AskEdgar Review

Ease of Use

Value

Quality

Summary

In search of a new stock research platform? Then you may have come across AskEdgar. This stock research platform makes use of an AI chatbot to summarize SEC filings, earnings calls, and help users learn more about companies’ financials. AskEdgar’s AI co-pilot has access to a complete database of SEC filings, earnings transcripts, financial information, and more. Learn more about this research platform by reading our complete AskEdgar review now.

AskEdgar is a stock research platform that uses AI to summarize SEC filings, summarize earnings calls, and help you dig into companies’ financials. It’s a fairly straightforward tool without a lot of bells and whistles, which can be refreshing for investors who just want a way to draw actionable information from filings quickly.

In my AskEdgar review, I’ll explain what this platform can do and how I use it to find investment opportunities. Read on to find out if AskEdgar is right for you.

About AskEdgar

AskEdgar launched in 2022, just a few months before the release of ChatGPT. It uses an AI copilot that has access to SEC filings, earnings transcripts, and stock financials to help you analyze companies and make investment decisions. The AI automatically tracks specific metrics about stocks, such as the likelihood of share dilution, and also enables you to ask any questions to speed up your research.

AskEdgar Pricing

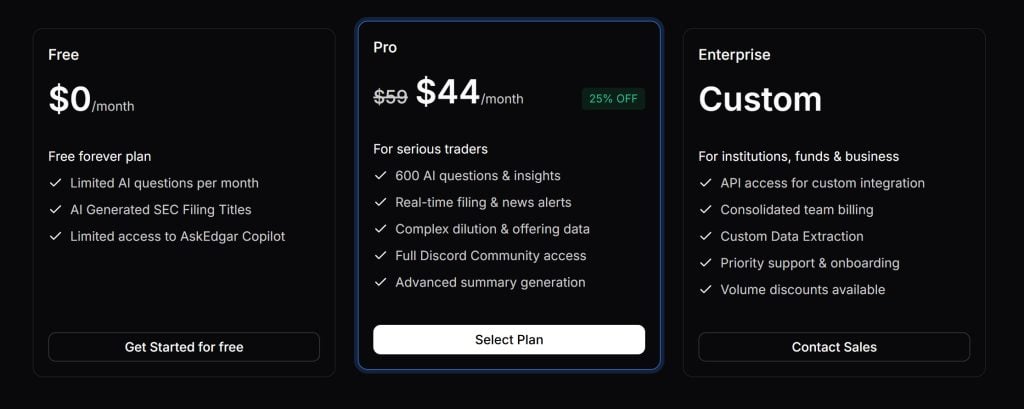

AskEdgar costs $44 per month or $444 per year. You get up to 600 AI queries per month and access to all of the platform’s data and features.

There’s also a free plan available, although this is mainly good for trying out AskEdgar or getting access to SEC filing summaries. You only get 20 AI queries per month and the free plan doesn’t offer access to AskEdgar’s stock insights or dilution risk ratings.

