When it comes to investing, research is everything. But let’s be honest, it can also be time-consuming and overwhelming, especially if you have never invested before or you’re still in the learning stages. That’s where I fall. I’ve spent countless hours doing research, trying to pinpoint where I should be investing my money, only to become overwhelmed and give up.

That’s when I started experimenting with artificial intelligence tools like ChatGPT and CoPilot to combine all of the information that I was finding online to make choosing much easier. Instead of reading 10 websites, I asked myself: Can you use AI to make the decisions for me?

Spoiler: Yes, you can. Is it foolproof? Of course not. We still have a long way to go when it comes to artificial intelligence, but it’s a very good place to start if you’re feeling lost. So, if you’re wondering how to use it for yourself or you’re curious to see what the process is like, I’m sharing the two-week experiment I ran using ChatGPT, CoPilot, and Investment

Step 1: Using ChatGPT to Give Me Stock Suggestions

I began by asking ChatGPT a simple question–aka, what should I invest in?

Prompt I used:

“What are the top 2 best stocks to buy today that are down big from a year ago and primed for a price resurgence soon?”

Here’s the output I got:

1. Tesla (TSLA)

Why it’s down:

Tesla’s stock has been hammered over the past year due to slowing EV demand in certain markets, aggressive price cuts, and pressure on margins.

Competition from Chinese EV makers and macroeconomic headwinds have also weighed on the price.

Why it may rebound:

Tesla is aggressively pivoting toward next-gen energy storage, autonomous driving, and AI-powered robotics.

FSD (Full Self Driving) subscription models and robotaxi networks could add new revenue streams.

Analysts expect margin recovery and earnings acceleration as costs decline and energy storage (Megapacks) gain traction.

2. PayPal (PYPL)

Why it’s down:

PayPal has seen heavy stock declines due to slower user growth, competition from Apple Pay and Stripe, and concerns over declining margins.

The stock is trading at historically low valuations compared to its cash flow and earnings potential.

Why it may rebound:

PayPal’s aggressive cost-cutting and focus on its Braintree platform are beginning to show results.

New leadership and partnerships (such as Venmo integrations and new merchant services) could reignite growth.

Analysts are calling it “deeply undervalued” compared to its fintech peers, making it a turnaround candidate.

Step 2: Using CoPilot to Analyze Financial Data

Next, I turned to CoPilot to ask it the same question. To keep this fair, I didn’t switch the prompt, nor did I include any extra information. I wanted to see which artificial intelligence platform was going to have the stronger answers at the end of this.

CoPilot’s output looked like this:

Same question to Copilot. Answer:

1. Charter Communications (CHTR)

Performance: Down 22% year-to-date and 18% over the past year

Why it dropped: The end of the Affordable Connectivity Program (ACP), which subsidized broadband for millions of customers, hit Charter hard

Why it’s primed for resurgence:

Despite the ACP ending, Charter posted robust profits and growing mobile service revenue

Trades at 9x trailing earnings and 15x free cash flow, making it attractively valued

Analysts expect EBITDA expansion and improved customer growth as the company adjusts to new conditions

2. PayPal Holdings (PYPL)

Performance: Lagging due to intense competition, especially from Apple in the payments space

Why it’s primed for resurgence:

Still commands a 45% global market share in online payment processing

Payment volume up 14% in Q1 to $404 billion

Launching a targeted advertising platform using data from its 400 million active accounts

Trades at 15x earnings, 12x estimates, and has a price-to-free cash flow ratio of 12

Projected to grow profits at a 16% compound annual rate over the next five years

The first thing I noticed right off the bat was that CoPilot gave me a shorter, more precise answer. However, the “why it’s primed for resurgence” included more hard data, which I found to be extremely useful.

I decided to rephrase the question, keeping it extremely simple, removing the focus on stocks that were down. Instead, I asked both platforms a very broad question.

Prompt I used:

“What are the top 2 best stocks to buy today?”

