Identify the barriers to AI adoption for your firm and find solutions for them.

79% of tax, accounting, and audit professionals expect artificial intelligence (AI) to have a high or even transformational impact on the future of their industry. But only 14% say their firms have a defined AI strategy in place. With AI adoption comes issues such as data privacy and security concerns, high costs and complexity of integration, and regulatory compliance. According to the 2025 State of Tax Professionals Report from Thomson Reuters Institute, incorporating AI technologies was the third highest challenge firm leaders said they are facing this year.

The challenges surrounding AI adoption not only test the firm’s technological capabilities but also their ability to maintain client trust and meet financial standards. In this blog post, we will explore these challenges and discuss how firms can overcome them to fully realize the potential of AI.

Jump to ↓

1. Data privacy and security concerns

2. Cost and complexity of AI integration

3. Training staff in AI technologies

4. Ensuring regulatory compliance

5. Managing client expectations and trust

How to overcome the challenges of adopting AI

1. Data privacy and security concerns

Data privacy and security stand out as one of the most significant challenges in the use of AI in financial services. According to the 2025 Generative AI in Professional Services Report, data security was listed as the top concern for tax firm respondents. Privacy and confidentiality of data entered in GenAI tools was the third-highest concern.

AI systems often require access to large amounts of sensitive data, including personal financial records, transaction histories, and confidential business information. This data is crucial for AI to perform tasks such as fraud detection, risk assessment, and personalized financial advice. However, it also opens the door to significant privacy risks. Clients are increasingly aware of the potential for data breaches and are more cautious about sharing their information. Therefore, firms must prioritize the protection of this data to maintain client confidence and avoid legal repercussions.

In the age of AI, robust cybersecurity measures are essential, not just a best practice. Cyber threats are evolving, and AI systems, while powerful, can also be vulnerable if not properly secured. Firms must invest in advanced encryption techniques and secure data storage solutions to safeguard against unauthorized access and data breaches. This includes regular security audits, continuous monitoring of AI systems, and strict access controls. By adopting a multi-layered approach to security, firms can significantly reduce the risk of data compromise and ensure that their AI technologies are used responsibly and safely.

Blog

A data security checklist for tax firms using GenAI

Read blog ↗

2. Cost and complexity of AI integration

Integrating AI into current systems isn’t just a technological challenge; it also involves substantial financial and logistical factors. The initial investment required for AI implementation can be substantial, including the costs of the technology, as well as the necessary infrastructure to support it. For accounting firms, this often entails upgrading servers, enhancing data storage capabilities, and ensuring integration with existing software, such as ERP systems and accounting platforms.

Off-the-shelf AI tools are often inadequate for the unique requirements of an accounting firm. Firms are faced with three options: customize a solution for their needs in-house, outsource experts to build them a solution, or buy an industry-specific tool. All three routes have pros and cons that firms need to weigh for their unique situation. Calculating the ROI for AI investment can help firms make the right decision.

Allocating resources for the maintenance and iterative updates of AI systems is also essential for firms. Unlike static software, AI technologies are dynamic and require constant refinement to adapt to changing data patterns and business requirements. This ongoing process of enhancement is vital to the accuracy of AI-driven tasks.

