If you’re wondering, “Should I invest in REITs?”—you’re not alone. Real estate investing has evolved far beyond buying rental properties. Today, Real Estate Investment Trusts, or REITs, offer a powerful way to earn passive income, diversify your portfolio, and tap into property markets—without ever picking up a hammer.

Contents

What is a REIT and How Does it Work?

Pros of REIT Investing

Cons of REIT Investing

Good REITs to Invest In

Types of REITs: Equity, Mortgage and Sector Specific

Are REITs a Good Investment? A Brief Lesson in Diversification

FAQ

Are REITs a Good Investment? Final Thoughts

Related

This article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

What is a REIT and How Does it Work?

REITs allow investors to earn income from real estate-without the need to buy or manage physical properties.

According to REIT.com, a real estate investment trust is an investment comprised of many companies, similar to a mutual fund or ETF. REITs own or finance income-producing real estate. By law, REITs must pay out at least 90% of their taxable income to shareholders, making them attractive for dividend-seeking investors.

You can invest in individual REITs or through a REIT ETF, which bundles multiple REITs into one diversified fund.

I’ve invested in both bricks and mortar real estate and REITs and I’m a fan of REITs.

REIT dividends provide steady cash flow and allow you to sleep at night. You won’t be woken up at 2 a.m. by a tenant with a plumbing emergency.

Investing in a real estate fund is as easy as reviewing a list of available funds and clicking “buy” at your online discount brokerage account. But before you rush out to invest, check out the advantages and disadvantages of REIT investing.

M1 Finance is a good place to create an investment portfolio and invest in REITs. (I have an account with M1 Finance.)

Pros of REIT Investing

High Dividend Yields: REITs must pay out 90% of taxable income. Great for income-focused investors.

Passive Income: No property management required.

Diversification: Helps reduce overall portfolio risk. Real estate exposure, without direct ownership.

Professional Management: Experts handle property decisions.

Liquidity: Buy and sell easily through your brokerage account.

Cons of REIT Investing

Market Volatility: REIT prices fluctuate like stocks.

Tax Treatment: Dividends are often taxed as ordinary income. You might want to own your REIT ETF in your IRA account.

Interest Rate Sensitivity: Rising rates can hurt REIT performance

Sector Risk: Some REITs (like office or retail) may underperform in certain economic cycles.

Good REITs to Invest In

Consider investing in a broadly diversified REIT ETF with a sample of real estate companies from various sectors. As an investor, I’ve bought broadly diversified real estate investment trusts in the U.S. and abroad. With interest rates declining, now is a good time to check out REITs, since real estate mortgages and the sector in general benefit from lower interest rates.

If you want broad exposure, these funds are a great starting point:

VNQ – Vanguard U.S. REIT ETF

VNQI – Vanguard Global ex-U.S. REIT ETF

RWR – SPDR Dow Jones REIT ETF

RWX – SPDR International REIT ETF

FGL – iShares Developed Real Estate ETF

These funds offer diversification across sectors and geographies, often with attractive yields.

M1 Finance is a good place to create an investment portfolio and invest in REITs. (I have an account with M1 Finance.)

Types of REITs: Equity, Mortgage and Sector Specific

There are two broad types of REITs:

Equity REITs: Own and operate physical properties like apartments, malls, data centers and more.

Mortgage REITs: Invest in real estate debt, such as mortgages and loans.

REITs span nearly every corner of the real estate market. Think demand for data centers will rise? Check out a data center REIT. If you believe seniors will age into Senior Living centers, consider this sector for a REIT investment.

Sample REIT ETF Sectors:

