Join Our Telegram channel to stay up to date on breaking news coverage

A group of crypto and fintech executives has urged the Trump administration to stop banks from charging fees for access to their customer data, arguing that it stifles innovation and customer choice.

In a recent letter sent to the President, the group claimed to share the Trump administration’s “commitment to a dynamic, competitive US economy,” but said this “shared vision for economic freedom is under direct threat from the nation’s largest banks.”

That’s after JPMorgan told fintechs and data aggregators that rely on the bank’s customer data that access to client information will no longer be freely available. PNC Financial Services Group Inc. is considering charging similar fees as well. These fees are set to impact the market in September, according to the group.

The letter included participation from executives such as Andreessen Horowitz General Partner Alex Rampell, Blockchain Association CEO Summer Mersinger, Gemini co-founders Tyler and Cameron Winklevoss, and Plume Network founder and CEO Christopher Yin.

Robinhood Chairman and CEO Vlad Tenev, Stripe co-founder and CEO Patrick Collison, and Shopify CEO and founder Tobi Lütke also joined the effort.

Trump Administration’s Mission To Build A Modern Economy Under Threat

Trump campaigned to make the US the crypto capital of the world ahead of the Presidential elections last year.

The crypto industry, which was then under attack by the US Securities and Exchange Commission (SEC), backed Trump’s campaign to the tune of hundreds of millions of dollars in an effort to bring about change.

“Your Administration has acted decisively to correct the misguided policies of the past, and is laying the groundwork for the US to build a truly 21st-century economy,” the group wrote, before saying that this hard work by the Trump administration “is being actively threatened” by big banks.

2/ We are asking @POTUS to stop the nation’s largest banks from imposing these exorbitant fees, which would keep Americans from linking their bank accounts to the financial tools and services they want to use.

— Financial Technology Association (@fintechassoc) August 14, 2025

Through “exorbitant” new account access fees, the group alleges those big banks are trying to “prevent consumers from connecting their accounts to better financial products of their choice.”

If the Trump Administration does not step in soon, the group argues it will result in a “dangerous legal interpretation” that a customer’s right to their account information does not mean that they can freely share access to the data with “a trusted application acting on their behalf.”

That will undermine the “long-standing principle of consumer choice,” the group of crypto and fintech executives argued.

“We urge you to use the full power of your office and the broader administration to prevent the largest institutions from raising new barriers to financial freedom,” they wrote.

This issues is centered around an “open banking rule” that was finalized in October last year by the Consumer Financial Protection Bureau (CFPB) under the former Joe Biden Administration. This rule allows customers to freely share bank data with fintechs.

While the rule was welcomed by the crypto community, leading banking industry groups opposed it. They subsequently sued the CFPB.

Trump initially signaled that he would side with the banks and kill the rule. However, he backtracked his decision towards the end of July amid pressure from crypto lobbyists, and ultimately chose to keep the rule in place.

His administration then told a judge that the rule will stay in place until it creates a new one that aligns better with the President’s policies.

Banking Groups Hit Back At Executives’ Claims

Banking groups, led by the American Bankers Association, countered the letter in a press release and accused the crypto and fintech executives of trying to “undermine free markets and engage in government price fixing.”

According to the banking groups, the fintech and crypto executives are trying to perpetuate an “absurd” double standard whereby they can charge fees for information access but still expect banks to provide the same service at no cost.

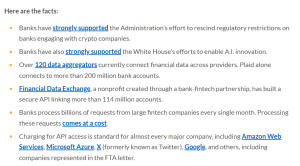

Banking groups state what they believe are the facts (Source: American Bankers Association)

The bankers also responded to allegations by the crypto and fintech execs that the banks’ proposed fees are an anti-competitive maneuver designed to “consolidate power.”

According to the bankers, their account information access fees align with the standard practice for companies that offer API access to data.

They highlighted that Amazon Web Services, Microsoft Azure, X (formerly Twitter), Google, and others do it. According to the banking groups, even some of the companies that signed the letter sent to Trump do it as well.

The bankers went on to add that they have “strongly supported” the Trump Administration’s efforts to “rescind regulatory restrictions on banks engaging with crypto companies.”

Trump Targets Debanking With New Executive Order

The clash between the crypto and traditional banking industries comes after Trump signed an executive order earlier this month which seeks to punish banks that restrict services to certain customers. During the former Biden Administration, this often included companies operating in the crypto space.

Under the new order, federal banking regulators are required to remove the “reputation risk” language from their guidance to lending institutions. This broad concept, according to crypto and other businesses, forced mainstream lenders to turn them away in the past.

The order also instructs regulators to investigate whether banks have any policies that enable them to participate in “unlawful debanking.”

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

Easy to Use, Feature-Driven Crypto Wallet

Get Early Access to Upcoming Token ICOs

Multi-Chain, Multi-Wallet, Non-Custodial

Now On App Store, Google Play

Stake To Earn Native Token $BEST

250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage