Paychex, Inc. (NASDAQ: PAYX), a leading provider of human capital management solutions, has reported strong results for the first quarter of fiscal 2026. Earnings increased year-over-year and exceeded analysts’ estimates. Stable demand across the company’s core offerings supported growth, while revenue and cost synergies from the recent Paycor acquisition contributed meaningfully to the topline.

However, the stock declined early Tuesday soon after the announcement. That reflects investors’ concerns over the sharp increase in expenses, fueled by higher compensation and Paycor-related amortization. The selloff dragged down the stock to its lowest level in nearly one year. PAYX has steadily declined after hitting an all-time high in early June.

EPS Beats

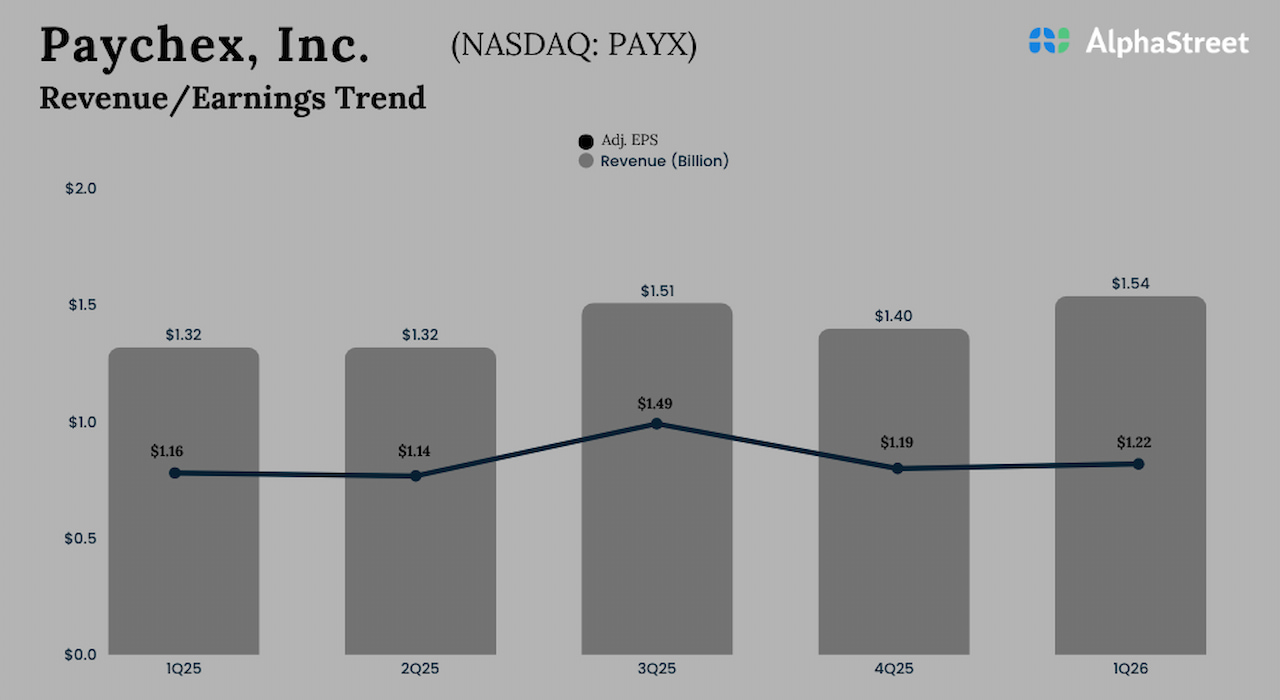

The Rochester-based company’s first-quarter revenue increased to $1.54 billion from $1.32 billion in the corresponding period last year, which is in line with Wall Street’s estimates. On an adjusted basis, Q1 earnings per share moved up to $1.22 from $1.16 in the year-ago quarter. Analysts had forecast a slower growth. On a reported basis, net income was $383.8 million or $1.06 per share in Q1, down from last year’s profit of $427.4 million or $1.18 per share.

Commenting on the Paycor integration, Paychex CEO John Gibson said in the Q1 earnings call, “Bringing the two companies together provides us a broader set of technology solutions and service models to both win and retain business. We have already enabled several notable client-retention wins in the quarter across our purpose-built platforms. Additionally, we are encouraged by the speed at which we have completed the back-end technology integrations to enable the full breadth of revenue and cost synergy opportunities for fiscal year 2026. We remain optimistic about the revenue synergies, particularly cross-selling Paychex retirement, ASO, and PEO solutions to Paycor’s approximately 50,000 clients.“

Ups Guidance

Paycor, the HR software company Paychex acquired in April this year, contributed around 17% to the core Management Solutions, and the segment’s total revenue grew 21% year-over-year. The management raised its earnings guidance for fiscal 2026, although it sees ongoing macroeconomic uncertainties impacting small and mid-sized businesses, which account for a major share of the company’s clientele.

Full-year adjusted earnings per share are expected to grow in the range of 9% to 11% now, compared to the 8.5-10.5% growth guided earlier. The company reaffirmed its FY26 revenue growth guidance in the 16.5-18.5% range. It continues to expect Management Solutions revenue to rise between 20% and 22% in FY26, and PEO & Insurance Solutions revenue to grow in the 6-8% range. The Paychex leadership said it is on track to achieve targeted Paycor revenue and cost synergies.

Tailwinds

Paychex has been witnessing a steady growth in product penetration across its HCM solutions, aided by retirement and HR outsourcing, particularly among small and mid-sized businesses. The company is leveraging AI and cloud-based platforms to automate routine HR tasks and deliver actionable insights. Stable free cash flow generation supports dividend payout ratio, with the current yield standing at an above-average 3%.

On Tuesday, Paychex shares opened sharply below their 12-month average of $144.59. The stock was trading down 4% in early trading, extending the downturn that followed the earnings announcement.

The post Paychex ups FY26 EPS guidance; on track to achieve targeted Paycor synergies first appeared on AlphaStreet.