Herbert Hoover was a progressive activist president when it came to intervention into the economy. During this period, while free market capitalism was already increasingly hampered in the US (i.e., central banking, business regulations to the benefit of politically-connected big business, the income tax, etc.), many countries were experimenting with bold new theories of central planning (e.g., socialism, communism, fascism). Herbert Hoover—before and during his presidency—was at the forefront of this progressive-interventionist paradigm. Somehow, Hoover received an undeserved reputation as “the last stubborn guardian of laissez-faire in America.”

Murray Rothbard, in chapter 15 of The Progressive Era—“Herbert Hoover and the Myth of Laissez-Faire”—wrote about the inversion of the historical truth regarding Hoover,

The major theme of this chapter is that this conventional historical view is pure mythology and that the facts are virtually the reverse: that Herbert Hoover, far from being an advocate of laissez-faire, was in every way the precursor of Roosevelt and the New Deal, that, in short, he was one of the major leaders of the 20th-century shift from relatively laissez-faire capitalism to the modern corporate state. In the terminology of William A. Williams and the New Left, Hoover was a preeminent “corporate liberal.”

Even prior to his presidency, Hoover had a plan to “reconstruct America” in his “Reconstruction Program,” which outlined a corporate state, complete with national planning through “voluntary” cooperation among businesses and groups under “central direction.” Under this plan, “the Federal Reserve was to allocate capital to essential industries and thereby eliminate the industrial ‘waste’ of free markets.” Additionally, public works like public dams, improvement of waterways, a federal home-loan banking system, promotion of unions, and government regulation of the stock market.

Herbert Hoover was—and always was—an economic interventionist. He only gained a reputation as a non-interventionist when he did not want to go as far as other progressives. Even as historians have softened on their outlook on Hoover, they usually still manage to avoid the obvious connection between interventionism and lack of economic recovery.

Hoover’s Interventionism

In 2011, Steven Horwitz published an excellent study titled “Herbert Hoover: Father of the New Deal.” In the executive summary, Horwitz explains,

Politicians and pundits portray Herbert Hoover as a defender of laissez faire governance whose dogmatic commitment to small government led him to stand by and do nothing while the economy collapsed in the wake of the stock market crash in 1929. In fact, Hoover had long been a critic of laissez faire. As president, he doubled federal spending in real terms in four years. He also used government to prop up wages, restricted immigration, signed the Smoot-Hawley tariff, raised taxes, and created the Reconstruction Finance Corporation—all interventionist measures and not laissez faire.

This was known at the time and afterward. In 1948, Raymond Moley—a member of FDR’s “brains trust” and the chief rhetorical strategist and policymaker of the early New Deal—wrote in an article in Newsweek titled “Reappraising Hoover” (cited in Horwitz), “When we all burst into Washington. . .we found every essential idea [of the New Deal] enacted in the 100-day Congress in the Hoover administration itself.” Further, Rexford Tugwell—another academic in the “brains trust”—was quoted in The Forgotten Man: A New History of the Great Depression (p. 149) as saying, “When it was all over, I once made a list of New Deal ventures begun during Hoover’s years as Secretary of Commerce and then as president. . . . The New Deal owed much to what he had begun.” Further, Tugwell once wrote to Moley (January 29, 1965), “we were too hard on a man who really invented most of the devices we used.”

