Why do more than 90% of traders lose money if we all look at the same charts, read the same news, and trade the same stocks?

It’s our own minds that get in the way.

It’s the psychological traps and biases that lead us down a path of self-sabotage.

That’s what makes AI tools so powerful.

These game-changing tools redefine the rules by allowing us to take emotions out of the equation.

Then, it goes a step further by sniffing out lucrative trading opportunities within the noise.

Discover how AI trading tools not only shield you from costly errors but also open the door to massive trading opportunities…

#1 Persistent Perseverance

One of the biggest challenges traders face is emotional decision-making. Even I fall victim to it from time to time.

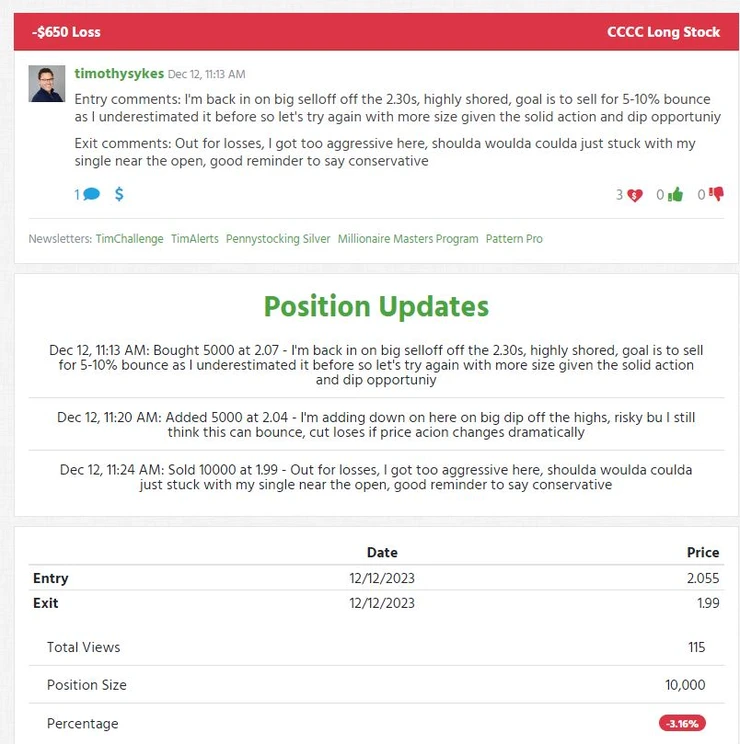

Heck, it happened to me when I traded CCCC.

It was flagged as a top pick, and rightly so. The stock leaped from $2.75 to $8.37, offering multiple winning moments for traders.

I was dead right when I initially took the trade on a Tuesday morning.

(Click here to view larger image.)

However, when I traded it in the afternoon, I let my emotions get the best of me. And despite the stock surging by the close, I talked myself out of the position and ended up taking a small loss.

(Click here to view larger image.)

If a trader like myself with over $7.5 million in career trading profits can stumble and make emotional decisions … how bad do you think it can get for new and less experienced traders?

For some, they blow out their accounts before they can ever figure out how to control their emotions.

How AI Solves This Issue:

AI trading tools have no emotions.

It makes decisions based on data, trends, and statistical probabilities…

Not on fear or excitement.

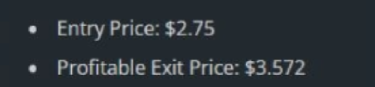

For example, on Tuesday afternoon, one AI tool that I use sent out an alert for CCCC at $2.75.

On Wednesday, the stock hit a high of $6.03…

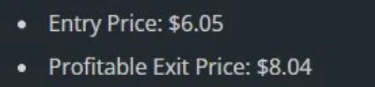

Most traders, including myself, would be reluctant to trade CCCC after such a monster move…

But the AI alerted CCCC again on Wednesday afternoon…

CCCC hit a high of $8.37 … reaching the AI’s profit target.

(Click here to view larger image.)

#2: Breaking The Cycle of Overtrading

Overtrading often stems from the urge to recover losses quickly or the misconception that more trades equal more profits.

This horrible habit increases exposure to risk and can lead to significant losses.

How AI Solves This Issue:

AI trading tools can scan the entire market for you, and spit out an automated report each trading day. It highlights the top stocks based on a proprietary ranking system.

Remember CCCC. A stock that experienced a monster move … surging by more than 200%.

Not only does my AI find the stocks with the highest potential … but it also lays out a game plan on how to potentially trade them.

This is critical for traders who suffer from overtrading because it can help them maintain a balance, ensuring that each trade aligns with a well-thought-out strategy rather than impulsive reactions.

#3: Eliminating Bias and Improving Decision Quality

Human traders are prone to biases like confirmation biases or overconfidence, which can skew their perception and decision-making process.

Take short sellers in this market as an example. They are probably 99% right on their thesis … but it’s their overconfidence that gets them destroyed.

How AI Solves This Issue:

AI operates without bias.

It processes information and recognizes patterns based on objective analysis, not subjective beliefs or past experiences. This unbiased approach can lead to more consistent and reliable trading decisions.

#4: Consistent Application of Risk Management Principles

One of the reasons why short sellers are getting destroyed in this market isn’t because they have bad ideas…

It’s because they are stubborn and lack any type of risk management skill.

They often ignore stop-loss orders or risk more than they should on a single trade because they feel like they will eventually be right.

How AI Solves This Issue:

AI trading tools come with their own set of risk management rules…

It clearly defines levels of support and resistance. As well as, what area you should look to cut losses.

This consistency ensures that risk parameters are always followed, protecting traders from unexpected market swings and emotional decision-making.

Time to Transform Your Trading

I’m releasing my AI trading tool to you this Friday. It’s called XGPT.

With it, you can put an end to self-destructive trading. I’ll walk you through everything you need to know on Friday. All you have to do is RSVP — it’s free.

Click here to save your spot now.

(Note: When you click the above, you will be automatically added to our XGPT 1-Day Profit Windows email list and you’ll receive messaging from our team. You can opt-out at any time. | Privacy Policy)

Cheers,

Tim SykesEditor, Tim Sykes Daily

Tim SykesEditor, Tim Sykes Daily

P.S. And as always, if you have any questions, email me at [email protected].