AskEdgar Features

AI Copilot

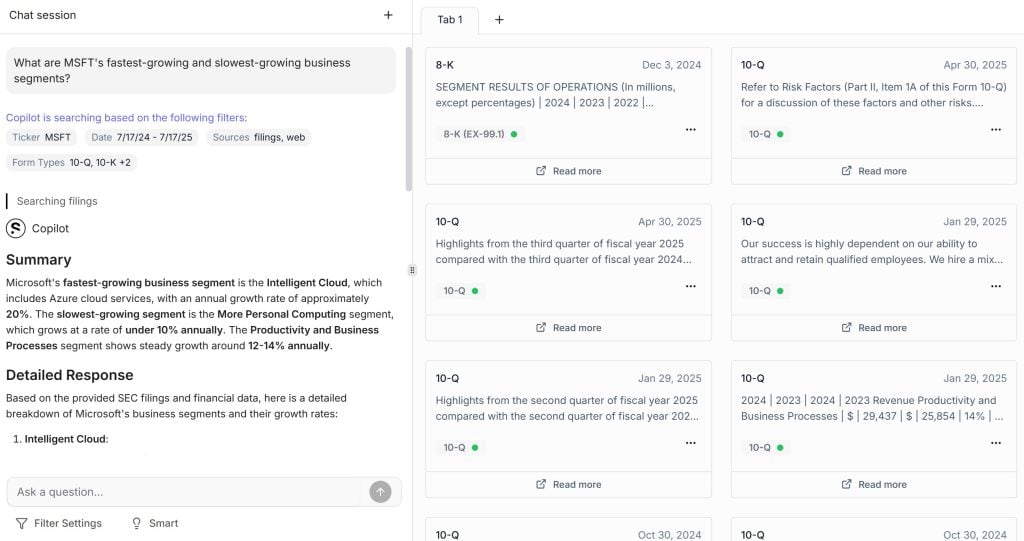

The main feature of AskEdgar is its AI copilot, a chatbot that’s trained to help you analyze stocks. The AI has access to a complete database of SEC filings, earnings transcripts, and financial information, plus can search the web to incorporate financial news and analyst commentary into its answers.

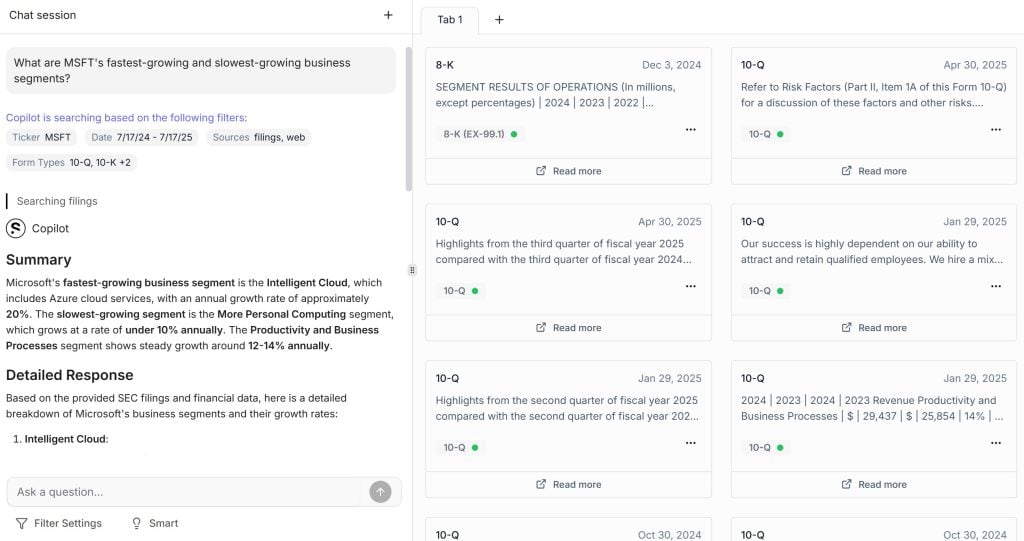

The AI copilot is pretty handy for both initial and in-depth stock research. You can ask broad questions about a company’s financial position, like how much debt a company has and what strategies it uses to manage that debt. You can also ask about what business segments are growing or shrinking within large companies, or about capital investments a company has planned. If you’re trying to dig into a single company and want to query data that’s available in SEC filings and earnings transcripts, the AI works impressively well.

