The US insurance industry faces a compounding crisis: the Bureau of Labor Statistics projects nearly 400,000 workers will leave through attrition by 2026, while claim volumes continue rising and operational complexity deepens. This staffing shortage hits third-party administrators particularly hard, as TPAs depend entirely on adjuster capacity to process claims, coordinate repairs, and manage the full lifecycle from intake to resolution. Traditional automation tools address isolated tasks like email management or document processing, but fail to solve the fundamental problem of end-to-end claims operations running on manual processes. Avallon addresses this systemic challenge with AI agents that automate the complete claims workflow, from answering intake calls and extracting data from medical reports to coordinating with employers and repair shops. The platform integrates directly with existing claims management systems, IVR platforms, and data warehouses, cutting processing time by up to 90% while maintaining full audit trails. Since completing Y Combinator’s Spring 2025 cohort, the company has achieved tenfold revenue growth and secured contracts with administrators across the US and Europe, including California-based multiline TPA Athens Administrators.

AlleyWatch sat down with Avallon CEO and Cofounder Cornelius Schramm to learn more about the business, the founding team’s experience building software for legacy industries, future plans, recent funding round, and much, much more…

Who were your investors and how much did you raise?

Avallon secured $4.6 million in seed funding, led by Frontline Ventures with participation from Y Combinator, 1984, Liquid2, and Booom.

Tell us about the product or service that Avallon offers.

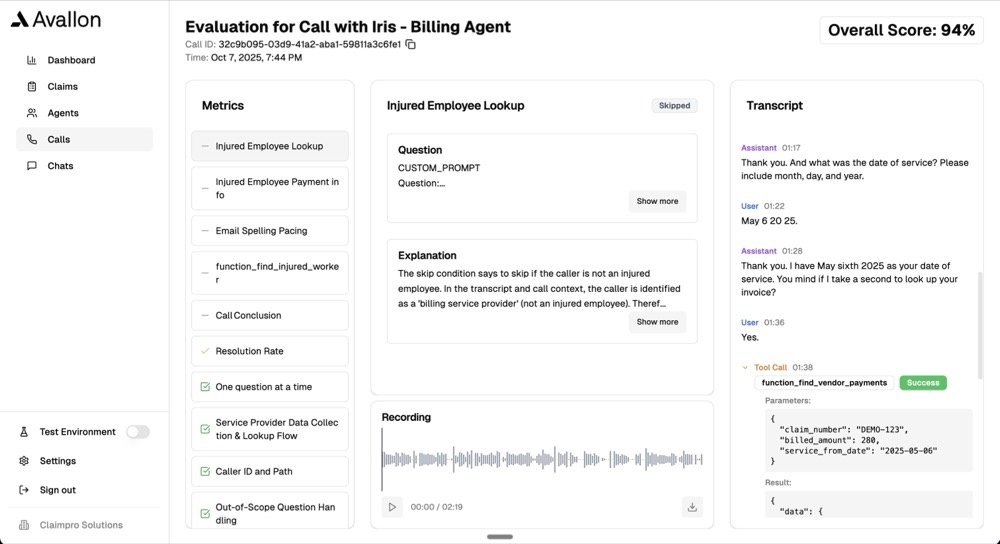

Avallon builds AI agents that automate insurance claims from intake to resolution, replacing weeks of paperwork and phone tag with intelligent back-office workflows that cut processing time by up to 90%.

TPAs, MGAs, and carriers use Avallon to overcome staffing challenges and improve operational efficiency. The platform is already live with multiple TPAs, including a nationwide partner with more than 400 adjusters. It uses conversational AI and advanced machine learning to automate calls, emails, document triage, and data entry, integrating seamlessly with existing systems.

The founding team brings together engineers and operators from Cornell, HSG, and MIT who have scaled software in legacy industries. They have previously worked at FINN, EY, and Taktile, and have direct experience with insurers including Allianz.

What inspired the start of Avallon?

