Choosing assisted living is a big decision, both emotionally and financially. Many families focus on the monthly base rate, but what you see isn’t always what you get. Hidden assisted living fees can add up fast, catching new residents off guard. These costs often lurk in the fine print or only come up during move-in. Knowing what to expect can help you avoid sticker shock and make better plans for your loved one’s care. Here are the most common assisted living fees that often go unmentioned until you’ve already settled in.

1. Move-In and Community Fees

Most assisted living communities charge a one-time move-in or community fee. This can range from a few hundred to several thousand dollars. It’s meant to cover administrative costs and facility upkeep, but it’s often not included in the initial price quote. Some places call it a “community fee,” while others label it as an “admission” or “enrollment” fee. Either way, it’s nonrefundable and due before you get the keys. Always ask for this number up front when comparing facilities.

2. Level of Care Assessments

After moving in, your loved one will be assessed to determine their care needs. This assessment can trigger additional assisted living fees if more help is required. While the base rate might cover basic assistance, services like medication management, mobility help, or incontinence care usually cost extra. The price structure for these levels isn’t always clear in marketing materials. Be sure to clarify what’s included—and what isn’t—before signing a contract.

3. Medication Management Charges

Handling medications is a key part of assisted living, but it’s rarely free. Many communities charge a monthly fee for medication reminders or administration. The more complex the medication routine, the higher the fee. Some charge per medication, while others use a tiered system. This can be a surprise for families who assume that all medical oversight is included in the base price.

4. Transportation Expenses

Transportation to doctor’s appointments, shopping trips, or religious services is often touted as a perk. However, many facilities only offer limited free rides. Additional trips, or destinations outside a set radius, can come with extra assisted living fees. Some places charge per mile or per trip, so it’s important to ask about transportation policies and costs up front.

5. Housekeeping and Laundry Fees

Basic housekeeping may be included, but anything beyond the standard can cost more. Deep cleaning, extra laundry loads, or frequent bed linen changes might all come with fees. If your loved one has special cleaning needs or wants more frequent service, expect to see additional charges on your bill. These fees can sneak up on you if you’re not paying close attention to what’s provided in the base rate.

6. Guest Meals and Dining Upgrades

Inviting family or friends for a meal is a nice way to keep your loved one connected, but guest meals usually aren’t free. Most assisted living communities charge extra for guests to eat in the dining room. Special meal requests, premium menu items, or in-room dining might also have upcharges. Ask to see the guest meal policy and any dining upgrade fees before hosting visitors.

7. Personal Care and Grooming Services

Haircuts, manicures, and other grooming services are rarely included in assisted living fees. While some facilities offer on-site salons, these services almost always cost extra. Prices are often similar to what you’d pay at a regular salon. If personal care is important to your loved one, factor these costs into your monthly budget.

8. Cable, Internet, and Phone Services

Basic utilities are usually included, but cable TV, high-speed internet, and private phone lines might not be. Many assisted living communities offer these as optional add-ons, sometimes at a premium. Packages and pricing can vary widely. If your loved one wants to stay connected, make sure to ask exactly what’s included and what costs extra. This is a common source of hidden assisted living fees.

9. Social Activities and Outings

Most facilities offer a calendar of activities, but not all are free. Off-site outings, special events, or classes may require an extra fee. Art classes, theater tickets, or day trips can add up over the month. Review the activity schedule and ask which events are included so you’re not surprised by charges for social engagement.

10. Emergency Response Systems

Many assisted living communities provide emergency call systems for residents’ safety. However, there may be a monthly charge for the device or for monitoring services. Some facilities include basic systems in the rent, but upgrades or wearable devices can cost more. It’s important to know what kind of emergency response is provided and whether you’ll pay extra for peace of mind.