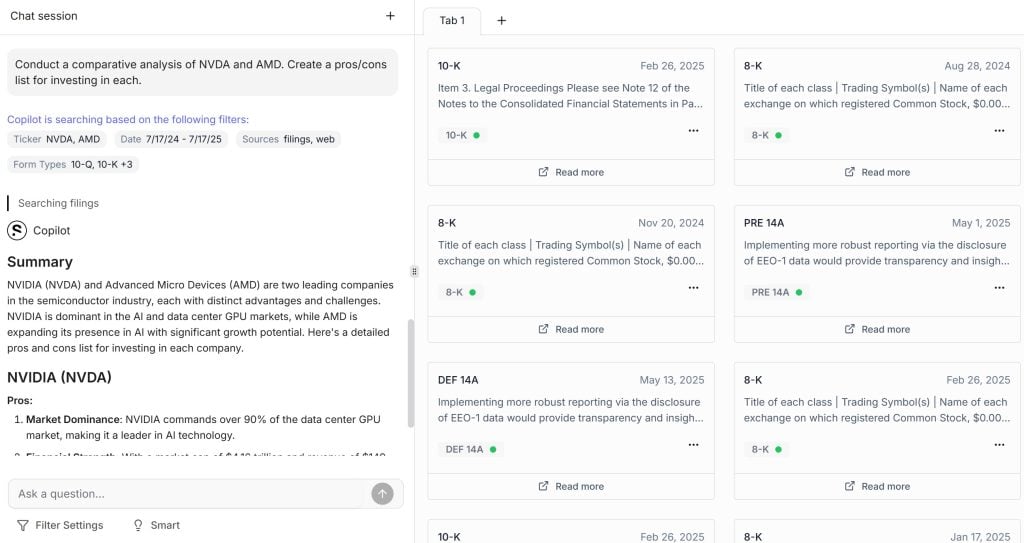

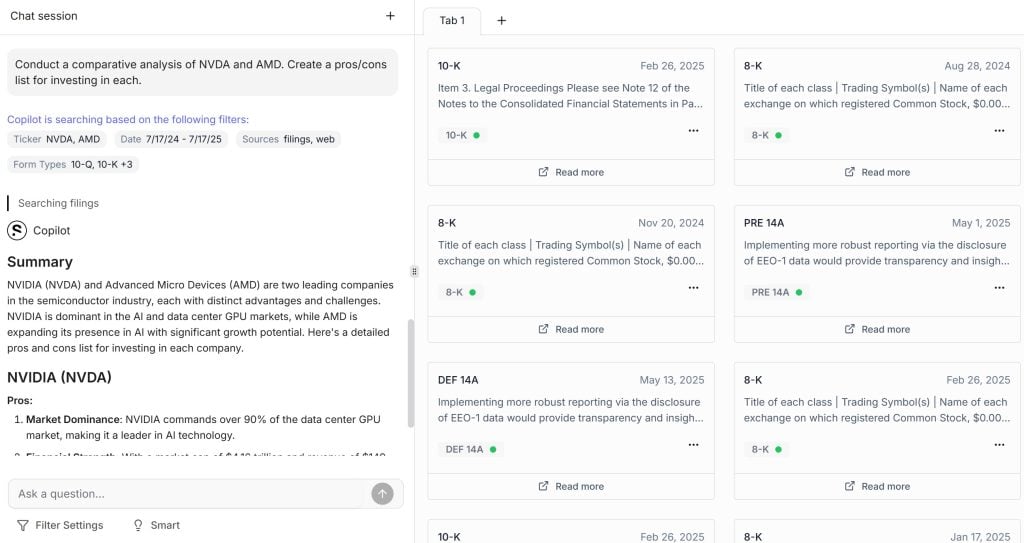

It’s also pretty good at conducting direct comparisons between two related companies. I asked it to conduct a comparative analysis of NVDA and AMD, and to create a pros and cons list for investing in each. It came back with a pretty robust analysis, including a summary table comparing key financial metrics for the two companies. This could be really useful for quickly finding the best stocks in a market subsector.

That said, I found that AskEdgar’s AI copilot isn’t very good at performing any sort of financial analysis or summarizing financial data about multiple stocks. For example, I asked it to calculate the average P/E ratio of tech companies with a market cap under $500 billion, and it wasn’t able to do that even though it has access to sector, market cap, and P/E data for all stocks in its database.

One interesting thing about the AI copilot is that it shows its work. When generating an answer, the AI populates another panel with all of the documents it’s accessing to answer your question. I usually found that there are too many SEC filings and earnings transcripts for this to be very helpful, but there are some cases where the AI is drawing mainly on just one or two earnings transcripts or web results. In this case, you can dig into the underlying documents to get more context for what the AI is reporting.