Three things converged.

First, family history. My grandfather was an insurance adjuster in Germany. Insurance wasn’t abstract. It was dinner table conversation.

Second, operational reality. At my previous employer FINN, a vehicle fleet startup, I saw insurance processes up close. Accidents happened. Claims piled up. The manual work was brutal.

Third, insider knowledge. My roommate worked as an insurance adjuster. He explained the daily grind. The endless forms. The phone tag. The manual data entry. It was chaos by design.

Insurance claims weren’t just slow. They were systematically broken. That’s what I set out to fix alongside my co-founders Bryan Guin, Moritz Bartusch and Leander Peter.

How is Avallon different?

Most solutions fix one thing: A tool for emails. A tool for documents. A tool for phone calls.

Avallon is a full-stack claims operation. Think of it as a digital teammate, not a point solution. We work across all inputs: phone calls, emails, documents. The core technology is the same and LLMs turn unstructured data into structured workflows, so it works regardless of where the data comes from. So we built something multimodal from the start.

But we don’t stop at automation, our AI generates insights. We see where operations break down, where adjusters get stuck, here time gets wasted. Over time, those insights make claims processing more efficient. They also surface patterns that help underwriting. The data flows both ways.

Other companies automate tasks. We automate operations and learn from them.

What market does Avallon target and how big is it?

The insurance industry is aging out. Adjusters are retiring faster than they can be replaced. That’s the core problem.

TPAs feel this most acutely. TPAs (third-party administrators) handle claims operations for insurance carriers. They’re the back office: processing paperwork, coordinating repairs, managing the entire claim from start to finish. Many also run independent adjusting firms, which means they send adjusters into the field to assess damage and process claims. Their entire business model depends on having enough adjusters and they don’t have enough. That’s where we come in.

TPAs are our initial market. There are over 42,000 of them across the US and Europe. They feel the pain daily and they know they need a solution. Sales cycles are fast because the problem is urgent.

We sell to them quickly, iterate on the product, and prove the technology works. That alone is a multibillion-dollar market.

Then we move up the stack to insurance carriers. Carriers are bigger, slower, and care more about underwriting. But once we’ve proven ourselves with TPAs, carriers become the natural next step. We’re starting where the pain is sharpest and the decisions move fastest.

What’s your business model?

We align our pricing with customer outcomes. The model varies by customer, but the principle stays the same: we succeed when they succeed.

Most implementations start with an upfront fee. We run a forward-deployed engineering process with our engineers embed directly in the customer’s workflow. We spend time in their systems, their processes, even their offices. We’ve sat in cubicle-filled rooms with adjusters for hours to understand what actually works.

After implementation, pricing depends on what the customer needs.

Some prefer a fixed price tied to volume. Others want a flat commitment. Some want variable pricing where our AI agents get paid per successful outcome. (That last one is our favorite because it completely aligns our incentives with theirs.)

The common thread: we don’t make money unless we deliver real value. Our pricing reflects that.

How are you preparing for a potential economic slowdown?

We’re running a cash-efficient business. Headcount and expenses grow with revenue, not ahead of it.

We’ve been fortunate to hit six figures in ARR quickly. Now we’re focused on keeping that ratio healthy. We’re abstracting our implementation process so it scales. The goal: more customers per engineer over time.

But we’re also moving fast. The market opportunity is massive and we’re balancing efficiency with speed.

Here’s what gives us confidence: the pain is real and urgent. Sales momentum is strong. Companies need what we’re building regardless of economic cycles. Adjuster shortages don’t disappear in a downturn. If anything, the pressure to automate increases when budgets tighten.

We’re building for the long term, but we’re not betting the farm on perfect conditions. Revenue discipline keeps us resilient.

What was the funding process like?

Classic YC playbook.

The moment we got into YC, investors started reaching out. We ignored them. Our partner Dalton Caldwell told us to focus on customers, not fundraising. So we did customer discovery, built the product, and signed deals.

