Published on November 10th, 2025 by Bob Ciura

High yield securities are thought of primarily as income generators. Less attention is paid to their ability to compound income over time.

There are three drivers for compounding income from any investment:

Reinvesting dividends

Dividend growth on a per share basis

The time over which the investment is held

The first compounding driver – reinvesting dividends – is especially powerful with high-yield securities. Higher yields mean that you can compound your income stream faster by reinvesting dividends.

For example, if all dividends from a 5.0% yielding stock are reinvested, you will compound your income stream at approximately 5.0% annually.

And since high yield securities, on average, don’t have particularly high growth rates, you can “create” income growth by reinvesting dividends until you need them for personal finance reasons.

With this in mind, we have created a spreadsheet of over 200 stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more…

You can download your free full list of all high dividend stocks with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

There are many high yield securities out there. But it’s not as common for a high-yield security to pay rising dividends on a per share basis over time.

When this happens, your income compounds, even when you don’t reinvest dividends.

Finally, and less discussed, is the time over which you hold your investment.

Time invested is central to compounding. You cannot generate significant compounding of income from any one investment without holding periods measured in years.

Too often, investors buy based on expectations for the next quarter (or sometimes even next few days). Time invested matters a great deal.

Compounding dividend income at 8.0% annually means you only get an extra $0.08 on the dollar in 1 year.

But compounding for 10 years means you get an additional $1.16 for every original dollar of income.

This article will provide a list of 10 top dividend stocks with 5%+ yields, that also have secure dividend payouts as indicated by a Dividend Risk Score of ‘C’ or better. They also have dividend payout ratios below 70%.

The stocks are listed by dividend yield, in ascending order.

Table Of Contents

The table of contents below provides for easy navigation of the article:

High Yield Dividend Compounder #10: Sonoco Products Co. (SON)

Sonoco Products provides packaging, industrial products and supply chain services to its customers. The markets that use the company’s products include those in the appliances, electronics, beverage, construction and food industries.

The company generates over $5 billion in annual sales. Sonoco Products is now composed of 2 major segments, Consumer Packaging, and Industrial Packaging, with all other businesses listed as “All Other”.

On April 16th, 2025, Sonoco Products raised its quarterly dividend 1.9% to $0.53, extending the company’s dividend growth streak to 49 consecutive years.

On July 23rd, 2025, Sonoco Products announced second quarter results for the period ending June 29th, 2025. For the quarter, revenue grew 17.9% to $1.91 billion, which was in-line with estimates. Adjusted earnings-per-share of $1.37 compared to $1.28 in the prior year, but was $0.08 less than expected.

Revenues and earnings benefited from the addition of Eviosys. For the quarter, Consumer Packaging revenues surged 110% to $1.23 billion, mostly due to contributions from Eviosys.

Volume growth was strong and favorable currency exchange rates also aided results. Industrial Paper Packing sales fell 2% to $588 million due to the impact of foreign currency exchange rates and lower volume following two plant divestitures in China last year.

Click here to download our most recent Sure Analysis report on Sonoco (SON) (preview of page 1 of 3 shown below):

