Published on August 4th, 2025 by Bob Ciura

We recommend long-term investors focus on high-quality dividend stocks. To that end, we view blue chip dividend stocks as among the best to buy-and-hold for the long run.

Blue chip stocks are established, financially strong, and consistently profitable publicly traded companies.

Their strength makes them appealing investments for comparatively safe, reliable dividends and capital appreciation versus less-established stocks.

We define blue chip stocks as those with at least 10 consecutive years of dividend increases.

You can download a copy of the blue chip stocks list by clicking on the link below:

There are currently more than 500 securities in our blue chip stocks list. The combination of dividend yield and growth, can result in outstanding long-term returns.

The blue chip stocks list includes stock market heavyweights such as Johnson & Johnson (JNJ), Coca-Cola (KO), Procter & Gamble (PG), and many more.

But there are also a number of lesser-known dividend stocks that are worthy of consideration.

In this research report, we analyze 10 blue chip dividend stocks many investors have never heard of.

The 10 stocks below have all increased their dividends for at least 10 years. They are all based in the U.S., with market capitalizations below $25 billion, meaning they get much less coverage in the financial media, and have smaller followings than the largest dividend payers.

They all have Dividend Risk Scores of ‘C’ or better in the Sure Analysis Research Database to ensure quality. Lastly, they have dividend yields at least at the average level of the S&P 500 Index, currently at 1.2%.

The list is sorted by dividend yield, in ascending order.

Table of Contents

The table of contents below allows for easy navigation.

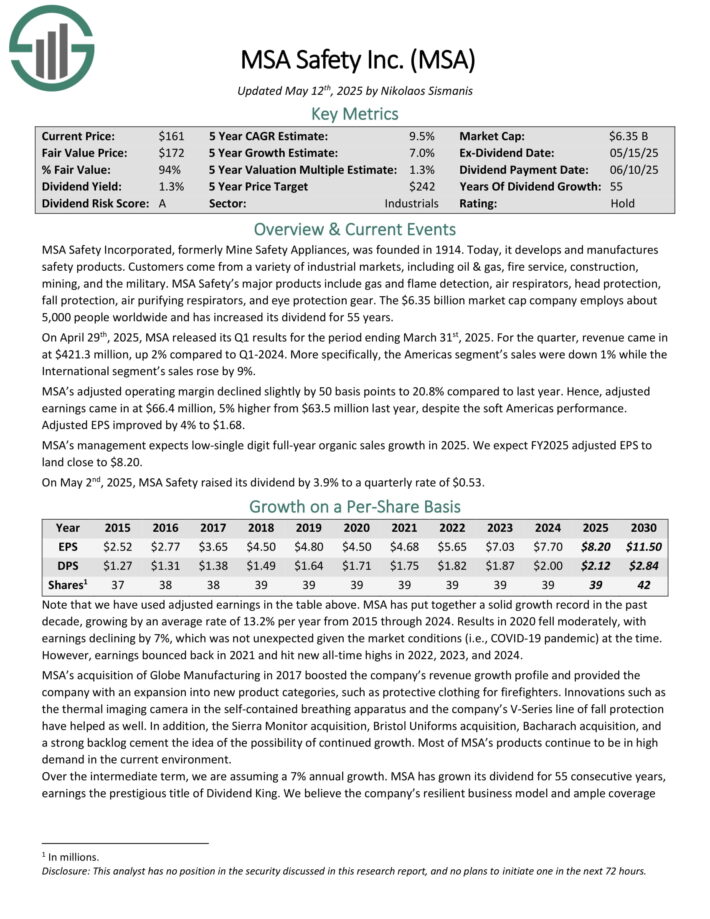

Best Dividend Stock You’ve Never Heard Of: MSA Safety (MSA)

MSA Safety Incorporated, formerly Mine Safety Appliances, was founded in 1914. Today, it develops and manufactures safety products.

Customers come from a variety of industrial markets, including oil & gas, fire service, construction, mining, and the military.

MSA Safety’s major products include gas and flame detection, air respirators, head protection, fall protection, air purifying respirators, and eye protection gear.

