What Is The AI Divide in Data Centers, Semiconductors and Sovereignty?

The AI Divide represents a strategic inflection point for global business. market dominance3. Those without these resources will fall behind, not just technologically but competitively, productivity4, customer engagement5, and decision-making6. is widening across industries and geographies, creating systemic issues for companies that fail to invest, such as:

The infrastructure gap is a key driver of the AI Divide, as advanced AI requires high-performance computing, scalable cloud platforms, and secure data pipelines. Companies with modern infrastructure can deploy AI at scale and innovate faster, while those without it face operational bottlenecks and competitive risk. For business leaders, closing this gap through strategic investment and partnerships is essential to maintain growth and resilience in an AI-driven economy.

Massive investments in sovereign AI infrastructure and hyperscale projects like Stargate are amplifying economic disparities in AI adoption. . For business leaders, this trend underscores the urgency of strategic investment and partnerships to remain competitive in an AI-driven global economy.

The productivity gap driven by AI is widening as companies deploy increasingly autonomous, agentic AI systems that handle complex workflows with minimal human oversight. For business leaders, this trend makes adopting agentic AI a strategic imperative to maintain competitiveness and shareholder value.

What Is Driving The AI Divide?

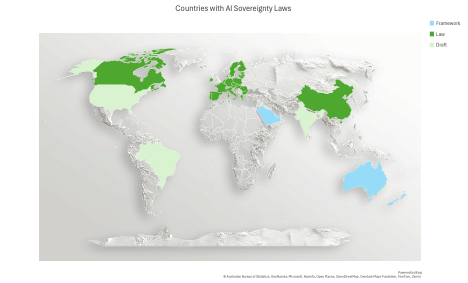

The global AI divide is widening as nations and corporations grapple with sovereignty, trade barriers, and resource constraints. Governments are enforcing data sovereignty laws to protect national interests, while tariffs and export controls on advanced chips and AI technologies—especially amid U.S.-China tensions—are reshaping supply chains and driving up costs. At the same time, building competitive AI systems requires massive compute power, vast datasets, specialized talent, and energy infrastructure, creating steep entry barriers. For business leaders, these dynamics make AI not just a technology issue but a strategic imperative requiring localized compliance, geopolitical risk planning, and partnerships to secure critical resources.

Governments are increasingly pursuing Sovereign AI strategies to strengthen domestic competitiveness, encouraging local AI development and prioritizing the use of nationally governed data to create advantages for businesses operating within their borders. However, Sovereign AI is not universally attainable. Many countries face binding constraints in capital availability, energy capacity, water resources, land, industrial ecosystems, and skilled talent, limiting their ability to build and sustain fully independent AI stacks.7

Tariffs are another tool of nations to promote the use of local goods and services. The impact of tariffs and reciprocal tariffs on AI is not just from semiconductors, but also from the raw materials and equipment needed for facilities supporting AI, such as data centers and power plants. Depending on where you plan to build your AI infrastructure and the complexity of your supply chain, tariffs can more than double costs. Negotiations between nations will hopefully conclude soon and eliminate the uncertainty enterprises face in where and when to build their AI capabilities.8

Export controls are also being used to exert control over the AI race. Restricting access to AI hardware and models has been employed to maintain a lead in AI development and innovation. This had the intended consequence of ensuring that specific countries and AI companies preserved their position pushing state-of-the-art AI. However, this created strong competition in the form of more efficient AI models (i.e. DeepSeek), hardware (Huawei Ascend), and new semiconductor foundries.9

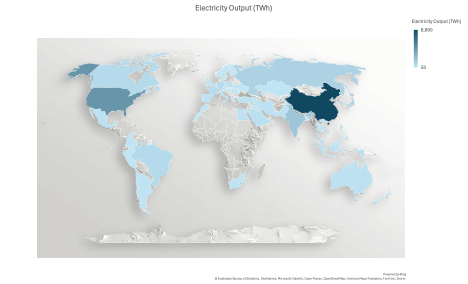

The next factor is the ever increasing requirements for AI infrastructure Increasingly powerful AI chips are driving up power demands and the cooling needed from IT infrastructure and data center facilities. This prevents AI from being built just anywhere: many existing enterprise data centers do not have the additional power from the grid to accommodate state-of-the-art AI systems and are not plumbed for water; and hyperscalers need a lot of land, energy, and water to handle their multi-tenant AI services.10

Research Goals

We are researching on what the AI Divide means to enterprise organizations globally. Specifically, we are assessing:

How it impacts organizations that operate globally, regionally, or locally

What benefits and disadvantages does the AI Divide create

What strategies can be used to mitigate the negative impacts of the AI Divide

Look forward to future blogs and reports on how to address these points! If you have any questions about what the AI Divide means for your organization and how you can mitigate its negative impacts, Forrester clients can request inquiries and guidance sessions with Forrester or reach out to your account team.

Data Sources

McKinsey: The state of AI in 2025: Agents, innovation, and transformation

McKinsey: Bold accelerators: How operations leaders re pulling ahead using AI

Financial Content: The AI Arms Race: Tech Giants Battle for Dominance, Reshaping Markets and Fueling Valuations

Apollo Technical: 27 AI Productivity Statistics You Want To Know

of.code: AI in Customer Service Statistics: 50+ Actionable Insights for your Business Strategy

Forbes: How AI Is Reshaping Corporate Decision-Making: From Data To Insights

Data sourced from Global AI Law and Policy Tracker, Global AI Regulation Tracker

Data sourced from World Tariff Profiles 2025, World Bank Tariff Data, Wikipedia

Data sourced from Bureau of Industry and Security

Data sourced from Energy Institute Statistical Review and IEA Electricity Market Report