Updated on January 28th, 2026 by Bob Ciura

Investing is all about earning the highest return possible, while minimizing risk. Of course, there are many routes investors can take to reach this destination.

Two of the most common ways people invest are the stock market, and in real estate. The subject of dividend stocks versus real estate is a complex topic, with no one right answer.

What works for one individual may not work for someone else.

When it comes to dividend stocks, we believe investors should focus on the Dividend Aristocrats, a group of 68 stocks in the S&P 500 Index that have raised their dividends for at least 25 consecutive years.

You can download an Excel spreadsheet of all 69 Dividend Aristocrats (with metrics that matter such as dividend yields and price-to-earnings ratios) by clicking the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

As a result, there are many different viewpoints on the subject. If you were to ask 10 different investors which is better, you might get 10 different answers.

There are pros and cons to each strategy, although studies have shown over the years that one approach may indeed be better than the other.

This article will discuss the various advantages and disadvantages of dividend investing versus real estate investing.

Dividend Investing Pros and Cons

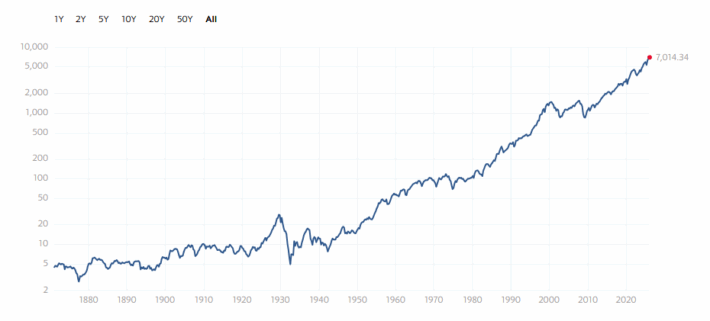

Investing in stocks has been one of the best ways to build wealth over the long-term. Consider the historical performance of the S&P 500 Index:

Source: Multpl.com

The S&P 500 Index recently crossed above 7,000, a record high.

On January 1, 2026, the S&P 500 Index closed at 6,901.78. On January 1, 1875, the index was at 124.49 points, adjusted for inflation. Over that 151-year period, the S&P 500 returned 2.7% per year, on average, after inflation.

This return does not include dividends.

Dividend stocks can be even more rewarding. Take, for example, the list of Dividend Aristocrats, a group of companies in the S&P 500 that have raised dividends for 25+ years.

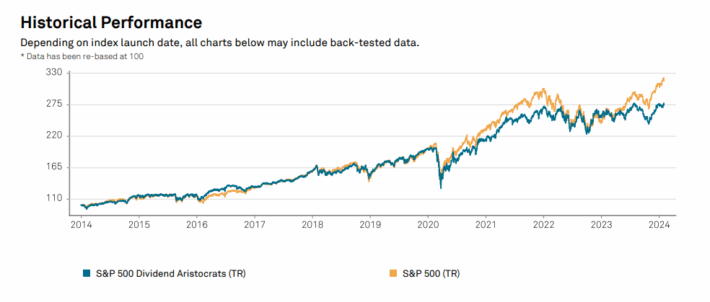

The S&P Dividend Aristocrats have slightly under-performed the broader S&P 500 Index in the past decade. Still, the Dividend Aristocrats generated strong total returns of 10.49% per year in the 10-year period ending December 31st, 2025.

Source: S&P Fact Sheet

The beauty of investing in dividends versus real estate, is that dividend stocks pay you to own them, not the other way around.

Dividend stocks are an especially attractive option for retirees, because dividend income can help replace lost wages after retirement, at a much lower cost than investing in real estate.

There are significant tax considerations for dividend investing.

Taxes can be a disadvantage of dividend investing, particularly if the investor does not make use of tax-advantaged accounts like IRAs.

Capital gains taxes, especially short-term rates, can eat into the returns that dividend stocks provide.