3. Training staff in AI technologies

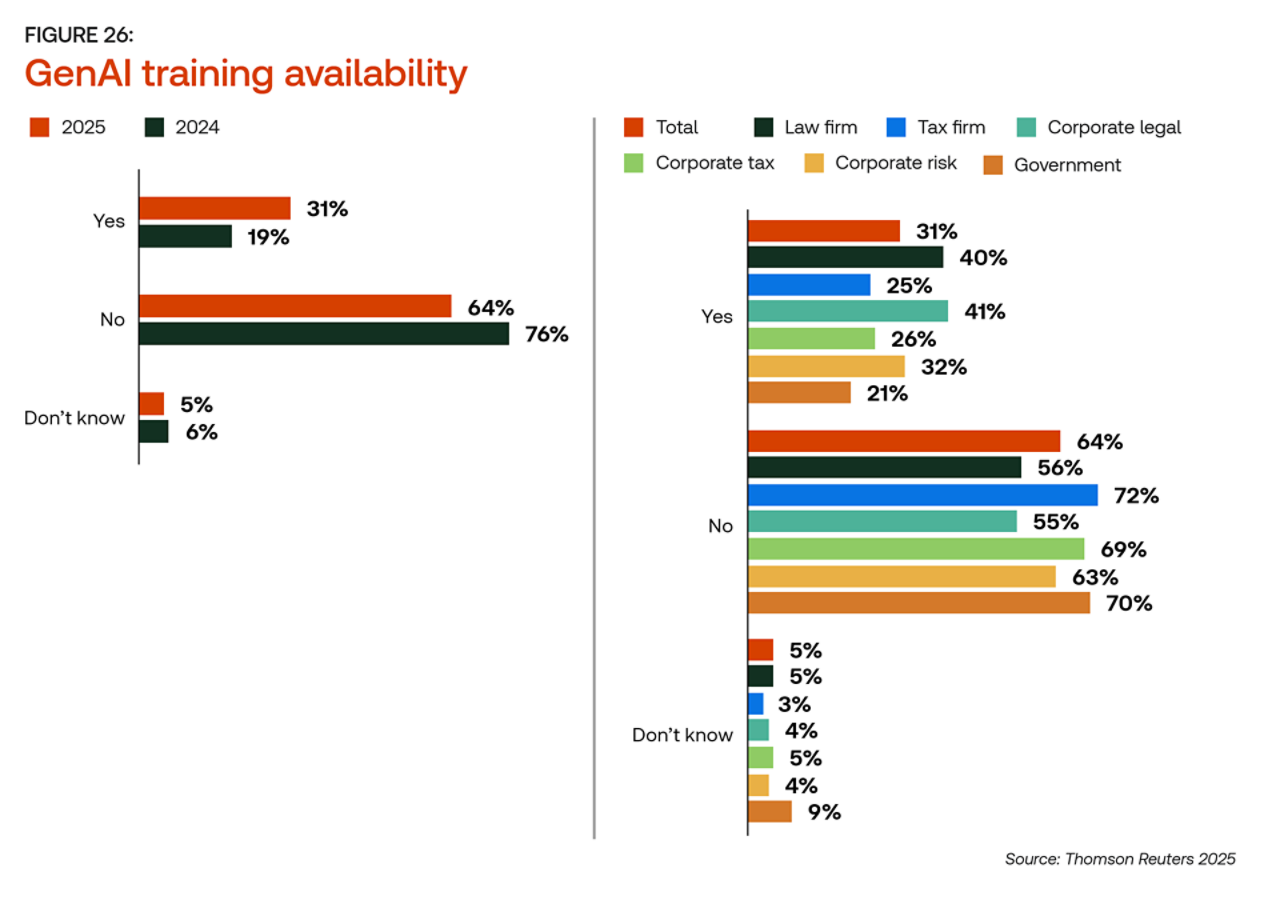

The challenges of adopting AI are multifaceted, but one of the most significant is ensuring that the accounting team stays current with the rapid advancements in AI. As of the 2025 GenAI report, only 25% of tax, accounting, and audit firms have provided training to employees about generative AI — the second lowest rate across professional services in the survey.

Unlike traditional software, AI systems are continuously evolving, which means that the knowledge and skills required to work with them must also be constantly updated. This need for continuous learning can be daunting, especially for firms with limited resources or those new to the AI landscape. However, the benefits of a well-trained team far outweigh the initial investment in time and effort.

To mitigate these challenges, many firms are turning to a variety of educational resources. Online courses and workshops have become a popular choice due to their flexibility and accessibility. Platforms such as Coursera, Udemy, and LinkedIn Learning offer a wide range of AI-related courses that can be tailored to the specific needs of an accounting team. These courses often cover the fundamentals of AI, machine learning, and data analytics, as well as more advanced topics like natural language processing and predictive modeling. By providing staff with the opportunity to learn at their own pace, firms can ensure that everyone has the necessary foundation to work with AI tools effectively. Additionally, workshops and seminars allow for more hands-on learning and immediate feedback, which can be invaluable in a field as complex and dynamic as AI.

Another effective method for training staff is using AI simulation tools. These tools provide a safe and controlled environment where employees can practice complex tasks and scenarios without the risk of real-world consequences. For example, an AI simulation might allow an accountant to experiment with different data sets and algorithms to better understand how AI can be applied to financial forecasting or fraud detection. This practical experience not only enhances their technical skills but also builds confidence in using AI technologies. Simulation tools can also help identify areas where additional training is needed, allowing firms to tailor their educational programs to the specific weaknesses of their team.

Mentoring programs are also a key component of training. Pairing less experienced staff with more seasoned professionals who have a strong grasp of AI can facilitate knowledge sharing and accelerate the learning curve. Mentors can provide guidance, answer questions, and offer real-world insights that are not always available in structured courses.

4. Ensuring regulatory compliance

As AI becomes more integrated into business processes, firms must ensure that their AI systems comply with data protection laws. These laws, such as the General Data Protection Regulation (GDPR) in the European Union and the California Consumer Privacy Act (CCPA) in the United States, impose strict requirements on how client information is collected, processed, and stored. Non-compliance can result in significant legal penalties, damaging both the firm’s reputation and its bottom line.

Facing industry-specific regulations is another challenge organizations must navigate. For instance, financial institutions are bound by Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). These standards govern the reporting and analysis of financial data, and any AI system employed in these processes must yield results that are both accurate and compliant. Ensuring that AI algorithms meet these regulatory standards without compromising the integrity of financial data is a formidable challenge.

5. Managing client expectations and trust

One of the challenges of adopting AI is ensuring that clients fully understand the technology’s role within the organization. Misunderstandings about what AI can and cannot do can lead to unrealistic expectations and, ultimately, dissatisfaction. Firms need to communicate the specific functions and limitations of AI clearly and consistently. This can be achieved through detailed explanations, demonstrations, and even educational materials that help clients grasp the nuances of the technology.

Transparency about AI usage and data handling is also important for building trust. Clients are increasingly aware of the potential risks associated with AI, including data privacy and security concerns. By implementing clear and robust AI usage policies, and providing regular updates on data handling practices, organizations can reassure their clients that their information is safe and being used ethically.

Clients often value the personal touch and the ability to connect with real people, particularly during complex or sensitive situations. AI can automate routine tasks and provide quick, accurate insights, but it should not replace the empathy and nuanced understanding that human staff can offer. Maintaining strong personal relationships with clients is key to long-term success, and AI should be seen as a tool that complements these efforts rather than undermines them.

How to overcome the challenges of adopting AI

At the end of the day, bringing AI into your accounting firm isn’t just about keeping up with the latest technology—it’s about making smart choices that benefit both your team and your clients. Yes, there are hurdles to overcome, from protecting sensitive information to training your staff and managing costs. But every challenge is also an opportunity to grow stronger and more efficient. The key is taking it one step at a time: start with a clear plan, invest in your people, and always keep your clients’ needs at the center of everything you do. When you approach AI adoption thoughtfully and transparently, you’re not just upgrading your systems—you’re building a foundation for long-term success that your clients can trust and your team can be proud of.

For more insights, download our special action report for the tax and accounting industry on how to build a framework for AI investment and adoption.

2025 Future of Professionals Report

Actionable insights for tax, audit and accounting firm leaders

Read special report ↗