Enjoy the current installment of “Weekend Reading For Financial Planners” – this week’s edition kicks off with the news that a recent survey of Americans who plan to hire an advisor in the next five years indicates that while referrals from friends and family remain the most common way individuals seek out a financial advisor, nearly all perform additional research on the advisor, including by seeking out online reviews and the advisor’s website. When considering an advisor’s reputation, top factors cited by respondents included transparency in fees and services, professional certifications and credentials, and positive online reviews on an independent website, among other areas. The survey also found broad openness amongst respondents for their advisor using Artificial Intelligence (AI)-powered tools for a variety of functions, including fraud detection and meeting notetaking, though they expressed more reservations about using AI for automated investment decisions (suggesting an opportunity for advisors to leverage their ability to relate to clients on a human level while taking advantage of some of the capabilities AI can offer).

Also in industry news this week:

A survey indicating Americans remain broadly worried about receiving their scheduled Social Security benefits suggests a valuable role for financial advisors in helping them understand the “true” state of the Social Security system and how potential legislative changes could impact their benefits and the taxes they pay

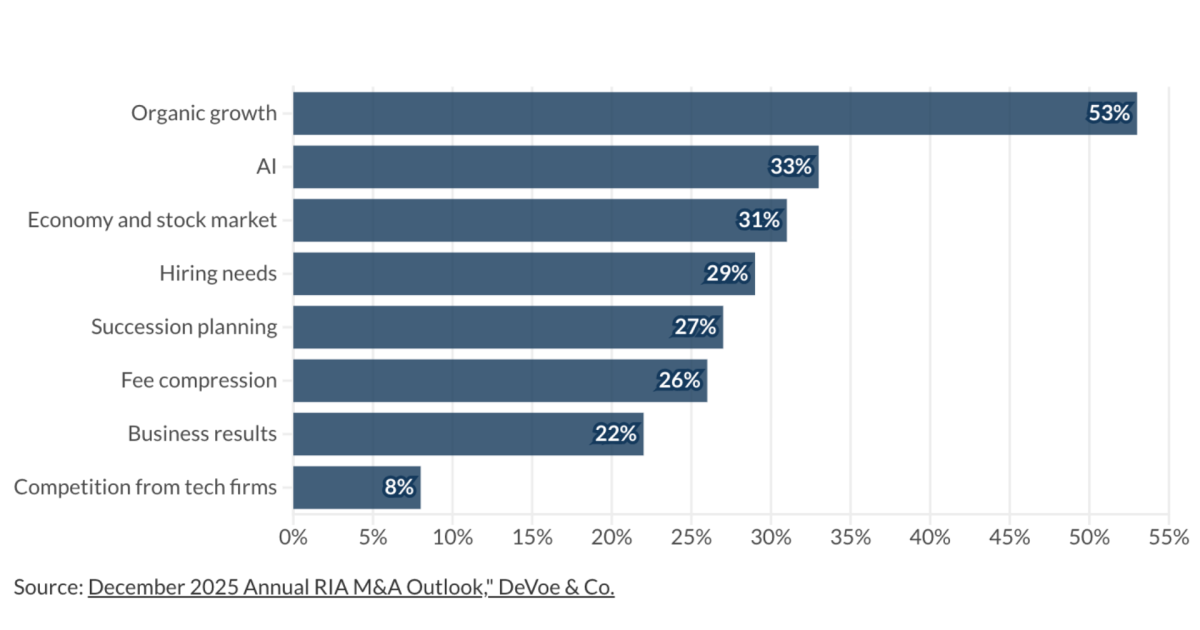

A report indicates that RIA M&A hit a fresh high in the first half of 2025 and suggests that amidst continued strong demand from buyers, the supply of selling firms will likely drive the pace of deals in the coming months

From there, we have several articles on retirement planning:

A seven-step process that can help clients estimate their expected cash flow needs in retirement more accurately than common rules of thumb

How the scheduled end of enhanced Affordable Care Act premium subsidies could increase the expenses of many early retirees and others with these health insurance policies

How reframing risk in retirement as “over- and under-spending” could help clients better understand the tradeoffs they face than a “success versus failure” framework

We also have a number of articles on marketing:

The potential value for financial advisors of having “channel focus” in marketing, going all-in on a single marketing channel rather than inconsistently focusing on several tactics

How some advisors are using Instagram to meet their target clients “where they are” on social media and to demonstrate their expertise and personalities

While many advisors focus on marketing tactics to reach potential clients around the country, both analog and digital marketing tools can allow advisors to tap into a potential client base closer to home

We wrap up with three final articles, all about health and wellness:

A recent study suggests that taking 7,000 steps each day could be a ‘sweet spot’ for improved health outcomes

An analysis suggests that it’s never too late to get the health benefits of an active lifestyle, with benefits accruing both to those who maintain a workout regimen and those who start fresh

Six ways to build a consistent exercise routine, from finding an accountability partner to using apps that offer rewards for sticking to a workout plan

Enjoy the ‘light’ reading!

Read More…