On April 29th, 2025, MSA released its Q1 results. For the quarter, revenue came in at $421.3 million, up 2% compared to Q1-2024.

More specifically, the Americas segment’s sales were down 1% while the International segment’s sales rose by 9%.

MSA’s adjusted operating margin declined slightly by 50 basis points to 20.8% compared to last year. Adjusted EPS improved by 4% to $1.68.

Click here to download our most recent Sure Analysis report on MSA (preview of page 1 of 3 shown below):

Best Dividend Stock You’ve Never Heard Of: Church & Dwight Co. (CHD)

Church & Dwight is a diversified consumer staples company that manufactures and distributes products under several well-known brands such as Arm & Hammer, Trojan, OxiClean, Spinbrush, First Response, Waterpik, Nair, Orajel, and XTRA.

Church & Dwight has paid quarterly dividends to shareholders for more than 120 consecutive years.

Church & Dwight posted second quarter earnings on August 1st, 2025, and results were better than expected on both the top and bottom lines. Adjusted earnings-per-share came to 94 cents, which was eight cents ahead of estimates.

Revenue was flat year-over-year at $1.51 billion, beating estimates by $20 million. Organic sales were up fractionally, as organic volume was up 0.8% and pricing and mix were down 0.7%.

Gross margin was 43% of revenue, off 410 basis points year-over-year. However, on an adjusted basis gross margins were down 40 basis points to 45% of revenue. These reflected the impact of higher manufacturing costs, including tariffs, recalls, and business exit charges.

Operating cash was $417 million for the first half of the year as capex was just $39 million. The company also completed a $300 million share repurchase program in Q2.

Click here to download our most recent Sure Analysis report on CHD (preview of page 1 of 3 shown below):

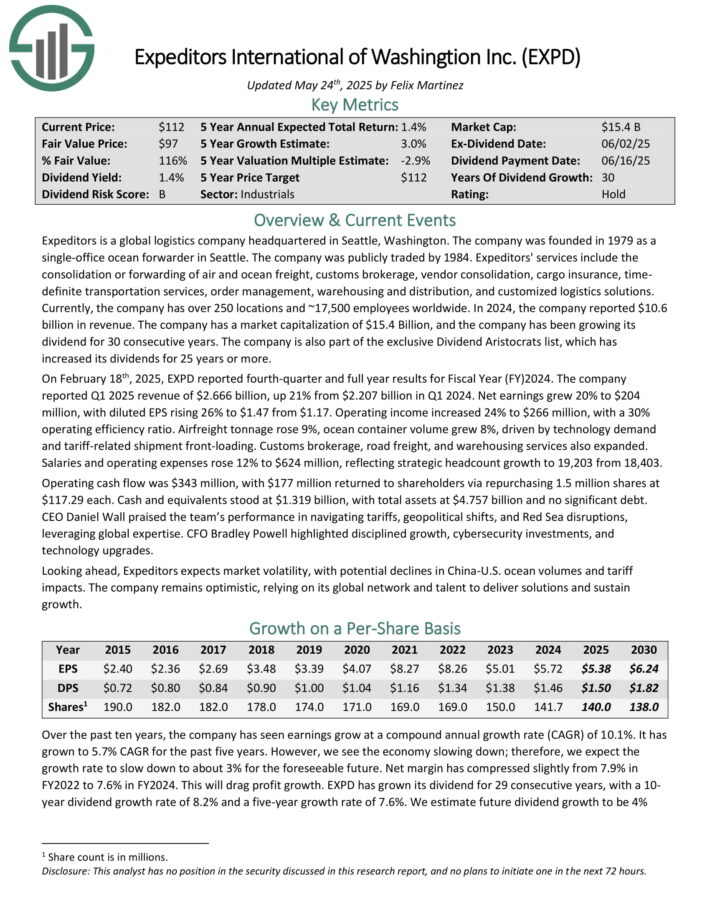

Best Dividend Stock You’ve Never Heard Of: Expeditors International of Washington (EXPD)

Expeditors is a global logistics company headquartered in Seattle, Washington. The company was founded in 1979 as a single-office ocean forwarder in Seattle.