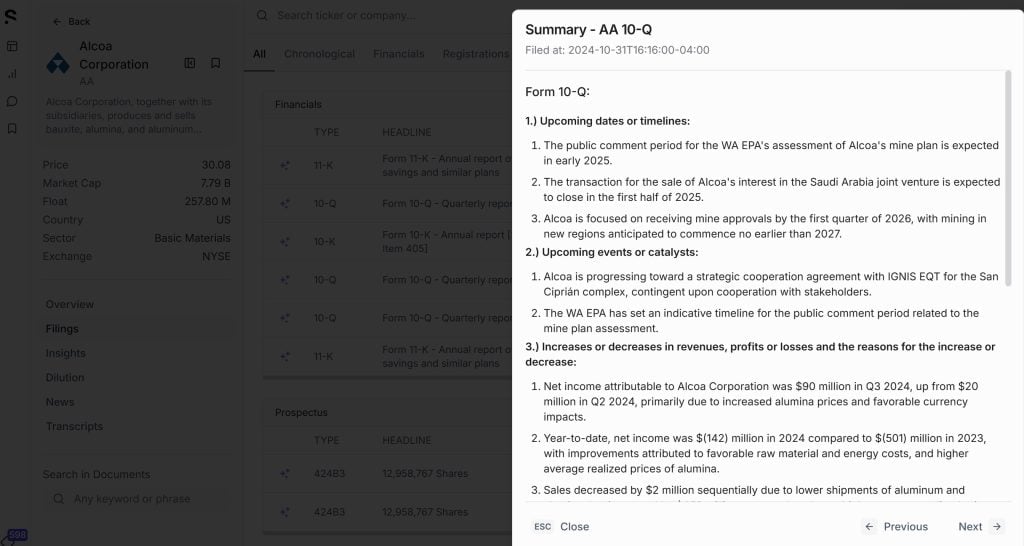

SEC Filing and Earning Transcript Summaries

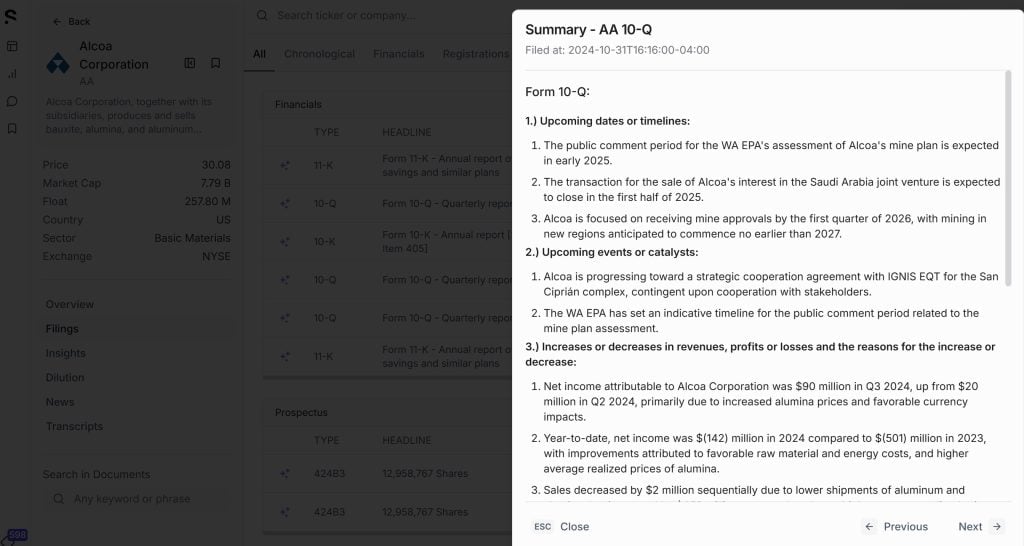

AskEdgar’s AI automatically summarizes SEC filings and earnings transcripts for all stocks in its database. The summaries are great and can save a lot of time spent reading documents.