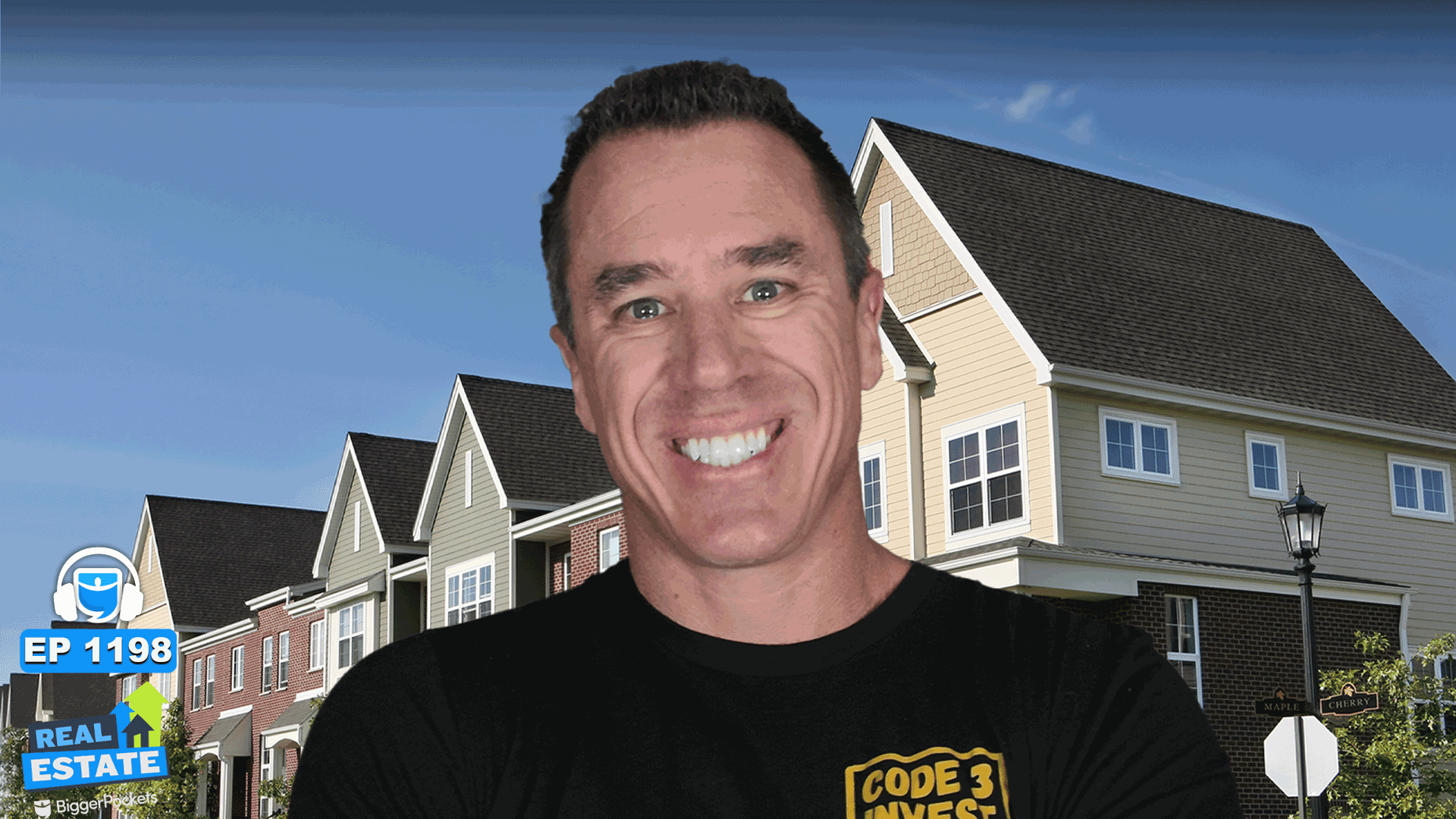

High Yield Dividend Compounder #9: Bristol-Myers Squibb (BMY)

Bristol-Myers Squibb is a leading drug maker of cardiovascular and anti-cancer therapeutics has annual revenues of about $46 billion.

On July 31st, 2025, Bristol-Myers announced second quarter results for the period ending June 30th, 2025. For the quarter, revenue inched higher by 0.6% to $12.3 billion, which was $890 million more than expected. Adjusted earnings-per-share of $1.46 compared unfavorably to $2.07 in the prior year and was $0.36 below estimates.

That said, EPS had favorable impact of $0.57per share related to an in-process research and development charge related to the company’s partnership with BioNTech.

U.S. revenues declined 3% to $8.5 billion. International grew 10% to $3.8 billion, but revenue grew 8% when excluding currency exchange. Eliquis, which prevents blood clots, grew 8% to $3.7 billion as U.S. growth was partially offset by changes in Medicare Part D related to legislation to lower drug prices.

Eliquis remains the top oral anticoagulant outside of the U.S. and generated more than $13 billion in revenue for 2024, which was a 9% increase from the prior year. Opdivo, which treats cancers such as advanced renal carcinoma, was higher by 7% to $2.6 billion due once again to global volume growth.

Bristol-Myers provided revised guidance for 2025 as well. Adjusted earnings-per-share are now projected to be in a range of $6.35 to $6.65 for the year.

