Following the release of last month’s official federal jobs numbers, President Trump complained that the commissioner of the Bureau of Labor Statistics was publishing inaccurate, too-low employment numbers to make Trump look bad. So, Trump fired the commissioner. Well, it looks like that didn’t fix “the problem”—as Trump saw it—because the latest employment numbers are even worse than last month’s numbers. Moreover, June’s total payroll number was revised down again in this week’s report, showing that the United States actually lost jobs in June.

June’s job losses—which now come in at -13,000—were then followed by a gain of an unimpressive 79,000 in July, with the new August total coming in at a paltry 22,000. Total job gains have now averaged a measly 29,000 for the past three months. This all suggests a rapidly weakening job market.

Some might point to the household survey—where total employed persons increased by 288,000 in August—as evidence of robust job growth. Unfortunately, the household survey also shows that the employment level is still below where it was in January of this year. That is, according to the household survey, there has been no employment growth at all in 2025, and is actually down by 500,000 employed persons over the past eight months. Over the past three months, job growth in the household survey has come in at an average of 40,000 per months. There’s simply not much good news here.

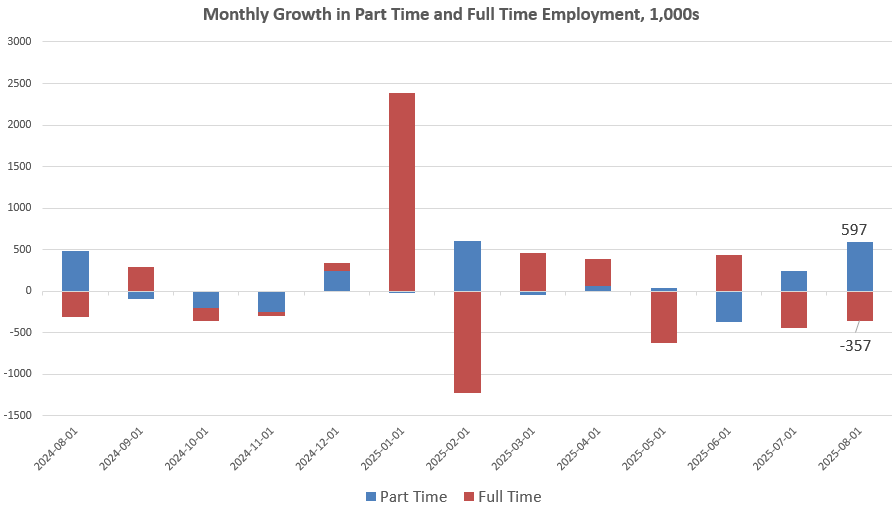

Another reason for concern is the fact that what job growth we have seen in the household survey has been due increasingly to part time employment. This is usually a sign of a weakening labor market. Specifically, for August, total full-time employment decreased by 357,000, compared to July. At the same time, part-time employment increased by 597,000. Over the past three months, full-time employment has fallen by an average of 360,000 jobs per month, while part-time has increased, on average, by 477,000.

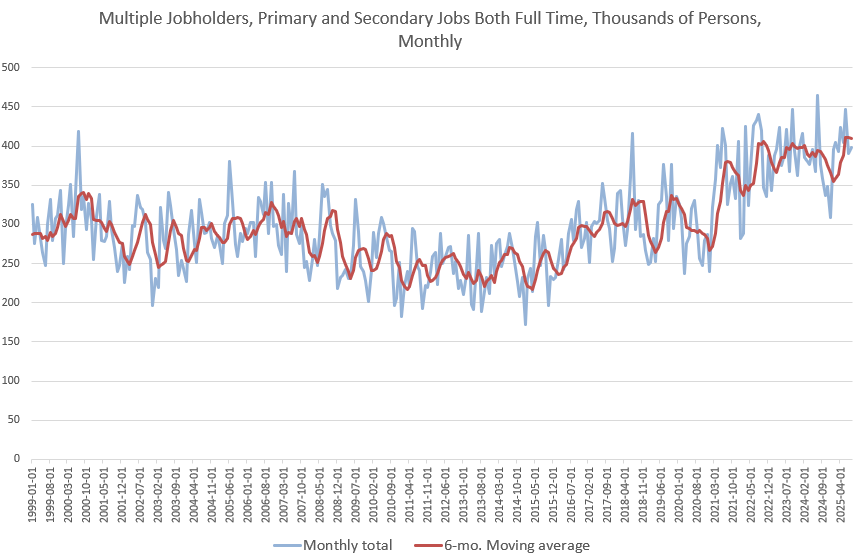

We should not be surprised, then, to find that more and more workers are holding down more than one part-time job to make ends meet. Notably, the total number of multiple job holders with two or more part-time jobs has been trending upward since 2021, and now sits near (at least) a 30-year high.