According to the Internal Revenue Service, long-term capital gains, meaning gains on stock investments that were held for at least one year, are typically 15% for most taxpayers.

For those in the top tax bracket for ordinary income, the long-term capital gains rate is 20%.

That said, short-term capital gains are subject to taxation as ordinary income.

And, if the stocks are held in taxable accounts, investors will have to pay tax on the dividend income as well. Qualified dividends are taxed at the same rate as long-term capital gains.

Even so, capital gains and dividend taxes are usually a much smaller tax bill than real estate taxes.

And, there are tax-advantaged accounts that dividend investors can utilize to shield themselves from taxes, such as the Roth IRA.

Of course, the biggest disadvantage of investing in dividend stocks versus real estate, is that dividend stocks won’t provide a roof over your head.

Now that we’ve sized up the pros and cons of dividend investing, we will move on to the pros and cons of real estate investing.

Real Estate Investing Pros and Cons

Comparing dividend investing to real estate investing is not always an apples-to-apples comparison. It’s not an either-or proposition; in most cases, the dividend investor still needs a place to live.

The appeal of investing in real estate is that it allows investors to build equity and one day pay off their mortgage, rather than paying rent to a landlord indefinitely.

A home can help build significant wealth for the homeowner, whereas renters will have to keep paying rent in perpetuity, with no equity built up.

Real estate can also generate income, for example by renting, although that sets up an additional set of issues.

However, real estate, on average, has produced fairly low returns over the past several decades.

Consider the Case-Shiller Home Index, a widely-used gauge of U.S. home values. As of November 1st 2025, the Case-Schiller Home Index stood at 330.447; on December 1st, 1890, the index was at 146.1 (all values are adjusted for inflation).

This means that, over the course of that nearly 135-year period, homes in the U.S. returned 0.5% per year in real terms.

Now compare these returns with the S&P 500 Index, referenced in the opening section—the S&P’s historical annual returns are more than five times that of real estate.

What real estate investors need to keep in mind are the costs of home ownership. This is what can erode the returns from real estate investing.

That is why, if someone tells you they bought a home for $200,000 and sold it 30 years later for $500,000, you shouldn’t assume they earned $300,000 in profit.

Outside of a mortgage, there are a number of additional costs that real estate investors have to pay that renters do not—just a few include mortgage interest, closing costs, homeowner’s insurance, taxes, and home owner’s association dues (if applicable).

And, this doesn’t even include costs to keep and maintain a home in proper condition, such as new appliances, furniture, etc.

In some cases, a homeowner could actually lose money, even if they sold their house at a much higher price than what they paid for it, because of the costs of ownership along the way.

Real estate investing does have its share of advantages. For example, home owners can deduct a portion of mortgage interest paid each year.

However, affordability has worsened due to rising interest rates. The average rate on a 30-year fixed mortgage hovers around 6.1% according to Bankrate. Of course, in the early 1980’s, it was not uncommon to see double-digit rates for 30-year fixed mortgages.

Final Thoughts

There is no single solution that works for everybody. There have been many investors who made their fortunes in the stock market, and many others who did so in real estate.

The Dividend Aristocrats have outperformed the broader market—and trounced real estate—with relatively low volatility. Essentially, investing in dividend stocks is the slow-and-steady route to building wealth.

Real estate investing involves a great deal of leverage—if you’ve put down 20% on a home (which many homeowners do not), you’ve borrowed 80% of the home value.

For a $500,000 home, that means investors are borrowing $400,000.

Leverage can amplify returns. But as many Americans learned the hard way during the 2008 real estate crash, leverage works both ways.

Other Dividend Lists

The Dividend Aristocrats list is not the only way to quickly screen for stocks that regularly pay rising dividends.

The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 54 stocks with 50+ years of consecutive dividend increases.

The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500.

The Complete List of Russell 2000 Stocks: arguably the world’s best-known benchmark for small-cap U.S. stocks.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].