Click here to download our most recent Sure Analysis report on BMY (preview of page 1 of 3 shown below):

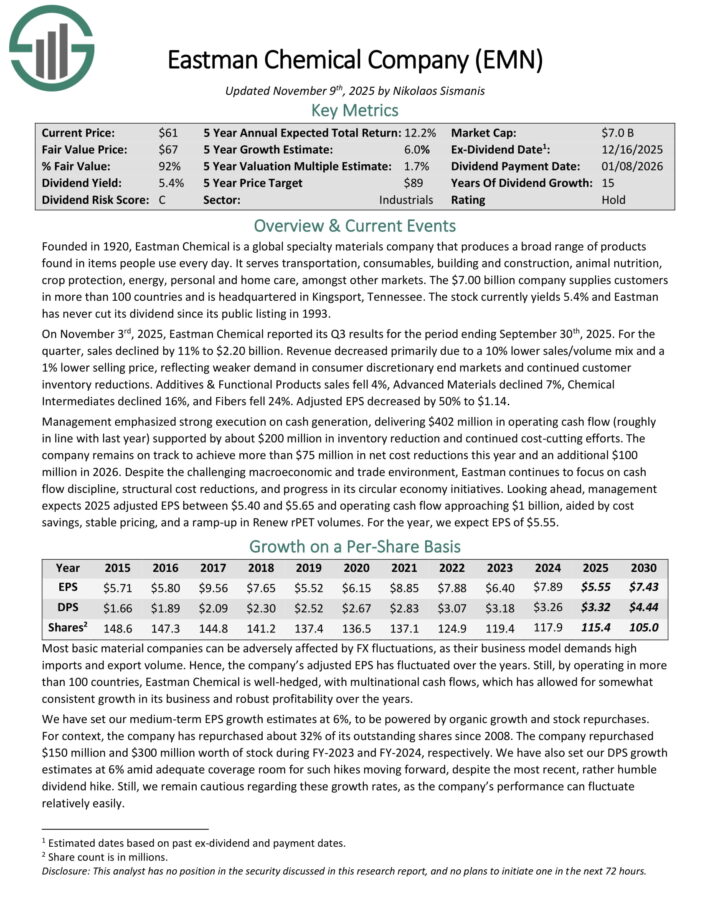

High Yield Dividend Compounder #8: Eastman Chemical (EMN)

Eastman Chemical is a global specialty materials company that produces a broad range of products found in items people use every day.

It serves transportation, consumables, building and construction, animal nutrition, crop protection, energy, personal and home care, amongst other markets.

On November 3rd, 2025, Eastman Chemical reported its Q3 results. For the quarter, sales declined by 11% to $2.20 billion.

Revenue decreased primarily due to a 10% lower sales/volume mix and a 1% lower selling price, reflecting weaker demand in consumer discretionary end markets and continued customer inventory reductions.

Additives & Functional Products sales fell 4%, Advanced Materials declined 7%, Chemical Intermediates declined 16%, and Fibers fell 24%. Adjusted EPS decreased by 50% to $1.14.

Management emphasized strong execution on cash generation, delivering $402 million in operating cash flow (roughly in line with last year) supported by about $200 million in inventory reduction and continued cost-cutting efforts.

The company remains on track to achieve more than $75 million in net cost reductions this year and an additional $100 million in 2026.

Despite the challenging macroeconomic and trade environment, Eastman continues to focus on cash flow discipline, structural cost reductions, and progress in its circular economy initiatives.

Looking ahead, management expects 2025 adjusted EPS between $5.40 and $5.65 and operating cash flow approaching $1 billion, aided by cost savings, stable pricing, and a ramp-up in Renew rPET volumes.

For the year, we expect EPS of $5.55.

Click here to download our most recent Sure Analysis report on EMN (preview of page 1 of 3 shown below):