The company was publicly traded by 1984. Expeditors’ services include the consolidation or forwarding of air and ocean freight, customs brokerage, vendor consolidation, cargo insurance, time definite transportation services, order management, warehousing and distribution, and customized logistics solutions.

Currently, the company has over 250 locations and ~17,500 employees worldwide. In 2024, the company reported $10.6 billion in revenue. The company has grown its dividend for 30 consecutive years.

Expeditor’s competitive advantage is the global footprint and an extensive network of shippers and carriers, which produce a substantial value that would be challenging to replicate for new entrants.

EXPD has a strong balance sheet with a debt-to-equity ratio of only 0.3. The dividend is very safe; the dividend payout ratio has not passed 36% for the past ten years.

Click here to download our most recent Sure Analysis report on EXPD (preview of page 1 of 3 shown below):

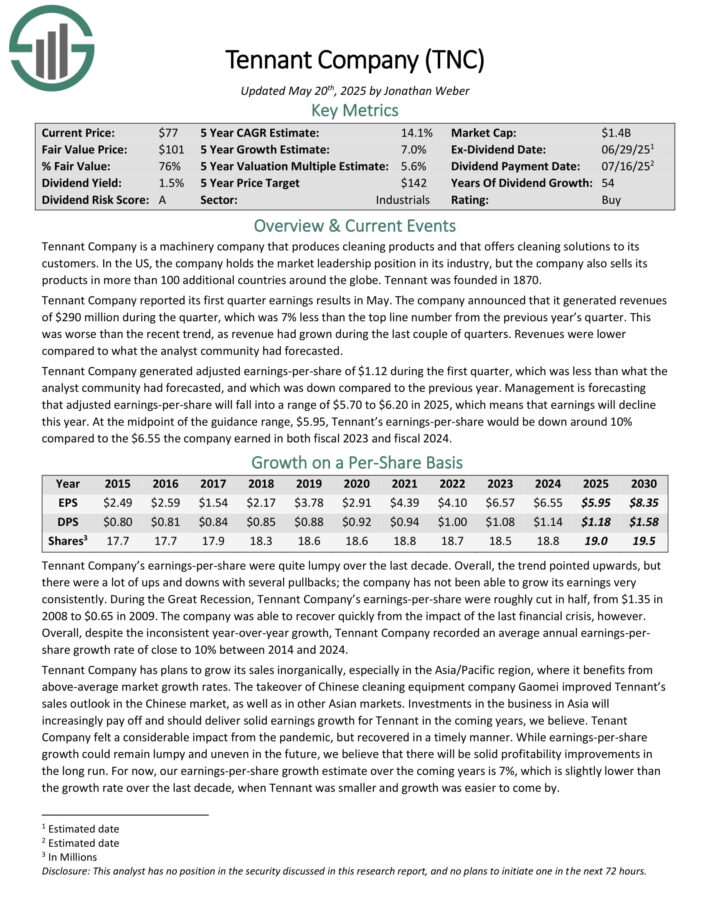

Best Dividend Stock You’ve Never Heard Of: Tennant Co. (TNC)

Tennant Company is a machinery company that produces cleaning products and that offers cleaning solutions to its customers.

In the US, the company holds the market leadership position in its industry, but the company also sells its products in more than 100 additional countries around the globe.

Tennant Company reported its first quarter earnings results in May. The company announced that it generated revenues of $290 million during the quarter, which was 7% less than the top line number from the previous year’s quarter.

This was worse than the recent trend, as revenue had grown during the last couple of quarters. Revenues were lower compared to what the analyst community had forecast.

Tennant Company generated adjusted earnings-per-share of $1.12 during the first quarter, which was less than what the analyst community had forecast, and was down compared to the previous year.

Management is forecasting that adjusted earnings-per-share will fall into a range of $5.70 to $6.20 in 2025, which means that earnings will decline this year. At the midpoint of the guidance range, $5.95, Tennant’s earnings-per-share would be down around 10%.