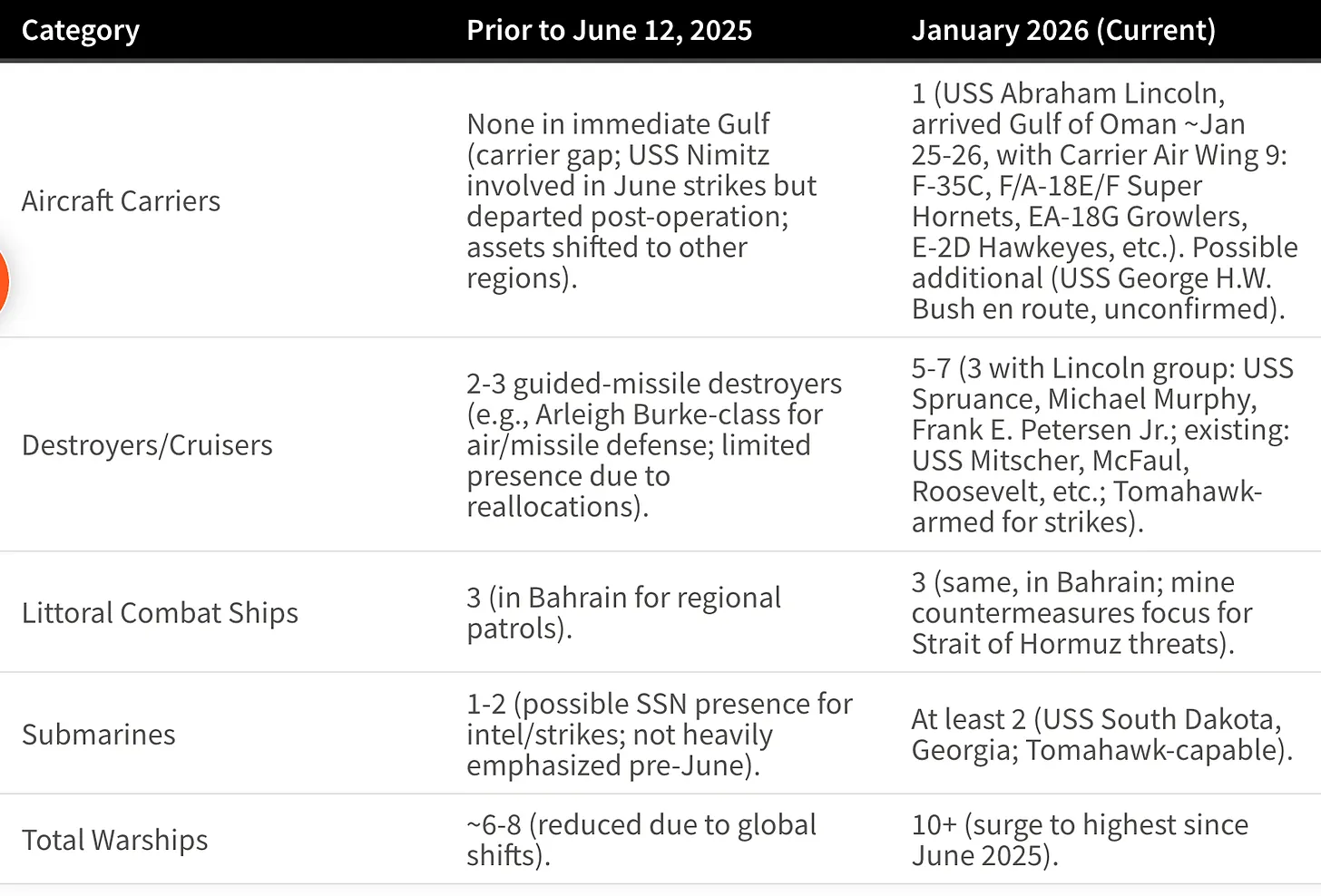

Just in terms of government spending, not to mention all the other interventions, we can see that government spending was increasing during the Hoover administration (see Figure #1).

Figure #1—Real Federal Spending (1929-1934)

Furthermore, and ironically, Hoover was so well-known as an interventionist and proponent of big government spending that the Roosevelt presidential campaign criticized Hoover on government spending. Just so the point is not missed, FDR himself attacked Hoover, accusing him of too much government spending. In his “Campaign Address on the Federal Budget at Pittsburgh, Pennsylvania” (October 19, 1932), Roosevelt said,

For over two years our Federal Government has experienced unprecedented deficits, in spite of increased taxes. We must not forget that there are three separate governmental spending and taxing agencies in the United States the national Government in Washington, the State Government and the local government. Perhaps because the apparent national income seemed to have spiraled upward from about 35 billions a year in 1913, the year before the outbreak of the World War, to about 90 billions in 1928, four years ago, all three of our governmental units became reckless; and, consequently, the total spending in all three classes, national, State and local, rose in the same period from about three billions to nearly thirteen billions, or from 8 1/2 percent of income to 14 1/2 percent of income.

