Autodesk, Inc. (NASDAQ: ADSK), the developer of popular design software AutoCAD, has reported strong results for the second quarter, sending the stock higher soon after the announcement. The company is in the midst of a strategic transformation, redefining the way it engages with customers and channel partners to drive operational efficiency. The management raised its full-year guidance to reflect foreign exchange tailwinds and the underlying strength of the business.

Stock Rallies

Following the earnings, Autodesk’s stock rallied and went past the $300 mark, after trading sideways in recent weeks. Its post-earnings performance was much better than that of the S&P 500, which closed slightly lower. The shares have grown about 15% in the past six months. ADSK appears poised to extend that momentum, underpinned by management’s upgraded guidance and disciplined growth strategy.

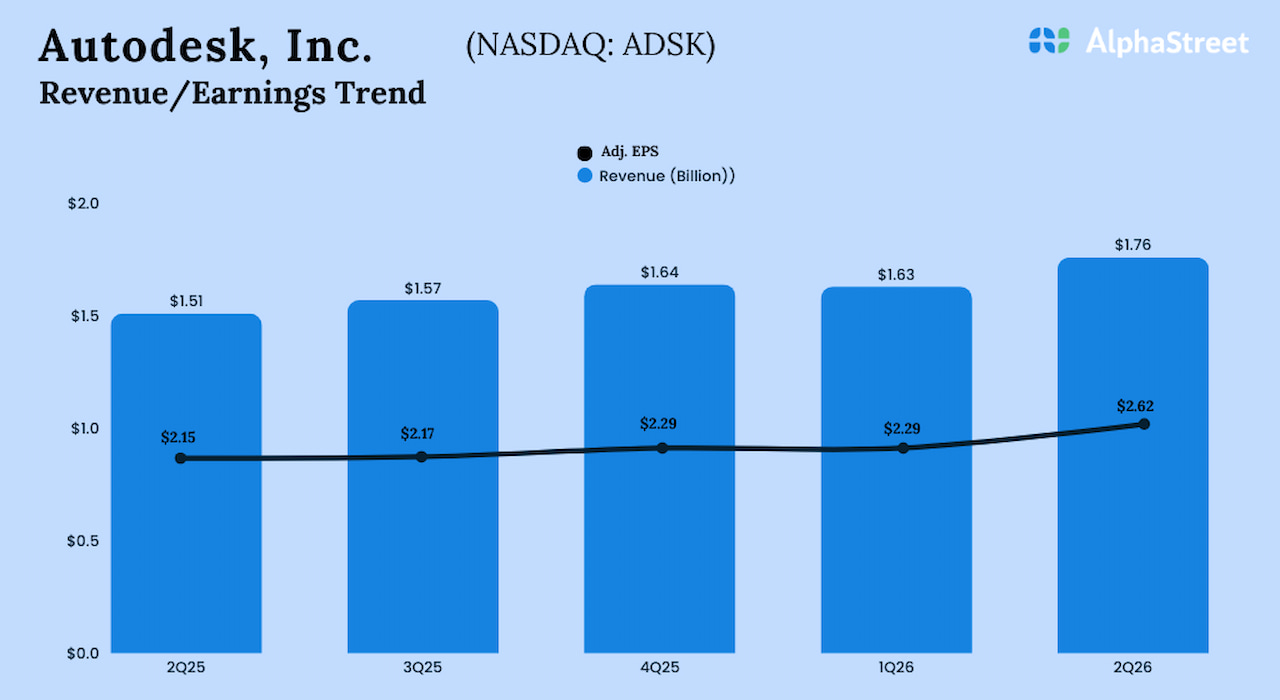

The design software company reported a 17% growth in second-quarter revenues to a record high of $1.76 billion. Revenues of the core Subscription business rose 18% from last year. The strong top-line growth translated into a sharp increase in adjusted earnings to $2.62 per share from $2.15 per share in the prior-year quarter. Net income increased to $313 million or $1.46 per share in the July quarter from $282 million or $1.30 per share in the same period last year. Revenue grew in double-digits across all business segments. Both the revenues and the bottom line topped expectations, continuing the recent streak of beating the Street view. At $1.68 billion, second-quarter billings were up 36% YoY.

Strategy

Cash flows continue to benefit from the transition to annual billings for most multiyear contracts, enabling Autodesk to allocate more cash for share repurchases. The company has been developing an integrated platform ecosystem to expand and scale its AI capabilities. The business looks on track to meet the long-term margin goal of 41% by 2029, leveraging its sales & marketing efficiency gains, operating leverage, and ongoing cost discipline. It is worth noting that the company is facing pressure from activist hedge fund Starboard Value to improve performance through cost cuts, margin expansion, and strategic changes.

From Autodesk’s Q2 2026 Earnings Call:

“In an uncertain geopolitical, macroeconomic, and policy environment, two things remain clear. First, our strong momentum and performance in 2026 set us up well to achieve our goals for the year. And second, we continue to make the right decisions to drive long-term shareholder value. We remain focused on executing our established strategic priorities in cloud, platform, and AI, optimizing our sales and marketing to drive higher operating margins and allocating capital to organic investments, targeted and tuck-in acquisitions, and continuing our share repurchase program as our free cash flow grows.”

Road Ahead

For the third quarter, the Autodesk management forecasts revenues in the range of $1.80 billion to $1.81 billion, and adjusted earnings per share between $2.48 and $2.51. Anticipating the ongoing growth momentum to extend into the remainder of the year, the company raised its full-year revenue guidance to the $7.025-7.075 billion range. Full-year adjusted earnings guidance has been raised to the range of $9.80 per share to $9.98 per share.

Over the past four months, shares of Autodesk have consistently stayed above their 52-week average value. ADSK traded slightly higher on Tuesday afternoon, after opening the session lower.