Click here to download our most recent Sure Analysis report on TNC (preview of page 1 of 3 shown below):

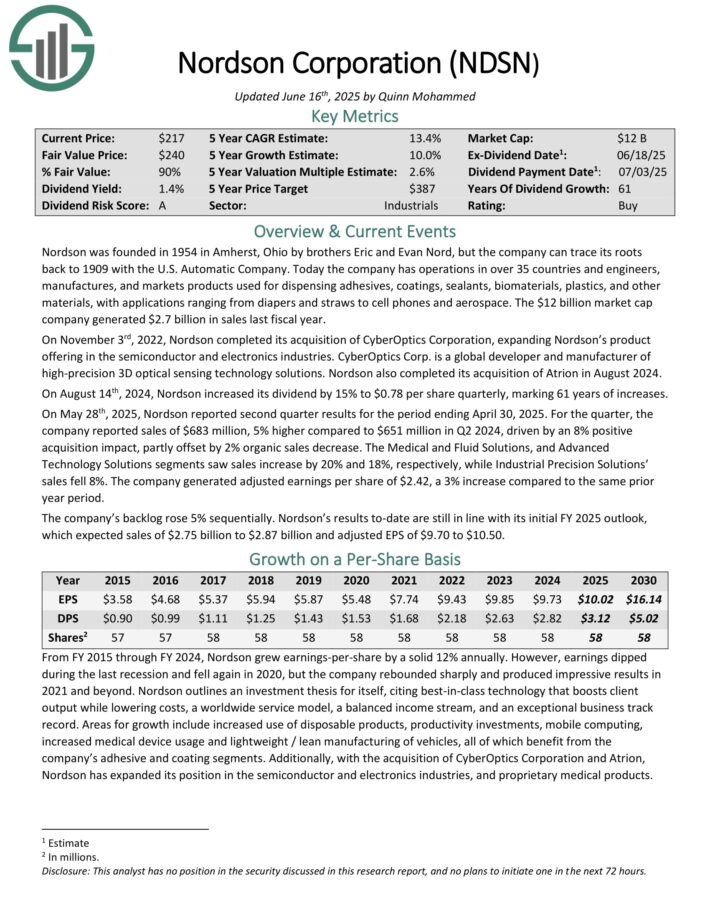

Best Dividend Stock You’ve Never Heard Of: Nordson Corp. (NDSN)

Nordson was founded in 1954. Today the company has operations in over 35 countries and engineers, manufactures, and markets products used for dispensing adhesives, coatings, sealants, biomaterials, plastics, and other materials, with applications ranging from diapers and straws to cell phones and aerospace.

The company generated $2.7 billion in sales last fiscal year.

On May 28th, 2025, Nordson reported second quarter results for the period ending April 30, 2025. For the quarter, the company reported sales of $683 million, 5% higher compared to $651 million in Q2 2024, driven by an 8% positive acquisition impact, partly offset by 2% organic sales decrease.

The Medical and Fluid Solutions, and Advanced Technology Solutions segments saw sales increase by 20% and 18%, respectively, while Industrial Precision Solutions sales fell 8%. The company generated adjusted earnings per share of $2.42, a 3% increase compared to the same prior year period.

The company’s backlog rose 5% sequentially.

Click here to download our most recent Sure Analysis report on NDSN (preview of page 1 of 3 shown below):

Best Dividend Stock You’ve Never Heard Of: Oshkosh Corporation (OSK)

Oshkosh Corporation is a leader in designing, manufacturing, and servicing a broad range of access equipment, commercial, fire & emergency, military and specialty vehicles and vehicle bodies.

Brands under the corporate umbrella include Oshkosh, JLG, Pierce, McNeilus, Jerr-Dan, Frontline, CON-E-CO, London and IMT.

The company operates in three segments – Access Equipment, Defense, and Vocational – with products offered in over 150 countries. It employs approximately 18,000 people.

On January 30th, 2025, Oshkosh declared a $0.51 quarterly dividend, which represented an 11% increase.

