If you’ve ever wondered why some people seem to attract lawsuits while others fly under the radar, here’s the truth: visibility invites litigation.

When your name pops up on deeds, annual filings, and public databases, contingency-fee lawyers see a target. My goal is simple—show you how to look penniless in the public record while still owning and controlling your assets.

This approach offers real estate asset protection, peace of mind, and legal privacy for small business owners, real estate investors, and families seeking to safeguard personal property and minimize personal liability.

Prefer to watch? Catch the companion video for this guide.

Why Should I “Look Penniless” in the Public Record?

Attorneys and creditors evaluate two things before pursuing a case:

1) Can I win? and 2) Can I collect? If your name is tied to visible real estate assets or personal property, they’ll assume there’s a payout. If you hold your assets in LLCs, trusts, or layered entities, you often prevent lawsuits before they even start.

What Exactly Creates That Target on My Back?

Your personal information appears everywhere:

Recorded deeds showing your address and ownership

Secretary of State filings listing members/managers

Property tax records with assessed values and purchase data

Online aggregators connecting your assets to your name

When your personal finances are easy to map, you invite creditor claims, lawsuits, and unwanted attention.

What’s the High-Level Strategy to Make Me “Disappear” From Easy Search?

We call it security through obscurity. It means structuring your real estate assets and small businesses so your ownership isn’t public knowledge:

Use an anonymous LLC for business and investment properties.

Title personal-use assets under revocable trusts or personal residence trusts.

Segregate your personal finances from your business accounts.

Keep everything compliant—no offshore tricks or fake tax shelters.

These steps don’t just protect assets—they also create tax advantages and peace of mind by legally separating ownership from exposure.

Request a free consultation with an Anderson Advisor

At Anderson Business Advisors, we’ve helped thousands of real estate investors avoid costly mistakes and navigate the complexities of asset protection, estate planning, and tax planning. In a free 45-minute consultation, our experts will provide personalized guidance to help you protect your assets, minimize risks, and maximize your financial benefits. ($750 Value)

How Should I Hold Rental Properties So They Don’t Point Straight to Me?

Treat every rental as a business, and hold it through a legal entity—not in your personal name. The best setup usually includes:

Property-Specific Limited Liability Companies (LLC): Each property is placed in its own LLC to isolate liability.

Anonymous Holding Company: Utilize a Wyoming LLC or Nevada LLC for privacy—these states don’t list owners or managers publicly.

Umbrella Structure: Your Wyoming holding company owns the state-level LLCs, protecting you from personal liability and keeping your name off public filings.

This creates true asset protection for real estate investors while maintaining eligibility for tax deductions and real estate tax benefits.

Won’t Annual Filings Eventually Expose Me Anyway?

That’s the trap. Many states look anonymous on the initial filing, but later require identifying information on the annual filing. The fix is to have your Wyoming holding company be the published manager or member—not you. If the state publishes anything, it points to Wyoming, which does not publish your personal details.

How Should I Title My Primary Residence?

Never title your home in an LLC—that mixes business and personal property and risks having your structure disregarded in court. Instead, use a Personal Residence Trust, a revocable trust designed for title privacy.

Use a generic name, like 123 Main Street Trust.

Appoint a Wyoming LLC or an attorney as trustee.

Keep your name out of the public deed record.

This approach protects your personal information, reduces liability, and provides peace of mind for you and your family members.

Another option is an irrevocable trust. These trusts transfer ownership of assets out of your estate entirely—protecting them from future creditor claims or lawsuits. However, they also limit your control, so they’re best used as part of a comprehensive plan designed with your tax advisor or legal professional.