This also helps to explain the discrepancy between the establishment survey and the household survey. The establishment survey includes part-time jobs, while the household survey measures employed persons. There are more jobs out there than there are employed persons, but those employed persons are increasingly having to rely on holding down more than one of the part time jobs in the establishment survey.

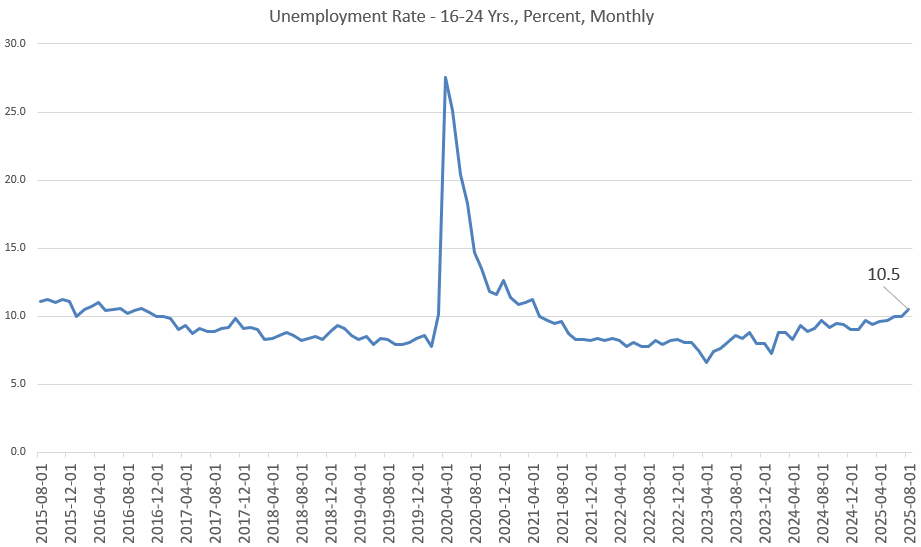

The stagnation in total employment is also fueling increasing unemployment. Yesterday, we looked at how the total number of unemployed persons (in the July data) exceeded the number of job openings for the same period. I predicted this would translate into a rising unemployment rate, and today’s data release shows this. The unemployment rate in August rose to 4.3 percent, which is the highest since October 2021. That’s being fueled in part by rapidly rising unemployment among young people. I mentioned yesterday that recent college graduates are now experiencing higher unemployment than all workers overall. Now, we find that that, for August, the overall unemployment rate for workers ages 16-24 years, rose to 10.5 percent. That’s the highest since April 2021. Excluding the covid period, we have to go all the way back to July 2016 to find a higher unemployment rate for that age group.

Meanwhile, the total number of unemployed persons in August rose to 7.38 million, the highest since September 2021. The number of discouraged workers also increased again in August, rising to 1.79 million.

What Will the Policy Response Be?

The employment numbers are so bad that President Trump has not commented on them as of this writing, and the White House has issued no press release on the topic.