Oshkosh holds a competitive advantage in its niche and has essential offerings for a variety of industries such as aerial work platforms, fire truck ladders and refuse collection bodies.

The company has leading brands, with a reputation for reliability and longevity, to go along with a comprehensive product line.

Click here to download our most recent Sure Analysis report on OSK (preview of page 1 of 3 shown below):

Best Dividend Stock You’ve Never Heard Of: Primerica, Inc. (PRI)

Primerica, Inc. provides term life insurance to middle-income households in the United States and Canada. On behalf of third parties, it also offers mutual funds, annuities, managed investments, and other financial products.

As of March 31st, 2025, PRI insured 5.7 million lives and had roughly 2.9 million client investment accounts. The company’s offerings are sold via a network of 152,167 licensed sales representatives, who are independent contractors.

PRI is organized into the following three operating segments: Term Life Insurance, Investment and Savings Products, and Corporate and Other Distributed Products.

On May 7th, PRI shared its first-quarter earnings report for the period ending March 31st, 2025. The company’s total operating revenue grew by 9.4% over the year-ago period to $804.8 million in the quarter. That was driven by strength in both the Term Life Insurance and Investment and Savings Products segments during the quarter.

Diluted EPS climbed 28.5% over the year-ago period to $5.05 during the quarter. This topped the analyst consensus by $0.27 for the quarter. That was due to a roughly 230-basis-point expansion in the net profit margin to 21% in the quarter.

Click here to download our most recent Sure Analysis report on PRI (preview of page 1 of 3 shown below):

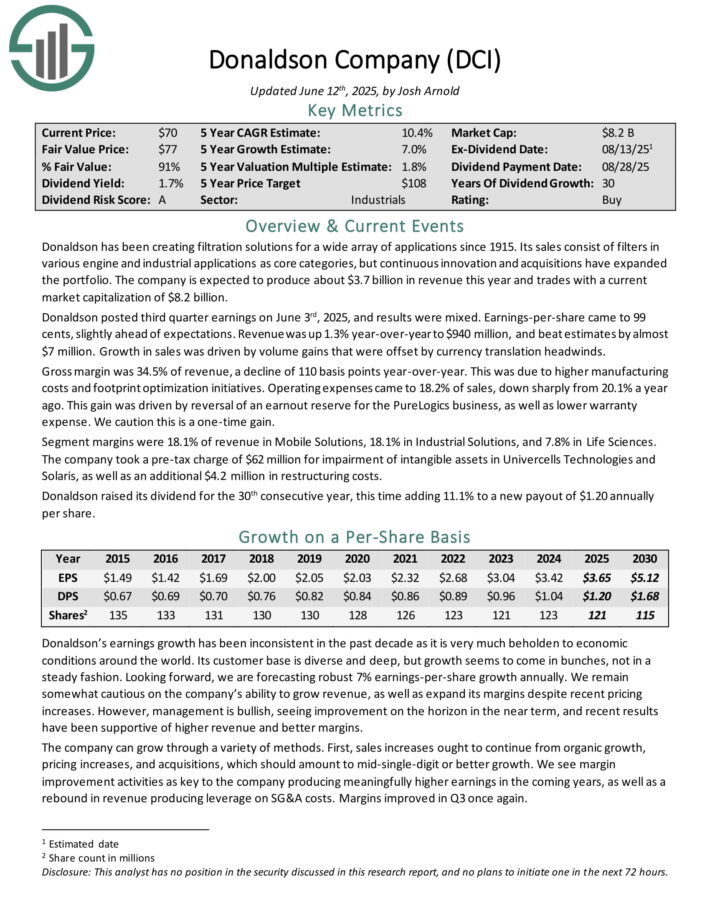

Best Dividend Stock You’ve Never Heard Of: Donaldson Co. (DCI)

Donaldson has been creating filtration solutions for a wide array of applications since 1915. Its sales consist of filters in various engine and industrial applications as core categories, but continuous innovation and acquisitions have expanded the portfolio. The company is expected to produce about $3.7 billion in revenue this year.

