CarMax, Inc. (NYSE: KMX) reported disappointing results for the second quarter of FY26, triggering a stock selloff on Thursday following the announcement. Sales and profit declined YoY and missed Wall Street’s expectations mainly due to inventory depreciation and the impact of tariff-driven sales pull-forward in prior quarters.

The used car retailer’s stock plunged as much as 20% in early trading on Thursday, marking one of the steepest single-day declines in recent memory. At one point, the stock dropped to the lowest level in about five years. KMX has been maintaining a downtrend after paring its early-year gains. It has dropped around 38% in the past six months alone.

Weak Outcome

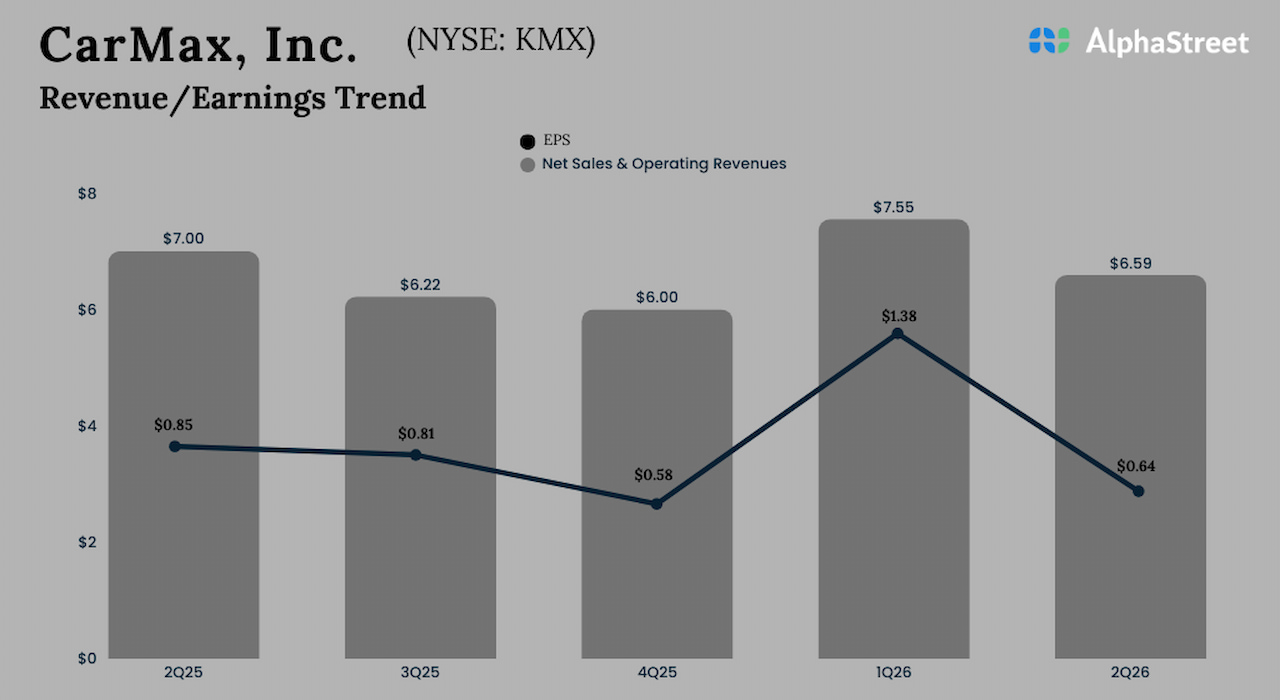

Second-quarter sales and operating revenues decreased to $6.59 billion from $7.01 billion in Q2 FY25. Market watchers were expecting a higher sales number for the latest quarter. Retail used unit sales and comparable store used unit sales declined by 5.4% and 6.3% respectively. Wholesale units dropped 2.2%. Revenues were affected by a pull-forward in sales, driven by pre-emptive buying ahead of anticipated tariff impacts. The weak top-line performance translated into a 28% fall in net income to $95.4 million. On a per-share basis, Q2 earnings dropped to $0.64 from $0.85 last year, missing estimates.

During the quarter, the company bought 293,000 vehicles from consumers and dealers, down 2.4% YoY. Digital capabilities supported around 80% of retail unit sales and net promoter score reached an all-time high. Meanwhile, the company said its overall inventory position and pricing environment have improved in the current quarter. Last month, CarMax launched the “Wanna Drive” marketing campaign, covering all major channels including linear TV, streaming and social media.

CarMax’s CEO Bill Nash described the second quarter as “challenging”, but exuded confidence in the company’s long-term strategy and diversified earnings model. Nash said during his post-earnings interaction with analysts, “While our second quarter results fell short of our expectations, we remain focused on driving sales, gaining market share, and delivering significant year-over-year earnings growth for years to come. We have a differentiated and best-in-class omnichannel customer experience and are focused on maximizing that advantage by driving operational efficiency and sharpening our go-to-market approach.”

Use of Cash

CarMax repurchased 2.9 million common shares for $180.0 million, ending quarter with a total of $1.56 billion available for repurchase. The company opened three new store locations in Tuscaloosa, El Cajon and Hagerstown, and set up one stand-alone reconditioning/auction center in New Kent County. Currently, it is on a drive to boost SG&A efficiency, targeting at least $150 million in incremental cost reductions over the next 18 months.

CarMax’s stock slipped to a 52-week low in Thursday’s post-earnings selloff, after opening the session at $45.02. That is down 45% from the levels seen at the beginning of the year.