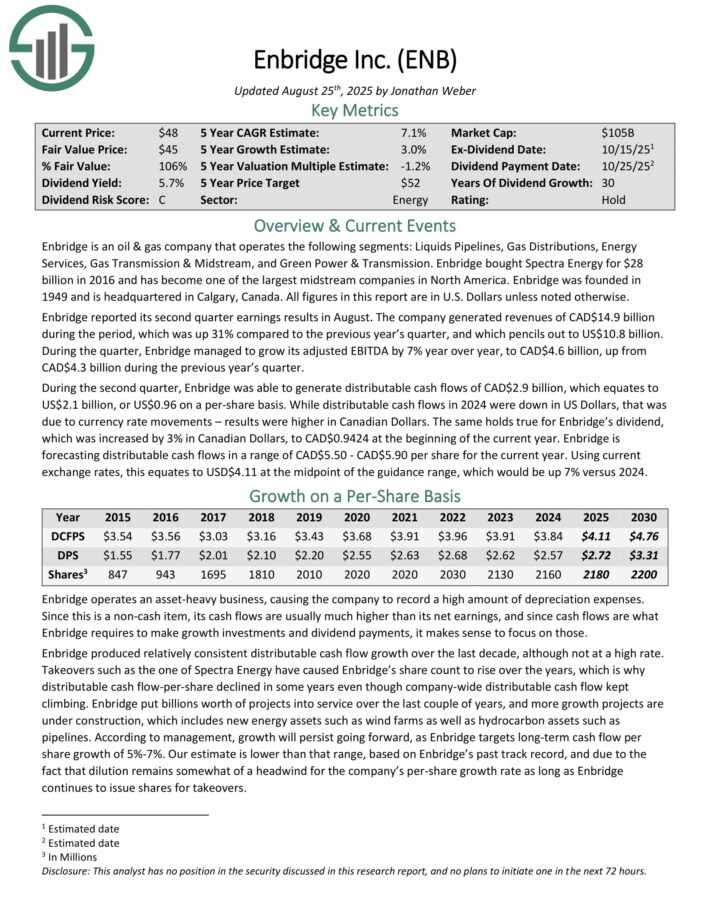

High Yield Dividend Compounder #7: Enbridge Inc. (ENB)

Enbridge is an oil & gas company that operates the following segments: Liquids Pipelines, Gas Distributions, Energy Services, Gas Transmission & Midstream, and Green Power & Transmission.

Enbridge bought Spectra Energy for $28 billion in 2016 and has become one of the largest midstream companies in North America. Enbridge was founded in 1949 and is headquartered in Calgary, Canada.

During the second quarter, Enbridge was able to generate distributable cash flows of CAD$2.9 billion, which equates to US$2.1 billion, or US$0.96 on a per-share basis.

While distributable cash flows in 2024 were down in US Dollars, that was due to currency rate movements – results were higher in Canadian Dollars.

The same holds true for Enbridge’s dividend, which was increased by 3% in Canadian Dollars, to CAD$0.9424 at the beginning of the current year.

Enbridge is forecasting distributable cash flows in a range of CAD$5.50 – CAD$5.90 per share for the current year.

Click here to download our most recent Sure Analysis report on ENB (preview of page 1 of 3 shown below):

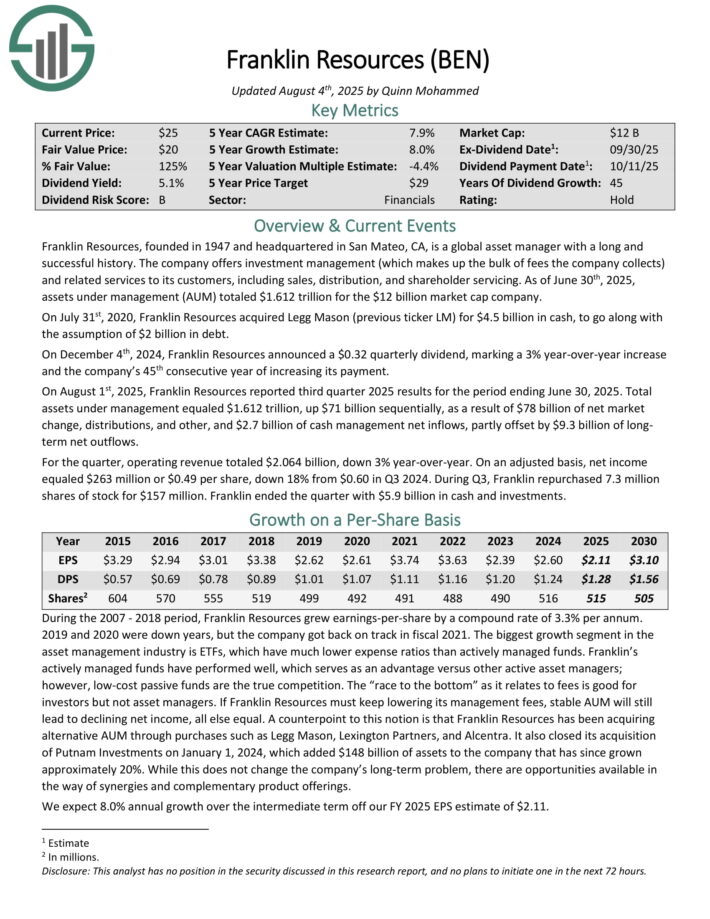

High Yield Dividend Compounder #6: Franklin Resources (BEN)

Franklin Resources, founded in 1947 and headquartered in San Mateo, CA, is a global asset manager with a long and successful history.