ChatGPT said:

1. Microsoft (MSFT)

Why it’s a top pick:

AI Leadership: Microsoft’s integration of OpenAI’s models into Azure, Office, and Windows gives it a dominant position in AI infrastructure and enterprise adoption.

Recurring Revenue: Strong growth in Azure cloud services and subscription-based products (Office 365, LinkedIn, GitHub).

Financial Strength: Consistent double-digit revenue growth, high free cash flow, and a strong balance sheet make it resilient.

2. Nvidia (NVDA)

Why it’s a top pick:

AI Boom: Nvidia’s GPUs are at the heart of AI computing, from data centers to autonomous vehicles.

New Product Cycles: Demand for next-gen GPUs and AI accelerators is outpacing supply, creating pricing power.

Earnings Growth: Revenue and EPS growth remain explosive, with analysts continuing to raise price targets.

CoPilot said:

1. Microsoft (MSFT)

Why it’s a top pick:

AI Leadership: Microsoft’s integration of OpenAI’s models into Azure, Office, and Windows gives it a dominant position in AI infrastructure and enterprise adoption.

Recurring Revenue: Strong growth in Azure cloud services and subscription-based products (Office 365, LinkedIn, GitHub).

Financial Strength: Consistent double-digit revenue growth, high free cash flow, and a strong balance sheet make it resilient.

2. Nvidia (NVDA)

Why it’s a top pick:

AI Boom: Nvidia’s GPUs are at the heart of AI computing, from data centers to autonomous vehicles.

New Product Cycles: Demand for next-gen GPUs and AI accelerators is outpacing supply, creating pricing power.

Earnings Growth: Revenue and EPS growth remain explosive, with analysts continuing to raise price targets.

Step 2: Testing Stock Picks in Investopedia’s Simulator

Before I went any further, I wanted to know: Would these stocks actually perform well in the current market?

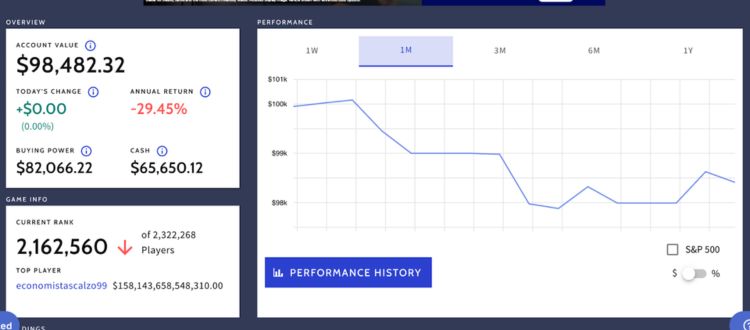

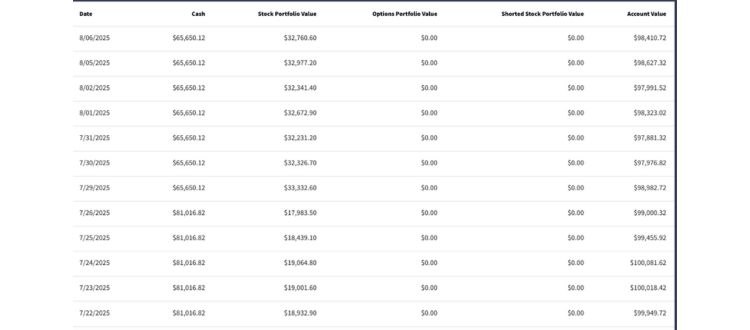

That’s when I logged into Investopedia’s Stock Simulator. It’s a free tool that lets you simulate trading with fake money, using real-time market data. I created a portfolio using the stocks ChatGPT and CoPilot suggested, and tracked them over the next few days and weeks.