Donaldson posted third quarter earnings on June 3rd, 2025, and results were mixed. Earnings-per-share came to 99 cents, slightly ahead of expectations. Revenue was up 1.3% year-over-year to $940 million, and beat estimates by almost $7 million. Growth in sales was driven by volume gains that were offset by currency translation headwinds.

Gross margin was 34.5% of revenue, a decline of 110 basis points year-over-year. This was due to higher manufacturing costs and footprint optimization initiatives. Operating expenses came to 18.2% of sales, down sharply from 20.1% a year ago.

Segment margins were 18.1% of revenue in Mobile Solutions, 18.1% in Industrial Solutions, and 7.8% in Life Sciences.

The company took a pre-tax charge of $62 million for impairment of intangible assets in Univercells Technologies and Solaris, as well as an additional $4.2 million in restructuring costs.

Donaldson raised its dividend for the 30th consecutive year.

Click here to download our most recent Sure Analysis report on DCI (preview of page 1 of 3 shown below):

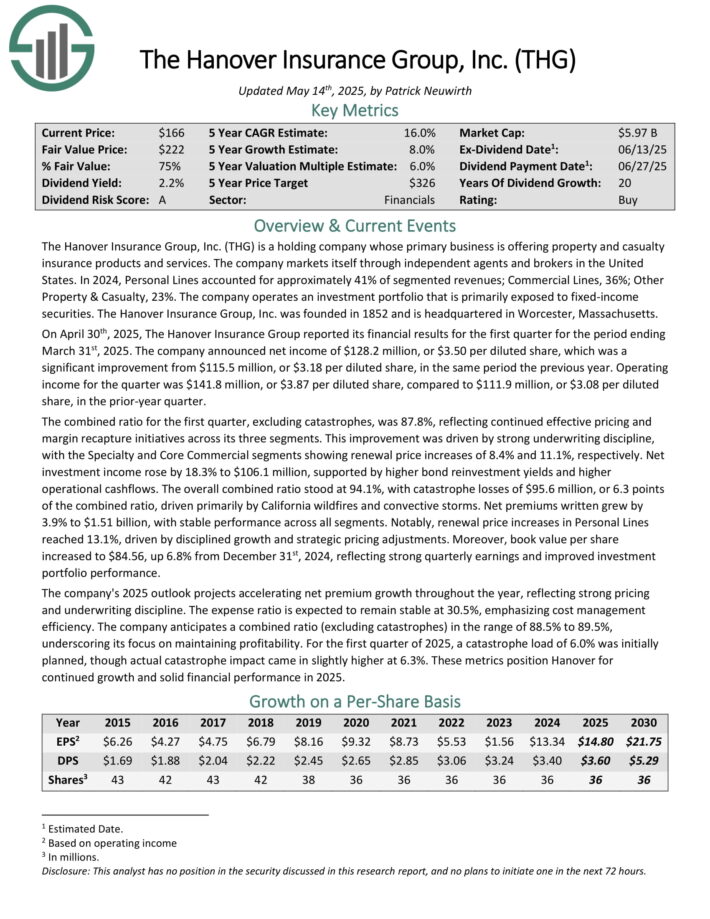

Best Dividend Stock You’ve Never Heard Of: Hanover Insurance Group (THG)

The Hanover Insurance Group is a holding company whose primary business is offering property and casualty insurance products and services.

The company markets itself through independent agents and brokers in the United States. In 2024, Personal Lines accounted for approximately 41% of segmented revenues; Commercial Lines, 36%; Other Property & Casualty, 23%. The company operates an investment portfolio that is primarily exposed to fixed-income securities.

On April 30th, 2025, The Hanover Insurance Group reported its financial results for the first quarter. The company announced net income of $128.2 million, or $3.50 per diluted share, which was a significant improvement from $115.5 million, or $3.18 per diluted share, in the same period the previous year.

Operating income for the quarter was $141.8 million, or $3.87 per diluted share, compared to $111.9 million, or $3.08 per diluted share, in the prior-year quarter.

The combined ratio for the first quarter, excluding catastrophes, was 87.8%, reflecting continued effective pricing and margin recapture initiatives across its three segments.