The company offers investment management (which makes up the bulk of fees the company collects) and related services to its customers, including sales, distribution, and shareholder servicing.

As of June 30th, 2025, assets under management (AUM) totaled $1.612 trillion for the $12 billion market cap company.

On July 31st, 2020, Franklin Resources acquired Legg Mason (previous ticker LM) for $4.5 billion in cash, to go along with the assumption of $2 billion in debt.

On August 1st, 2025, Franklin Resources reported third-quarter 2025 results. Total assets under management equaled $1.612 trillion, up $71 billion sequentially, as a result of $78 billion of net market change, distributions, and other, and $2.7 billion of cash management net inflows, partly offset by $9.3 billion of long-term net outflows.

For the quarter, operating revenue totaled $2.064 billion, down 3% year-over-year. On an adjusted basis, net income equaled $263 million or $0.49 per share, down 18% from $0.60 in Q3 2024.

During Q3, Franklin repurchased 7.3 million shares of stock for $157 million. Franklin ended the quarter with $5.9 billion in cash and investments.

Click here to download our most recent Sure Analysis report on BEN (preview of page 1 of 3 shown below):

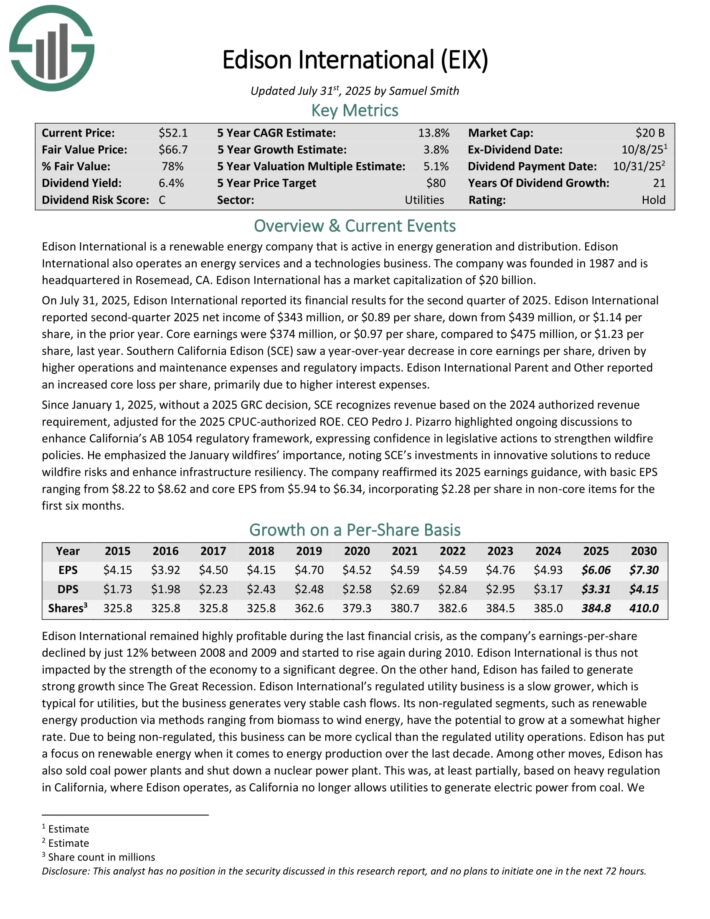

High Yield Dividend Compounder #5: Edison International (EIX)

Edison International is a renewable energy company that is active in energy generation and distribution. Edison International also operates an energy services and a technologies business. The company was founded in 1987 and is headquartered in Rosemead, CA.

On July 31, 2025, Edison International reported its financial results for the second quarter of 2025. Edison International reported second-quarter 2025 net income of $343 million, or $0.89 per share, down from $439 million, or $1.14 per share, in the prior year.

