Shares of Beyond Meat, Inc. (NASDAQ: BYND) fell 6% on Wednesday. The stock has dropped 69% year-to-date. The plant-based meat company delivered another quarter of disappointing results and its outlook for the upcoming three-month period is not encouraging either. Although BYND is persisting in its efforts for a turnaround, the possibility of this seems low at the moment.

Continued revenue declines and losses

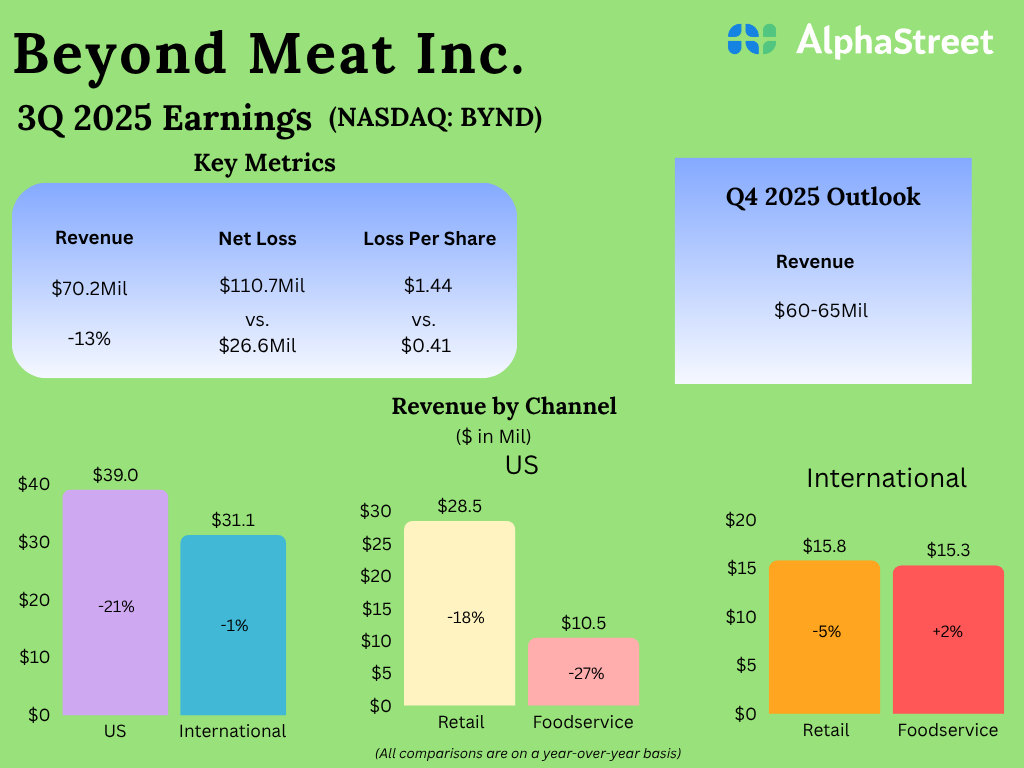

Beyond Meat continues to see declines in revenues along with continued losses quarter after quarter. In the third quarter of 2025, revenues fell over 13% to $70.2 million compared to the previous year. The top line decrease was driven by a 10% drop in volume and a 3.5% drop in net revenue per pound.

Volumes were impacted by weak category demand, reduced points of distribution in US retail, and lower sales to Quick Service Restaurant (QSR) customers in international foodservice. Higher trade discounts, product sales mix changes, and price decreases for certain products led to lower net revenue per pound.

Net loss in Q3 widened to $110.7 million, or $1.44 per share, from $26.6 million, or $0.41 per share, in the year-ago period. Gross margin dropped to 10.3% in the quarter from 17.7% last year. Margins were hurt by higher cost of goods sold per pound and lower net revenue per pound.

Segment declines

Beyond Meat saw revenues decline in both the US and international segments. Within the US, the company saw double-digit revenue declines in both the retail and foodservice channels, driven by declines in volume and net revenue per pound. Volumes were hurt mainly by soft category demand while net revenue per pound was impacted by higher trade discounts and price cuts for some products.

In the international retail channel, revenues were down 4.6%, due to a 12.5% drop in volume caused by lower sales of BYND’s burger, dinner sausage, and chicken products. The volume decline was partly offset by a 9.1% increase in net revenue per pound, which was driven by product sales mix changes, and price increases for some products.

On its earnings call, the company mentioned that although category dynamics in key international markets were more favorable compared to the US, two of its top three markets in the European Union were seeing year-over-year declines.

The international foodservice channel alone posted a 2% growth in revenues, helped by a 4% growth in volume, partly offset by a 2% drop in net revenue per pound. Volumes were driven by higher sales of chicken products to a QSR customer, while net revenue per pound was hit by changes in product sales mix.

Beyond Meat is striving to drive a recovery through product innovation, partnerships with retailers and cost reduction. Against a weak demand backdrop, it is focusing on driving growth with restaurants and institutions that cater specifically to health-conscious customers.

Bleak outlook

Beyond Meat has issued a muted outlook for the fourth quarter of 2025 as it continues to face a weak and uncertain macroeconomic environment. The company expects revenue of $60-65 million for Q4, which is lower on both a sequential and year-over-year basis.

Even though Beyond Meat seems optimistic about its recovery, there appears to be too many hurdles in its path at this point.