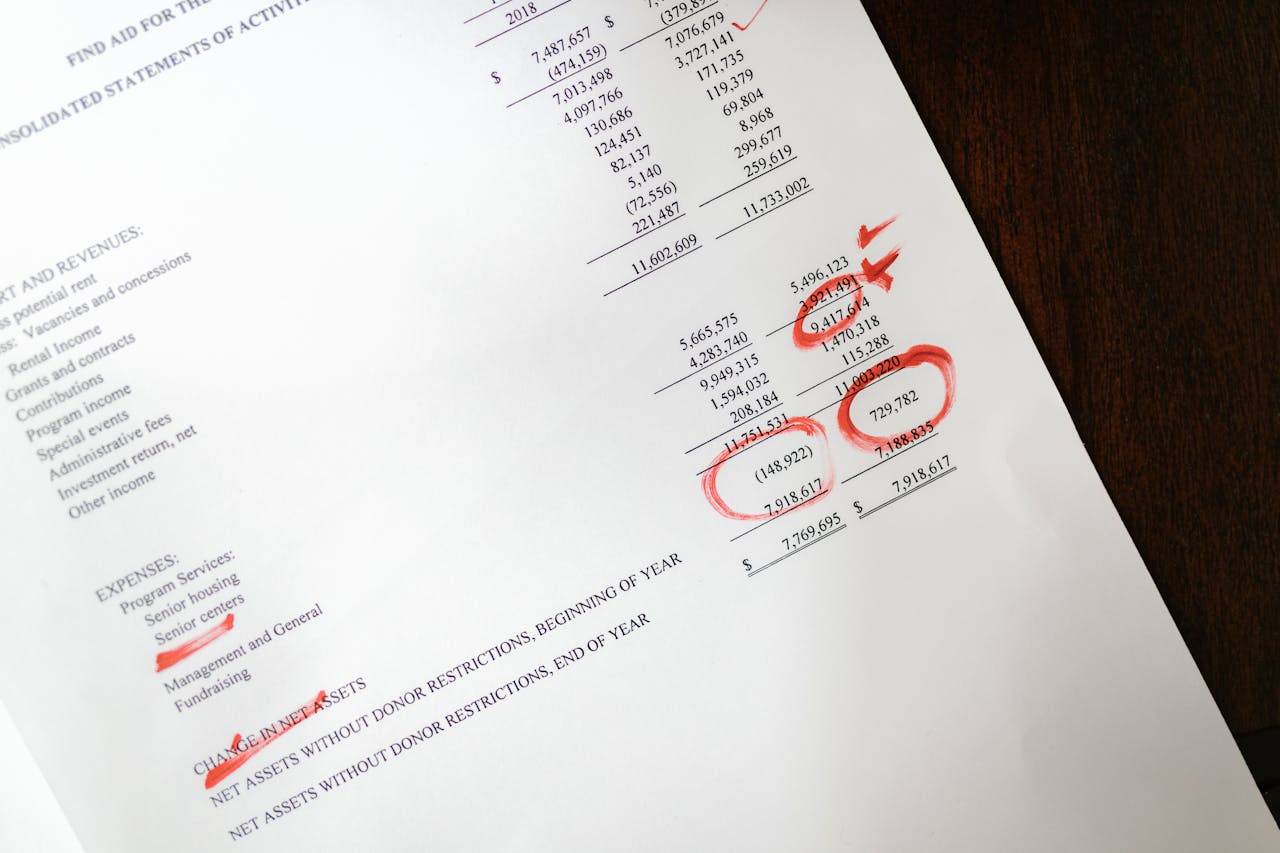

How to Avoid Surprises with Assisted Living Fees

Hidden assisted living fees are a common source of frustration for families. The key to avoiding unexpected costs is to ask detailed questions before signing a contract. Request a full breakdown of all possible fees and get them in writing. Review the contract carefully and don’t be afraid to negotiate or shop around.

It’s also smart to read reviews and talk to current residents or their families about their experiences. Planning ahead and understanding the true costs will help you find the right fit without blowing your budget.

Have you encountered any hidden assisted living fees? Share your experiences or tips in the comments below!

Read More

11 Assisted Living Costs That Keep Rising With No Explanation

6 Insurance Loopholes That Slash Elderly Care Premiums Overnight

Travis Campbell is a digital marketer and code developer with over 10 years of experience and a writer for over 6 years. He holds a BA degree in E-commerce and likes to share life advice he’s learned over the years. Travis loves spending time on the golf course or at the gym when he’s not working.