Core earnings were $374 million, or $0.97 per share, compared to $475 million, or $1.23 per share, last year. Southern California Edison (SCE) saw a year-over-year decrease in core earnings per share, driven by higher operations and maintenance expenses and regulatory impacts.

Edison International Parent and Other reported an increased core loss per share, primarily due to higher interest expenses.

The company reaffirmed its 2025 earnings guidance, with basic EPS ranging from $8.22 to $8.62 and core EPS from $5.94 to $6.34, incorporating $2.28 per share in non-core items for the first six months.

Click here to download our most recent Sure Analysis report on EIX (preview of page 1 of 3 shown below):

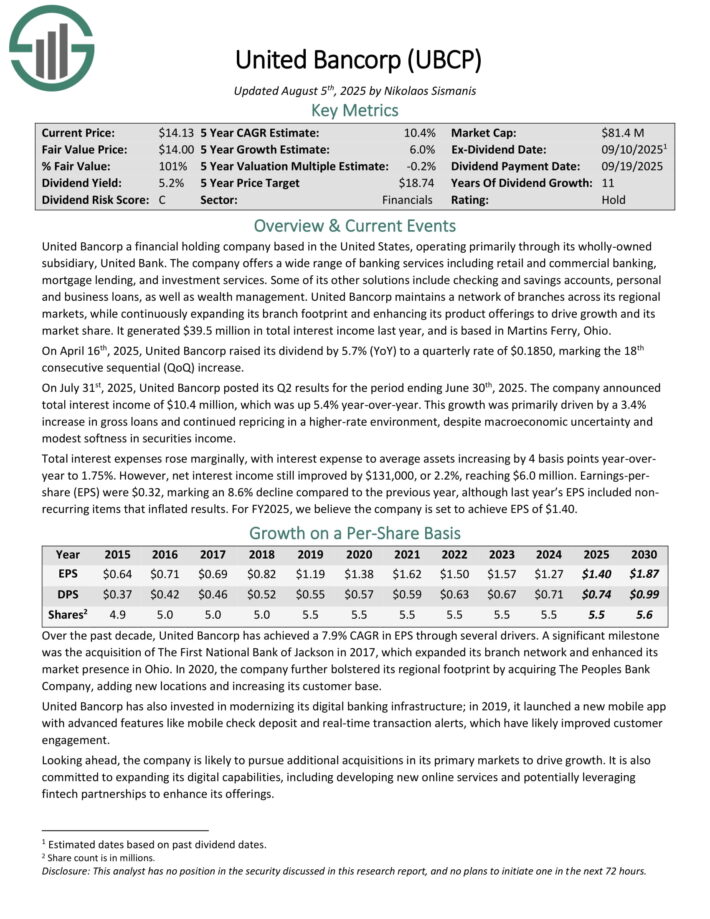

High Yield Dividend Compounder #4: United Bancorp (UBCP)

United Bancorp a financial holding company based in the United States, operating primarily through its wholly-owned subsidiary, United Bank.

The company offers a wide range of banking services including retail and commercial banking, mortgage lending, and investment services. Some of its other solutions include checking and savings accounts, personal and business loans, as well as wealth management.

United Bancorp maintains a network of branches across its regional markets, while continuously expanding its branch footprint and enhancing its product offerings to drive growth and its market share. It generated $39.5 million in total interest income last year, and is based in Martins Ferry, Ohio.

On April 16th, 2025, United Bancorp raised its dividend by 5.7% (YoY) to a quarterly rate of $0.1850, marking the 18th consecutive sequential (QoQ) increase.

On July 31st, 2025, United Bancorp posted its Q2 results for the period ending June 30th, 2025. The company announced total interest income of $10.4 million, which was up 5.4% year-over-year.

This growth was primarily driven by a 3.4% increase in gross loans and continued repricing in a higher-rate environment, despite macroeconomic uncertainty and modest softness in securities income.

Total interest expenses rose marginally, with interest expense to average assets increasing by 4 basis points year-over-year to 1.75%. However, net interest income still improved by $131,000, or 2.2%, reaching $6.0 million. Earnings-per-share (EPS) were $0.32, marking an 8.6% decline compared to the previous year.

