Small caps outperform as Fed rate cuts lower borrowing costs and boost demand.

Affordable valuations and growth potential attract investors to small-cap stocks.

Two small-cap stocks are offering promising prospects despite sector-specific risks.

Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

The Russell tracks the performance of 2,000 small-cap U.S. companies across various sectors, such as financials, technology, healthcare, and consumer services. It was established in 1984 by the Frank Russell Company and is a subset of the Russell 3000, which represents 95% of all U.S. stocks.

The Russell 2000 has risen by 5% over the past month, surpassing the ’s 1% gain, and small-cap stocks may continue to outperform for two main reasons:

1. Interest Rate Sensitivity: Historically, small-cap stocks tend to do better when the Federal Reserve cuts interest rates. These companies rely heavily on the domestic market and are more sensitive to rate changes than larger firms. They often carry more debt and face difficulties borrowing cheaply. Lower rates make credit more affordable, enabling these companies to refinance at lower costs, borrow at reduced rates, and improve their profit margins. Additionally, lower interest rates boost domestic demand through increased consumer credit, business investment, and mortgages, directly benefiting small-cap businesses.

2. Valuation and Growth Potential: Small-cap stocks are generally more affordable compared to their large-cap counterparts. For example, the S&P 600 small-cap index has a forward price-to-earnings ratio of 16, while the S&P 500 is at 23. This valuation, combined with lower interest rates, typically creates a favorable environment for risky assets. Investors seeking higher returns are drawn to small-cap stocks due to their greater growth potential, despite the accompanying risks.

Currently, market indicators suggest an 80-85% probability of a in September, which could further support the performance of small-cap stocks.

In this article, we will examine some intriguing stocks with potential, although they carry inherent risks due to their profiles. These are not purchase recommendations but rather analyses based on information and data.

1. LandBridge

owns and manages land and resources to boost oil and natural gas development in the United States. It possesses acreage in and around the Delaware Basin in Texas and New Mexico. Founded in 2021, its headquarters are in Houston, Texas.

Since August 15, its shares have also been listed on NYSE Texas, a new electronic stock exchange in Dallas.

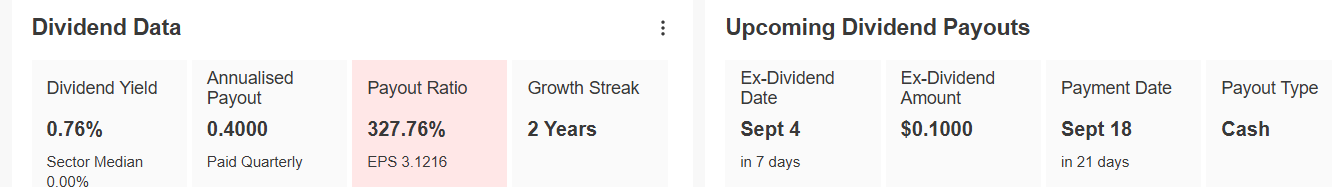

The company will pay a dividend of $0.10 per share on September 18, with shares needing to be held by September 4 to qualify for the dividend. The annual dividend yield is 0.76%.

Source: InvestingPro

The company reported a significant rise in for the second quarter, hitting $47.5 million, an 83% increase from the previous year. Despite this impressive revenue growth, the company’s earnings per share (EPS) were $0.24, which did not meet market expectations.

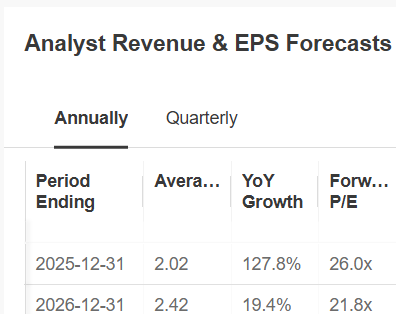

By 2025, the company’s earnings per share (EPS) are anticipated to grow by 127.8%, followed by an additional increase of 19.4% by 2026.

Source: InvestingPro

Source: InvestingPro

Strategic partnerships and land acquisitions are continuing to fuel the company’s growth. It is also involved in leasing for data centers, digital infrastructure, cryptocurrency mining, and renewable energy like solar and wind.

However, there are two key risks. First, the company still carries significant debt, although steps are being taken to reduce it. Second, despite its diversification efforts, a large portion of its income remains tied to oil and gas activities, making it susceptible to fluctuations in that sector.

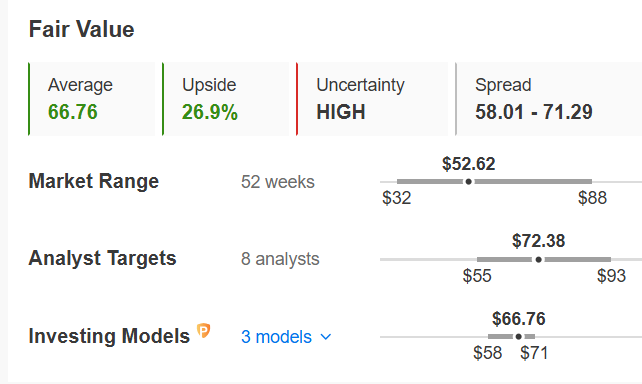

Currently, the shares are trading 26.9% below their fair value, which is estimated at $66.76 based on fundamentals. Market consensus suggests an average target price of approximately $72.38.

