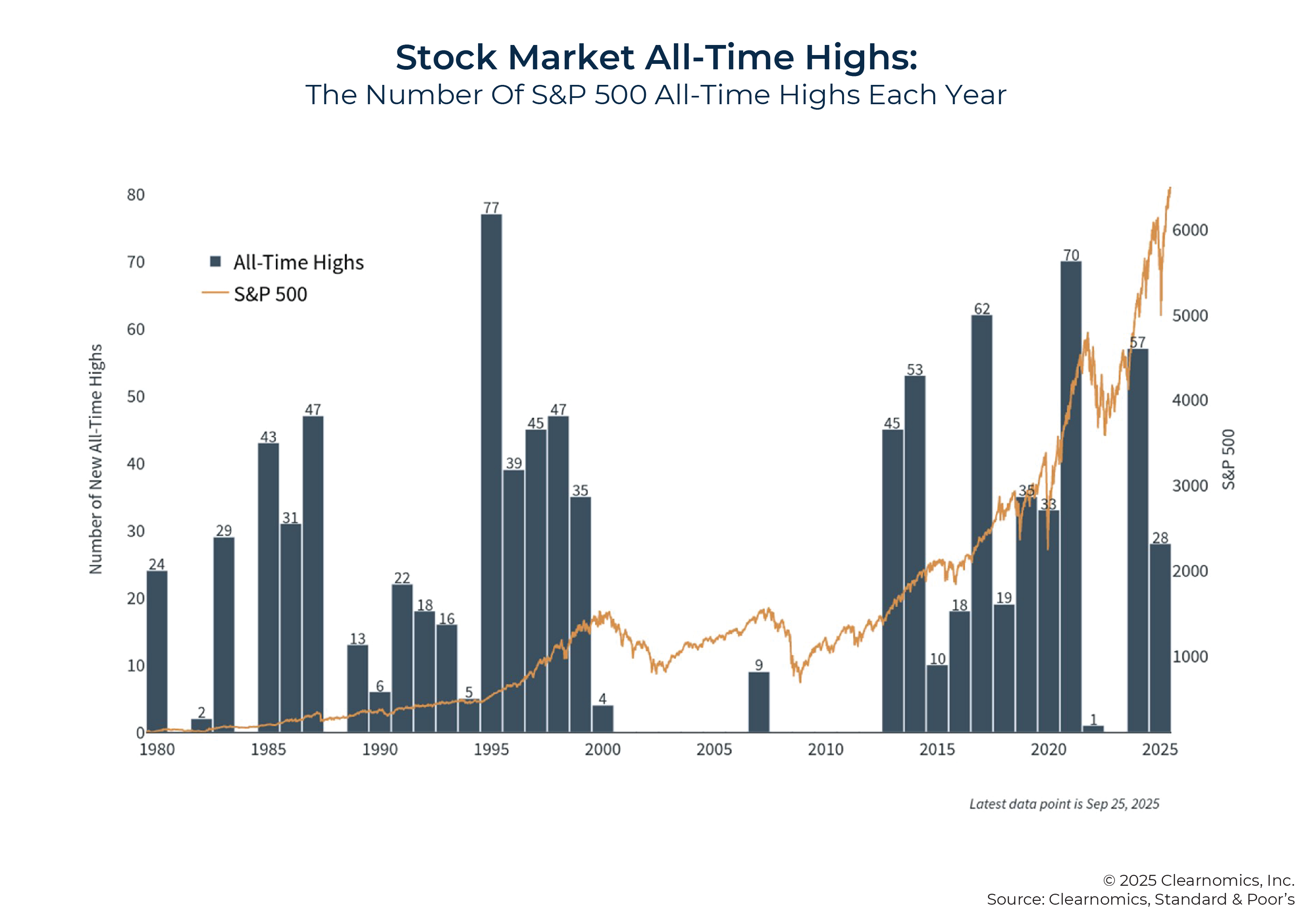

Despite the sharp declines earlier in the year, the stock market has brought positive returns in 2025, reaching 28 record highs so far. While some investors may worry about a pullback at these levels, history shows that markets often continue to climb even after reaching new records (for instance, 2021 experienced 70 all-time highs). Still, concerns about elevated valuations of major market indices are also common. Notably, though, while valuations are important for long-term investors, they typically don’t predict short-term market movements well. Instead, they tend to be more useful for guiding asset allocation rather than for determining whether to enter or exit the market completely. Further, while the strong performance of the “Magnificent 7” technology stocks (powered in part by investments in artificial intelligence infrastructure) has led to increased market concentration, corporate earnings have exceeded expectations so far this year across many sectors, and strong performance in the months ahead could improve valuations as well.

Investors have also been paying close attention to the Federal Reserve, which, after much anticipation, delivered its first rate cut of 0.25% at its September meeting. Additional cuts remain possible, though Fed officials will continue to monitor key data points on inflation (which has steadied but remains above target) and employment (which presents a mixed picture, with low unemployment but slowing job growth).

The third quarter also saw passage of the “One Big Beautiful Bill Act” (OBBBA), which brought greater clarity to the tax landscape for 2025 and beyond. In upcoming conversations, advisors can highlight not only how the law will affect clients’ personal tax situations – such as the expanded cap on State And Local Tax (SALT) deductions – but also how it may shape America’s fiscal trajectory. With the law projected to add $3.4 trillion to the deficit over the next decade, it raises important questions about long-term fiscal sustainability.

Ultimately, the key point is that the current market and economic environment presents both opportunities and challenges for investors as the year draws to a close. While the S&P 500 has reached record highs and corporate earnings continue to exceed expectations, the underlying landscape remains complex, with tech-driven concentration risk and persistent fiscal concerns. This highlights the critical role of financial advisors in guiding clients through market complexities and helping them stay focused on their long-term goals, rather than the daily headlines!

Read More…