Published on October 22nd, 2025 by Felix Martinez

High-yield stocks pay out dividends that are significantly higher than the market average. For example, the S&P 500’s current yield is only ~1.2%.

High-yield stocks can be particularly beneficial in supplementing retirement income. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

Capital Southwest Corporation (CSWC) is part of our ‘High Dividend 50’ series, which covers the 50 highest-yielding stocks in the Sure Analysis Research Database.

We have created a spreadsheet of stocks (and closely related REITs, MLPs, etc.) with dividend yields of 5% or more.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Next on our list of high-dividend stocks to review is Capital Southwest Corporation (CSWC).

Business Overview

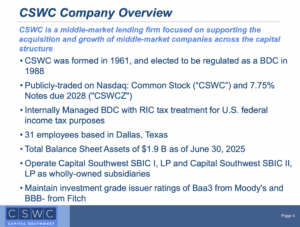

Capital Southwest Corporation is a Dallas-based, internally managed investment company structured as a Business Development Company (BDC). It provides tailored debt and equity financing to lower middle-market (LMM) companies and debt capital to upper middle-market (UMM) companies in the U.S., generating approximately $82 million in annual revenue.

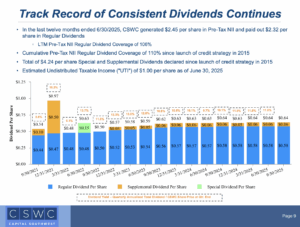

On July 23, 2025, the company changed its base dividend to a monthly payment of $0.1934 per share, along with a supplemental dividend of $0.06, maintaining an annualized base dividend of $2.32, as reflected in our estimates.

Source: Investor Relations

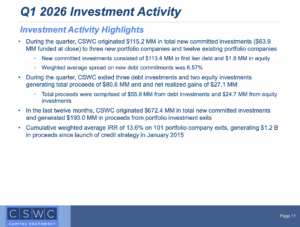

Capital Southwest Corporation (Nasdaq: CSWC) reported Q1 FY2026 results for the quarter ended June 30, 2025. The company’s $1.8 billion investment portfolio includes $1.6 billion in credit, mostly first-lien senior secured debt, and $166 million in equity. During the quarter, CSWC committed $113.4 million in new credit and $1.8 million in equity co-investments. Pre-tax net investment income was $32.7 million ($0.61 per share), supported by $27.2 million in realized equity gains. Cash totaled $46.9 million, net assets $916.5 million, NAV $16.59 per share, and dividends were $0.64 per share.

CSWC originated $115.2 million in new investments and received $80.6 million in proceeds from prepayments and exits, generating $27.1 million in net realized gains. Total investment income rose to $55.9 million from $52.4 million, driven by higher interest income and yields. Operating expenses were $8.0 million, interest expense $15.3 million, and net investment losses totaled $4.9 million, resulting in a $27.0 million increase in net assets for the quarter.

Liquidity remains strong, with $46.9 million in cash and $397.2 million in unused credit capacity. CSWC raised $41.7 million via its Equity ATM Program and holds SBA licenses for additional leverage. The company will shift regular dividends to a monthly schedule and expects higher deal flow in the next quarter, maintaining a conservative investment approach while supporting middle-market business growth.

Source: Investor Relations

Growth Prospects

Capital Southwest Corporation (CSWC) is positioned for sustained growth through strategic funding initiatives and a strong financial foundation. In 2025, the company enhanced its liquidity with a $347.7 million senior unsecured note offering and secured a second SBIC license, providing access to up to $350 million in low-cost, SBA-guaranteed funding.

These moves strengthen CSWC’s capacity to pursue new investments, support portfolio growth, and manage refinancing needs efficiently. Analysts currently maintain a “Buy” rating, with a consensus price target of $23.50, indicating potential upside of nearly 15% from current levels.

Looking ahead, CSWC projects $283.9 million in revenue and $196.4 million in earnings by 2028, reflecting a 10.7% annual revenue growth rate. The company’s consistent ability to generate strong pre-tax net investment income, coupled with its conservative underwriting and flexible financing model, positions it to capitalize on emerging opportunities in the lower and upper middle-market segments while delivering long-term value to shareholders.

Source: Investor Relations

Competitive Advantages & Recession Performance

Capital Southwest Corporation (CSWC) leverages its competitive advantages as an internally managed BDC by providing flexible debt and equity solutions to middle-market companies. Its focus on first-lien senior secured debt, conservative underwriting, and access to SBIC licenses and an Equity ATM program gives it financial flexibility and the ability to act quickly on new investment opportunities.

The company has demonstrated resilience during economic downturns, with non-accruals accounting for less than 1% of its portfolio and a conservative debt-to-EBITDA ratio of 3.4 times. By targeting stable middle-market businesses, CSWC consistently maintains dividends and net investment income, demonstrating a defensive and reliable business model.

The company performed well during the previous major economic downturn, the Great Recession of 2008-2009:

2008 earnings-per-share: $0.24

2009 earnings-per-share: $0.68

2010 earnings-per-share: $4.91

Dividend Analysis

The company’s annual dividend is $2.32 per share. At its recent share price, the stock has a high yield of 10.0%. This excludes some small special dividends the company has declared.

Given the company’s earnings outlook for 2025, NII is expected to be $2.35 per share. As a result, the company is expected to pay out 99% of its NII to shareholders in dividends.

Source: Investor Relations

Final Thoughts

Capital Southwest is a well-diversified and long-established business development company that has successfully navigated multiple market cycles. Since its 2015 spinoff, the company’s financials have grown steadily, supported by low-cost financing and disciplined portfolio expansion.

We project medium-term annualized returns of 9.5%, excluding supplemental dividends, driven by its strong dividend yield and growth. However, the stock is rated a hold.

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].