Hartford Funds researchers, in collaboration with Ned Davis Research, found that dividend stocks averaged an annualized return of 9.2% between 1973 and 2024, and did so while being less volatile than the benchmark index.

By comparison, non-dividend stocks earned a more modest annualized return of 4.31% over 51 years and were more volatile than the .

With that in mind, we set out to find three interesting stocks that pay a significant dividend, trade at low valuations, and are usually supported by the broader market.

Here they are:

1. Enterprise Products Partners

Enterprise Products Partners LP (NYSE:) is a company mainly engaged in the transportation, storage, and processing of energy products such as , , and petrochemicals. It was founded in 1968 and is headquartered in Houston, Texas.

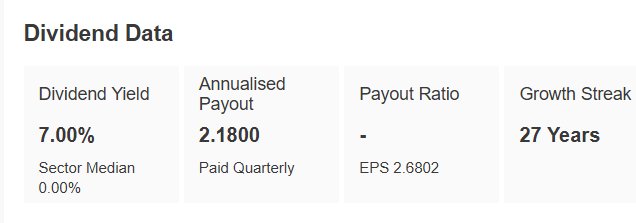

It has increased its dividend in each of the last 27 years, and the yield currently stands at 7%.

Source: InvestingPro

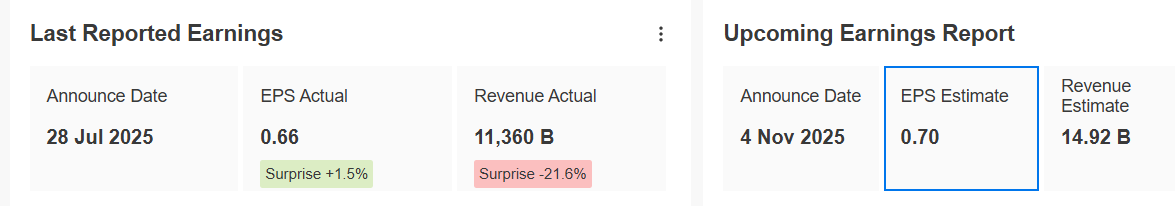

In the , it beat earnings per share (EPS) expectations with $0.66 per share versus a forecast of $0.65 — a positive surprise of 1.54%. However, revenue came in significantly below projections at $11.36 billion compared to the anticipated $14.49 billion, down 21.6%. It will present its accounts for the quarter on November 4.

Source: InvestingPro

Being an energy intermediary has one advantage: cash flow predictability. Most of the contracts Enterprise has signed with drilling companies are fixed in nature. This eliminates all aspects of inflation and price volatility, allowing Enterprise to accurately forecast its cash flow from operations one or more years in advance.

It has more than half a dozen major projects under construction, totaling $5.6 billion. These projects — primarily focused on expanding its exposure to liquefied natural gas — should be operational by the end of 2026 and are expected to boost the company’s cash flow.

The forward price-to-earnings (P/E) ratio is 10.5, roughly in line with its average forward P/E over the past five years.

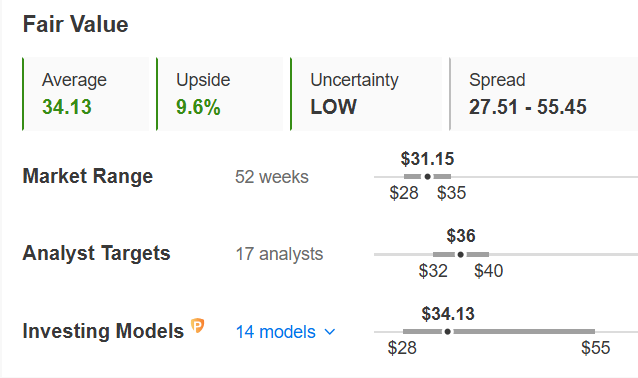

Its shares are trading 9.6% below their fair value, or value according to fundamentals, which would be $34.13. The market consensus gives it a price target of $36.

Source: InvestingPro

2. Stanley Black & Decker

Stanley Black & Decker (NYSE:) is a manufacturer and distributor of products for do-it-yourself and gardening, as well as for commercial applications. In 1843, Stanley Works was born, and in 1910, Black & Decker was founded. In 2010, Stanley Works merged with Black & Decker. It is headquartered in New Britain, Connecticut.

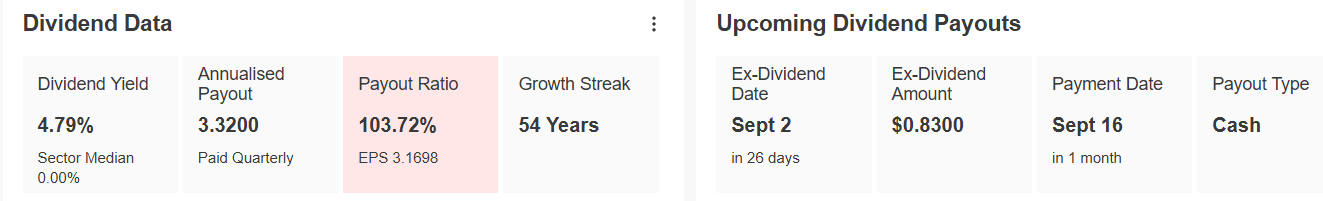

It will pay a dividend of $0.83 on September 16, and shares must be held prior to September 2 to receive it. The company’s dividend yield is 4.79%.