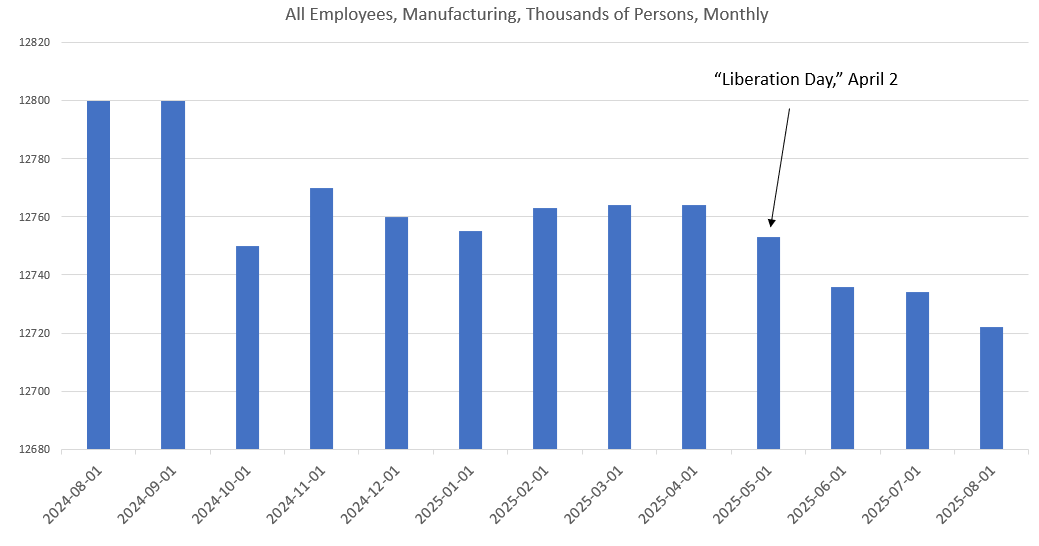

The administration may be hard at work trying to come up with some explanation for why the administration’s flagship policy of raising taxes (i.e., tariffs) on millions of Americans hasn’t produced a boon in new employment. Indeed, the promised renaissance in manufacturing jobs—that was to be fueled by protectionist tariffs—has not materialized. Since April, when Trump announced “liberation day” and hiked new tariffs, the US has lost 42,000 manufacturing jobs.

On the other hand, the continued decline in the job market will help Trump in his repeated calls for more monetary inflation from the Federal Reserve in the name of stimulating job growth. Price inflation remains well above the Fed’s target rate of two percent, and this has fueled resistance at the FOMC to further forcing down the target policy interest rate.

With these latest jobs numbers, though, it is likely the Fed will want to be seen as “doing something” for the job market and now the Fed is far more likely to implement another reduction to the target interest rate. This will further add to the historic flood of monetary inflation that has fueled new bubbles in asset prices, and has contributed to the dollar losing nearly 25 percent of its purchasing power over that period.

Even with an additional boost to monetary inflation, though, it is possible we will see moderation in price inflation (i.e., CPI inflation). As workers become unemployed or underemployed in larger numbers, they will have fewer dollars to bid up prices in many areas measured by the CPI basket of goods. That is, workers will have to cut back on purchases of food, gasoline, and related everyday goods. Rising unemployment will also put downward pressure on home prices. Even if mortgage rates fall, unemployed workers can’t make mortgage payments, regardless of how low rates might fall.

Unfortunately, we are unlikely to see much actual deflation, although it is badly needed. Only deflation can return to consumers some of the purchasing power they lost during the covid panic and the resulting 40-year highs in CPI inflation that appeared during 2022. Deflation would also help to unravel 20-plus years of easy-money fueled malinvestment and financial bubbles. Were this to occur, the economy would then be rebuilt along more sustainable lines that conform to actual market demand, in contrast to the easy-money economy of speculative manias that enriches wealthy asset-holders at the expense of ordinary people.

It’s this last point that suggests to us what the central bank will do as employment data worsens and deflationary pressures emerge: the central bank will intervene on the side of wealthy asset owners to ensure that no sizable deflation in asset prices occurs, ensuring that consumers continue to see an evaporation of purchasing power even as their job prospects disappear. We’ll start to hear a lot in the media about how the Fed is working to increase inflation in order to get it back up to the “two-percent targe” to combat “deflationary” pressures—as if deflation were a bad thing.

This is the opposite of what the central bank should do, which is to refrain from any further intervention in the economy. The Fed should stop buying assets of any kind, and allow interest rates to be set by the marketplace instead of by central planners at the Treasury and at the Fed. As a result, asset prices would fall substantially, and the prices would rapidly become more affordable. It would also become possible again for ordinary people to earn a decent amount of interest on ordinary savings as interest rates gradually rose. In other words, the economy would—for the first time in decades—begin to swing back in favor or ordinary savers, young workers, and first-time home buyers.

Unfortunately, the Trump administration vehemently opposes any such change and will demand that the central bank intervene to further help Trump’s Wall Street allies.