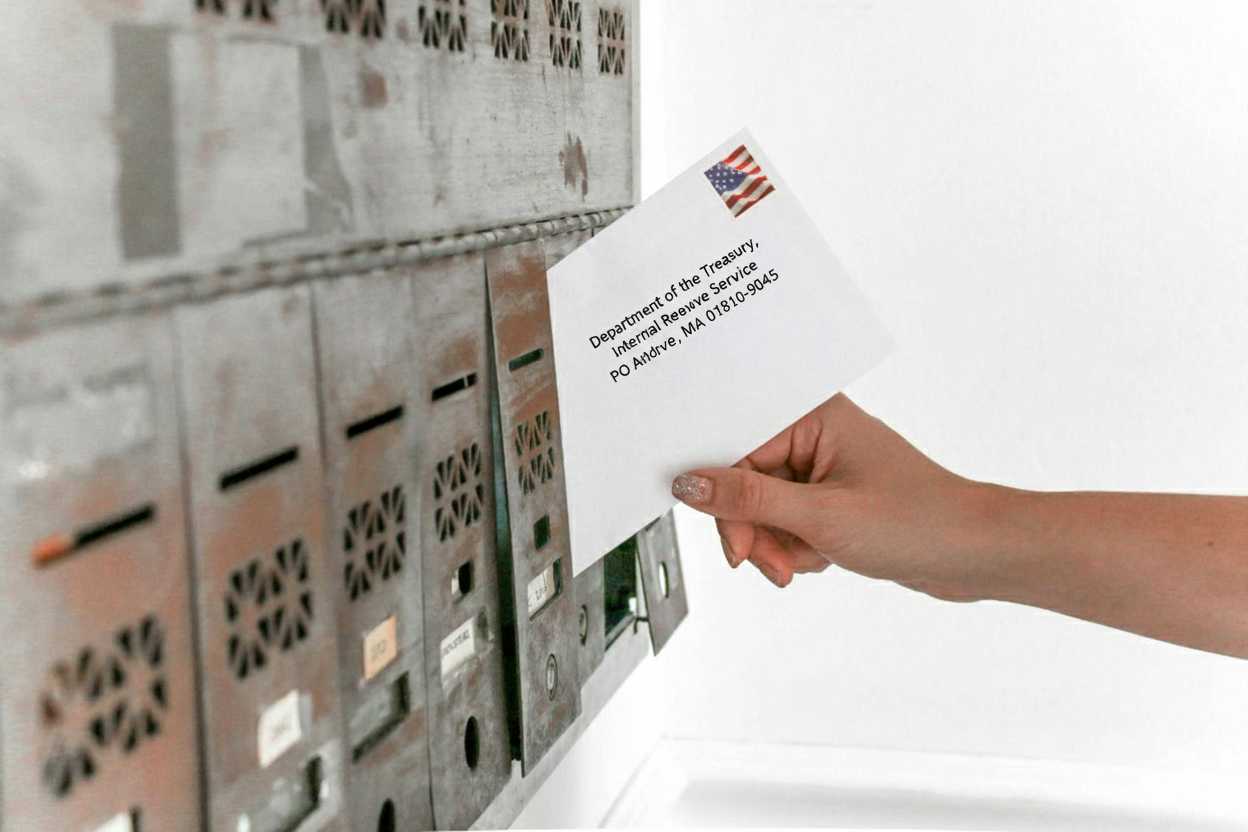

What About My Bank & Brokerage Accounts—How Do I Keep Those Safe From Garnishment?

Public-record privacy isn’t the direct issue here—SSN-based attachment is. After a judgment, collectors garnish large banks that are linked to a debtor’s Social Security Number. If the account bears your SSN, it’s at risk.

Banking: Use a Privacy Banking Trust (a simple grantor trust that obtains its own EIN). If a creditor sends a garnishment keyed to your SSN, it won’t match the trust’s EIN—no attachment.

Brokerage: Combine entity + trust for both privacy and protection:

Form a Wyoming LLC or trust to own the brokerage account (business activity like trading can justify entity use).

A creditor’s best remedy against your LLC interest is a charging order (they can only take distributions if you make them). Don’t distribute, and you keep trading/growing while they wait—and usually settle.

If your brokerage won’t open business accounts, first move the account into a grantor trust, then have the trust own the LLC. Brokerages are familiar with trusts, and you still get the firewall.

Is This All Actually Legal—& Will Courts Respect It?

Yes—when done correctly. LLCs have been in existence for decades, with a rich body of case law and well-defined corporate veil standards.

States write these laws and enforce them. Pay the fee, follow the formalities, and the courts know exactly how to treat you. The keys:

Separate banking for each entity

No commingling of funds

Annual maintenance and basic minutes (1–2 governance touchpoints per year)

Substance over form (rentals are businesses; personal-use assets remain personal)

Do that, and you’ll be in a strong position. More importantly, you’ll look like there’s nothing easy to take.

What Common Mistakes Blow Up Privacy or Protection?

DIY filings that look anonymous at the start, but reveal you on annual reports

Forming an LLC and putting your home into it (invites “sham” arguments)

Cute naming that links back to you (avoid “The Mathis Property Group LLC”)

Commingling or using one bank account for multiple entities

Outsourcing control offshore, where you can’t actually get your money back

Following social-media “tax hacks” that are really fraud in a trench coat

Are Offshore Trusts a Good Idea?