Source: InvestingPro

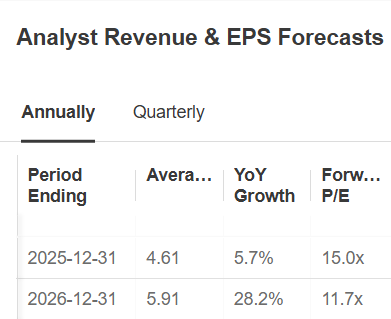

In second-quarter , sales declined 2% year-on-year to $3.95 billion. Its net profit rose sharply to $101.9 million. We will learn the next quarter’s results on October 23. For the full computation of 2025, EPS (earnings per share) is expected to increase by 5.7%, and by 2026, by 28.2%.

Source: InvestingPro

The company remains focused on its supply chain transformation and cost-saving initiatives. In fact, the global cost reduction program initiated in 2022 has already generated around $1.8 billion in savings. In addition, it is relocating production out of China to mitigate the tariff impact, shifting to Asia.

There is operational improvement with expanding margins and proper execution of the efficiency plan, as well as potential if the construction and manufacturing sector in the U.S. reactivates.

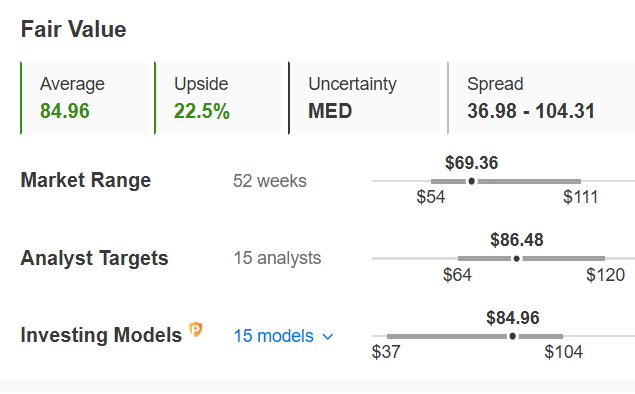

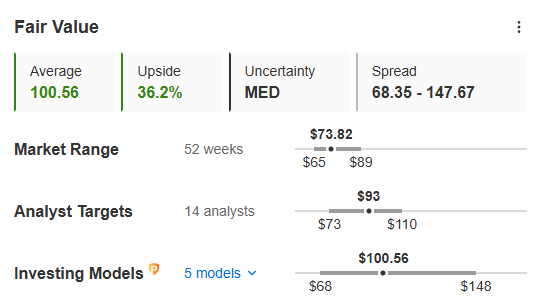

Its shares are trading 22.5% below their value based on fundamentals, which would be $84.96. The market consensus gives it an average price target of $86.48.

Source: InvestingPro

3. MetLife

MetLife (NYSE:) offers an interesting case study among large insurance companies, combining characteristics of both value and growth. Its forward price-to-earnings ratio of 8.6x is significantly below its historical average and the broader sector, suggesting the stock may be undervalued.

Source: InvestingPro

However, this low multiple is not due to deteriorating fundamentals. Analysts expect strong earnings growth of nearly 50% in 2025, along with a projected 5.9% increase in revenue—unusual for a mature insurer. The stock also holds a “Strong Buy” consensus from analysts, based on earnings outlook and operational improvements.

Source: InvestingPro

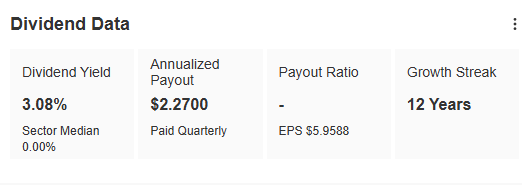

In terms of income, MetLife has a long history of shareholder returns. The company has raised its dividend for 12 consecutive years and maintained uninterrupted payouts for 26 years. While the current dividend yield is 2.7%, this is supported by a conservative payout ratio, which allows for potential increases in the future. Additionally, MetLife repurchased $510 million worth of shares in the second quarter of 2025, contributing to a high total shareholder yield.

****

Be sure to check out all the market-beating features InvestingPro offers.

InvestingPro members can unlock a powerful suite of tools designed to support smarter, faster investing decisions, like the following:

ProPicks AI

Built on 25+ years of financial data, ProPicks AI uses a machine-learning model to spot high-potential stocks using every industry-recognized metric known to the big funds and professional investors. Updated monthly, each pick includes a clear rationale.

Fair Value Score

The InvestingPro Fair Value model gives you a clear, data-backed answer. By combining insights from up to 15 industry-recognized valuation models, it delivers a professional-grade estimate of what any stock is truly worth.

WarrenAI

WarrenAI is our generative AI trained specifically for the financial markets. As a Pro user, you get 500 prompts each month. Free users get 10 prompts.

Financial Health Score

The Financial Health Score is a single, data-driven number that reflects a company’s overall financial strength.

Market’s Top Stock Screener

The advanced stock screener features 167 customized metrics to find precisely what you’re looking for, plus pre-defined screens like Dividend Champions and Blue-Chip Bargains.

Each of these tools is designed to save you time and improve your investing edge.

Not a Pro member yet? Check out our plans here or by clicking on the banner below. InvestingPro is currently available at up to 50% off amid the limited-time summer sale.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.