Data updated dailyConstituents updated annually

The consumer discretionary sector is one of the larger constituents of the broader stock market. Having exposure to this important S&P 500 component is important for any well-diversified investment strategy.

With that in mind, we’ve compiled a list of over 250 consumer discretionary stocks along with important investing metrics, which you can download below:

The list of consumer discretionary stocks was derived from these major sector ETFs:

iShares U.S. Consumer Discretionary ETF (IYC)

Invesco S&P Small Cap Consumer Discretionary ETF (PSCD)

Keep reading this article to learn about the merits of investing in consumer discretionary stocks.

How To Use The Consumer Discretionary Stocks List To Find Investment Ideas

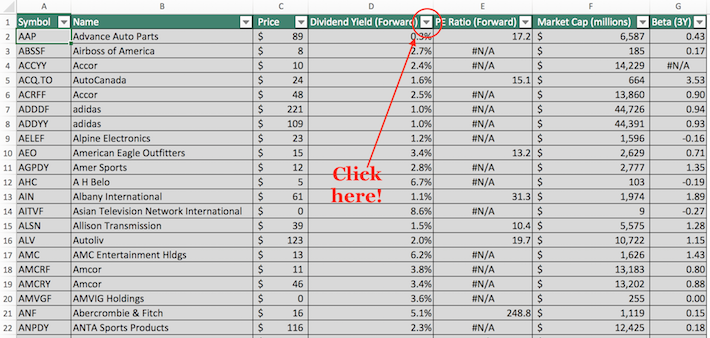

Having an Excel document containing the names, tickers, and financial data for all dividend-paying consumer cyclical stocks is extremely useful.

This tool becomes even more powerful when it is combined with a working knowledge of Microsoft Excel.

With that in mind, this section will demonstrate how to implement two actionable financial screens to the stocks already held within the consumer discretionary stocks list.

The first screen we’ll apply is for stocks with dividend yields above 2%. Since the S&P 500 is trading at a dividend yield of approximately 2% right now, this screen will be called the “above-average dividend yield” screen.

Screen 1: Above-Average Dividend Yields

Step 1: Download the consumer discretionary stocks list at the link above.

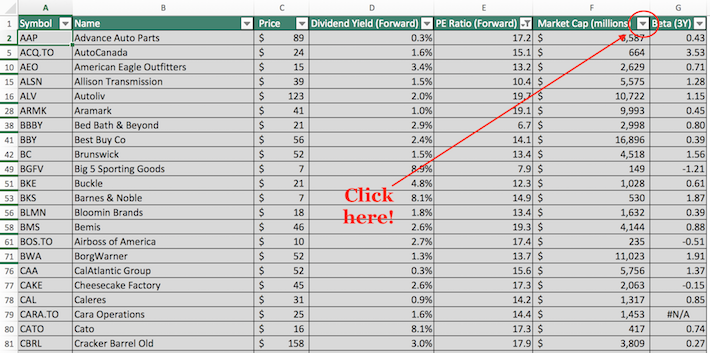

Step 2: Click on the filter icon at the top of the dividend yield column, as shown below.

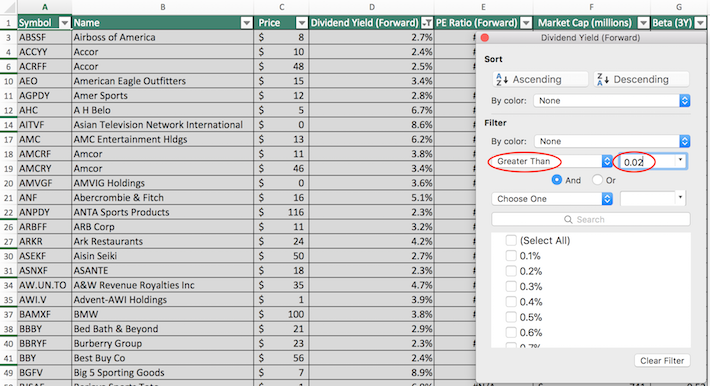

Step 3: In the resulting filter window, change the filter setting to “Greater Than” and input 0.02 into the field beside it, as shown below.

The remaining stocks in this Excel sheet are dividend-paying consumer discretionary stocks with dividend yields above 2%.

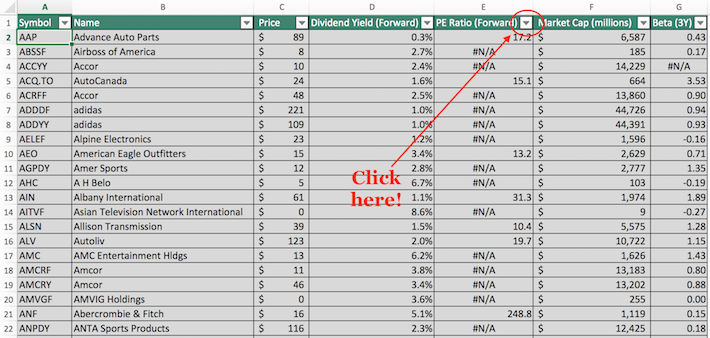

The next screen that we’ll implement is for dividend-paying consumer discretionary stocks with price-to-earnings ratios below 20 and market capitalizations above $5 billion.

