Investors Shift From Big Tech to Old-School Value Stocks

After years of chasing the market’s high-flying tech giants, investors appear to be turning toward the market’s long-overlooked players. Stocks in traditional sectors like healthcare and industrials are suddenly back in demand — signaling what many call a “value comeback.”

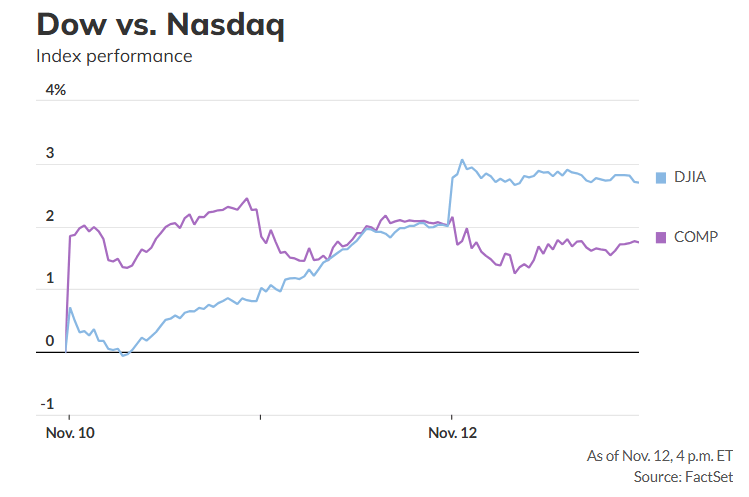

On Wednesday, the Dow Jones Industrial Average closed above 48,000 for the first time ever, marking its second consecutive record high. Optimism surrounding the possible end of the longest U.S. government shutdown fueled the rally, according to Sam Klar, portfolio manager at GMO Domestic Resilience ETF.

“The main theme is: Value is back,” said Jamie Cox, managing partner at Harris Financial Group, noting the strong rebound in healthcare and industrial stocks.

While the Dow climbed, the Nasdaq Composite slipped 0.26%, highlighting a rotation away from tech-heavy momentum names. The Dow has now outperformed the Nasdaq by 2.38 percentage points over the past two sessions — its best showing since February.

AI Momentum Fades

This shift reflects a broader cooling in the AI trade, which has dominated markets for much of the past year. Once-unstoppable names like Oklo Inc. (OKLO) and Palantir Technologies (PLTR) have stumbled, while undervalued sectors — especially healthcare — have gained traction.

“Earlier this year, it seemed like nothing could go wrong for AI stocks,” Klar said. “Now the market is questioning how sustainable that growth really is.”

Analysts suggest that part of this move may simply be profit-taking after massive gains in tech. “It’s a responsible reallocation of capital,” Cox added.

Shutdown End in Sight

Markets also found support as Congress moved closer to passing a funding bill that would reopen the federal government. Historically, shutdowns have had little long-term effect on equities, and stocks often rally once they end, said Adam Turnquist, chief technical strategist at LPL Financial.

Still, the S&P 500 has posted one of its worst November starts in years, raising doubts about whether the market can regain its usual year-end strength.

Rotation or Reset?

Some analysts caution that this may be a temporary rotation rather than a long-term trend. Bob Savage, head of markets macro strategy at BNY, noted that institutional investors haven’t significantly reduced exposure to tech. Instead, many are likely locking in profits before year-end.

“This rotation is all about getting safely through to the end of the year without blowing up on valuation,” Savage said.

He added that the Federal Reserve’s December decision on another potential rate cut could determine how the first quarter of 2026 shapes up. “Show me another Fed cut and growth,” he said, “and I’ll tell you what I’m going to do in 2026.”

For now, the market appears to be rebalancing rather than breaking down — but whether value’s resurgence lasts into next year remains the big question.