Published on October 30th, 2025 by Felix Martinez

High-yield stocks pay out dividends that are significantly higher than the market average. For example, the S&P 500’s current yield is only ~1.2%.

High-yield stocks can be particularly beneficial in supplementing income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

GeoPark Limited (GPRK) is part of our ‘High Dividend 50’ series, which covers the 50 highest-yielding stocks in the Sure Analysis Research Database.

We have created a spreadsheet of stocks (and closely related REITs, MLPs, etc.) with dividend yields of 5% or more.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Next on our list of high-dividend stocks to review is GeoPark Limited (GPRK).

Business Overview

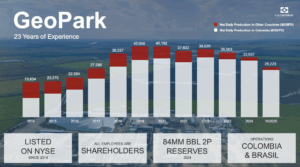

GeoPark Limited, based in Bogotá, Colombia, explores and produces oil and gas in Colombia, Ecuador, Argentina, and Brazil. Founded in 2002, it has a market capitalization of $326 million and is known for its high operational efficiency, including an 81% drilling success rate and low operating costs of $13 per barrel in 2023-2024. Around 90% of its production is cash flow positive even at Brent prices of $25-$30, making it a low-cost, competitive producer.

However, GeoPark’s performance is highly sensitive to oil and gas price swings, resulting in volatile results and losses in four of the last 10 years. Its efficiency and low costs make it strong operationally, but market cycles drive financial outcomes.

Source: Investor Relations

The company reported Q2 2025 revenue of $119.8 million, slightly above expectations, and a net loss of $10.3 million, driven by a one-time impairment in Ecuador. Excluding this charge, net profit was $20.7 million, driven by cost reductions, lower depreciation, and tax benefits. Adjusted EBITDA was $71.5 million, with a 60% margin, reflecting disciplined capital and cost management.

Production averaged 27,380 boepd, supported by $23.9 million in capital expenditures focused on drilling and workovers in core blocks. The company captured $12.5 million in efficiency savings, divested non-core Ecuadorian assets for $7.8 million, and maintained a strong balance sheet with $266 million in cash and a 1.1x leverage ratio.

GeoPark hedged 87% of expected 2025 production, earning a $4.9 million gain, and declared a quarterly dividend of $0.147 per share. Management continues to focus on cost efficiency, strategic divestments, and disciplined capital allocation to drive long-term growth despite market volatility.

Source: Investor Relations

Growth Prospects

Since its founding, GeoPark has steadily expanded production from zero to roughly 37,000 barrels per day, demonstrating a strong operational track record. The company’s recent entry into Vaca Muerta, Argentina—a region with ~16 billion barrels of largely undeveloped reserves—positions it for significant future growth. GeoPark plans to more than triple production in this area, increasing output from 6,000 barrels per day in 2024 to 19,500 barrels per day by 2029.

Despite its growth potential, GeoPark remains highly sensitive to oil and gas price volatility, a challenge common to most producers in the region. Past performance has reflected this cyclical exposure, with earnings fluctuating sharply in response to market conditions. The company’s ability to maintain low costs and disciplined capital allocation will be key to navigating these swings while pursuing expansion.

Looking ahead, oil prices are expected to remain moderate due to OPEC’s output restoration and the global shift toward clean energy. Nevertheless, GeoPark is likely to benefit from a low base effect in 2025, with projected production and revenue growth of around 8%, driven by operational efficiency and the development of new reserves in Vaca Muerta.

Competitive Advantages & Recession Performance

GeoPark’s key competitive advantage lies in its low-cost structure and high operational efficiency. With operating costs of around $13 per barrel and a market-leading drilling success rate of 81%, the company can generate positive cash flow even at low oil prices, giving it resilience in a highly cyclical industry. Its strategic focus on core assets, disciplined capital allocation, and cost-optimization programs further strengthens its position relative to peers in Latin America.

However, GeoPark remains sensitive to the volatility of oil and gas markets, which can lead to sharp swings in earnings during periods of falling prices. While its low-cost operations help mitigate the impact of downturns, the company has experienced losses in four of the past ten years. Despite this, its financial discipline, hedging strategies, and portfolio diversification allow it to navigate recessions and maintain long-term growth potential.

2008 earnings-per-share: $1.03

2009 earnings-per-share: -$0.20

2010 earnings-per-share: $0.11

Dividend Analysis

The company has an annual dividend of $0.59 per share. At its recent share price, the stock has a high yield of 7.3%.

Given the company’s 2025 earnings outlook, EPS is expected to be $0.90 per share. As a result, the company is expected to pay out roughly 66% its EPS to shareholders in dividends.

Final Thoughts

GeoPark benefited in recent years from above-average oil prices driven by the Ukrainian crisis and significant OPEC production cuts. However, now rapidly restoring output, which could limit near-term gains. The stock is projected to offer an average annual return of 13.5% over the next five years, supported by a 7%+ dividend yield and 8% earnings-per-share growth, partially offset by a modest -0.6% valuation headwind.

The stock carries a hold rating and is suitable only for investors who can tolerate periods of low oil prices, which put pressure on performance. Slowing oil demand from China could further weigh on the stock. GeoPark’s historical underperformance versus the S&P 500—–31% versus +87% over five years and +85% versus +219% over the past decade—serves as a cautionary reminder of the risks associated with investing in the company.

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].