The U.S. housing market’s inventory is growing, putting pressure on prices and slowing new construction, according to fresh research from the Bank of America Institute. As of June, existing-home supply reached 4.7 months, the highest level since July 2016. New-home supply surged even further to 9.8 months—its highest point since 2022—highlighting how quickly inventory is building across the housing market.

The influx of available homes reflects sluggish demand, with builders citing weak buyer urgency, affordability challenges, and lingering job instability. The Institute noted new-home inventory is now at its highest level since 2007, the year before the housing market collapse that led to the Great Financial Crisis.

ResiClub co-founder Lance Lambert told Fortune that the rising inventory tells us that “homebuyers are gaining leverage” as slack in the housing market is increasing. “The Pandemic Housing Boom saw too much housing demand all at once, home prices overheated too fast in many markets, and underlying fundamentals got too stretched.”

Lambert characterized the last few years as a “recalibration period” where the housing market is smoothing out that excess. Mounting inventory sucks out appreciation in more markets—and even causes outright corrections in some markets’ home prices. He said he expects the underlying fundamentals to slowly improve as that happens and incomes keep rising. “It takes time.” This period is different from 2007, he said, because that window saw a far greater weakening of the housing market and upswing in resale inventory, along with unsold, completed newbuild homes.

BofA Research

One striking shift: The median price of a new home has actually fallen below that of an existing home—a reversal of the usual market dynamic. BofA said this pricing inversion underscores how builders are being forced to discount amid rising supply and softer demand. “Builders are starting to pull back on new home starts in many markets,” Bank of America wrote. While the slowdown is broad-based, conditions vary regionally, with some areas such as the Midwest proving more resilient than others.

“Since the Pandemic Housing Boom fizzled out in 2022, and the affordability squeeze was fully felt,” Lambert told Fortune, “the national power dynamic has slowly been shifting from sellers to buyers as homes have a harder time selling and active inventory for sale builds.”

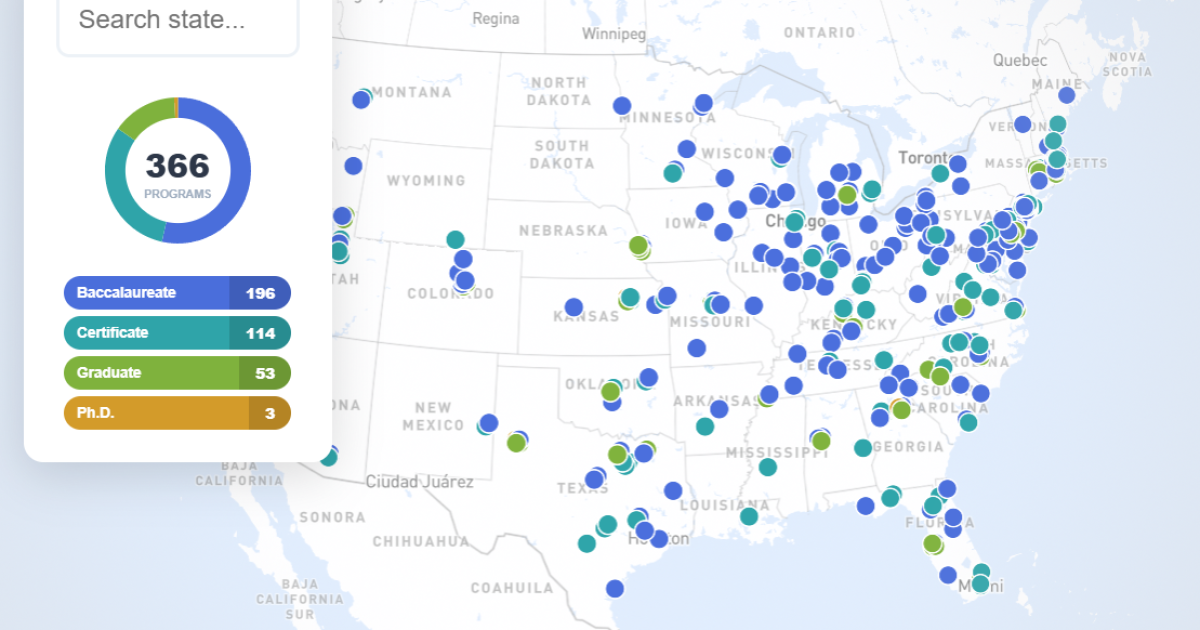

Still, Lambert noted the inventory picture varies significantly across the country. For instance, it remains most limited across notable sections of the Midwest and the Northeast, although still growing, he said. On the other hand, active inventory has neared or surpassed pre-pandemic 2019 levels in many parts of the Sun Belt and Mountain West, and he said that is where homebuyers have gained the most leverage.

The trend comes as the Federal Reserve has begun trimming interest rates in an effort to support both broader economic growth and housing affordability. Whether those cuts will be enough to reignite demand remains an open question.

For now, the data signals a market in transition: high inventory, moderating prices, and builders caught between a cautious consumer and the need to manage supply.

For this story, Fortune used generative AI to help with an initial draft. An editor verified the accuracy of the information before publishing.