Yves here. The Angry Bear post below called a recession watch, but yours truly is upgrading it to a stagflation watch. That is due the fact that inflation persists and Trump tariff effects set to start kicking in over the next few months means relief is not likely….at least until the economy gets a lot weaker. And keep further in mind that we are seeing this slide in activity despite the Federal government continuing to engage in “net spending” as in running large deficits that should be goosing activity.

By New Deal democrat. Originally published at Angry Bear

“Recession Watch” instituted for US economy, as economically weighted ISM indexes indicate present contraction

Two months ago, in response to the new orders components of the economically weighted ISM manufacturing and services indexes, I hoisted a yellow flag “Recession Watch.” That continued last month as well.

This month the economically weighted headline numbers tipped into contraction as well. Together with other negative readings in the goods-producing sector of the economy and flagging if still positive services indicators, the yellow flag now transitions into a red flag “recession watch” for the economy as a whole.

Let’s start with this morning’s crucial report.

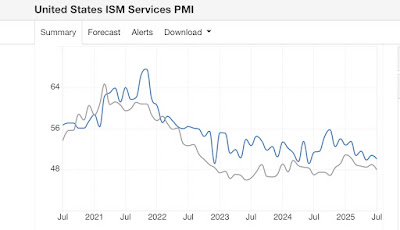

According to ISM, in July the services sector of the US economy grew at the lowest increment possible, just 0.1 over the balance point at 50.1. The more leading new orders component also grew just slightly at 50.3.

To recap, because manufacturing is much less important to the economy than in the decades before the Millennium, the economically weighted average of the ISM services index (75%) as well as manufacturing (25%), especially over a three month period (to cut down on noise), has been much more accurate since 2000.

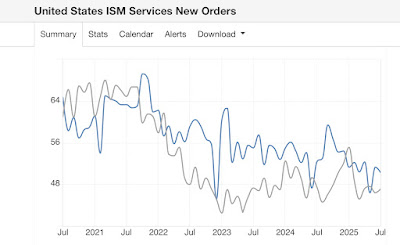

Starting with new orders, the previous two months came in at 51.3 and 46.4, giving us at three-month average of 49.3. As I reported yesterday, the three-month average for manufacturing new orders was 47.0. Here are what both look like [Note: all graphs from TradingEconomics.com. Blue is services, gray is manufacturing]:

The three month economically weighted average for new orders is 48.8, indicating contraction, just as it has for the previous two months.

The difference this month is that contraction has spread to the headline numbers as well. The previous two months for the service sector were 50.8 and 49.9, making the three month average 49.1. Yesteday the three month average for the manufacturing sector was 48.5. Here is that graph:

As a result, the economically weighted three month average for the headline indexes is 49.1. This has tipped the entirety of the indexes into not just leading but *present* contraction.

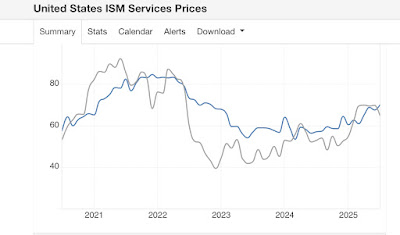

Before I conclude, what happened with the prices paid component is also noteworthy. The prices paid component clocked in at 69.9, a 2.5 year high, as is the three-month average. As the below graph shows, the prices paid component of the manufacturing index has also made 3-year highs, although it backed off in July:

In short, what the ISM manufacturing and services indexes together tell us is that we have accelerating inflation, manufacturing contraction, and services just treading water. Or, in other words, stagflation.

Two months ago I concluded with the statement: “In the meantime, watch to see if the remaining short leading indicators to fall into place, most notably new jobless claims, consumer retail spending, employment in the goods-producing sectors, at very least a stalling in aggregate real payroll growth.” With the exception of new jobless claims, all of these have either stalled or contracted.

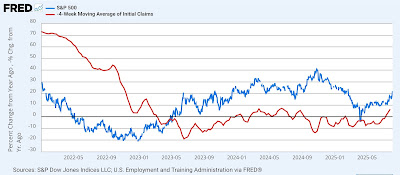

As I’ve said in the past two months, treat the terms “watch” and “warning” the way you would for weather. A “watch” means that conditions are right, and the economy is at significantly heightened risk of a recession starting in the next few months. A “warning” would mean that a recession is likely, and almost imminently. A “recession watch” for the US economy is now amply justified. Almost the only reason for not upgrading to a “warning” already is the below graph:

With rare exception, before a recession begins stock prices peak and turn down, while initial jobless claims turn up by 10% or more YoY. In addition to the above, I really think we need one more month of data to see if the recent downturn in real consumer spending is just payback for the previous front-running of tariffs, or whether it is a more durable trend.

But to reiterate, consider this the initiation of a “Recession Watch” for the US economy as a whole.