Click here to download our most recent Sure Analysis report on UBCP (preview of page 1 of 3 shown below):

High Yield Dividend Compounder #3: Equinor ASA (EQNR)

Equinor ASA, previously named Statoil, is one of the largest European publicly traded oil companies. The company is renowned for building up Norway’s wealth, with the country having ownership of ~67% of the company.

The ownership interest is managed by the Norwegian Ministry of Petroleum and Energy.

On May 2nd, 2025, Equinor announced the sale of its 60% operated stake in the Peregrino field offshore Brazil to PRIO SA for up to $3.5 billion, as part of its strategy to streamline its international portfolio.

On October 29th, 2025, Equinor reported its Q3 results for the period ending September 30th, 2025. Total revenues were $26.0 billion, up 2% from Q3 2024, as higher realized gas prices and higher production offset lower liquids prices.

Liquids prices fell 12% year-over-year to $64.9/bbl, while European gas prices held firm at $11.4/mmbtu. Total production rose 7% to 2,130 mboe/day, driven by Johan Sverdrup and new volumes from Johan Castberg and Halten East.

For the quarter, Equinor posted a net loss of $0.20 billion versus a profit of $2.29 billion in Q3 2024. Impairments of $754 million from lower price assumptions weighed on results, while net operating income fell 24% to $5.27 billion. Adjusted net income declined 57% year-over-year to $0.93 billion, and adjusted EPS was $0.37, down from $0.79.

Cash flow from operations after taxes paid was $5.33 billion, and the adjusted net debt ratio improved to 12.2%. Equinor declared a $0.37 per share dividend and began the final $1.27 billion tranche of its $5 billion 2025 buyback.

Click here to download our most recent Sure Analysis report on EQNR (preview of page 1 of 3 shown below):

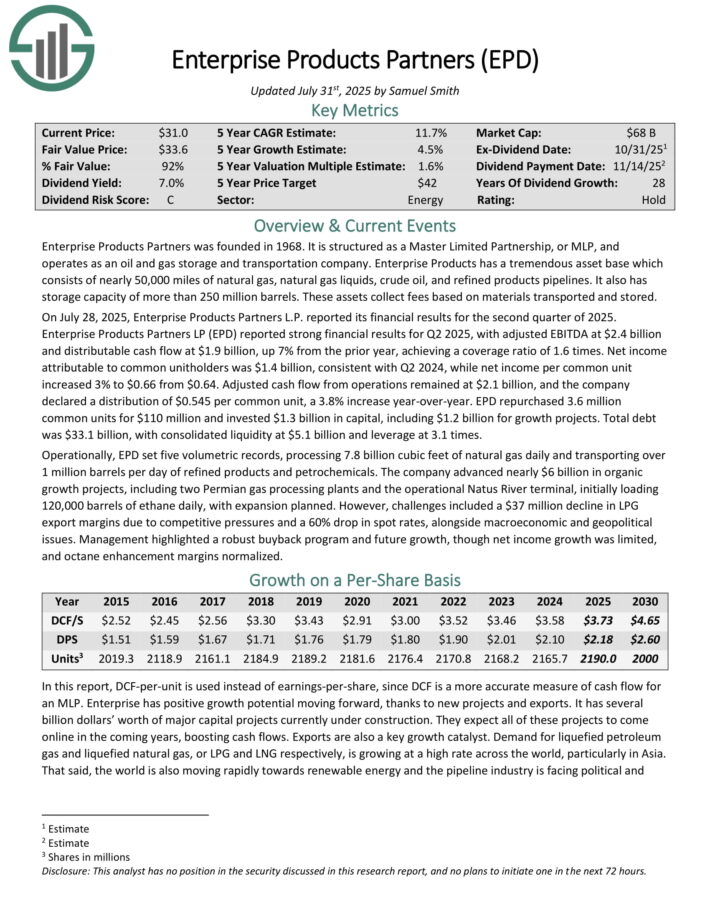

High Yield Dividend Compounder #2: Enterprise Products Partners LP (EPD)

Enterprise Products Partners was founded in 1968. It is structured as a Master Limited Partnership, or MLP, and operates as an oil and gas storage and transportation company.

Enterprise Products has a large asset base which consists of nearly 50,000 miles of natural gas, natural gas liquids, crude oil, and refined products pipelines.