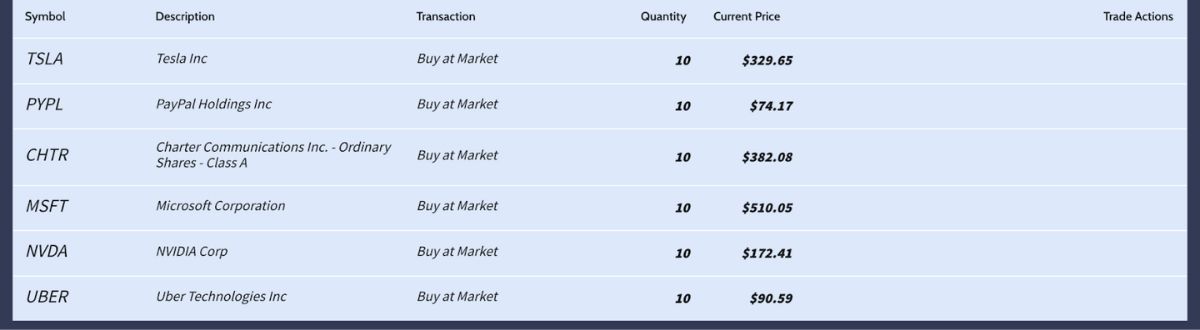

Here’s what I did:

Created a new portfolio in the simulator

Added the stocks ChatGPT and CoPilot recommended (I purchased 10 stocks of each to keep things equal)

Set a goal: hold for 14 days and track percentage change, volatility, and news sentiment

Watched how the portfolio behaved during market fluctuations

Here’s a screenshot of the very beginning:

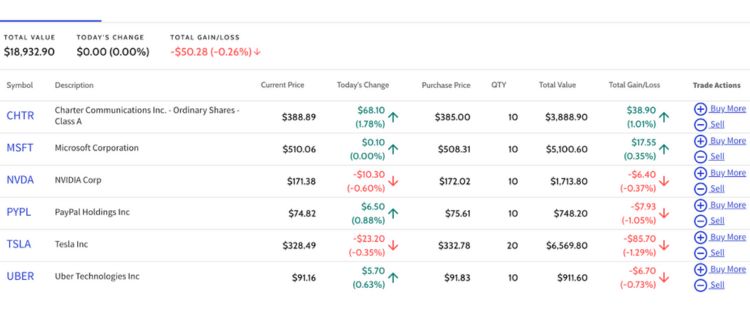

Once it was live, the platform looked a little something like this (this was taken the following day after the initial “purchase”

I did end up ultimately decided to purchase 10 more Tesla shares, because I wanted to see what a larger investment would look like for a company that has been in the headlines consistently lately.

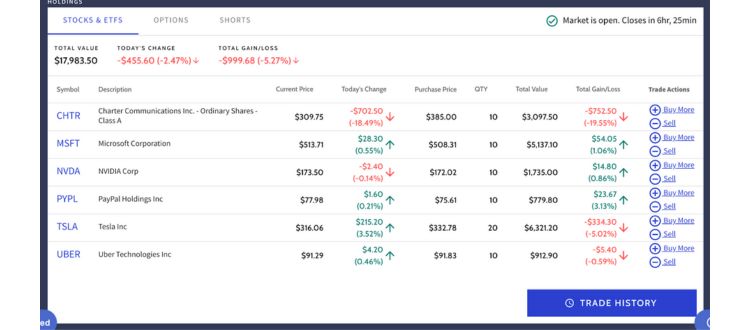

The experience gave me a chance to see which picks held steady, which fluctuated wildly, and which surprised me. Some early standouts affirmed ChatGPT’s logic. Others made me rethink certain sectors or company-specific risks. This is what the portfolio looked like a week into this experiment:

This is not exactly what I was expecting. I knew that the market was going to fluctuate, and I wasn’t necessarily expecting to be net positive for every stock, but it was interesting to see that neither CoPilot’s nor ChatGPT’s predictions were entirely correct. Both had their moments where we saw an increase, and there were other moments where we saw a loss.

