In This Article

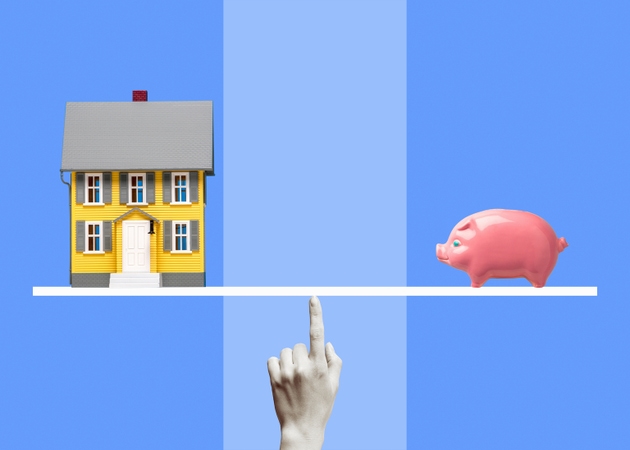

Americans are tired of worrying about interest rates. That could help explain why over 40% of American homeowners are mortgage-free—the highest figure on record, according to ResiClub’s analysis of census data, as reported in the New York Post.

However, it’s not a strategic investment strategy. Rather, it’s because Americans are getting older and have gradually paid down their 30-year loans.

Despite that, the growing number of paid-off homes could have far-reaching ramifications for the housing industry, including real estate investors.

Mortgage-Free America: The New Reality

As the baby boomer generation nears retirement, many have paid off their primary mortgages or sold larger homes and bought smaller ones for cash. ResiClub notes that 54% of mortgage-free homeowners are aged 65 and older.

The greatest concentration of mortgage-free homes is in the South and Midwest, where median ages are higher. In Texas, 61.8% of McAllen, 57.8% of Brownsville, and 57.1% of Beaumont residents have paid their last home loan installment.

The opposite is true in fast-growing cities with younger demographics, which have the smallest number of free-and-clear residents, such as:

Washington D.C.: 26.4%

Provo, Utah: 27%

Denver, Colorado: 27.1%

Greeley, Colorado: 27.2%

Ogden, Utah: 28.8%

Why This Trend Matters for Real Estate Investors

The downside

Communities with large numbers of paid-off properties and homeowners happy to stay in place translates to less overall mobility, fewer motivated sellers, and less property churn. In short, it’s a bad place to buy deals, for both flippers and landlords.

According to Redfin, U.S. property turnover is at an all-time low, with only 28 of every 1,000 homes selling in the first nine months of 2025. High mortgage rates have not encouraged older homeowners to part with their most prized asset and trade or invest for cash flow.

“America’s housing market is defined right now by caution,” said Chen Zhao, Redfin’s head of economics research, in a press release. “Many sellers are staying put—either because they’re locked into low rates, or unwilling to accept offers below expectations. When both sides hesitate, sales naturally fall to historic lows.”

The upside

Homeownership is increasingly problematic as residents age. Aside from non-mortgage-related costs such as taxes, insurance, and utilities, maintenance can be prohibitively expensive, especially in older homes.

It presents a golden opportunity for homeowners to leverage their equity, either through a sale, reverse mortgage, or by having a third party rent and manage their primary residence. Meanwhile, they can use the cash flow to move into a rental community or an elder care facility, where they no longer have to deal with the stress of keeping up a home.

How much cash is available?

Given the geographic location of many of the paid-off properties and the age of the homeowners, it’s safe to assume that most of the homes are not McMansions. According to property data analyst Cotality, U.S. homeowners with mortgages have about $302,000 in equity as of Q1 2025. Roughly $195,000 of that is considered “tappable”—available for withdrawal while maintaining at least 20% equity in the home—which isn’t much where investing is concerned.

Most data and analytics sites quote the total amount of equity available, combining this for homes with and without mortgages. The Intercontinental Exchange (ICE) Mortgage Monitor report puts the average amount of home equity at $313,000 as of March 2025.

You might also like

Low-Risk Strategies to Leverage Equity in a Paid-Off Home

Depending on a homeowner’s age and risk tolerance, there are several ways to use the equity in a fully paid-off mortgage.

The fact that the mortgage is paid off and not already leveraged with a HELOC often indicates the homeowner’s profile. Leveraging is not something that sits comfortably with them. So, using the money to make money in the short term and then returning the cash to a line of credit to be used again is likely the most suitable course of action.

Here are a few ways owners can make their money work for them—without causing sleepless nights.

Become a hard money lender

Lending money to other investors to flip homes and occupying a first lien position, with a deed in lieu of foreclosure to protect your position, is a fairly fail-safe move, provided you have done your due diligence on the home you are lending on and the people borrowing your money.

Invest in a vacation property

This is a slightly riskier move. Buying a second home for cash by taking out a HELOC on your primary residence at a lower rate than current mortgage rates allows you to enjoy having a vacation home to visit and also rent out via short-term rental sites. The rental should cover the cost of the additional loan or more, while offering tax breaks and equity appreciation.

Flip houses

If you have the inclination and know-how, using your cash to flip homes means sidestepping hard-money lenders. In fact, you can be the hard money lender and pay your company a higher interest rate for borrowing your home’s money, closing fast with an all-cash offer. Once the house is sold, the proceeds return to you.

Add an ADU to your primary residence for extra income

Adding an ADU to your primary residence involves taking on additional debt, but the cash flow from the new dwelling should help pay it off quickly. Management and maintenance is easy because you are always nearby. Conversely, living in your ADU and renting out your primary residence will enable you to pay off the additional loan more quickly.

Final Thoughts

In the current economic climate, with rising food, energy, and insurance costs, paying off a mortgage takes a homeowner’s most significant monthly cost off the table, so tapping into the equity should not be taken lightly.

Using equity to make money in the short term with lower-risk investment strategies is advisable rather than buying a long-term rental and hoping the tenant pays on time, especially for older homeowners on a fixed income.

For flippers especially, the high percentage of older homeowners with paid-off mortgages presents an opportunity. Many would be interested in giving up the rigors of maintaining a home in exchange for a fast closing and a fair all-cash price, allowing them to live out their final years in a low-stress setting.