The company’s 2025 outlook projects accelerating net premium growth throughout the year, reflecting strong pricing and underwriting discipline. The expense ratio is expected to remain stable at 30.5%, emphasizing cost management efficiency.

Click here to download our most recent Sure Analysis report on THG (preview of page 1 of 3 shown below):

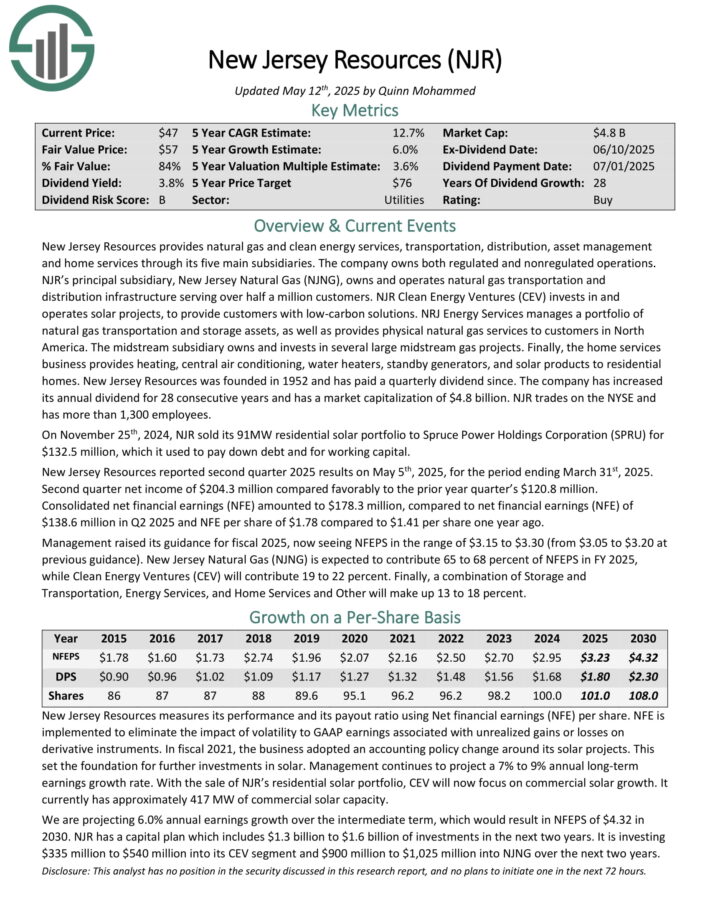

Best Dividend Stock You’ve Never Heard Of: New Jersey Resources (NJR)

New Jersey Resources provides natural gas and clean energy services, transportation, distribution, asset management and home services through its five main subsidiaries. The company owns both regulated and non-regulated operations.

NJR’s principal subsidiary, New Jersey Natural Gas (NJNG), owns and operates natural gas transportation and distribution infrastructure serving over half a million customers. NJR Clean Energy Ventures (CEV) invests in and operates solar projects, to provide customers with low-carbon solutions.

NRJ Energy Services manages a portfolio of natural gas transportation and storage assets, as well as provides physical natural gas services to customers in North America.

The midstream subsidiary owns and invests in several large midstream gas projects. Finally, the home services business provides heating, central air conditioning, water heaters, standby generators, and solar products to residential homes.

New Jersey Resources reported second quarter 2025 results on May 5th, 2025, for the period ending March 31st, 2025. Second quarter net income of $204.3 million compared favorably to the prior year quarter’s $120.8 million.

Consolidated net financial earnings (NFE) amounted to $178.3 million, compared to net financial earnings (NFE) of $138.6 million in Q2 2025 and NFE per share of $1.78 compared to $1.41 per share one year ago.

Management raised its guidance for fiscal 2025, now seeing NFEPS in the range of $3.15 to $3.30 (from $3.05 to $3.20 at previous guidance).

Click here to download our most recent Sure Analysis report on NJR (preview of page 1 of 3 shown below):

Additional Reading

If you are interested in finding other quality dividend growth stocks, the following Sure Dividend resources may be useful:

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].