“Come-easy-go-easy” was the rule. It was all very merry while it lasted. We did not greatly worry. We thought we were getting rich. But when the Crash came, we were shocked to find that while income melted away like snow in the spring, governmental expense did not drop at all. It is estimated that in 1932 our total national income will not much exceed 45 billions, or half of what it used to be, while our total cost of Government will likely be considerably in excess of 15 billions. This simply means that the 14 percent that Government cost has risen to has now become 33 1/3 percent of our national income. Take it in terms of human beings: It means that we are paying for the cost of our three kinds of Government $125 a year for every man, woman and child in the United States, or $625 a year for the average family of five people. Can we stand that? I do not believe it. That is a perfectly impossible economic condition. Quite apart from every man’s own tax assessment, that burden is a brake on any return to normal business activity. Taxes are paid in the sweat of every man who labors because they are a burden on production and are paid through production. If those taxes are excessive, they are reflected in idle factories, in tax-sold farms, and in hordes of hungry people, tramping the streets and seeking jobs in vain. Our workers may never see a tax bill, but they pay. They pay in deductions from wages, in increased cost of what they buy, or — as now — in broad unemployment throughout the land. There is not an unemployed man, there is not a struggling farmer, whose interest in this subject is not direct and vital. It comes home to every one of us! (emphasis added)

Both Hoover and Roosevelt promoted massive federal spending on public works, federal farm price supports, bailouts for banks, railroads, and other industries, trade protectionism, wage and labor market interventions, credit and banking controls, federal home and mortgage interventions, price-fixing, cartelization, and production controls. Both Hoover and Roosevelt believed that heavy and immediate government intervention was necessary to bring recovery from the Great Depression. Both of their administrations oversaw unprecedented governmental interventions in the economy, neither of them realized the hoped-for recovery, and both facilitated programs that demonstrably hampered economic growth.

Hoover the Foil

Toward the end of his administration, as the Great Depression dragged on, Herbert Hoover apparently indicated that he had lost some faith in the efficacy of his prescribed interventions. While not a laissez-faire president, nor was Hoover a fascist or communist; he resisted a certain extent of collectivization unlike Roosevelt, therefore, Hoover was caricatured by political opposition as a non-interventionist and this allowed FDR to contrast himself against Hoover. The Democratic campaign began to reshape Hoover’s reputation, absurdly using him as a foil—the anti-Roosevelt. Davis W. Houck, in “Rhetoric as Currency: Herbert Hoover and the 1929 Stock Market Crash,” Rhetoric & Public Affairs 3 (2000) records two statements from two other historians on this subject,

The inevitable comparisons, and their absurdity, is insightfully noted by Alfred B. Rollins: Hoover became “merely the polar opposite of those characteristics popularly arrogated to Roosevelt. He became the man that Roosevelt was not, a mere foil for his artful and persuasive adversary [Alfred B. Rollins, “The View from the State House: FDR,” in The Hoover Presidency: A Reappraisal, ed. Martin L. Fausold and George T. Mazuzan (Albany: SUNY Press, 1974), p. 123].”

Similarly, Ellis W. Hawley notes, “Hoover remained an anti-Roosevelt. His activities served as backdrops or foils for the progressive innovations of the New Deal, and his accepted interpreters were historians primarily concerned with tracing, explaining, and celebrating the ‘Roosevelt Revolution’ [Ellis W. Hawley, “Herbert Hoover and Modern American History: Sixty Years After,” in Herbert Hoover and the Historians, ed. Mark M. Dodge (West Branch: Herbert Hoover Presidential Library Association, 1989), p. 5].”

Houck concludes, “Yet, ideologically and rhetorically, Hoover and Roosevelt were often more similar than different.” Both Hoover and Roosevelt were economic interventionists, and that was the problem.