Inflation has made winter more expensive than ever, and seniors are feeling the pressure. Heating bills, medical expenses, and grocery prices all tend to rise during the colder months, making winter budget fixes essential for retirees living on fixed incomes. Many older adults say their dollars simply don’t stretch as far as they used to, especially when unexpected seasonal costs appear. Without a plan, winter can quickly become financially overwhelming. Understanding which winter budget fixes actually work helps seniors stay ahead of rising expenses.

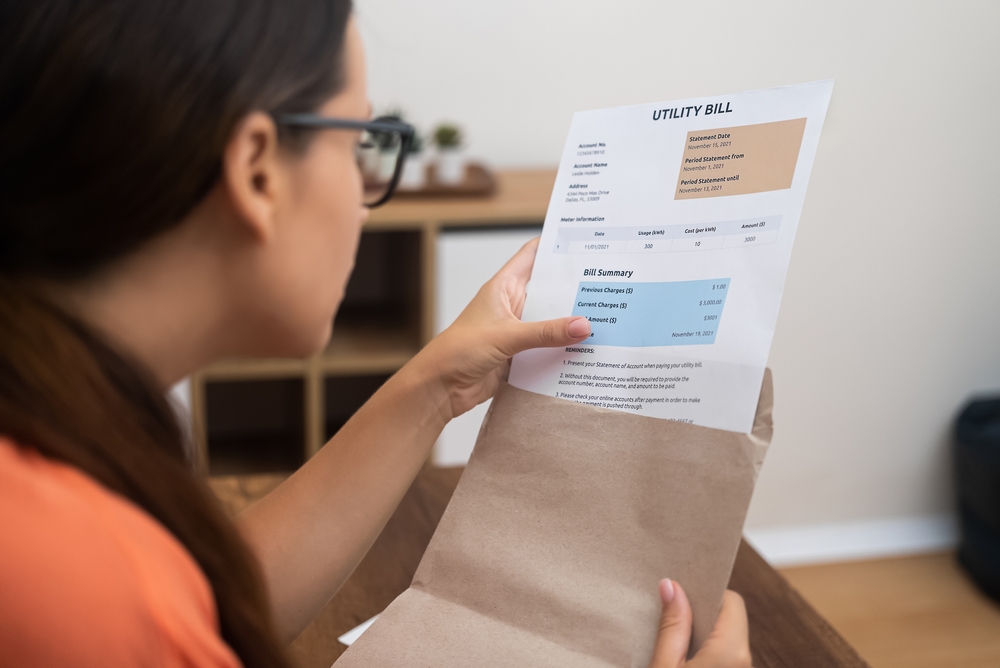

1. Switching to Budget Billing for Utilities

One of the most effective winter budget fixes is enrolling in budget billing programs offered by utility companies. These programs spread heating and electricity costs evenly throughout the year, preventing large spikes during the coldest months. Seniors who rely on Social Security often appreciate the predictability this provides. Instead of facing unpredictable bills that jump by hundreds of dollars, retirees can plan around a consistent monthly amount. This winter budget fix is especially helpful for older adults living in drafty or older homes.

2. Reducing Grocery Costs With Senior Discount Days

Grocery prices have risen sharply, making food one of the biggest winter expenses for seniors. Many stores offer senior discount days, loyalty programs, or digital coupons that can significantly reduce costs. Taking advantage of these savings opportunities is one of the simplest winter budget fixes available. Seniors who plan their shopping around discount days often save 10 to 20% on essentials. This fix helps retirees stretch their food budget without sacrificing nutrition.

3. Reviewing Insurance Policies for Hidden Increases

Insurance premiums often change in January, and reviewing policies is one of the most important winter budget fixes seniors can make. Many retirees discover new deductibles, higher copays, or reduced coverage only after receiving their first bill of the year. By reviewing policies early, seniors can catch hidden increases and adjust their budgets accordingly. This step also helps retirees determine whether switching plans during the next enrollment period might save money. Staying informed is essential when inflation affects nearly every aspect of healthcare.

4. Cutting Back on Unused Subscriptions and Services

Subscription creep is a real issue for many retirees, making this one of the most overlooked winter budget fixes. Streaming services, magazines, home security add‑ons, and unused memberships can quietly drain a senior’s budget. Winter is the perfect time to review bank statements and identify recurring charges that no longer serve a purpose. Canceling even a few small subscriptions can free up extra cash for heating bills or groceries. This fix helps seniors regain control over their monthly expenses.

5. Applying Early for Energy Assistance Programs

Energy assistance programs often operate on a first‑come, first‑served basis, making early application one of the most valuable winter budget fixes. Programs like LIHEAP, utility hardship funds, and local nonprofit grants can significantly reduce heating costs. Seniors who apply early are more likely to receive help before funding runs out. Even retirees who think they may not qualify are often surprised to learn they meet the income requirements. This winter budget fix can save hundreds of dollars during the coldest months.

6. Planning Meals Around Affordable Staples

Food inflation has hit seniors hard, making meal planning one of the most practical winter budget fixes. Retirees can stretch their grocery budget by planning meals around affordable staples like beans, rice, oats, frozen vegetables, and canned goods. Cooking larger batches and freezing leftovers can also reduce waste and save money. Seniors who plan meals ahead of time are less likely to rely on expensive takeout or last‑minute grocery trips. This fix helps retirees maintain healthy eating habits without overspending.

7. Using Community Resources to Reduce Winter Expenses

Many communities offer free or low‑cost services that can help seniors save money during winter. These may include meal programs, transportation services, weatherization assistance, or senior‑center activities. Taking advantage of these resources is one of the most effective winter budget fixes, yet many retirees don’t realize what’s available. Seniors who stay connected to local organizations often discover programs that significantly reduce monthly expenses. This fix helps older adults maintain independence while protecting their savings.

When Winter Budget Fixes Become a Long‑Term Strategy

For some seniors, winter budget fixes become long‑term habits that improve financial stability year‑round. Strategies like reviewing subscriptions, planning meals, and monitoring utility usage can benefit retirees in every season. Inflation may continue to fluctuate, but strong budgeting habits help seniors stay prepared. These winter budget fixes are not just temporary solutions—they are tools that support long‑term financial health. Retirees who adopt these habits often feel more confident and secure throughout the year.

A Warmer Winter Through Smarter Planning

Winter doesn’t have to be a season of financial stress. With the right winter budget fixes, seniors can stay warm, healthy, and financially stable even as inflation rises. These strategies empower retirees to take control of their expenses and protect their savings. A little planning goes a long way when winter costs start to climb. The more prepared seniors are, the more comfortable and confident they’ll feel throughout the season.

If you’ve tried any winter budget fixes that helped you save money, share your tips in the comments. Your advice may help another senior stay financially secure this winter.

You May Also Like

9 Money Moves That Feel Smart But Ruin Your Future

12 Financial Tasks Seniors Should Tackle Before the First Snow

8 Inflation-Driven Grocery Swaps Seniors Are Making to Stretch Budgets

6 Winter Health Expenses Older Adults Forget to Budget For

High Winter Heating Costs Are Forcing Older Adults To Rework Their Budgets