Psychology is just as important as strategy in stock trading.

The market will test your patience, discipline, and emotional control constantly. If you don’t manage your mindset, no amount of technical analysis will save your account.

Here are the 4 psychological traps every trader should learn to avoid.

#1: Fear of Missing Out (FOMO) on Opportunities

FOMO leads to rushed entries and bad timing. You see a stock up 50% and think you’re missing out. But by the time you buy, it’s already peaked. Real trading isn’t about catching every move — it’s about waiting for high-probability setups.

#2: Revenge Trading After Taking a Loss

Taking a loss hurts. But trying to “get it back” right away leads to overtrading and more losses. Step away. Review the mistake. Wait for your next setup.

#3: Overconfidence After a Winning Streak

A few good trades can lead to sloppy thinking. You start ignoring your rules and sizing up too much. That’s when the market humbles you. Stay grounded after wins.

#4: Losing Patience and Forcing Trades

No setup? No trade. Forcing trades out of boredom or pressure is one of the fastest ways to burn money. Sit out until the chart tells you it’s time.

Tools That Can Help You Trade Smarter

Today’s trader has more tools than ever to make better trading decisions. From advanced charting software to AI-driven platforms, the right setup can improve your speed, accuracy, and discipline.

But tools are only useful if you use them correctly.

Over the years, I’ve seen students improve their performance just by tracking their trades or learning to read price action better using simple tools.

You don’t need expensive software — you need consistency in how you use what you have.

Here’s what I recommend starting with…

✅ Keep a Trading Journal to Track Performance

Documenting your trades helps you learn from both wins and losses. Include the entry, exit, strategy, outcome, and how you felt during the trade.

✅ Use Market News and Data Platforms

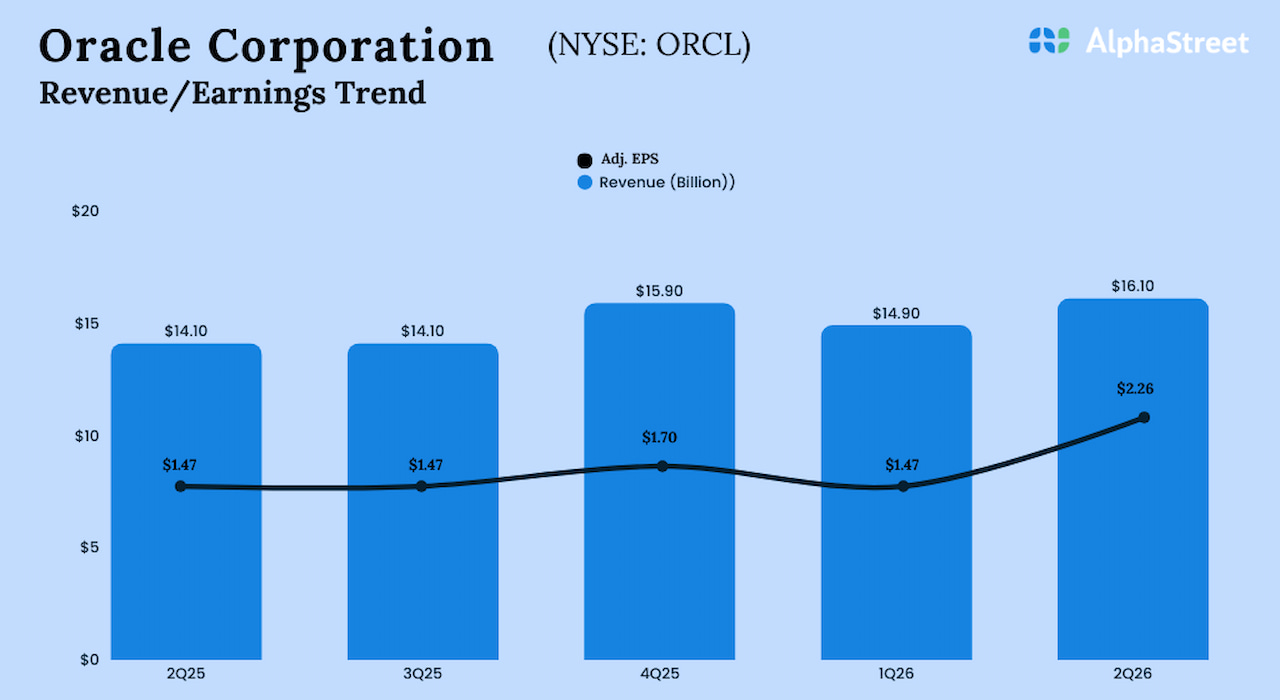

Real-time news gives you context. Earnings, guidance, filings, and sector trends can move stocks fast. Stay updated.

✅ Leverage Charting and Technical Analysis Software

Use tools like support/resistance levels, moving averages, and volume indicators to refine entries and exits. Don’t trade blindly.

✅ Explore AI and Automation in Trading

AI tools can scan for patterns or automate parts of your strategy. Just make sure you understand the logic behind them.

✅ Take Advantage of Advanced Retail Tools

Many brokers now offer tools like level 2 data, premarket scanners, and advanced order types. Learn to use them to improve execution.

This is a market tailor-made for traders who are prepared. Stocks thrive on volatility, but it’s up to you to capitalize on it. Stick to your plan, manage your risk, and don’t let FOMO drive your decisions.

These opportunities are fast and unpredictable, but with the right strategy, you can make them work for you.

If you have any questions, send them to me at [email protected].

Cheers,

Tim SykesEditor, Tim Sykes Daily