If you want to dive directly into an earnings call transcript, AskEdgar will create a table of contents so you can jump straight to the content that you’re interested in. You can also ask the AI copilot questions about a specific filing or transcript. This can be helpful for, as an example, finding out what company executives are saying about a specific business line in their latest earnings call.

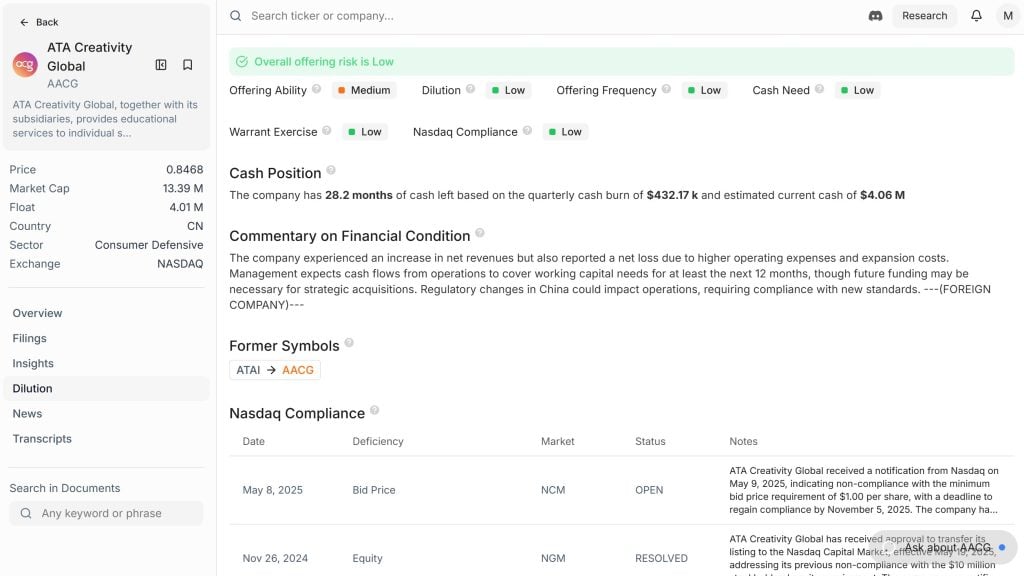

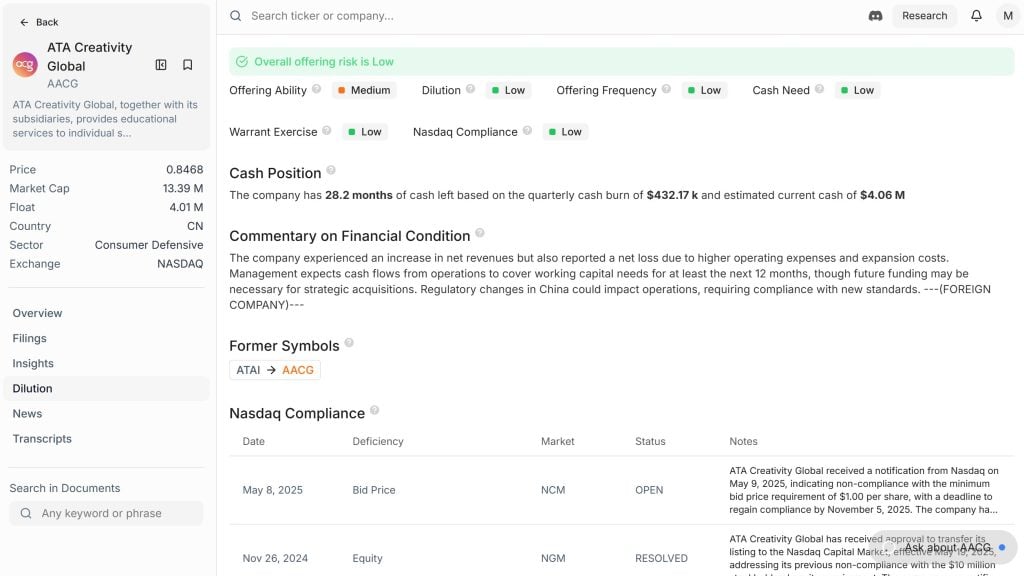

Dilution Risk Analysis

One of the more unique features of AskEdgar is dilution risk analysis. This uses SEC filings to determine whether a company is likely to issue new shares or warrants, which could negatively impact a stock’s price. It assigns grades based on each company’s offering ability, how frequently new shares have been issued in the past, and its need for cash. It also provides a summary of all past offerings and financial health considerations that could induce an offering.

🏆 Top Rated Services 🏆

Our team has reviewed over 300 services. These are our favorites:

Alongside dilution risk analysis, AskEdgar also tracks companies’ compliance with exchange listing requirements. This is a nice double-check for penny stocks, which often have current or past non-compliance notices.

