Shares of Signet Jewelers Limited (NYSE: SIG) fell over 3% on Tuesday. The stock has gained 3% year-to-date. The jewelry retailer delivered strong results for the third quarter of 2026, with growth in sales and profits. The company hiked its guidance for the full year of 2026 but offered a cautious outlook for the fourth quarter. SIG continues to make progress on its Grow Brand Love strategy which helped drive its quarterly performance.

Top and bottom line growth

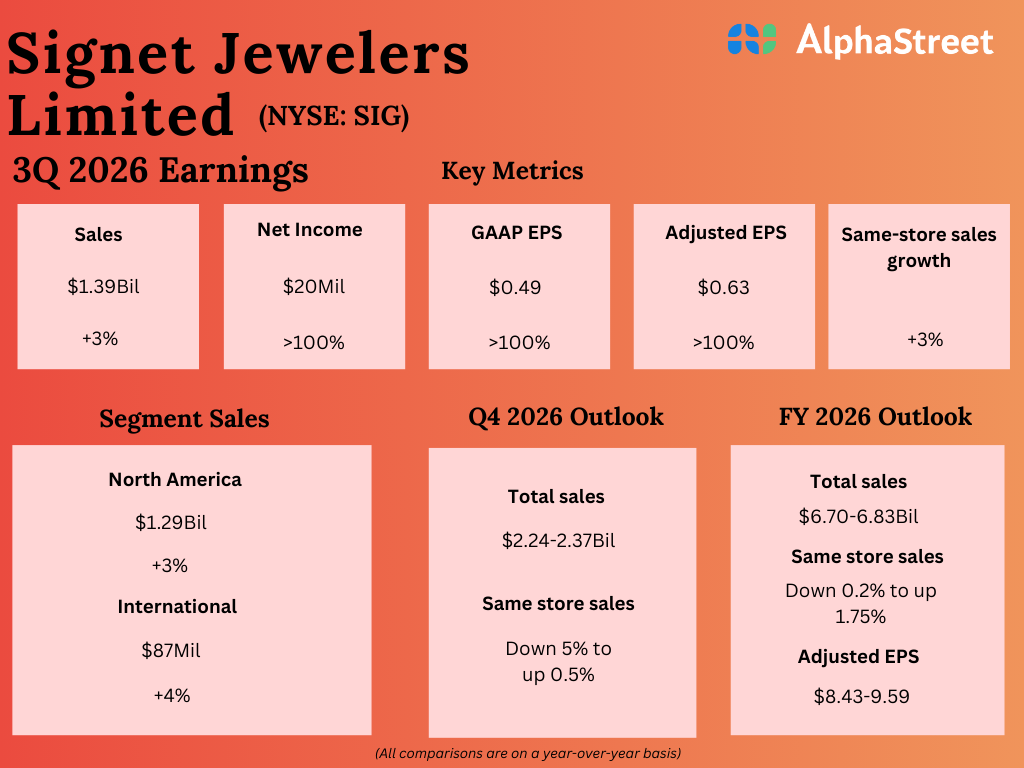

Signet witnessed top and bottom line growth in the third quarter of 2026. Total sales increased 3.1% year-over-year to $1.4 billion. Same-store sales rose 3%. Earnings, on an adjusted basis, more than doubled to $0.63 per share versus the prior-year period.

Business performance and Grow Brand Love strategy

Signet recorded sales increases across both its segments in the third quarter. The North America segment saw both total sales and same-store sales increase 3% while the International segment saw total sales grow 4.4% and same-store sales gain 3.6%.

All three categories, bridal, fashion, and watches, recorded growth during the quarter, helped by a strong assortment. SIG continues to gain traction on its Grow Brand Love strategy, with its largest brands Kay, Zales, and Jared delivering combined same-store sales growth of 6% in the quarter.

Within the bridal category, unique offerings and strategic pricing helped drive high-single-digit sales growth for the Kay, Zales, and Peoples brands. In fashion, Jared saw comp sales grow 10%, led by strength in diamonds, gold, and men’s jewelry. Lab-grown diamonds, or LGDs, continue to gain popularity, increasing its penetration to 15% of fashion sales in Q3, which is almost double from last year.

Signet’s gross margin expanded by 130 basis points to 37.3%, driven by merchandise margin expansion and services growth. The company is working on driving margins through a pricing and promotion strategy that involves select price increases and less reliance on promotions. Growth in the high-margin services business is also helping in margin expansion. SIG has also managed to mitigate a large part of its tariff impacts through strategic sourcing.

Signet’s efforts in revamping its stores is paying off with its recently renovated Kay, Zales, Jared stores seeing a mid-single-digit gain in sales. The company continues to shift high-performing stores to stronger markets and better locations and these actions are yielding positive results.

Guidance – full-year hike and caution on Q4

Signet raised its guidance for the full year of 2026 based on its third quarter performance. The jeweler now expects total sales to range between $6.70-6.83 billion, and same-store sales to be down 0.2% to up 1.75% for the year. Adjusted EPS is expected to be $8.43-9.59.

However, the company has provided a cautious outlook for the fourth quarter of 2026 due to external disruptions since late October and a muted consumer sentiment. It has seen a slowdown in traffic, mainly in brands with more exposure to customers from the lower to middle income bracket. SIG expects total sales of $2.24-2.37 billion for Q4 while same-store sales are expected to be down 5% to up 0.5%.

The post Signet Jewelers (SIG): A look at the progress made on Grow Brand Love first appeared on AlphaStreet.