Published on November 6th, 2025 by Felix Martinez

High-yield stocks pay out dividends that are significantly higher than the market average. For example, the S&P 500’s current yield is only ~1.2%.

High-yield stocks can be particularly beneficial in supplementing income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

Alpine Income Property Trust, Inc. (PINE) is part of our ‘High Dividend 50’ series, which covers the 50 highest-yielding stocks in the Sure Analysis Research Database.

We have created a spreadsheet of stocks (and closely related REITs, MLPs, etc.) with dividend yields of 5% or more.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Next on our list of high-dividend stocks to review is Alpine Income Property Trust, Inc. (PINE).

Business Overview

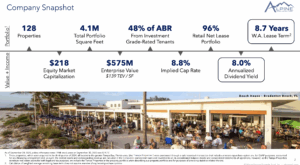

Alpine Income Property Trust is a real estate investment trust that focuses on owning and operating a high-quality portfolio of commercial net lease properties across the United States. As of its latest filings, the company’s portfolio includes 128 retail and office properties located in 35 states, collectively generating approximately $52.2 million in annual rental revenue. Alpine’s properties are primarily leased to strong national and regional tenants under long-term net-lease agreements, providing stable, predictable cash flow.

Founded in 2019, Alpine Income Property Trust is externally managed by Alpine Income Property Manager, which is owned by CTO Realty Growth (NYSE: CTO). CTO also holds an 8% ownership interest in the trust, aligning both companies’ long-term interests. Headquartered in Daytona Beach, Florida, Alpine operates without direct employees, relying instead on its external manager for property acquisition, asset management, and operations. The trust’s strategy emphasizes disciplined growth through selective acquisitions, capital recycling, and maintaining a diversified portfolio of investment-grade tenants to deliver consistent income and long-term shareholder value.

Source: Investor Relations

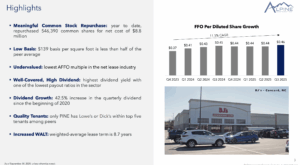

The company reported Q3 2025 revenue of $14.6 million, up 8% year over year but slightly below estimates. The company posted a net loss of $1.3 million ($0.09 per share), while FFO rose to $0.46 per share from $0.45 a year ago. Alpine raised full-year 2025 guidance for FFO and AFFO to $1.82–$1.85 per share.

During the quarter, Alpine invested $49.7 million across new properties and commercial loans, yielding an average of 8.6%. Year-to-date investments reached $136 million, and three properties were sold for $6.2 million. The portfolio now spans 128 properties in 34 states, generating $46.3 million in annual rent, with 48% from investment-grade tenants like Lowe’s and Dick’s Sporting Goods.

Alpine ended the quarter with $621 million in assets, $61 million in liquidity, and $358.5 million in long-term debt at a 4.5% rate. The quarterly dividend was maintained at $0.285 per share. Management reaffirmed strong investment momentum and raised its 2025 investment target to $200–$230 million.

Source: Investor Relations

Growth Prospects

Since its inception in 2019, Alpine Income Property Trust has demonstrated strong financial growth as it has built out its property portfolio. The company’s adjusted funds from operations (AFFO) per share rose from $1.04 in 2020 to $1.77 in 2022, driven by aggressive acquisitions and favorable financing conditions. During this period, Alpine took advantage of low interest rates to expand its portfolio with high-quality, long-term leased properties to tenants such as Lowe’s and Dollar General.

Although growth temporarily slowed in 2023—when AFFO per share fell to $1.49 due to higher interest rates and a pause in acquisitions—the company quickly regained momentum in 2024, rebounding to $1.74 per share. This recovery was fueled by a shift toward higher-yielding commercial loans, strategic asset recycling, and an improved tenant mix, with a greater emphasis on investment-grade tenants.

Looking ahead, Alpine’s growth prospects remain positive despite a more challenging rate environment. The trust has effectively positioned itself for stability by locking in a fixed 2.15% interest rate on its 2026 term loan, which will help offset the impact of rising borrowing costs through mid-2026.

Management continues to focus on expanding its portfolio through disciplined acquisitions and loan investments that enhance income quality and yield. Analysts project a medium-term growth rate of roughly 3.5% annually for both AFFO per share and dividends, supported by Alpine’s conservative balance sheet, prudent capital allocation, and focus on sustainable, long-term growth.

Competitive Advantages & Recession Performance

Alpine Income Property Trust’s main competitive advantage lies in its focus on high-quality, long-term net lease properties leased to strong national and regional tenants. Nearly half of its rental income comes from investment-grade tenants such as Lowe’s and Dick’s Sporting Goods, providing a stable and reliable cash flow base. The net lease model also shifts most property-level expenses—like maintenance, insurance, and taxes—to tenants, allowing Alpine to maintain high margins and predictable earnings.

Additionally, its external management by CTO Realty Growth provides the company with experienced leadership, real estate expertise, and acquisition opportunities that strengthen its portfolio without the overhead of a large internal team.

During economic downturns, Alpine’s portfolio structure provides resilience. Net lease agreements ensure consistent rental income even in weaker markets, as tenants are typically locked into long-term contracts. Its focus on necessity-based and recession-resistant tenants—such as home improvement, discount retail, and essential services—further supports stability when consumer spending declines.

While rising interest rates can pressure profits, Alpine’s conservative balance sheet and fixed-rate debt through mid-2026 help protect earnings. Overall, the company’s diversified tenant base, disciplined financial management, and steady cash flow make it well-positioned to withstand and recover from economic slowdowns.

Source: Investor Relations

Dividend Analysis

The company’s annual dividend is $1.14 per share. At its recent share price, the stock has a high yield of 7.6%.

Given the company’s 2025 earnings outlook, AFFO is expected to be $1.84 per share. As a result, the company is expected to pay out roughly 62% of its AFFO to shareholders in dividends.

Final Thoughts

Overall, Alpine Income Property Trust has demonstrated strong management and a well-structured portfolio despite its brief trading history. While growth is likely to moderate compared to the rapid expansion seen in a low-rate environment, we project annualized returns of approximately 14.5% through 2030. This performance is expected to be supported by a 7.6% dividend yield, 3.5% annual AFFO per share growth, and potential valuation appreciation. We maintain a hold rating on PINE.

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].