It also has storage capacity of more than 250 million barrels. These assets collect fees based on volumes of materials transported and stored.

On July 28, 2025, Enterprise Products Partners L.P. reported its financial results for the second quarter of 2025. Distributable cash flow was $1.9 billion, up 7% from the prior year, with a coverage ratio of 1.6 times. Net income per common unit increased 3% to $0.66 from $0.64.

Adjusted cash flow from operations remained at $2.1 billion, and the company declared a distribution of $0.545 per common unit, a 3.8% increase year-over-year. EPD repurchased 3.6 million common units for $110 million and invested $1.3 billion in capital, including $1.2 billion for growth projects.

Click here to download our most recent Sure Analysis report on EPD (preview of page 1 of 3 shown below):

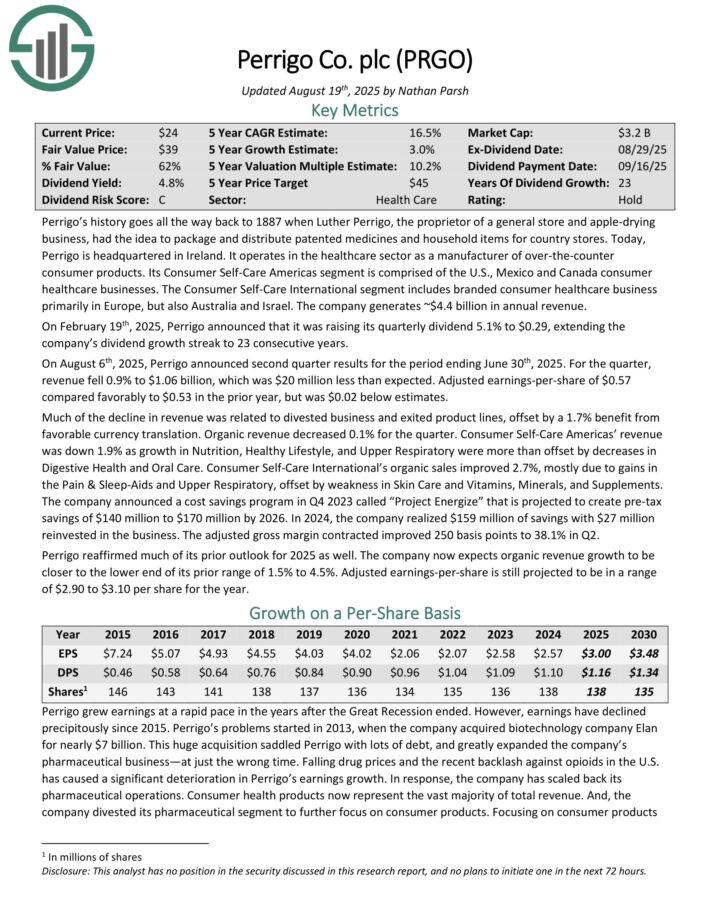

High Yield Dividend Compounder #1: Perrigo plc (PRGO)

Perrigo operates in the healthcare sector as a manufacturer of over-the-counter consumer products. Its Consumer Self-Care Americas segment is comprised of the U.S., Mexico and Canada consumer healthcare businesses.

The Consumer Self-Care International segment includes branded consumer healthcare business primarily in Europe, but also Australia and Israel. The company generates ~$4.4 billion in annual revenue.

On August 6th, 2025, Perrigo announced second quarter results. For the quarter, revenue fell 0.9% to $1.06 billion, which was $20 million less than expected. Adjusted earnings-per-share of $0.57 compared favorably to $0.53 in the prior year, but was $0.02 below estimates.

Much of the decline in revenue was related to divested business and exited product lines, offset by a 1.7% benefit from favorable currency translation. Organic revenue decreased 0.1% for the quarter.

Consumer Self-Care Americas’ revenue was down 1.9% as growth in Nutrition, Healthy Lifestyle, and Upper Respiratory were more than offset by decreases in Digestive Health and Oral Care.

Consumer Self-Care International’s organic sales improved 2.7%, mostly due to gains in the Pain & Sleep-Aids and Upper Respiratory, offset by weakness in Skin Care and Vitamins, Minerals, and Supplements.

Click here to download our most recent Sure Analysis report on PRGO (preview of page 1 of 3 shown below):

Additional Reading

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].