Source: InvestingPro

2. Lantheus

Based in Billerica, Massachusetts, specializes in medical diagnostic products, which are extensively used by cardiologists, oncologists, radiologists, and other healthcare professionals.

The company does not pay dividends, preferring to reinvest its earnings into the business to drive growth and deliver value to shareholders.

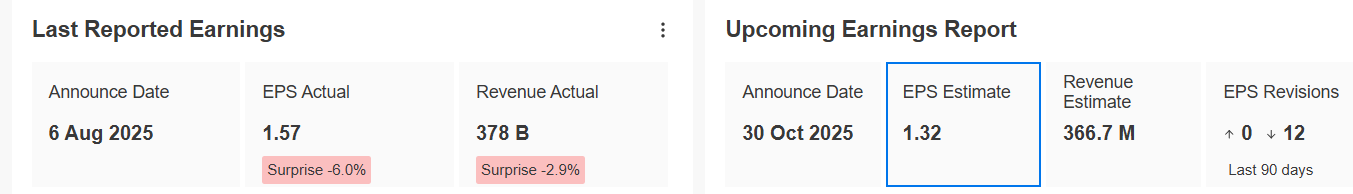

In the second quarter, the company reported that fell short of forecasts. It posted adjusted earnings per share (EPS) of $1.57, missing the expected $1.67, while revenue was $378 million, below the anticipated $389.14 million. The company is set to report its next quarterly results on October 30, with EPS expected to grow by 4.4% in 2026.

Source: InvestingPro

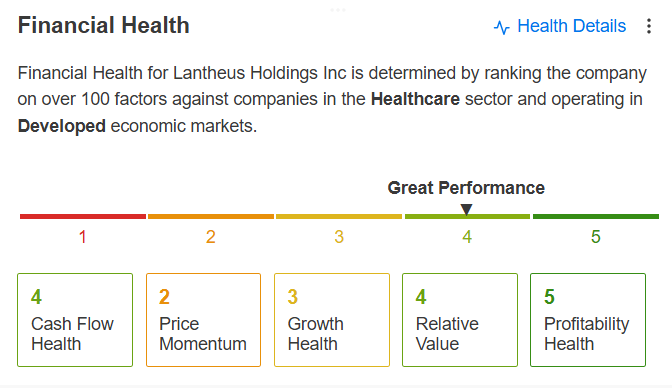

The company maintains strong financial health, earning an overall score of “very good” (with 5 being the highest possible score). It demonstrates solid liquidity, as shown by a current ratio of 4.29. Additionally, the company holds a prominent position within its specialized niche.

Source: InvestingPro

The company has expanded its portfolio and international presence through several acquisitions, including Progenics Pharmaceuticals and EXINI Diagnostics.

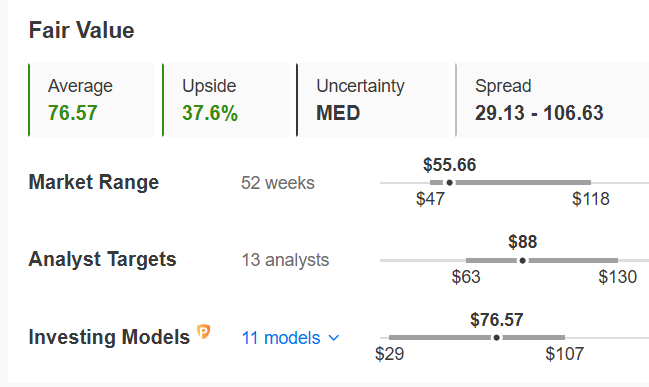

Currently, its shares are trading 37.6% below their fair value, estimated at $76.57 based on fundamentals. Market consensus sets the average target price at $88.

Source: InvestingPro

Final Words

The has outperformed the Nasdaq 100, benefiting from Federal Reserve rate cuts that enhance small-cap performance through cheaper credit and increased domestic demand. These more affordable small-cap stocks offer high growth potential, despite higher risks.

Among potential investments, LandBridge and Lantheus Holdings offer intriguing options. LandBridge, focusing on energy and renewables, shows significant EPS growth but faces sector volatility. Lantheus, a medical diagnostics leader, expands through acquisitions despite recent earnings misses. Both trade below fair value, implying potential upside.

***

InvestingPro provides a comprehensive suite of tools designed to help investors make informed decisions in any market environment. These include:

AI-managed stock market strategies re-evaluated monthly

10 years of historical financial data for thousands of global stocks

A database of investor, billionaire, and hedge fund positions

And many other tools that help tens of thousands of investors outperform the market every day!

Not a Pro member yet? Check out our plans here.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.