For U.S. persons, offshore is usually a mirage.

Even if a foreign trustee ignores a U.S. court, you are still here, and courts can compel you to repatriate or sit in contempt.

Also, if you send assets to a jurisdiction that shrugs at U.S. orders, guess who else loses leverage? You. We’ve seen trustees disappear or refuse returns.

Don’t trade control for a thin illusion of safety.

What Is a “Vortex Trust,” and Why Is Everyone Whispering About It?

It’s the current hot-button tax scam dressed up as asset protection.

Promoters stack multiple trusts, run circular fee schedules, and claim that income to a trust isn’t income (it is).

They’ll promise you’ll “never pay taxes again,” sometimes with a fake church bolted on and a “disregarded” ghost LLC.

Expect significant upfront fees and potentially more substantial legal issues. The IRS targets these schemes aggressively. If it sounds like alchemy, it’s probably fraud.

Bottom line: Real asset protection isn’t about dodging tax; it’s about clean titling, proper entities, and disciplined operations.

How Does This Help With Public Courts & Practical Litigation Risks?

Public courts operate on evidence and collectability. Your job is to ensure that the public record shows no easy path to recovery. When opposing counsel runs the usual searches—deeds, assessor portals, Secretary of State, corporate aggregators—they hit:

Title in a generic trust with a third-party/LLC trustee

Property LLCs with a Wyoming manager/member and no personal name

No bank accounts linked to your SSN

No brokerage in your personal name

No obvious “pile of gold”

That combination discourages filings, reduces nuisance suits, and drives earlier, cheaper settlements when disputes do arise.

Can I Really Keep This Simple & Affordable?

Yes. These are plain-vanilla, state-recognized tools—LLCs and revocable grantor trusts—used for title and privacy, not tax magic.

Formation filing fees and annual fees are modest, and once set up, maintenance is mostly discipline (separate accounts, consistent records, brief annual minutes).

Simple wins—and it’s what courts respect.

When Should I Start?

Before you buy your next asset—or now, if you’ve already accumulated. We routinely clean up non-anonymous, overexposed structures by:

Re-domesticating or merging entities into Wyoming

Retitling properties into proper LLCs

Implementing privacy and banking trusts

Removing your name/address from deeds and annual filings going forward

It’s all fixable. But it’s cheapest and cleanest when done up front.

Quick FAQ

Q: Will a charging order stop a creditor from raiding my brokerage?A: It limits them to distributions from your business entity. If you don’t distribute, they wait—and usually settle.

Q: Can I name my trust after myself?A: You can—but don’t. Use generic, property-based names to avoid breadcrumb trails.

Q: Is a living trust the same as a Personal Residence Trust?A: Mechanically, both are a type of trust known as a revocable grantor trust. We design the residence trust to ensure title privacy by controlling the name, trustee selection, and recorded details.

Q: Does this reduce my taxes?A: These strategies are for asset protection and privacy, not tax reduction. You still file and pay taxes properly.

Q: How do I protect my retirement accounts?A: Your retirement accounts—such as IRAs and 401(k)s—already enjoy certain federal protections. However, if you use a self-directed IRA or invest in real estate through your retirement plan, improper structuring can create personal exposure. A qualified tax advisor helps you properly title and coordinate your retirement assets with your overall strategy.

Q: Is this just for landlords?A: No. Business owners, professionals, traders, and high-income earners with visibility benefit from making public records boring.

What Should I Do Next?

If you’re serious about protecting your wealth and privacy, now’s the time to act. Whether you own rental properties, operate a small business, or simply want to safeguard your family’s financial future, the right structure makes all the difference.

Start by reviewing your current setup. When your name appears on public filings, deeds, or business records, you expose yourself to risk. Anderson Advisors helps clients every day restructure their assets and remove personal information from public view while maintaining full legal compliance.

Our team specializes in asset protection for small business owners and real estate investors—building privacy-driven plans that defend against lawsuits, creditor claims, and unexpected financial risks.

We’ll help you take control of your privacy and reclaim your peace of mind. Schedule your free 45-minute Strategy Session with a Senior Advisor today. We’ll evaluate your entities, review exposure risks, and design a protection plan that keeps your assets secure and your name out of the public record.