In the last two weeks before Demo Day, we had real traction. That’s when we started the fundraising process. We packed all our investor meetings into two and a half weeks. It was grueling but efficient.

YC gives great advice, connects you with the right investors and teaches you to run a structured process. It works.

We closed quickly on SAFEs and ended up with incredible partners like Frontline.

The lesson: build first, fundraise second. Traction makes everything easier.

What are the biggest challenges that you faced while raising capital?

The pace. Two to three weeks packed morning to evening with back-to-back meetings. You’re constantly refining your pitch, managing your energy, and trying to figure out which investors you actually want to work with.

This was my first fundraise. The first week and a half was brutal. Lots of rejections and even more ghosting. Doubt crept in. I wasn’t sleeping. I drank seven coffees a day just to stay sharp for every call.

It’s a strange game. You’re building rapport while signaling confidence. You’re staying optimistic while getting rejected. You’re maintaining conviction when your brain is running on fumes.

YC helps enormously: they prepare you, connect you and teach you how to run the process. But it’s still grueling.

The turning point was traction. Once we had signed customers and real revenue, conversations changed and investors moved faster. The energy shifted.

Fundraising tests you. But if you can survive those two weeks, you come out with great partners and a much clearer story.

What factors about your business led your investors to write the check?

VCs underwrite three things at the early stage. I think we checked all three boxes.

Team strength: Startups are a rollercoaster. Investors look for resilience. They look for people who’ve risen fast in previous roles. They want founders who can adapt when things break.

Market size: Insurance is a glaringly obvious application for AI. Insurtech is having a renaissance. The market is massive. Investors saw the potential to build a giant business.

Traction: Early proof points matter. Can you execute commercially? Can you build product? We had signed customers and revenue. That showed we could do both.

What are the milestones you plan to achieve in the next six months?

The next six months are critical.

We have our first customers live and successful implementations we can replicate. Now we scale those use cases and keep everything running reliably. At the same time, we’re building the sales machine and making the product more scalable.

My main focus as CEO is hiring. We need top talent to maintain momentum.

The milestones:

Growth: Onboard more customers every month through templatized implementations. That means showing up at conferences, meeting customers where they are, solving hard problems, and finding patterns we can productize.

Team: Grow headcount with revenue. Keep the culture strong.

Revenue: Significant multiples of where we are now.

We’re firing on all cylinders. The goal is to keep it that way.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Talk to customers. Build product. There’s infinite opportunity right now, especially with AI. Keep digging for pain points. You’ll find traction.

If you’re passionate and you assemble a killer team, you’ll raise money eventually.

Tactically: don’t chase VCs. They’ll come when you’re interesting enough. It’s a bit of a weird status and momentum game where you want to always signal that you don’t need them.

Surround yourself with great people and founders. Solve real customer problems. The rest follows.

New York’s advantage: industry diversity. Every industry is here: finance, insurance, healthcare, media, fashion, logistics, real estate. San Francisco is all tech. New York gives you access to problems most founders never see. You can meet someone running a taxi fleet, managing billion-dollar insurance claims, or coordinating hospital operations. These are messy, offline industries with real pain. They’re desperate for solutions. That diversity means more surface area for discovery. You’re not competing in an echo chamber. Use it.

Where do you see the company going now over the near term?

To the moon 🙂

The next six months are about execution: scale our implementations, build the sales machine and hire top talent.

The milestones:

Growth: Onboard more customers monthly through templatized implementations.

Team: Grow headcount with revenue. Keep the culture strong.

Revenue: Significant multiples of where we are now.

What’s your favorite fall destination in and around the city?

Central Park. Hard to beat for fall foliage.

Honestly, I don’t have much time to visit right now. Our offices are in Williamsburg, and we’re traveling constantly for conferences and sales. But Central Park during marathon weekend was incredible.

There are plenty of other great parks too, but Central Park is the classic for a reason.