Screen 2: Low Price-to-Earnings Ratios, Large Market Capitalizations

Step 1: Download the consumer discretionary stocks list at the link above.

Step 2: When implementing a multi-factor screen like this one, it does not matter which metric is filtered first. We’ll screen first for price-to-earnings ratios below twenty.

To do so, begin by clicking the filter icon at the top of the price-to-earnings column, as shown below.

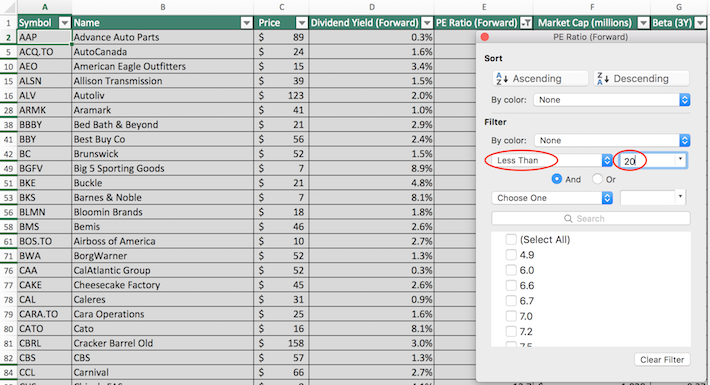

Step 3: In the resulting filter window, change the filter setting to “Less Than” and input “20” into the field beside it, as shown below.

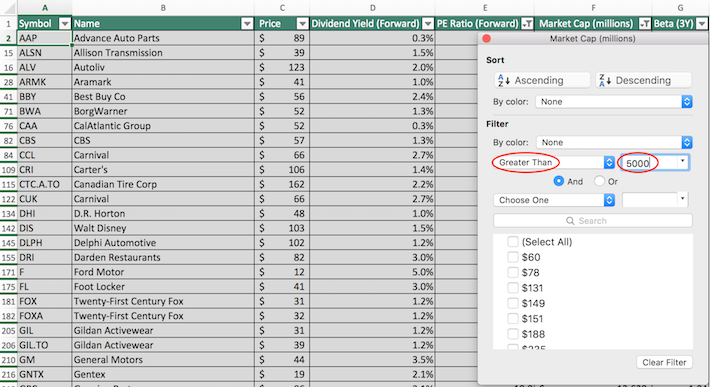

Step 4: Close out of the filter window by clicking the exit button (not by clicking the “Clear Filter” button). Then, click on the filter icon at the top of the market capitalization column, as shown below.

Step 5: Change the filter setting to “Greater Than” and input 5000 into the field beside it. Note that since the consumer discretionary stocks list measures market capitalization in millions of dollars, filtering for stocks with market capitalizations above “$5,000 million” is equivalent to screening for stocks with capitalizations exceeding $5 billion.

The remaining stocks in this Excel document are dividend-paying consumer discretionary stocks with price-to-earnings ratios below 20 and market capitalizations above $5 billion.

You now have a strong fundamental understanding of how to use the consumer discretionary stocks list to find high-quality investment ideas.

The remainder of this article will provide a detailed summary of the merits of investing in the consumer discretionary sector.

Why Invest In Consumer Discretionary Stocks

As with many things, there is a time and a place for consumer discretionary stocks.

As their name implies, consumer discretionary stocks are cyclical in nature. This is because they produce goods and services that are considered non-essential by the average consumer.

The non-essential business models of these companies mean that their financial performance is highly reliant on the state of the overall economy.

When times are good, consumer discretionary stocks will perform very well; conversely, recessions will cause consumer discretionary stocks to perform worse than their consumer staples counterparts.

What does this mean for self-directed investors looking for exposure to consumer discretionary stocks?

Well, recessions tend to negatively impact the profits (earnings-per-share) of consumer discretionary companies. More importantly, it tends to affect their stock prices far more.

This means that recessions are usually the best time to buy consumer discretionary stocks because their price-to-earnings ratios tend to decline to well below their normal levels. Similar logic suggests that right now is probably not the best time to buy consumer cyclical stocks.

After a very lengthy bull market, stock prices are elevated and the S&P 500’s price-to-earnings ratio is well above its long-term historical averages.

With that said, there are still individual bargains within the sector (despite its broad overvaluation). The best way to find them is to apply a quantitative ranking methodology such as The 8 Rules of Dividend Investing.

Final Thoughts

The consumer discretionary sector is home to many strong dividend stocks.

With that said, it is not the only place you should look for high-quality dividend growth investment opportunities.

If you’re willing to explore ideas outside of the consumer discretionary sector, the following databases contain some of the most high-quality dividend stocks around:

If you’re looking for other sector-specific dividend stocks, the following Sure Dividend databases will be useful:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].