Step 4: Asking Again

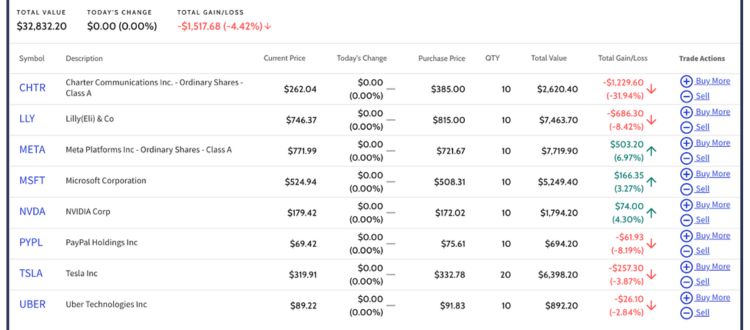

A week into the experiment, I decided to ask ChatGPT for two more options to invest in. Of course, these two stocks did not have the longevity of the other two, but I wanted to see what it would look like if we added two more options to the mix.

This was its answer:

1. Meta Platforms (META)

Why it’s compelling in 2025:

AI-driven Ad Revenue Recovery: Meta is leveraging AI to drive more efficient ad targeting, which is boosting ad performance and revenue across Instagram and Facebook.

Huge User Ecosystem: Billions of monthly active users across Facebook, Instagram, WhatsApp, and Threads provide a data and monetization advantage.

Metaverse & AI Investments: Despite skepticism, its Reality Labs division and Llama AI models position it for longer-term growth in spatial computing and open-source AI.

2. Eli Lilly (LLY)

Why it’s hot right now:

Weight Loss Drug Boom: Its blockbuster GLP-1 drug (Zepbound) is experiencing massive demand for obesity and diabetes treatment.

Strong Pipeline: Eli Lilly has promising Alzheimer’s and oncology drugs in late-stage development.

High Margin Business: Pharma is historically resilient in economic slowdowns, and Eli Lilly’s margins are among the best in the industry.

And that’s where we ended up today:

Two Weeks In

In the end, here’s what my growth looked like throughout those two weeks:

What I Learned (and Would Do Differently)

Using AI tools like ChatGPT and CoPilot doesn’t mean you’ll automatically become a Wall Street pro, but it does give you an edge, especially when it comes to speed, clarity, and organizing your thoughts. If I were to do it differently, I would ask both ChatGPT and CoPilot to expand further, giving me more details.

Some other questions I might ask include:

What are the top-performing sectors right now, and which undervalued stocks exist within them?

What’s a good stop-loss and take-profit strategy for specific stocks?

What are safer dividend stocks to pair with more volatile growth picks?

If I’m investing for retirement in 20 years, which sectors tend to outperform long-term?

What seasonal patterns exist for these stocks or sectors during Q3/Q4? (or whatever quarter you’re looking at investing in)

A few takeaways:

CoPilot is fantastic for Excel-based analysis. It’s great for those who already use spreadsheets or prefer to see things broken down in charts. However, ChatGPT can also do this depending on your prompt

ChatGPT is best for strategy and context. It won’t give you hot stock tips, but it will help you think like a long-term investor. It

You still need to double-check everything. AI is helpful, not infallible. While it is a very strong tool, I highly recommend using it as a jumping-off point and then going from there.

For example, if I were to invest my money into these stocks using AI, I would most likely do the following:

Ask for stock recommendations

Ask AI to dive further into the recommendations given beyond the surface-level information it initially gives

Research the company outside of AI

Test it on Investopedia (if I were unsure)

Decide whether or not it’s a worthy investment from there

Would I Use AI for Investing Again?

Absolutely—AI has the potential to be a powerful ally in investing, as long as you treat it like a tool, not a crystal ball. It can help you analyze trends, spot opportunities, and make more informed decisions, but it shouldn’t replace critical thinking or sound judgment.

For those who want personalized, fiduciary advice, human advisors still offer unmatched value. But for DIY investors looking to sharpen their strategy, AI is an incredible resource—smart, fast, and always evolving. Use it wisely, and it can absolutely elevate your investing game.

See what folks in the Saving Advice forums are saying about investing with AI.

Read More

9 Low-Risk Investments That Are Quietly Underperforming in 2025

8 “Low-Maintenance” Investments That Require Constant Oversight