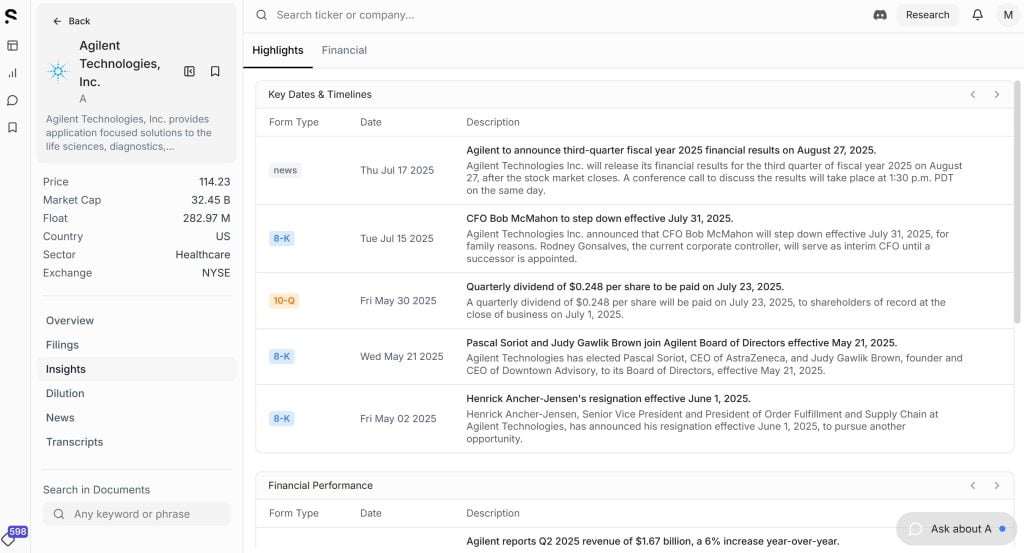

Insights

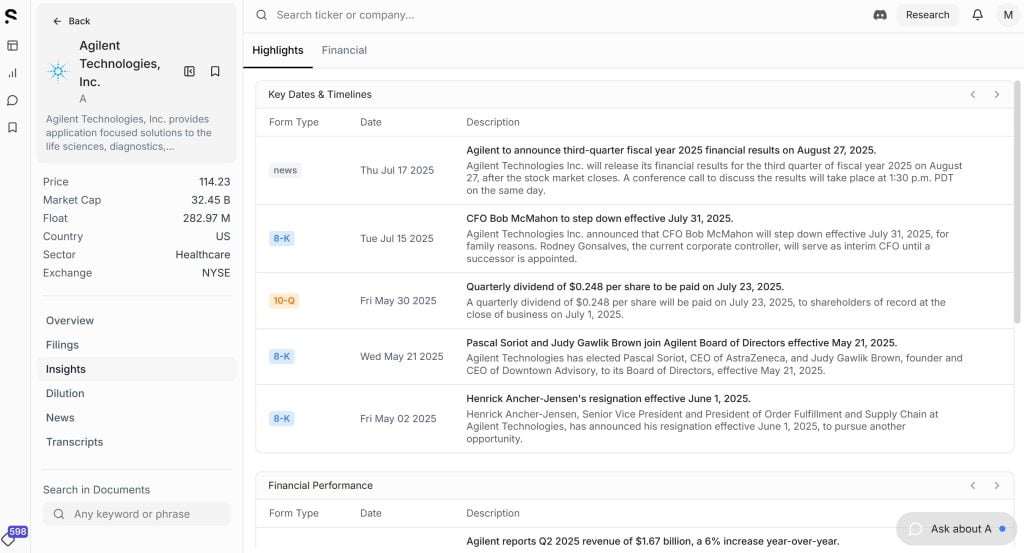

AskEdgar offers an ‘Insights’ dashboard for each stock that’s split into two panels: highlights and financial.

The highlights panel lists all recent SEC filings and earnings call transcripts and provides a one or two sentence summary with the most important information investors need to know. The financial panel offers a high-level overview of a company’s financial health, including its recent financing activities and cash flow. Surprisingly, there’s no table of financial data included here, so this is much more suitable for a quick overview than an in-depth dive.

Is AskEdgar Easy to Use?

AskEdgar is very easy to use. The platform is pretty focused on its core features, without a lot of extras to distract from the main AI-powered tools. You can jump straight into a conversation with the AI copilot or search for a specific ticker to get details about recent filings and dilution risk.

One thing I especially liked about the platform is that the AI copilot is accessible on any page using a button in the bottom-right corner of the page. This is great for asking questions about a stock or document you’re currently looking at.

The only major drawback I found is that AskEdgar’s AI copilot doesn’t have a chat history or multiple tabs. If you leave the chat page, your entire chat history will disappear with no way to recover it.

AskEdgar Platform Differentiators

AskEdgar is one of a growing number of platforms that are using AI to speed up stock research. If you’re mainly interested in analyzing SEC filings, alternatives include PublicviewAI, Fintool, QullAI, and more.

What really sets AskEdgar apart is that it’s so simple and easy to use. Other platforms have a lot more tools for AI-powered financial analysis or data visualization that makes them more complex. Using AskEdgar feels a lot like using ChatGPT, but you can trust that the financial data you’re getting is accurate and up-to-date.

