According to BIS Research, the Small Modular Reactor market is undergoing a dramatic transformation. Valued at $159.4 million in 2024, it’s projected to reach $5,179.6 million by 2035, growing at an astounding CAGR of 42.31%. This growth reflects a global pivot toward reliable, low-carbon nuclear technologies for decentralized energy needs.

Market Overview

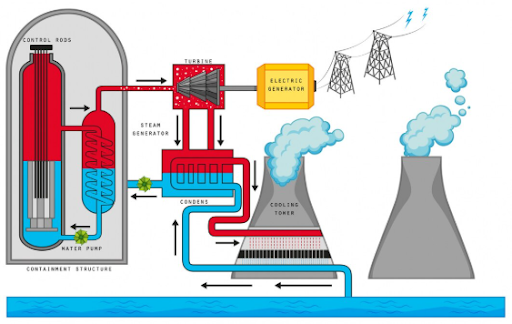

SMRs are compact, scalable nuclear reactors that offer cost-effective, safe, and flexible power solutions—ideal for utilities, industrial processes, remote sites, and military bases. Factory fabrication, reduced construction timelines, and inherent safety designs are key factors contributing to their accelerating adoption.

Key Market Trends

1. Modular Construction & Standardization

Factory-built modules allow rapid on-site assembly, reducing construction time and costs. Standardization minimizes project risk and enhances scalability.

2. Advanced Reactor Innovation

Next-gen SMRs include molten salt, high-temperature gas-cooled, and fast neutron reactors, improving efficiency and safety while expanding use cases.

3. Digital Monitoring & Automation

AI-driven digital twin technology and automation improve reliability, maintenance, and regulatory compliance—especially in harsh or remote environments.

4. Policy Alignment & Climate Goals

Nations are aligning SMRs with climate policies, seeing them as vital to meet net-zero targets by 2050 and replace aging fossil fuel infrastructure.

Market Segmentation

Segment

Description

Application

Electricity generation (largest), CHP, desalination, off-grid

Reactor Type

Water-cooled, molten salt, liquid metal, high-temp gas

Capacity

<25 MW, 25–100 MW, 101–300 MW, >300 MW

End Users

Utilities, industrials, microgrids, desalination plants

Request a Sample for Small Modular Reactor Market – A Global and Regional Analysis 2025-2035

Regional Insights

North America

U.S. & Canada lead due to DOE-backed funding, streamlined regulation, and industry-university partnerships.

Notable players: NuScale Power, BWX Technologies.

Europe

The UK’s Rolls-Royce SMR program receives government and private investment.

France and Russia focus on SMR export markets.

Asia-Pacific

China and Japan are investing in next-gen reactor designs and grid-integration pilots.

China National Nuclear Corporation is a dominant regional force.

Drivers of Growth

Decarbonization mandates and fossil phaseouts

Energy security and grid reliability concerns

Industrial demand for heat and hydrogen production

Faster ROI due to lower upfront capital costs vs traditional nuclear

Competitive Landscape

Key players shaping the market:

NuScale Power, LLC

Rolls-Royce plc

Westinghouse Electric

Terrestrial Energy

EDF, Moltex Energy, General Atomics

These companies are investing in:

Joint ventures and tech licensing

Demonstration projects in North America and Europe

AI-powered operations and modular site deployment

Visit Here for Access Of TOC

Future Outlook

Between 2025–2030, the SMR market will transition from R&D and pilot phases to early commercial rollouts. Expect:

More standardized reactor designs

Widespread off-grid and microgrid deployments

Greater acceptance from regulators and investors

Increased public-private partnerships

Trending Questions About SMRs

What is a Small Modular Reactor (SMR)?

An SMR is a compact nuclear reactor designed for modular construction and deployment. It generates power between 10–300 MW and is ideal for flexible, distributed energy use.

Are SMRs safe compared to traditional reactors?

Yes. SMRs use passive safety systems that shut down reactors automatically without external intervention, significantly reducing accident risks.

What are SMRs used for besides electricity?

Besides power generation, SMRs are used in district heating, desalination, hydrogen production, and industrial heat applications—especially in remote or resource-intensive industries.

Why are countries investing in SMRs?

SMRs align with net-zero targets, offer energy independence, and are faster and cheaper to build than large nuclear plants—making them attractive for national energy strategies.

Who are the major players in the SMR market?

Top companies include NuScale Power, Rolls-Royce, Westinghouse Electric, Terrestrial Energy, and BWX Technologies, all of which are innovating new designs and expanding global partnerships.

What are the challenges for SMR adoption?

Challenges include licensing hurdles, waste management, financing early projects, and public perception around nuclear energy safety.

How do SMRs compare with renewables?

Unlike solar/wind, SMRs provide consistent baseload power 24/7 and require less land. They’re complementary to renewables in hybrid grid models.

Final Thoughts

The Small Modular Reactor market is not just a subset of the nuclear industry—it’s the next-generation solution to many of today’s energy challenges. With fast-growing demand for low-carbon, scalable energy, SMRs are well-positioned to disrupt traditional power systems across regions and industries. The next decade is a launchpad for a safer, decentralized nuclear future.