Sector

Examples

Residential

Apartments, condos

Commercial

Office buildings, malls

Industrial

warehouses, logistics hubs

Healthcare

Hospitals, senior living

Infrastructure

Cell towers, pipelines

Data Centers

Cloud storage facilities

Self-Storage

Storage units

Timberland

Forests and woodlands

Mortgage

Real estate loans

Are REITs a Good Investment? A Brief Lesson in Diversification

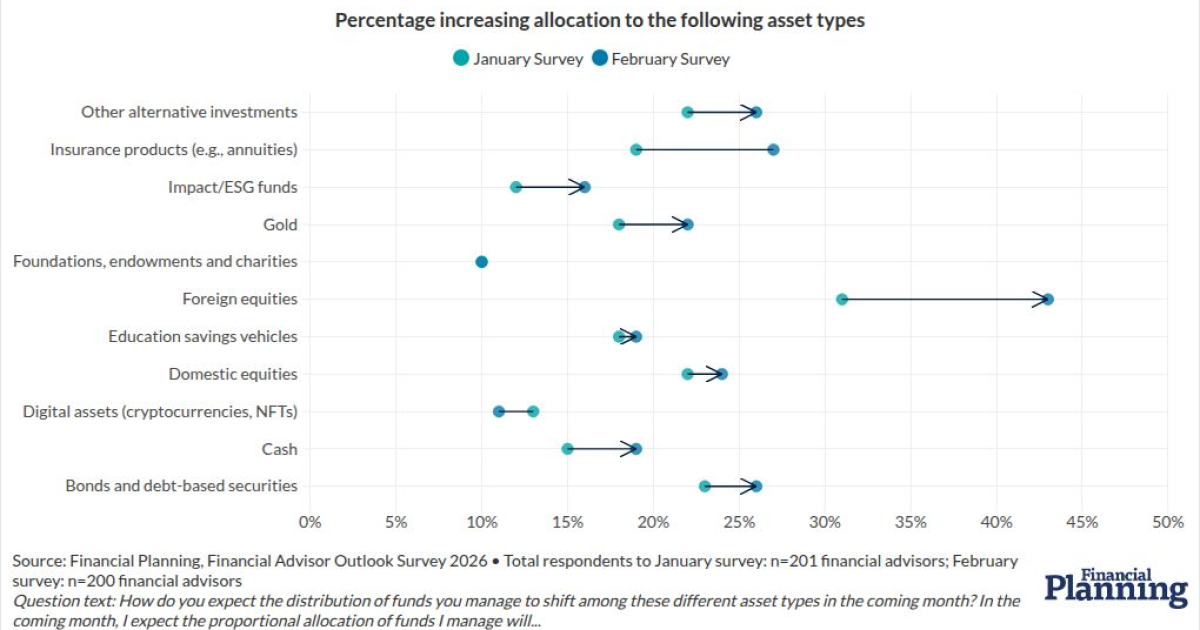

Long before Modern Portfolio Theory proved the benefit of diversification, “Don’t put all your eggs in one basket” was practiced. Intuitively, it makes sense to spread your income and investment risk around. The rationale behind diversification and asset allocation is that when one asset goes down in value, another may go up. Spread your investments and risk around and you’ll decrease the volatility of your returns.

Add real estate to the mix and the added diversification, and lower correlation with the other asset classes can increase cash flow and lower the overall risk of your portfolio.

Bonus; Should I pay off my mortgage or invest in the stock market?

FAQ

REITs make money from rent they receive. They also make money when they sell real property for a profit.

Yes. Like most investments, if the share price goes down, and you sell your investment, then you would lose money. When investing, it’s best to own various asset types, so that when one falls in price, others will remain steady or increase.

REITs send IRS Form 1099-DIV to their shareholders. The form breaks down the dividend distributions into ordinary income, capital gains, and return of capital. Investors pay taxes according to their tax rate for each category of income.

REITs pay out roughly 90% of their taxable earnings. The actual REIT payout ratio depends upon how those earnings are calculated.

Are REITs a Good Investment? Final Thoughts

Real estate investment trusts offer a compelling gateway to property ownership—without the headaches of tenants, toilets, or turnover. Whether you’re seeking passive income, portfolio diversification, or long-term capital appreciation, REITs can play a valuable role in your financial strategy. With decades of personal experience investing in REITs, I’ve seen firsthand how they can deliver steady dividends and growth over time. While no investment is without risk, a well-chosen REIT fund—especially within a diversified portfolio—can be a smart, accessible way to build real estate wealth. As always, match your investments to your goals, risk tolerance, and time horizon.

Related

Diversyfund Review – Real Estate Crowd Funding for Everyday Investors

REITs and Crowdfunding – How to Invest

EquityMultiple Review – Is This Crowdfunding Platform for You?

Fundrise vs REITs – Which is Best?

Groundfloor Review – Invest in Real Estate Notes for Cash Flow