The other thing that’s unique about AskEdgar is its dilution risk analysis. This is something I haven’t seen from other platforms, and it’s a really great feature for penny stock investors. You could ask about dilution risk when using other AI platforms, but the fact that AskEdgar has a whole panel dedicated to this is a big plus.

What Type of Trader Is AskEdgar Best For?

AskEdgar can be a very handy tool for investors who want to speed up stock research and stay up to date on the latest details from companies’ SEC filings and earnings calls. It’s great for digging into a stock without staring at tables of financial data, and it can help you conduct a quick comparative analysis of related companies.

Beginner and experienced investors alike can use AskEdgar effectively since you can ask the AI for a basic pros/cons list or dive deep into financial analysis. Tools like dilution risk analysis, exchange compliance tracking, and financial insights make this platform especially suitable for penny stock investors.

Is AskEdgar Worth It?

AskEdgar is relatively inexpensive for the time savings it can offer in the stock research process. Plus, if you just want summaries of SEC filings and earnings transcripts, you can use the platform’s free plan.

It’s important to note that AskEdgar isn’t a replacement for a stock screener or a fundamental analysis platform. It works best when focusing on a single stock and can struggle with analyzing multiple companies. You also won’t find detailed financial information without asking the AI for it and there are no data visualizations. So, AskEdgar works best as one tool within your research pipeline rather than as the only tool you use to make investment decisions.

Pros

AI copilot offers clear summaries of financial data

Includes summaries of SEC filings and earnings transcripts

Dilution risk analysis helps with analyzing penny stocks

Very user-friendly

Free plan available

Cons

Doesn’t offer direct access to financial data or visualizations

Struggles with financial math and multi-stock analyses